A Major Cause Of The Economic Depression Of 1929 Was: Complete Guide & Key Details

Hey there, history buffs and curious minds! Ever wonder what turned the jazzy Roaring Twenties into the somber 1930s? You know, the Big One? The Great Depression? It’s one of those historical events that sounds, well, depressing. But guess what? Understanding it can actually be a blast!

Seriously! Think of it like a giant puzzle. And the best part? You get to be the detective, piecing together clues about how the world's economy went from a champagne toast to a cracker and water. Today, we're diving deep into one of the biggest villains in this economic drama: the stock market crash.

The Roaring Twenties: A Party Going Too Hard?

So, picture this: it's the 1920s. Flappers are dancing, jazz is swinging, and everyone, it seems, is getting rich! Or at least, that's what it felt like. The economy was booming, businesses were thriving, and people were feeling fantastic. And what better way to join the party than by investing in the stock market? It was like the hottest new club in town, and everyone wanted a ticket.

Suddenly, buying stocks wasn't just for the super-rich anymore. Regular folks, like your grandpa's neighbor, were putting their hard-earned cash into companies. And why wouldn't they? The market seemed to be going nowhere but up. Prices were soaring, and everyone was making a tidy profit. It was a feeding frenzy, and the feeling was utterly euphoric.

Companies were booming, and their stock prices were climbing higher and higher. It was like watching a rocket launch, but instead of fire, it was pure optimism. This, my friends, is where things start to get a little… wobbly.

The Wild Ride of Speculation

Now, here's where our detective work gets interesting. People weren't just buying stocks because they believed in a company's long-term potential. Oh no. They were buying them because they thought the price would go up tomorrow. And the day after that. And the day after that!

This, my friends, is called speculation. It's like betting on a horse race, but instead of a horse, it's a company's share price. And when everyone is betting, and everyone thinks they're going to win, things can get a bit out of hand.

Imagine a game of musical chairs, but with stock prices. Everyone is scrambling to get a seat, and the music is playing at full blast. The problem is, there are only so many chairs, and the music can't play forever. This frenzy drove stock prices to dizzying heights, far beyond what the actual value of the companies could justify. It was an economic house of cards, built on pure excitement.

This is where a nifty little concept called buying on margin comes in. Think of it like borrowing money to buy more lottery tickets. You put down a small percentage of the stock's price, and your broker loans you the rest. The idea is that you'll make enough profit to pay back the loan and still have a huge chunk of change left over. Sounds good, right? For a while, it was!

But what happens when the music stops? What happens when those stock prices start to fall? Well, if you owe money on those stocks, and their value plummets, you're in a world of hurt. Your broker will come calling for their loan, and you might not have the money to pay it back. It’s a domino effect, and the first domino to fall was the inflated stock market.

Black Tuesday: The Day the Music Stopped

Then came October 29, 1929. We call it Black Tuesday. It wasn't just a bad day; it was the day. The stock market, which had been chugging along like a runaway train, suddenly hit the brakes. Hard.

Panic set in. Everyone who had been riding high suddenly saw their fortunes disappearing before their eyes. People rushed to sell their stocks, trying to salvage whatever they could. But when everyone is trying to sell and nobody is buying, what happens to prices? Yep, they plummet even further.

Imagine trying to escape a crowded theater through a single exit. That's kind of what it felt like on Wall Street. The sell-off was so intense that it became a self-fulfilling prophecy of disaster. The fear was palpable, and it spread like wildfire.

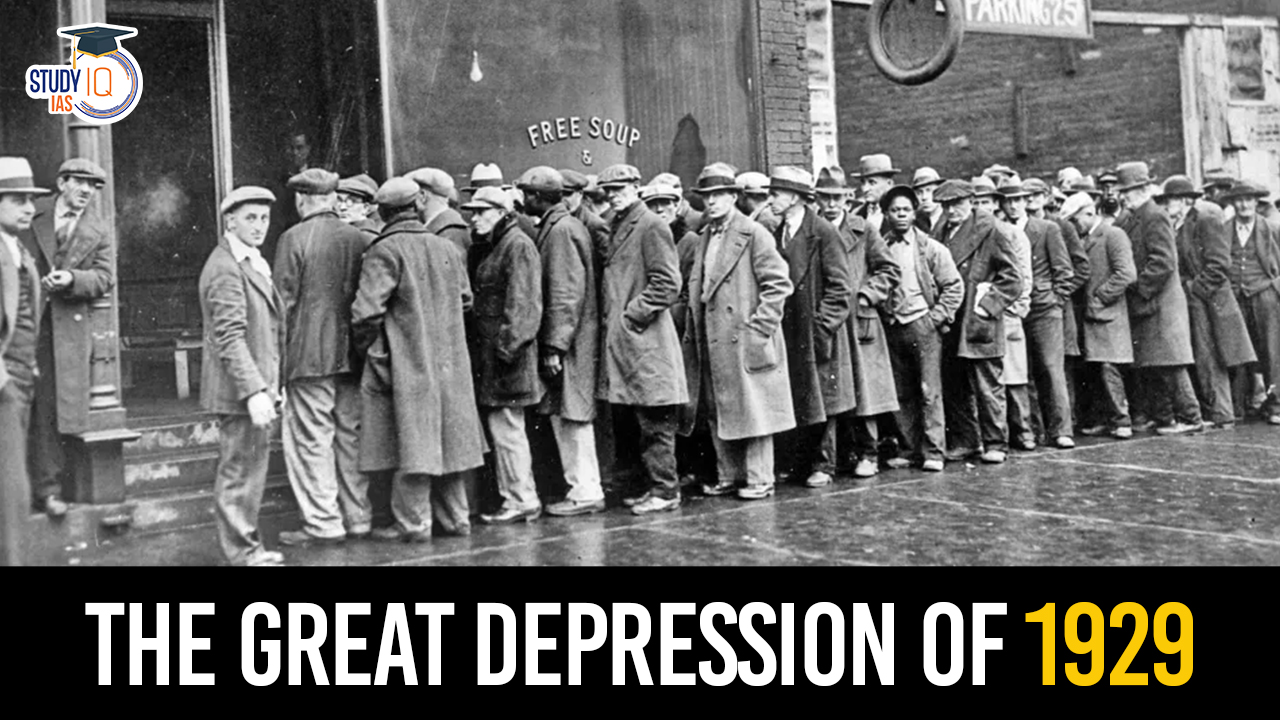

Billions of dollars were wiped out in a matter of days. Fortunes were lost, dreams were shattered, and the party atmosphere of the Roaring Twenties vanished faster than a magician's rabbit.

The Ripple Effect: Why This Matters to You (and How It Can Be Fun!)

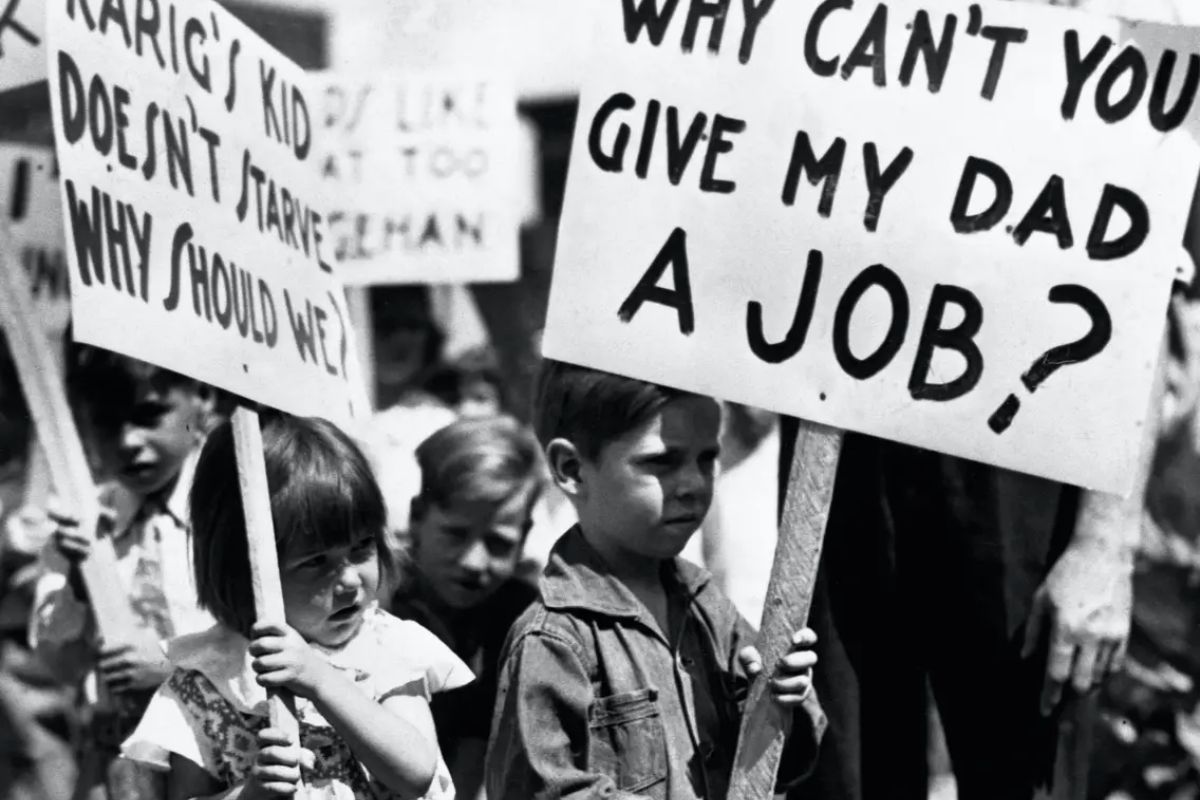

So, why is this whole stock market kerfuffle such a big deal? Because it wasn't just about the wealthy losing their millions. This crash sent shockwaves through the entire economy. When people lost their savings, they stopped spending. Businesses, seeing a drop in demand, started laying off workers. Banks, which had lent money to investors and businesses, started to fail.

It was like a giant economic hangover. The party was over, and everyone had to deal with the messy consequences. This is the foundation of what we call the Great Depression. A cascade of economic failures, all triggered by that initial, massive stock market collapse.

Now, you might be thinking, "This is all very interesting, but how does knowing about a 90-year-old market crash make my life more fun?" Ah, my friend, that’s the spirit! Understanding history is like having a superpower. It gives you perspective!

By learning about the mistakes of the past, we can become smarter about our own financial decisions. It teaches us about the dangers of unchecked optimism, the importance of diversification (don't put all your eggs in one basket, or in this case, all your cash into one stock!), and the power of a balanced approach to investing.

Think of it like learning the rules of a complex game. Once you understand the rules, you can play it better, avoid the traps, and even enjoy the strategy. The stock market, and the economy in general, is a fascinating game, and knowing the history helps you play it more wisely.

Plus, it makes for great conversation! Imagine dropping a casual "Did you know that the 1929 stock market crash was largely fueled by rampant speculation and buying on margin?" at your next dinner party. Instant intellectual cred, right there!

The Takeaway: Knowledge is Power (and Can Be Pretty Entertaining!)

So, there you have it! A peek behind the curtain of the 1929 stock market crash. It wasn't just a single event; it was a culmination of over-enthusiasm, risky financial practices, and a whole lot of optimism that, sadly, wasn't built on solid ground.

The lesson? While it's great to be excited about opportunities, it's even better to be informed. Understanding the forces that shaped our past can empower us to navigate the present and build a brighter future. And hey, if you can learn a thing or two while enjoying a good historical mystery, that’s a win-win in my book!

Keep digging, keep learning, and remember, understanding history isn't just about dusty books; it's about unlocking the secrets of how we got here, and how we can make things even better. The world of economics and history is a vast, intriguing landscape, and every piece of knowledge you gain is a step towards a more informed and, dare I say, more fun life!