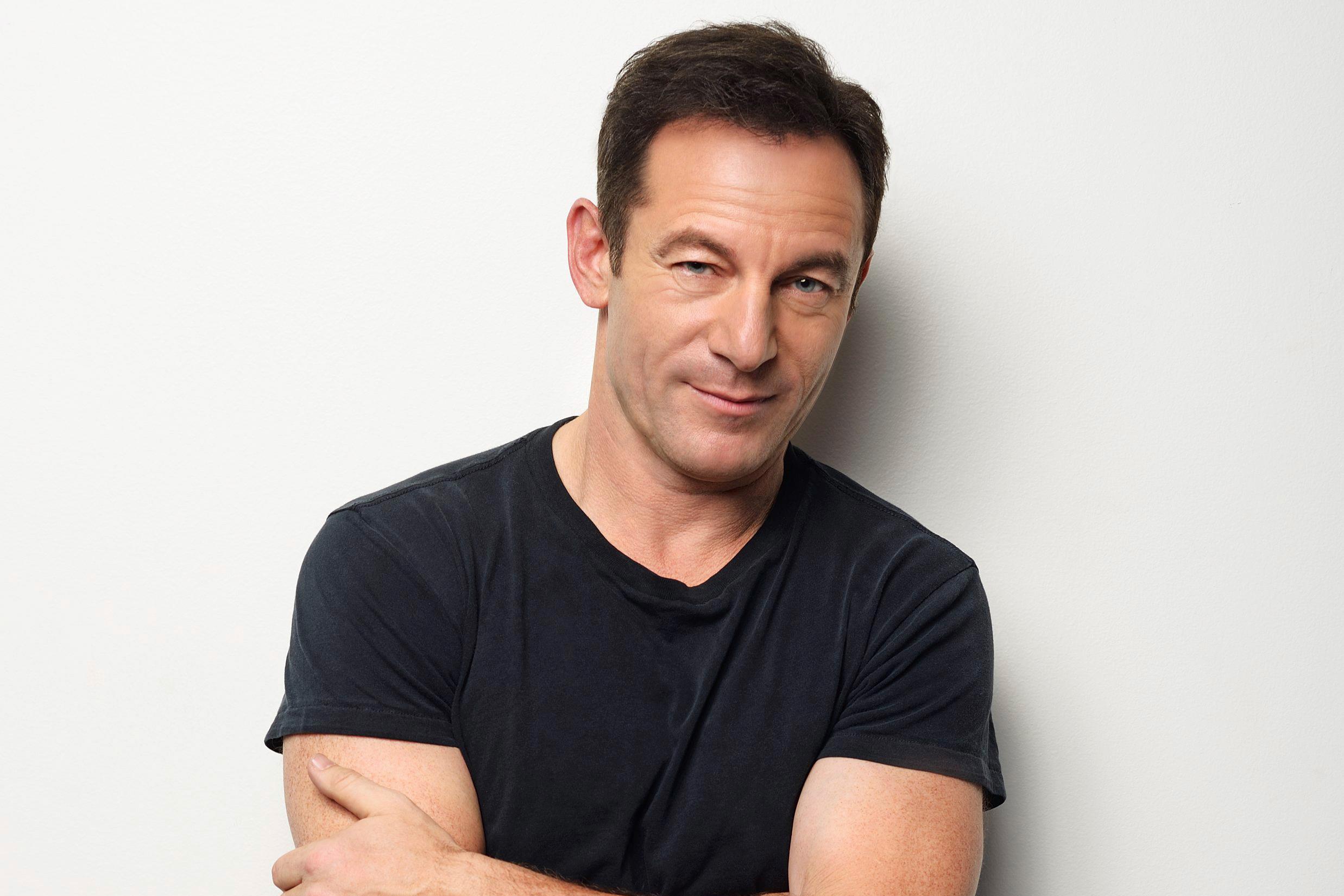

Actor Jason Isaacs Discusses His Financial Misstep Of Lifestyle Creep: Complete Guide & Key Details

Hey there, lovely people! Ever feel like you’re just trying to keep your head above water, financially speaking? You’re definitely not alone. Even folks who seem to have it all figured out, like our favorite handsome actor Jason Isaacs, can sometimes stumble a bit when it comes to their wallets. And guess what? Jason recently opened up about a common financial pitfall called “lifestyle creep,” and honestly, it’s something we can all learn from. So, let’s dive in, shall we?

You know that feeling when you finally get a little extra cash, maybe a raise at work, or a nice bonus? Your first thought might be, "Woohoo! Time to treat myself!" And that’s perfectly fine! A little indulgence is good for the soul. But here’s where lifestyle creep starts to sneak in, like a mischievous little gremlin who loves shiny new things.

What Exactly is Lifestyle Creep?

Imagine this: you’ve been driving your trusty, slightly dented, but perfectly reliable old car for years. It gets you from point A to point B, no drama. Then, you get a promotion, and suddenly, you’re eyeing that sleek, brand-new SUV with all the fancy gadgets. It’s not that you need it, but it just feels… nicer. And before you know it, that car payment is a regular fixture in your budget, and your old car is just a distant memory.

That, my friends, is lifestyle creep in a nutshell. It’s when your spending gradually increases as your income increases. It’s not about being reckless; it’s often about subtle, almost unnoticed shifts in your habits. Think of it like this: you start buying the fancier brand of coffee, then the more expensive cheese, then you upgrade your phone every year instead of every two. Each individual change might seem tiny, but over time, they add up, and suddenly, your bank account feels a lot lighter.

Jason Isaacs's "Aha!" Moment

Jason Isaacs, who you’ve seen in everything from Harry Potter to The Patriot, recently shared his own experience with this phenomenon. He talked about how, as his career took off and his income grew, his spending habits naturally followed suit. It wasn’t a sudden, extravagant splurge, but more of a slow, steady climb. He realized that he was living at a level that his earlier, less affluent self might have found… well, a bit excessive.

He’s not alone in this! Think about your own life. Have you ever looked back and thought, "Wow, I used to be happy with this, but now I just feel like I need that upgrade"? Maybe it’s a subscription you barely use but can’t bring yourself to cancel, or perhaps it’s those impulse purchases that seemed like a good idea at the time but are now gathering dust.

Why Should We Care About Lifestyle Creep?

Now, you might be thinking, "So what? If I earn more, shouldn't I enjoy it?" And the answer is a resounding YES! It’s absolutely important to enjoy the fruits of your labor. The reason why lifestyle creep can be a problem is that it can prevent you from reaching your bigger financial goals.

Let’s say you dream of buying a house, retiring early, or even just having a comfortable emergency fund for those unexpected "oops!" moments (like your car suddenly needing a new transmission!). If all your extra income is being absorbed by those little, everyday upgrades, it can make those bigger dreams feel further and further away. It’s like trying to fill a bucket with a tiny leak – you’re constantly adding water, but it’s draining away just as quickly.

The "What Ifs" That Can Haunt Us

Jason Isaacs’s reflection is a good reminder that even those in the public eye are susceptible to these everyday financial temptations. It highlights that financial awareness is key, regardless of how much money you make. When we’re not mindful of our spending, lifestyle creep can leave us feeling like we’re always just a paycheck away from trouble, even when our income has doubled.

Imagine your friend Sarah. She got a great job with a good salary. Instead of saving for a down payment on a condo, she started eating out more, buying designer clothes, and taking lavish weekend trips. A few years later, she’s still renting, and while she has some nice things, she feels stressed about her finances and still isn’t closer to homeownership. That’s lifestyle creep in action, and it can be a real buzzkill for achieving your long-term aspirations.

Key Details from Jason Isaacs's Experience (and Ours!)

So, what can we glean from Jason’s honest admission? Here are some key takeaways:

1. It's a Gradual Process

Lifestyle creep isn't a sudden explosion of debt. It’s more like a slow, gentle tide that gradually pulls your spending habits further out to sea. You might not even notice it happening until you look back and realize your expenses have significantly outpaced your income growth.

2. It's Often Unconscious

We’re not usually making conscious decisions to inflate our lifestyles. It’s often driven by social comparison, marketing, or simply the desire for a bit more comfort and convenience. Think of those targeted ads that seem to know exactly what you’re thinking about buying next!

3. Awareness is the First Step

Jason’s willingness to talk about it is crucial. It normalizes the experience and encourages us to examine our own spending. The moment you say, "Hmm, I wonder where all my money is going?" is the moment you start taking control.

4. It's Not About Deprivation

This isn’t about living like a monk or denying yourself any joy. It’s about being intentional with your money. It’s about making sure your spending aligns with your values and your long-term goals.

How to Combat the Creep (Without Feeling Deprived!)

So, how do we keep those sneaky gremlins of lifestyle creep at bay? Here are some practical, everyday tips:

1. Track Your Spending (No, Really!)

This is the golden rule. Use a budgeting app, a spreadsheet, or even a good old-fashioned notebook. Seeing exactly where your money goes is eye-opening. You might be surprised by those daily coffees or impulse online purchases.

2. Set Clear Financial Goals

What are you saving for? A down payment? A dream vacation? Early retirement? Having concrete goals makes it easier to prioritize and say "no" to unnecessary spending. Think of it as your financial compass.

3. Automate Your Savings

Treat your savings like a bill. Set up automatic transfers from your checking account to your savings or investment accounts on payday. Out of sight, out of mind, and it grows without you even thinking about it!

4. Practice the "Pause"

Before making a non-essential purchase, especially a larger one, give yourself a 24-hour (or even a week!) waiting period. Often, the urge will pass, and you'll realize you didn't really need it.

5. Budget for Fun!

This is crucial! If your budget is all work and no play, you’re more likely to overspend when the temptation arises. Allocate a reasonable amount for discretionary spending and enjoy it guilt-free!

6. Revisit Your Budget Regularly

Life changes. Your income might go up, your expenses might shift. Make it a habit to review your budget at least once a quarter to ensure it’s still serving you.

The Takeaway

Jason Isaacs’s candid confession is a gentle nudge for all of us to be more mindful of our financial habits. Lifestyle creep is a natural tendency, but with a little awareness and some simple strategies, we can ensure our spending habits serve our dreams, rather than hinder them. So, let’s all take a moment, look at our own financial lives, and make sure we’re steering our ships towards our desired destinations, one intentional financial decision at a time. Happy saving (and spending wisely)!