Alibaba Group Stock Price February 21 2025 Google Finance: Price, Costs & What To Expect

Hey there, coffee buddy! So, you're wondering about Alibaba's stock price, huh? Specifically, what's the buzz around February 21st, 2025, according to our trusty Google Finance pal? Well, grab another sip, because we're about to dive into this with all the casual coolness of a Saturday morning. No need for those stuffy financial jargon words here, we're just gonna chat about it, plain and simple. Think of this as our little stock market gossip session.

First off, let's get one thing straight: predicting the future of the stock market is about as easy as predicting if your cat will actually use that expensive new toy you bought it. It's a wild ride, folks! Especially with a company as massive and, let's be honest, sometimes as volatile as Alibaba. So, while Google Finance is a fantastic tool, and we'll totally peek at what it might be telling us, remember this is all just educated guesswork, okay? We're not financial advisors, just curious humans with an interest in how this whole digital giant is doing.

Now, February 21st, 2025. That's still a little ways off, isn't it? We're talking about a future that hasn't even happened yet! It's like trying to imagine what your hair will look like next year. Will it be fabulous? A disaster? Who knows! But what we can do is look at the current trends, the whispers on the wind, and the general vibe around Alibaba to make some informed guesses. It’s like trying to guess the weather by looking at the clouds.

So, what's the deal with Alibaba these days, anyway? Well, this Chinese tech behemoth is involved in pretty much everything, right? E-commerce, cloud computing, digital media, you name it. They're like the Swiss Army knife of the internet, but on a global scale. And when a company is that big, its stock price is influenced by, well, everything. From the economic climate in China to global trade relations to, you know, whether they accidentally launch a new product that everyone loves or hates.

Let's get down to brass tacks, or should I say, digital cents. Google Finance, bless its algorithmic heart, will be showing us the price. That's the number you see flashing on your screen, the one that makes your heart do a little jig or sink faster than a lead balloon. But it's not just about that single number, is it? We've also got to think about the costs.

What costs are we talking about here? Well, it's not just the sticker price of the stock itself. We're talking about the costs of doing business for Alibaba. Think about their massive infrastructure, their research and development (gotta stay ahead of the game, right?), their marketing campaigns (who can forget those elaborate Chinese New Year ads?). All these expenses eat into their profits, and profits, my friend, are what investors generally love to see.

And then there are the other "costs" – the regulatory hurdles. China's government has a big say in how these tech giants operate, and sometimes those regulations can feel like a surprise rain shower on your picnic. If there are new rules, new investigations, or even just a stern word from the authorities, that can definitely put a damper on things and, you guessed it, affect the stock price. It's like trying to run a race with an unexpected obstacle course popping up.

So, what can we expect for February 21st, 2025? Ah, the million-dollar question! Or, you know, the billion-dollar question for Alibaba. If I had a crystal ball, I'd be selling fortunes, not writing articles, wouldn't I? But we can definitely ponder some possibilities.

One major factor, as always, will be the overall health of the Chinese economy. Is it booming? Is it chugging along? Or is it facing some headwinds? Alibaba is so intertwined with China's economic engine that its stock price will pretty much be a reflection of that. If consumers are spending, businesses are growing, and the government is feeling optimistic, that's generally good news for Alibaba.

Then there's the global tech scene. Is AI still the hot new thing? Are there new competitors popping up like mushrooms after a spring rain? Alibaba needs to keep innovating, keep expanding, and keep finding new ways to wow us. If they're launching groundbreaking new tech or dominating new markets, that's going to send positive vibes through the stock.

Let's also think about consumer sentiment. Are people still feeling confident about buying online? Are they trusting platforms like Tmall and Taobao? Customer trust is like the secret sauce for e-commerce. If people feel good about shopping with Alibaba, they'll keep clicking "add to cart," and that's music to investors' ears.

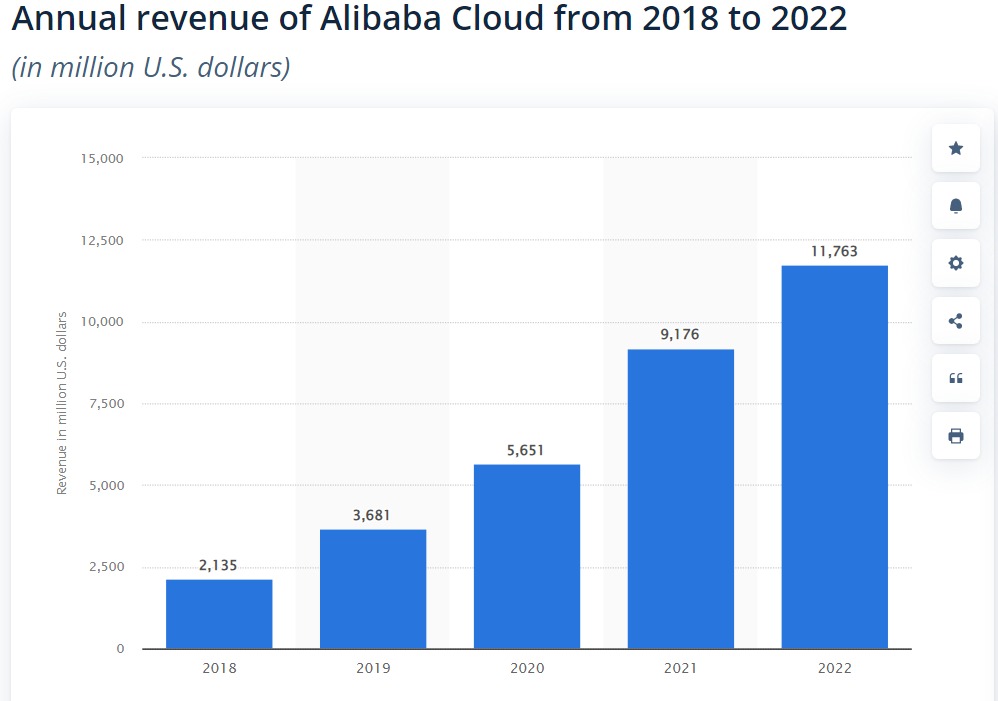

And what about their cloud business, Alibaba Cloud? This is a huge growth area for them. As more and more businesses move to the cloud, Alibaba Cloud is in a prime position to benefit. If they're landing big clients or expanding their global data centers, that's a major plus. It's like them building more super-highways for data.

Now, here's where we get a little speculative, but in a fun, coffee-fueled way. Imagine this: It's February 2025. Maybe Alibaba has just announced some stellar earnings for the previous quarter. Perhaps their cloud division has blown expectations out of the water. Maybe they've made a big, exciting acquisition that signals a new era of growth. In that scenario, you'd expect to see the stock price doing a happy dance, climbing higher and higher. Investors would be like, "Take my money!"

Or, flip that coin. What if there's been some unexpected regulatory news out of China? What if global economic uncertainty is making people nervous? What if a major competitor has launched a product that's stealing their thunder? In that case, the stock price might be looking a bit more… glum. It might be taking a little dip, and investors might be scratching their heads, wondering what's next.

It’s also important to remember that the stock market doesn't always move in straight lines, does it? It's more like a roller coaster, with ups and downs and unexpected twists and turns. So, even if things are looking rosy, there can still be short-term fluctuations. A single tweet, a random news headline, a shift in market sentiment – any of these can cause a little ripple.

Let’s consider the "costs" in a broader sense too. The cost of competition is a big one. Alibaba isn't the only player in town, not by a long shot. They've got rivals in China like JD.com and Pinduoduo, and globally, they're up against giants like Amazon. Staying ahead means constantly investing in new technologies and improving their services. That's a continuous cost, but one that’s necessary for survival and growth.

And what about the cost of innovation? Developing new AI capabilities, expanding their logistics network, pushing into new markets – these all require significant investment. If their R&D spending is high, it might initially put a slight pressure on profits, but the hope is that these investments will pay off in the long run with new revenue streams and market dominance. It's like planting seeds for a future harvest.

So, when you look at Google Finance on February 21st, 2025, and you see that price, remember all the layers underneath it. It’s not just a number; it's a story. A story of economic trends, consumer behavior, technological advancements, and the ever-present dance between a company and the regulators.

Think about it this way: If Alibaba has managed to successfully navigate the changing regulatory landscape in China, that's a huge win. If they've continued to expand their international presence, especially in emerging markets, that's another big tick in the positive column. And if their core e-commerce business remains strong, while their cloud and digital media segments show impressive growth, then I'd imagine that February 21st, 2025, could be a rather cheerful day for BABA shareholders.

On the flip side, if there are any unexpected geopolitical tensions, if consumer spending in China falters, or if their innovative edge starts to dull, then that stock price might tell a different tale. It’s a constant balancing act for these massive corporations.

Let’s not forget the intangible costs too. The cost of maintaining brand reputation is crucial. If there’s a major data breach or a scandal, it can take years and a whole lot of money to repair the damage. Alibaba, like any global brand, has to be mindful of public perception.

And what about the cost of talent? Attracting and retaining the brightest minds in the tech industry is a fierce battle. Alibaba needs top-tier engineers, data scientists, and strategists to keep its engines running. Their human capital is as vital as their technological infrastructure.

Ultimately, when we peek at Google Finance for Alibaba's stock price on February 21st, 2025, we're seeing a snapshot of market sentiment. It's what investors collectively believe the company is worth at that exact moment. And that belief is shaped by a million different factors, big and small.

So, while I can't give you a definitive "up" or "down," I can say this: Keep an eye on the news, stay curious about their business developments, and remember that the stock market is a fascinating beast. It’s a reflection of our collective hopes, fears, and predictions about the future. And on February 21st, 2025, when you check Google Finance, you'll be seeing one of those many possible futures unfold. Cheers to that!