Alphabet Inc. Googl Intraday Price Movement May 23 2025: Price/cost Details & What To Expect

Hey there, fellow digital wanderers and market watchers! Let's kick back and chat about something that’s pretty much woven into the fabric of our lives: Alphabet, the big brain behind Google. Specifically, we’re going to peek into the crystal ball – or, you know, just look at the charts – for Alphabet’s intraday price movement on May 23rd, 2025. Think of this less as a stuffy financial report and more as a casual coffee-break chat about where the digital tide might be taking us.

Now, predicting stock prices is a bit like predicting the weather. You can have a pretty good idea, but there’s always a chance for a surprise gust of wind or, in this case, a sudden surge or dip. So, as we dive into May 23rd, 2025, remember that this is all about exploring possibilities, not laying down concrete bets. We’re aiming for an easy-going understanding, a vibe that’s as chill as your Sunday morning scroll through Google News.

The Alphabetian Ecosystem: More Than Just a Search Bar

Before we get to the nitty-gritty of the ticker tape, let's appreciate what Alphabet is. It's not just that friendly little search engine that helps you find out who won the Oscar for Best Supporting Actor in 1998 (it was James Coburn, by the way, for Affliction). Alphabet is a sprawling digital universe. We’re talking about:

- Google Search: The OG, the king, the… well, you get it.

- YouTube: Where cat videos and viral dance challenges reign supreme.

- Waymo: Those self-driving cars that are slowly but surely making their way onto our roads. Think of them as the future of your daily commute, minus the road rage.

- Google Cloud: The backbone of so many businesses, humming away in the digital ether.

- Android: The operating system that powers a gazillion smartphones worldwide.

- Google Pixel: Their own line of sleek devices, giving Apple and Samsung a run for their money.

- Verily: Exploring the frontiers of life sciences. This is where the really sci-fi stuff happens.

This incredible diversity is key. When we talk about Alphabet’s stock, we’re not just talking about ad revenue from search. We’re talking about the ripple effects from a new YouTube feature, the excitement around a Waymo milestone, or even a breakthrough in Verily's research. It’s a complex symphony, and the stock price is the conductor’s baton, reacting to all the different instruments.

May 23rd, 2025: A Glimpse into the Intraday Dance

Alright, let’s set our imaginary calendar to May 23rd, 2025. What kind of movements might we see in Alphabet’s (GOOGL) intraday price? The market is a dynamic beast, influenced by everything from global events to a particularly catchy TikTok trend that redirects search queries. Here’s how we can think about it, keeping it light and accessible.

Morning Buzz: The Opening Bell Optimism

Imagine it’s Friday morning. The weekend is almost here, and there’s a general sense of optimism in the air. This is often reflected in the stock market. Alphabet’s price might see an initial upward trend as the market opens. This could be fueled by:

- Positive overnight news: Perhaps a glowing review of a new Pixel feature, a significant partnership announced for Google Cloud, or even a positive analyst report released after market close the day before.

- General market sentiment: If the broader market is having a good day, tech stocks, especially giants like Alphabet, tend to follow suit. Think of it like a rising tide lifting all the digital boats.

- Anticipation of weekend activity: People might be more inclined to invest, thinking about how their portfolios will perform over the next couple of days.

On this particular Friday, let’s say there was a big tech conference that concluded the previous evening, and Alphabet unveiled a game-changing AI advancement that’s got everyone talking. That could translate into a strong start for GOOGL.

Midday Momentum: The Navigational Charts

As the day progresses, the initial excitement might settle into a more measured pace. The intraday price movement will then be influenced by real-time data and news. We’ll be watching:

- Trading volume: Are a lot of people buying or selling? High volume often indicates stronger conviction behind the price movement.

- Key economic indicators: Any major economic data releases – inflation reports, employment figures – can send ripples through the entire market. Even though Alphabet is a global company, domestic economic health is a big factor.

- Competitor movements: What are Meta, Microsoft, or Amazon up to? The tech world is a competitive arena, and the actions of rivals can impact Alphabet’s stock. Imagine if Microsoft announced a major AI integration that directly challenged Google's new offering – that would certainly make waves.

- Specific Alphabet announcements: Sometimes, companies will drop news mid-day. This could be anything from a surprise earnings update (though unlikely for a standard trading day) to a minor product tweak that investors find significant.

For our May 23rd, 2025, scenario, let's imagine that the midday sees a bit of a consolidation phase. The initial AI buzz has settled, and investors are digesting the implications. Perhaps there's a slight pullback as some early buyers take profits, or maybe it hovers around a certain price point as traders wait for more concrete evidence of the AI’s impact on user engagement or advertiser spend.

Afternoon Adjustments: The Wind Shifts

The afternoon session can be fascinating. This is often when traders make their last-minute adjustments before the market closes. We might see:

- End-of-day buying or selling pressure: Institutional investors might be rebalancing their portfolios, or traders looking to close out positions might influence the price.

- Foreign market influence: As European and Asian markets close, their sentiment can sometimes spill over into the US market.

- Breaking news: A late-breaking story, whether it’s geopolitical, technological, or even something as seemingly mundane as a supply chain hiccup affecting hardware production, can cause a sudden shift.

On May 23rd, 2025, picture this: a tech blog publishes an in-depth analysis of Alphabet’s new AI, suggesting it has the potential to significantly boost YouTube ad revenue. This positive spin could lead to a late-day rally, pushing GOOGL higher as buyers jump in, sensing a profitable opportunity before the weekend.

The Closing Bell Symphony

The closing price is, in essence, the day’s verdict. It’s the price at which the last trade occurs. For GOOGL on May 23rd, 2025, the closing price would be the culmination of all these intraday movements, influenced by the overall mood of the market and the specific narratives surrounding Alphabet.

What to Expect: Decoding the Price Tag

When we talk about "price/cost details," we're essentially looking at the numbers that tell the story of supply and demand. For Alphabet, on any given day, you'll be looking at:

- The Opening Price: Where trading begins.

- The High: The peak price reached during the trading session.

- The Low: The lowest price the stock dipped to.

- The Closing Price: The final price.

- Volume: The total number of shares traded. This is your indicator of how much "activity" there was.

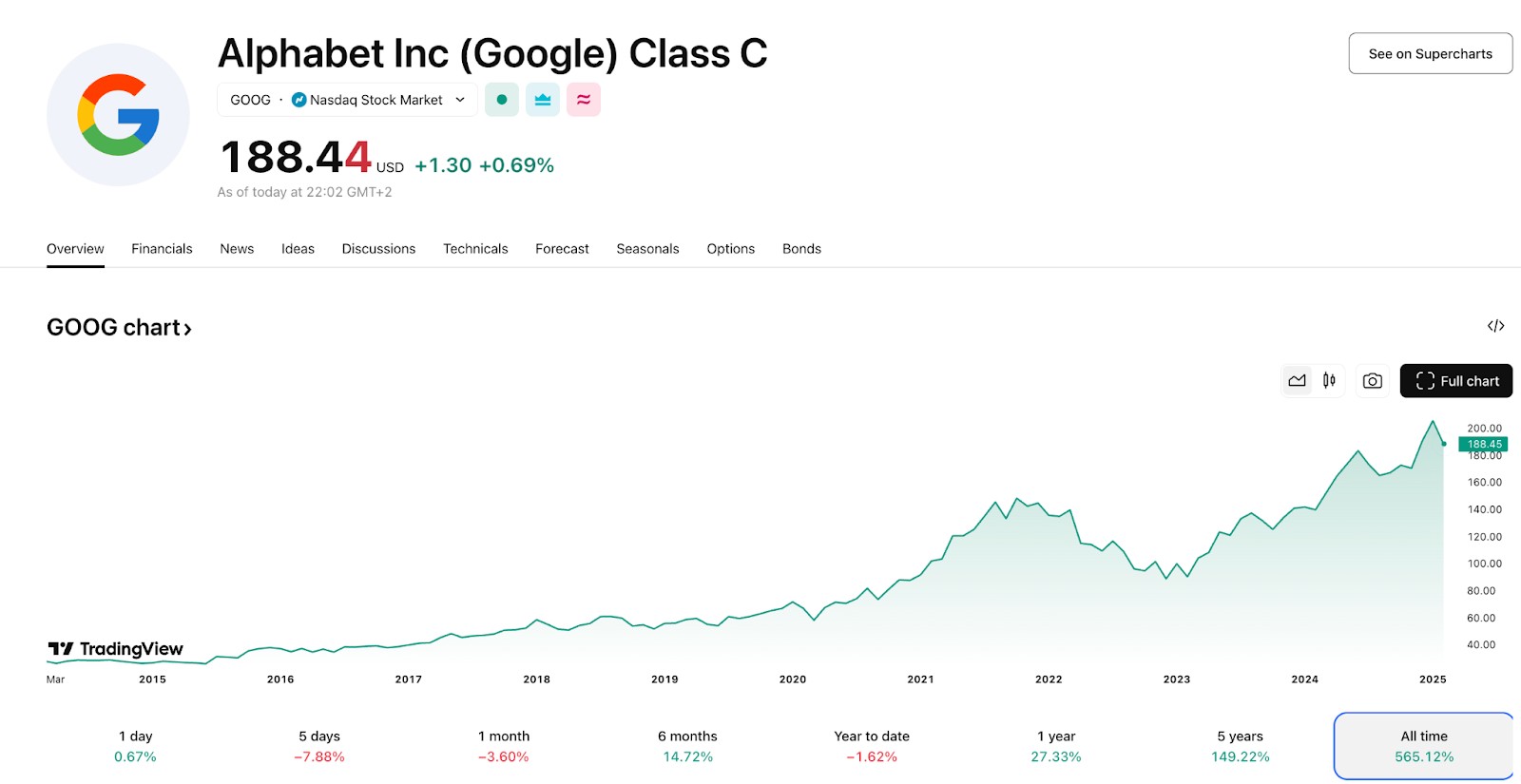

On May 23rd, 2025, if our hypothetical AI breakthrough story gained traction, we might see GOOGL open at, say, $150, climb to a high of $155 during the day, dip slightly to $148 on some profit-taking, and then close strong at $154. The volume would likely be higher than average, reflecting the increased interest. These are purely illustrative numbers, of course! The actual figures will depend on a myriad of factors.

Practical Tips for the Casual Observer

Even if you're not a day trader, understanding these intraday movements can be fun and informative. Here are a few ways to stay in the loop:

- Follow Reputable Financial News: Sites like Bloomberg, The Wall Street Journal, and Reuters offer real-time updates and analysis. For a more digestible take, look for tech-focused publications.

- Use Stock Tracking Apps: Most financial platforms have intuitive apps where you can set price alerts for GOOGL. Get a notification if it hits your target price, or dips below a level you're watching. It’s like having a personal stock market assistant in your pocket.

- Understand the Context: Don't just look at the numbers. Read why the price is moving. Is it earnings? A new product? A regulatory concern? Think of it like reading the footnotes in a good book – they add depth and meaning.

- Diversify Your "Information Diet": Just as a balanced portfolio is wise, so is a balanced approach to information. Don't rely on just one source.

- Remember the Long Game: While intraday movements are exciting, Alphabet's long-term growth is often driven by broader trends and innovation. Don't get too caught up in the daily fluctuations if you're thinking about longer-term investment.

Fun Facts and Cultural Cues

Did you know that the original name for Google was "BackRub"? Thankfully, they changed it! Imagine searching "BackRub for cat videos." It just doesn't have the same ring to it.

Also, consider how much our lives have been shaped by Alphabet. From the way we navigate our cities with Google Maps, to the music we discover on YouTube, to the sheer volume of information at our fingertips – it's a testament to their pervasive influence. Think about it: if you wanted to know what a "meme" was in 2005, you'd probably have to ask a teenager. Now, Google instantly tells you.

On May 23rd, 2025, the market will be reacting to the present and the anticipated future. Will AI continue its meteoric rise? Will Waymo finally dominate the streets? These are the questions that fuel the trading floor, and in turn, the stock price.

A Reflection for Your Own Daily Flow

Looking at the intraday movements of a company like Alphabet is, in a way, a microcosm of life itself. There are moments of excitement and optimism, periods of quiet consolidation, and sometimes, unexpected shifts that can feel jarring. We have our own "opening bells" each morning, our "midday slumps," and our "afternoon rallies" as we navigate our personal and professional lives.

Just as the market reacts to news and trends, we too are influenced by the world around us. The key, for both stock prices and our own well-being, is not necessarily to predict every single fluctuation, but to understand the broader currents, adapt to changes, and maintain a sense of perspective. So, as you’re scrolling through your feed on May 23rd, 2025, or any day for that matter, remember that even the most complex systems, like Alphabet’s stock price, are made up of a series of moments – some exciting, some calm, all part of the ongoing narrative.