Altria Shares Ended Lower Behind The S&p 500.: Complete Guide & Key Details

Hey there, ever feel like the stock market is this big, mysterious club that only suits-and-ties types understand? Well, let's peek behind the curtain together, shall we? Today, we're going to chat about something you might have seen in the news: Altria shares ended lower behind the S&P 500. Sounds a bit technical, right? But honestly, it's like understanding why your favorite bakery's croissants weren't as flaky as usual. There's a reason, and it might actually be interesting to you!

So, what exactly is Altria? Think of it as the big boss behind some familiar names. You know, the folks who bring you cigarettes like Marlboro, but also have their fingers in other pies. They've been around for a while, a bit like that reliable old friend who's always there, but sometimes you wonder what they're up to behind closed doors. And the S&P 500? That's basically a big basket of the 500 biggest and baddest companies in America. It’s like the overall health check for the entire US stock market. If the S&P 500 is doing great, it generally means most of the big players are doing well. If it’s struggling, well, it’s like most people having a bit of a sniffle.

Why Should You Even Care About Altria's Stock Price?

Now, you might be thinking, "Why on earth should I care if Altria's stock went down, or if it did better or worse than this 'S&P 500' thing?" That's a fair question! It’s not like you’re personally invested in whether Mr. Altria gets to buy a new yacht today. But here’s the fun part: companies like Altria are part of the bigger economic soup we're all swimming in. When big companies do well, it can mean good things for jobs, for retirement funds (yes, your 401k!), and even for the general mood of the country. And when they stumble, it’s a tiny blip on the radar that can sometimes tell us something about what’s going on in the world.

Imagine you're at a big family reunion. The S&P 500 is like the overall vibe of the party. Is everyone laughing and having a grand time? Great! That's a healthy S&P 500. Now, Altria is like Uncle Bob at that reunion. He's a character, for sure, and he has his own drama. If Uncle Bob is having a bit of a tough time, maybe he spilled his drink or had a mild disagreement with Aunt Carol, he might not be as jovial as usual. That's what happened here: Altria’s stock price didn’t keep up with the general happy march of the S&P 500. It’s like Uncle Bob was a bit under the weather while everyone else was doing the macarena.

What Does "Lower Behind The S&P 500" Actually Mean?

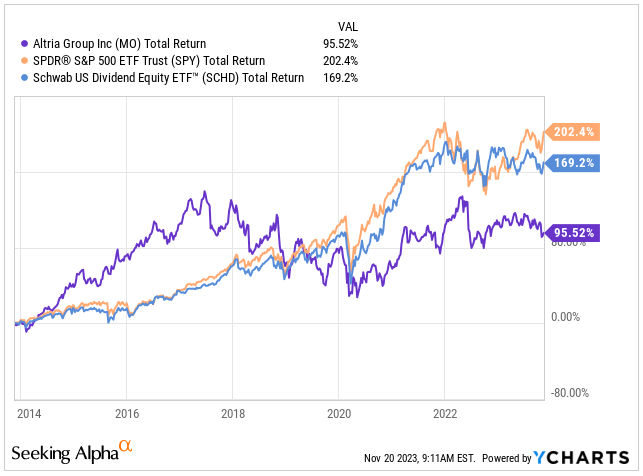

Let's break down that phrase: "Altria shares ended lower behind the S&P 500." Think of it like a race. The S&P 500 is the main racehorse, chugging along nicely. Altria is another horse in that same race. If Altria ended "lower behind" the S&P 500, it means the S&P 500 horse ran faster and won the race by a bigger margin than the Altria horse. It doesn't necessarily mean Altria lost money, but rather that it didn't gain as much as the average of the other 499 big companies. So, while the rest of the stock market was perhaps enjoying a little hop, skip, and a jump, Altria took a slightly more leisurely stroll.

It's a bit like when you're trying to bake a cake with a recipe. The recipe tells you how much flour, sugar, and eggs to use. The S&P 500 is like a perfectly baked cake. Altria is a cake that maybe, just maybe, got a little too much baking soda. It's still a cake, but it's not quite as perfectly puffed up as the ideal. This difference, this slight underperformance, is what the news is pointing out.

So, What's the Story Behind Altria's Pace?

Now, the juicy part: why might Altria have been taking that leisurely stroll? Companies, just like people, have their own unique challenges and opportunities. For Altria, one of the biggest things to consider is the changing world of smoking and tobacco. It's no secret that fewer people are smoking traditional cigarettes these days. It's like how fewer people use landline phones now that we all have smartphones. This means Altria, whose bread and butter has historically been those traditional cigarettes, has to adapt. They're trying to get into new areas, like products that don't burn tobacco, or even other types of businesses. Think of it like a classic rock band trying to release a hip-hop album. It's a big shift, and not everyone is going to love it immediately.

Sometimes, the news about these shifts can make investors a bit nervous. They might be wondering, "Will Altria's new ventures be as profitable as the old ones?" This uncertainty can lead to the stock not performing as well as other, perhaps more straightforward, companies in the S&P 500. It's like when you hear your favorite restaurant is changing its chef – you might be excited about new dishes, but you also might worry if the old favorites will still be as good.

Key Details to Ponder (Without Getting Too Technical)

When you hear about stock prices, there are a few things that are always at play. For Altria, some of the key details revolve around:

- Sales figures: How many of their products are they actually selling? If fewer people are buying their traditional cigarettes, that's a big deal.

- New Product Success: Are their new ventures, like those smoke-free options, actually taking off? Imagine launching a new video game – will it be a blockbuster hit or a flop?

- Regulatory Changes: Governments sometimes make rules about tobacco products. These rules can affect how much companies can sell or how they advertise. It's like having a referee blow the whistle on certain moves in a game.

- Investor Confidence: Do people who invest money (investors) believe in Altria's future? If they're worried, they might sell their shares, which can drive the price down.

So, when Altria's shares ended lower behind the S&P 500, it's likely a combination of these factors playing out. It's not usually one single dramatic event, but rather a series of ongoing trends and decisions.

What Does This Mean for You, My Friend?

Honestly, for most of us just going about our daily lives, a single day's performance of one company might not seem like a big deal. But here's why it's worth a little nod:

- Retirement Dreams: If you have a retirement account (like a 401k or pension), it's probably invested in a whole bunch of companies, including ones like those in the S&P 500. When the market does well, your retirement savings tend to grow. So, understanding what’s happening with big players like Altria gives you a tiny peek into the engine that drives those savings.

- Economic Whispers: Altria's story is a bit of a microcosm of broader economic trends. The shift away from traditional smoking is a huge societal change, and companies like Altria are on the front lines of adapting. Their struggles and successes can be early indicators of how businesses are navigating these big shifts.

- Just Being Informed: It's always good to have a general awareness of what's going on. You don't need to be a stock market guru, but understanding a little bit can help you feel more confident when you hear these sorts of headlines. It's like knowing a little about how your car works – you don't need to be a mechanic, but understanding the basics is useful!

So, next time you see a headline about a company's stock, remember it's not just numbers on a screen. It's about the stories of companies trying to navigate a changing world, and those stories, in their own way, affect all of us. Altria's dip behind the S&P 500? It's just one chapter in a much bigger, ongoing story.