Are Navient Ffelp Loans Eligible For Forgiveness? Here’s What’s True

Alright, pull up a chair, grab a (metaphorical, for now) latte, and let’s dish about Navient and those fabled FFELP loans. You know, the ones that have been lurking in your financial psyche like a particularly persistent Pokémon? We’ve all been there, right? Staring at those statements, wondering if they’re secretly written in ancient hieroglyphs. So, the million-dollar question (or, you know, the tens-of-thousands-of-dollars question) is: are these bad boys eligible for forgiveness? Let’s crack this nut, shall we?

First off, let’s define our terms, because who doesn't love a good acronym, especially when it involves your hard-earned cash? FFELP stands for the Federal Family Education Loan Program. Think of it as the OG of federal student loans, birthed before the Direct Loan program took over. And Navient? Well, Navient became a household name (or perhaps a household groan) as one of the major servicers of these loans. They were the friendly (or not-so-friendly, depending on your billing cycle) folks collecting your payments.

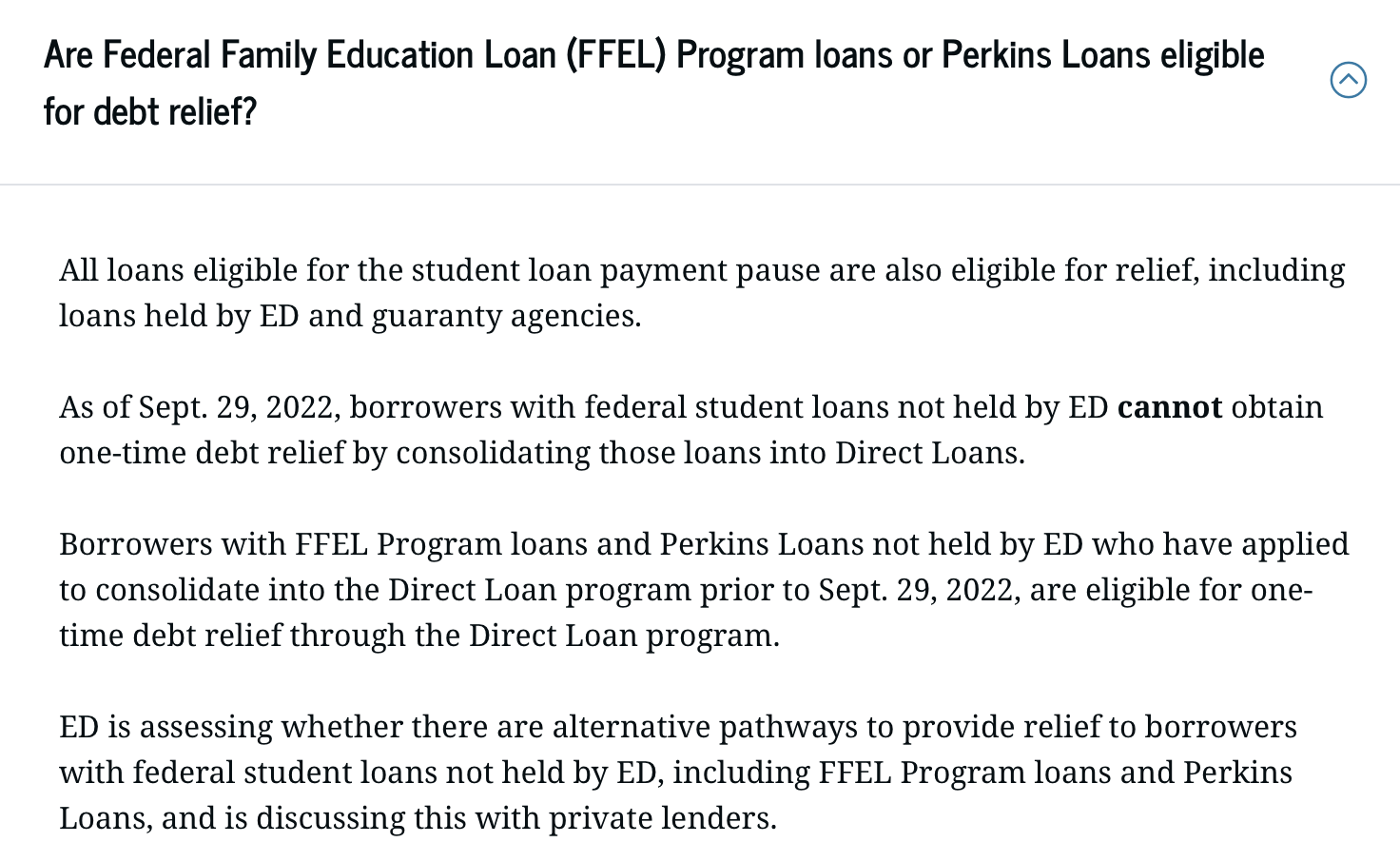

Now, about that sweet, sweet forgiveness. This is where things get a little... twisty. Like a pretzel that’s been through a marathon. The truth is, most original FFELP loans are NOT directly eligible for the forgiveness programs that apply to Direct Loans. Ouch. I know, right? It’s like finding out your golden ticket is actually just a well-designed coupon for a free high-five. Not quite the same value.

But wait! Don’t go throwing your reusable coffee cups at the wall just yet. There’s a glimmer of hope, a tiny, flickering candle in the otherwise dark cave of student loan debt. Forgiveness for FFELP loans is a bit of a special edition kind of deal. It usually requires a little bit of administrative wizardry, a dash of governmental decree, or, in some cases, a whole lot of patience.

The Direct Consolidation Connection: Your FFELP Lifeline?

Here’s the main way you can get your FFELP loans in the game for forgiveness: Consolidation. Think of consolidation as giving your loans a superhero makeover. You combine all your eligible FFELP loans into a single, brand-new loan under the Direct Loan Program. And why is this important, you ask? Because the Direct Loan Program is the one that gets all the cool toys, like Public Service Loan Forgiveness (PSLF) and income-driven repayment (IDR) forgiveness.

So, if your FFELP loans are sitting there, looking all old-school, the magic trick is to consolidate them into a Direct Consolidation Loan. Once they’re part of the Direct Loan family, they suddenly become eligible for all the goodies that Direct Loans are entitled to. It's like inviting your slightly-less-fashionable cousin to the prom, and suddenly they get to dance with everyone!

However, and this is a big however, it’s crucial to understand that not all FFELP loans are eligible for consolidation. Some might be PLUS loans made to parents, or they might have other specific characteristics that keep them out of the consolidation party. It’s like a bouncer at a very exclusive club saying, “Sorry, you’re not on the list, buddy.”

What About Navient's Role in All This?

Navient, being the servicer, was the gatekeeper for your FFELP payments. Now, you might be thinking, “Did Navient screw me over?” And look, the relationship with loan servicers can be… complicated. We’ve heard stories, haven't we? Of calls that felt like they were routed through a labyrinth, of confusing paperwork, and of customer service that made you want to communicate solely through interpretive dance.

Navient has actually been involved in settlements and has had to make changes to its practices. Some borrowers with FFELP loans serviced by Navient might have experienced issues that the government has tried to address. For instance, there was a significant settlement where Navient agreed to provide $1.7 billion in relief to federal student loan borrowers, including discharge for certain private loans and refunds for some borrowers who made payments on FFELP loans that should have been discharged.

So, if you were a Navient borrower, it's worth investigating if you were part of any specific relief programs or if your loans were impacted by these settlements. Think of it as checking if you accidentally qualified for a bonus prize in the cosmic lottery!

The Wild World of Forgiveness Programs (and How FFELP Might Fit In)

Let’s talk about the actual forgiveness programs. This is where things get really interesting, and also, potentially, a little confusing. The two big ones are:

- Public Service Loan Forgiveness (PSLF): This is for folks working full-time for the government or a qualifying non-profit organization. You make 120 qualifying payments, and BAM! The rest of your Direct Loans are forgiven. Remember that consolidation trick? If you consolidate your FFELP loans into a Direct Loan, those payments can count towards PSLF. This is a game-changer for many!

- Income-Driven Repayment (IDR) Forgiveness: These plans, like PAYE, REPAYE, IBR, and ICR, calculate your monthly payment based on your income and family size. After 20 or 25 years of payments, the remaining balance is forgiven. Again, the catch is that original FFELP loans generally don't qualify for IDR plans directly. But guess what? Consolidate them into a Direct Loan, and suddenly they’re in the running!

There are also other, more specific forgiveness programs, like those for teachers or students who were defrauded by their schools. The eligibility for these can be a bit more nuanced, and whether your FFELP loan fits in often depends on the specific program rules and, you guessed it, whether you've consolidated.

The "Make-Up" Forgiveness (aka the IDR Adjustment)

Now, for a bit of good news that’s been a real lifesaver for many FFELP borrowers who didn’t consolidate. The Department of Education has been implementing a series of adjustments to the IDR payment count. This is like a historical recount of your payments, and it's been correcting past inaccuracies and counting more periods than previously allowed towards IDR forgiveness.

What does this mean for FFELP loans? Well, some FFELP loans that were not consolidated have been able to benefit from this IDR adjustment. If you were making payments on your FFELP loans and they were in an eligible repayment plan, some of those payments might now be counting towards the 20 or 25 years needed for IDR forgiveness. This is HUGE, and it means you might be closer to forgiveness than you thought, even without consolidating!

However, this is a limited-time opportunity, and the clock is ticking on some aspects of these adjustments. So, if you haven't checked this out, now is the time to investigate.

So, What’s the Bottom Line?

Here’s the no-nonsense, coffee-stained truth: original FFELP loans are generally not eligible for forgiveness on their own. They’re like the wallflowers at the student loan dance, waiting for someone to ask them to twirl.

Your best bet for unlocking forgiveness eligibility for your FFELP loans is often through Direct Consolidation. This merges your FFELP loans into the Direct Loan program, opening the door to PSLF and IDR forgiveness. But do your homework, because not all FFELP loans can be consolidated.

And don't forget that recent IDR adjustment. It’s been a lifesaver for some FFELP borrowers who kept their loans as-is. This could be your golden ticket, even if you haven’t consolidated!

The key takeaway here is to be proactive. Don't just let those loans gather dust and interest. Go to the official Federal Student Aid website (studentaid.gov). It’s the ultimate source of truth, and it can help you navigate the labyrinth. Navient is a servicer, but the rules and programs are set by the Department of Education. So, while you might have had your dealings with Navient, your forgiveness eligibility is determined by federal policy.

It's a jungle out there in student loan land, but with a little research and a lot of persistence, you might just find your way to that sweet, sweet relief. Now, who needs a refill?