Are There Penalties For Withdrawing From Roth Ira? Here’s What’s True

Ah, the Roth IRA. It’s that magical little retirement savings account, promising tax-free growth and, dare we dream, a comfortable future where you can finally buy all those novelty socks you’ve been eyeing. But then life happens, doesn't it? Suddenly, you find yourself staring at your phone, a notification flashing about an unexpected car repair that’s going to cost more than your last vacation (and believe me, that vacation involved a lot of questionable street food). Your mind drifts to that Roth IRA. Can you… dip into it? Are there penalties? It’s like looking at your emergency cookie stash when you really need a cookie, but you know there’s a secret rule about when you can break it out.

Let’s ditch the jargon and talk real life. Think of your Roth IRA contributions as setting aside some extra cash for a future you. Maybe that future you wants to travel the world, or finally perfect that sourdough starter. You’ve diligently put money in, watching it (hopefully!) grow. Now, let’s say current you has a sudden craving for… well, not cookies, but maybe a new roof because the rain is doing a drum solo on your ceiling. The question on everyone’s lips, spoken or whispered to a bewildered cat: “Can I touch my Roth IRA money without Uncle Sam slapping me with a giant ‘gotcha’ fine?”

The short answer, the one that might make you breathe a sigh of relief while you simultaneously start calculating how much you can take, is: it depends. It's not a simple "yes" or "no," which, let's be honest, is rarely how anything truly important in life works, is it? It’s more like navigating a maze where some paths lead to freedom and others… well, let's just say they involve extra paperwork and a stern talking-to from a very official-sounding person.

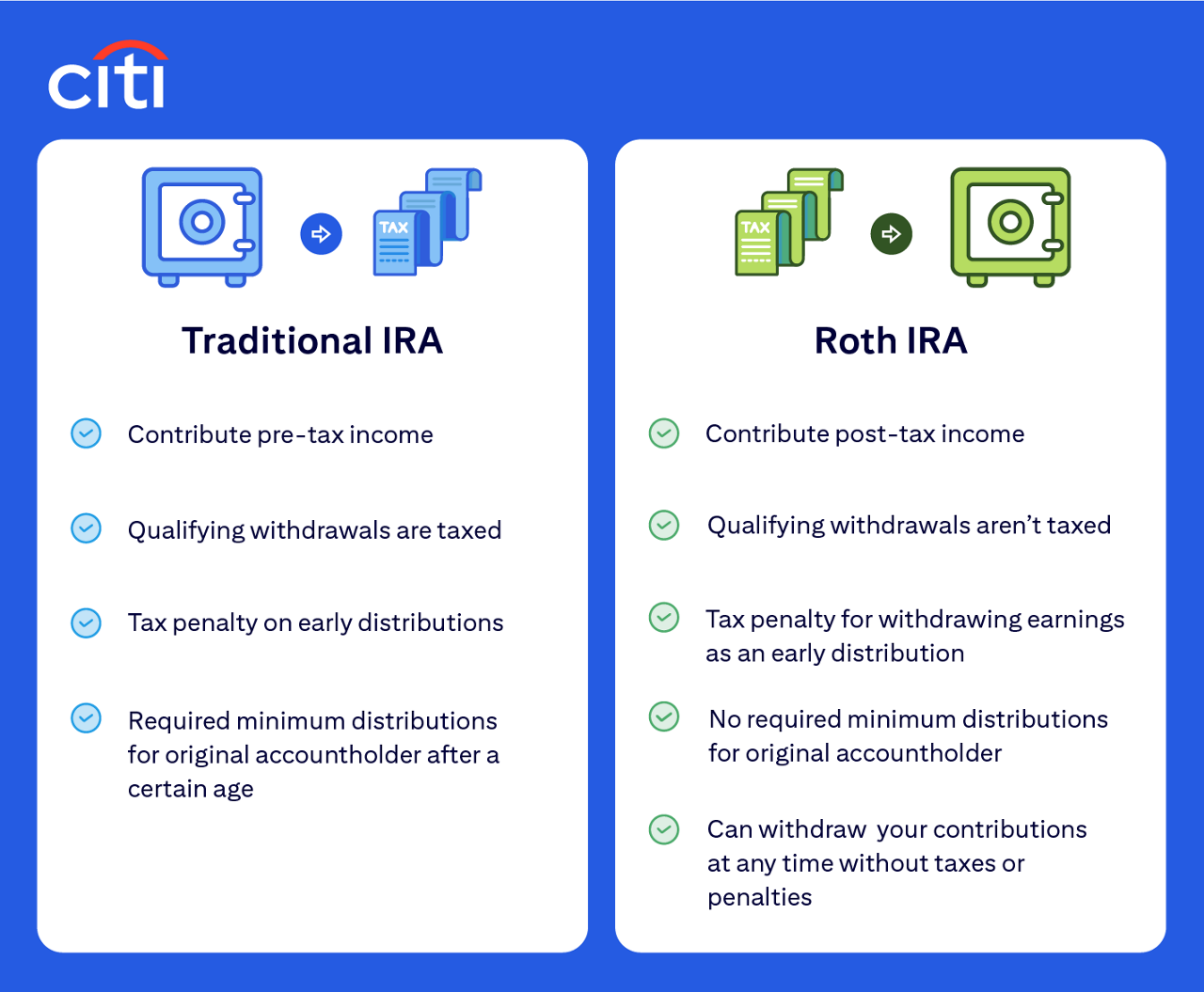

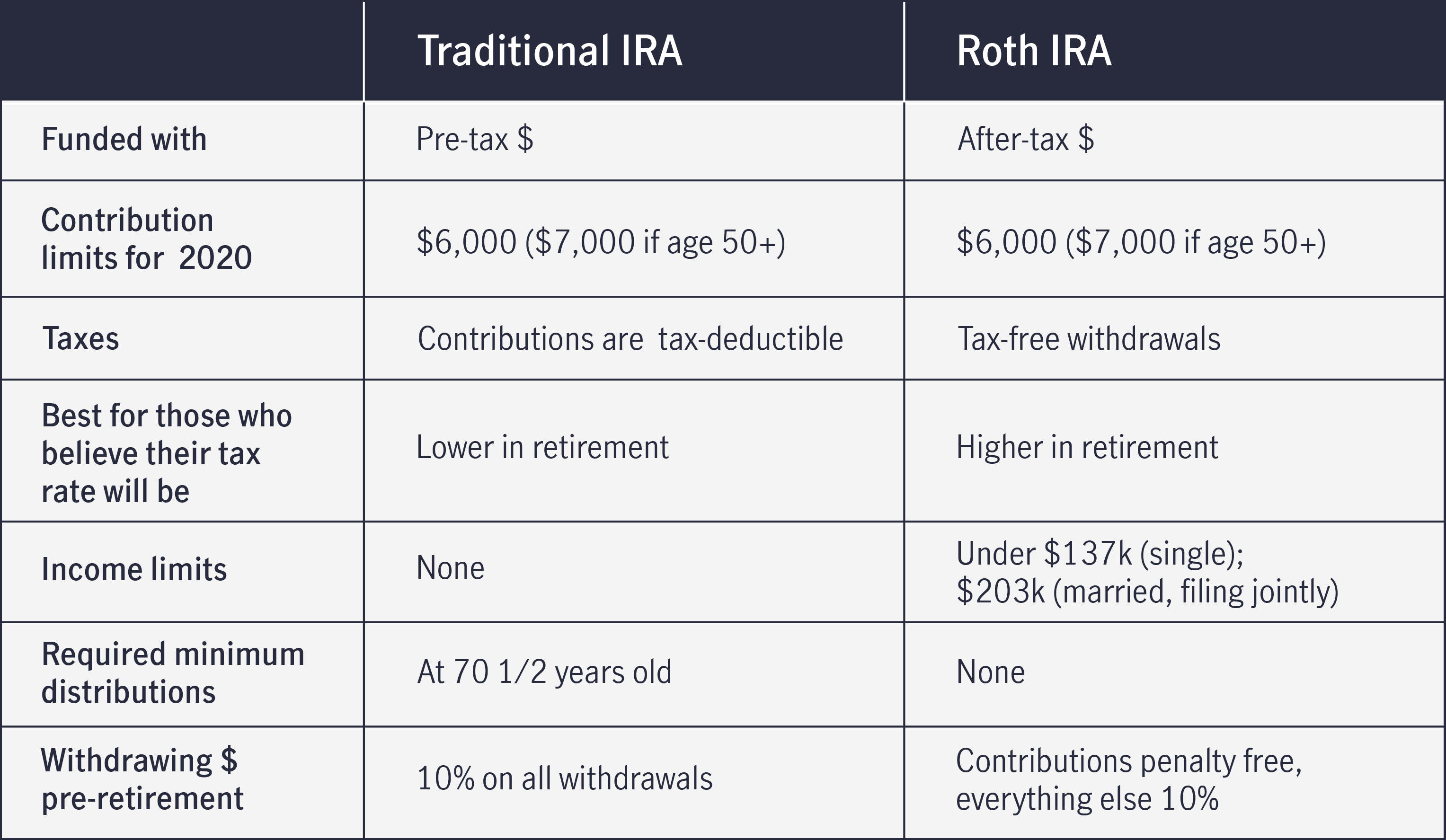

The Golden Rule: Contributions vs. Earnings

Here's where we start to unravel the mystery, and it’s a pretty straightforward distinction. Imagine your Roth IRA is a beautifully decorated cake. The contributions are the actual cake batter you put in. The earnings are the sprinkles, the frosting, the little edible glitter – all the fancy stuff that makes it extra special and grows over time.

Now, the really good news, the kind that makes you want to do a little happy dance in your kitchen: you can generally withdraw your contributions from a Roth IRA anytime, for any reason, without penalty or taxes. Yep, you heard that right. It’s like you paid for the cake batter, and even if you decide you only want the batter and not the frosting (for now, anyway), you can take it back. No questions asked. It’s your money, you put it in, you can take it out. Easy peasy, lemon squeezy.

Think of it this way: you bought a new pair of shoes, and you’ve worn them around the house a bit. But then you realize they’re just not “you.” You can return them for a full refund, right? That’s your Roth contributions. They’re still yours, in a way, until you’ve truly committed them to the “retirement cake.”

So, What About the Sprinkles? (The Earnings)

This is where things get a little more… delicate. The earnings – that’s the money your contributions have made over time, thanks to smart investing (or just good luck, let’s be honest). These are the bits that the IRS gets a little protective of. Why? Because the whole point of a Roth IRA is to give you tax-free growth in retirement. If you start pulling out those earnings early, you’re kind of messing with that deal.

Generally, if you withdraw your earnings before you’re 59 ½ and before the account has been open for five years (more on that later!), you’re likely looking at a 10% early withdrawal penalty. Plus, you’ll have to pay regular income tax on those earnings. It’s like trying to sneak a bite of the finished cake before your birthday party – you might get away with it for a bit, but eventually, someone’s going to notice and you might have to clean up the mess.

So, if you’ve got $10,000 in contributions and $2,000 in earnings, and you need to withdraw $3,000, the first $2,000 of that withdrawal will come from your contributions. You’re golden! The next $1,000? That’s coming from your earnings. And that’s when the penalty and taxes might kick in.

When the IRS Looks the Other Way: Exceptions to the Rule

Now, because life is rarely black and white, the IRS, in its infinite wisdom (and perhaps a touch of empathy), has created some exceptions. These are the situations where you can tap into your earnings without facing that dreaded 10% penalty. It’s like finding a secret shortcut in a video game.

First-Time Homebuyer’s Dream (or Nightmare, Depending on the Market)

Buying a home is a huge life event, and it often requires a big chunk of cash. If you’re a first-time homebuyer (meaning you haven't owned a primary residence in the past two years), you can withdraw up to $10,000 in earnings from your Roth IRA for qualified first-time homebuyer expenses. This can be for the down payment, closing costs, or even improvements. Just remember, this is a lifetime limit per person.

Think of it this way: you've been saving for retirement, but the universe presents you with the opportunity to own your own little slice of the world. The IRS says, “Okay, we get it. Here’s a little help.” It's like your retirement fund offering you a loan for your future nest egg, which is your actual nest. Pretty cool, right?

Education, Education, Education!

Higher education is another big one. If you need to pay for qualified education expenses for yourself, your spouse, your children, or your grandchildren, you can withdraw earnings from your Roth IRA without the 10% penalty. This includes tuition, fees, books, and even room and board. There’s no dollar limit on this one, but it still only applies to qualified expenses.

It's like your Roth IRA saying, "You know what's more important than a fancy retirement yacht? A brain full of knowledge!" It’s a pretty generous loophole for investing in your intellectual future.

Disability: When Life Throws a Curveball

If you become totally and permanently disabled, the IRS is generally understanding. If you withdraw from your Roth IRA due to a disability, you can usually avoid the 10% early withdrawal penalty on earnings. The IRS defines disability pretty strictly, so it's not just a "having a bad day" kind of thing, but a significant, long-term incapacity.

This is a situation where your financial savings are a safety net for a much more serious life event. The government, through the IRS, acknowledges that sometimes, circumstances are beyond your control, and they don’t want to add financial penalties to your existing hardship.

Death: The Ultimate Withdrawal

This one’s a bit morbid, but it’s a reality. If the Roth IRA owner passes away, beneficiaries can inherit the IRA. The rules for withdrawing inherited Roth IRAs are a bit complex and depend on the beneficiary (spouse vs. non-spouse, etc.), but generally, there’s no 10% penalty on earnings for the beneficiaries. They will typically have to withdraw the account over a period of years (usually 10 years if inherited from someone who died after their required beginning date), but the withdrawals themselves are usually tax-free if the account was properly set up.

It’s a way for the Roth IRA’s tax advantages to continue to benefit loved ones, even after the original owner is gone. It’s a final, albeit somber, gift.

Major Medical Expenses: When the Bill is Too Big to Ignore

If you have unreimbursed medical expenses that exceed a certain percentage of your Adjusted Gross Income (AGI), you can withdraw earnings from your Roth IRA to cover those costs without the 10% penalty. The threshold is currently 7.5% of your AGI. This is meant to help you cover those truly crippling medical bills that your insurance just doesn't quite cover.

It’s like your Roth IRA saying, "Look, you've got a health emergency. We'll help you out with the bills, no strings attached (well, no penalty strings attached)."

Health Insurance Premiums While Unemployed

If you're unemployed and receiving unemployment compensation for 12 consecutive weeks, you can withdraw earnings from your Roth IRA to pay for health insurance premiums without the 10% penalty. This is a lifeline to keep you covered while you're searching for your next gig. It’s a specific scenario designed to prevent financial hardship from impacting your basic needs.

Qualified Disaster Distributions

In the event of a federally declared disaster, the IRS might offer relief, allowing penalty-free withdrawals from retirement accounts, including Roth IRAs, for up to $100,000. These funds can be used for expenses and losses incurred due to the disaster. It’s a way for the government to help people rebuild after catastrophic events.

The 5-Year Rule: The Silent Guardian

Remember that mention of the five-year rule? This is a crucial piece of the puzzle when it comes to withdrawing earnings penalty-free, even in situations that aren’t listed above. For any withdrawal of earnings to be tax-free and penalty-free (outside of the exceptions we just discussed), your Roth IRA must have been open for at least five years. This five-year clock starts ticking on January 1st of the tax year in which you made your first contribution to any Roth IRA.

So, even if you’re over 59 ½, if your Roth IRA hasn't met the five-year mark, and you withdraw earnings for something that isn’t one of the specific exceptions, you could still owe taxes and the 10% penalty. It’s like waiting for a delicious cake to cool down before you can frost it – you have to be patient for the full benefit.

Let’s say you opened your Roth IRA in 2020. It's now 2024, and you're 40 years old. You’ve only been in the Roth game for 4 years. If you withdraw earnings, even though you're past retirement age in spirit, you're not past the 5-year mark. You’ll likely owe taxes and the penalty. But if you’d opened it in 2018, you’d be golden for most general withdrawals of earnings (assuming you’re over 59 ½).

Putting it All Together: A Simple Guide

So, let's boil it down. Imagine your Roth IRA is like a piggy bank, but with two sections:

- Section 1: Your Coins (Contributions) - You can take these out whenever you want, no questions asked, no penalty. This is your emergency cash for a leaky faucet or a surprise birthday gift.

- Section 2: The Shiny Stickers You’ve Collected (Earnings) - These are the bonus goodies. You can take these out without penalty if:

- You’re 59 ½ or older.

- You’re disabled.

- You’re using it for a first-time home purchase (up to $10k).

- You’re paying for qualified education expenses.

- You’ve got huge medical bills (over 7.5% of AGI).

- You’re unemployed and paying for health insurance.

- There’s a qualified disaster.

- And, crucially, your Roth IRA has been open for at least 5 years (the 5-year rule!).

If you need to take out earnings, and none of those exceptions apply, and you haven’t hit the 5-year mark, then yes, you’re probably looking at a 10% penalty plus regular income tax on those earnings. It’s like trying to cash in a coupon that’s expired and not applicable to the item you want to buy. Frustrating, but understandable from the issuer's perspective.

The Bottom Line: Plan Wisely

The Roth IRA is a fantastic tool for long-term wealth building. The ability to withdraw contributions tax-free and penalty-free is a huge perk, acting as a sort of flexible safety net. However, the intent of the account is for retirement, so touching your earnings early should be a last resort.

Before you even think about tapping into your Roth IRA earnings, always consult with a tax professional or financial advisor. They can help you navigate the specifics of your situation, understand the implications, and ensure you’re making the best decision for your financial future. They’re like the experienced tour guide who knows all the hidden paths and potential pitfalls of your financial journey.

So, while the idea of a penalty-free withdrawal of your contributions is a welcome relief for those unexpected life moments, remember the golden rule: your contributions are your safety net, but your earnings are for your golden years. Tread wisely, and may your future self thank your present self for a well-managed Roth IRA!