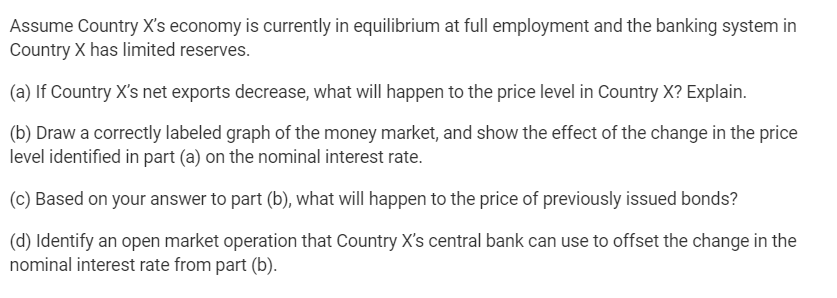

Assume A Country's Economy Is Currently In Recession: Complete Guide & Key Details

So, the news has been a bit… gloomy. You know, the kind of talk that makes you want to reach for the comfort snacks. Yep, we’re talking recession. It’s a word that can send shivers down your spine, conjuring images of doom and gloom. But hey, before you start building that bunker out of tinned beans and toilet paper (remember that phase?), let’s take a deep breath and get real about what a recession actually means, and more importantly, how we can navigate it with our sanity (and maybe even our wallets) intact.

Think of it like this: an economy is a bit like a really big, complex party. Sometimes the music is pumping, everyone’s dancing, and the drinks are flowing freely. That’s a boom! But every now and then, the DJ needs a break, people start mingling more quietly, and maybe the bar runs a little low on the good stuff. That’s a recession. It’s not the end of the party, just a bit of a lull. And just like at a party, knowing what to do when things slow down can make all the difference.

What Exactly Is This "Recession" Thing?

Alright, let’s get down to brass tacks, without the jargon that makes your eyes glaze over faster than a budget airline meal. Essentially, a recession is when an economy experiences a significant, widespread, and prolonged downturn. The most common way economists spot one is if a country’s Gross Domestic Product (GDP) – basically, the total value of all goods and services produced – shrinks for two consecutive quarters (that’s six months, folks).

It’s like your favorite online store suddenly has way fewer items and is running a lot fewer sales. Less stuff being made and sold means less money circulating. Think of it as the economy taking a collective sigh and deciding to chill for a bit.

Key Details to Keep in Mind:

- Reduced Spending: When people and businesses feel uncertain about the future, they tend to spend less. This is the ripple effect. If you’re holding back on buying that new gadget, the company that makes it might slow down production, hire fewer people, and so on.

- Job Market Wobbles: Sadly, one of the most noticeable impacts is on jobs. Companies might freeze hiring, cut back on hours, or, in tougher times, lay off staff. This is where things can feel a bit more personal.

- Lower Inflation (Sometimes): While recessions can sometimes be linked to rising prices (stagflation, a whole other beast!), often, the reduced demand means prices might stabilize or even fall for some goods and services. Remember when those flight deals started popping up after the initial shockwaves of a few years ago? That’s the flip side of lower demand.

Why Does This Even Happen? (The "Oops, We Partied Too Hard" Theory)

Economies are complex beasts, and recessions can be triggered by a cocktail of factors. Sometimes, it's like a perfect storm. We might have seen too much rapid growth, leading to overspending and debt. Think of it like going a bit overboard at the all-you-can-eat buffet – eventually, you need to digest.

Other times, it could be a shock to the system: a global pandemic (hello, recent memory!), a sudden spike in oil prices (remember those gas station signs?), or even a financial crisis. These external events can shake the confidence of consumers and businesses, leading them to tighten their belts.

Fun Fact: The term "recession" itself comes from the Latin word "recedere," meaning "to go back" or "withdraw." So, in a way, the economy is just taking a step back to regroup!

So, What Does This Mean for YOU? (The "My Wallet is Crying" Edition)

Okay, let’s be honest. When you hear "recession," your first thought might be about your own finances. And that’s perfectly normal. It can mean:

- Job Insecurity: As mentioned, this is a big one. If your industry is particularly vulnerable, it’s wise to be prepared.

- Reduced Purchasing Power: If your income is affected, or if prices for essentials do rise in certain sectors, your money might not stretch as far.

- Investment Volatility: Stock markets often react to recessions, which can be unnerving if you have investments.

But here’s the crucial part: it’s not all doom and gloom. Many people successfully navigate recessions by being smart, adaptable, and a little bit savvy. Think of it as a chance to really dial in your financial habits.

Your Recession Survival Toolkit: Practical Tips for Everyday Life

Alright, let’s roll up our sleeves and get practical. This is where we can take control and make things a little less… scary.

1. Become a Budgeting Boss

This is the golden rule. If you’re not already tracking your spending, now’s the time to start. Think of your budget as your financial GPS. There are tons of apps that can help, or you can go old-school with a spreadsheet or a good old notebook.

Actionable Tip: Categorize your spending. Differentiate between needs (rent, groceries, utilities) and wants (those impulse buys, subscription services you barely use). See where you can trim the fat without feeling like you’re sacrificing all the joy.

Cultural Reference: Remember those frugal grandmas who could stretch a dollar further than an Olympic gymnast? Channel that spirit! They knew the power of a well-planned meal and a keen eye for a bargain.

2. Build (or Beef Up) Your Emergency Fund

This is your financial safety net. Aim to have at least 3-6 months of living expenses saved up. If you’re not there yet, even small, consistent contributions make a difference.

![[FREE] Assume a country's economy is currently in recession. Draw a](https://media.brainly.com/image/rs:fill/w:3840/q:75/plain/https://us-static.z-dn.net/files/dc2/4b9c376ed5b462a07330a8f5e3c3ecdb.png)

Actionable Tip: Automate your savings. Set up an automatic transfer from your checking to your savings account every payday. Out of sight, out of mind, and steadily growing!

Fun Fact: The concept of an emergency fund dates back centuries. Historically, people would save for unexpected crop failures or natural disasters. We’re just doing it for rent and unexpected car repairs!

3. Tame Your Debt Dragon

High-interest debt can be a real drag, especially when money is tight. If possible, try to pay down credit card balances or other high-interest loans.

Actionable Tip: Consider the "debt snowball" or "debt avalanche" method. Snowball tackles smallest debts first for psychological wins, while avalanche prioritizes highest interest rates for maximum long-term savings. Pick what works for your motivation!

4. Become a Savvy Shopper

This isn’t about deprivation; it’s about being smart.,

Actionable Tip: Comparison shop! Use price comparison websites, sign up for email alerts for sales, and don’t be afraid of generic brands for staples. For big purchases, wait for sales events like Black Friday (or the post-recession equivalent!).

Cultural Reference: Think of the satisfaction of snagging a great deal. It’s a mini-victory that feels amazing. It’s like a treasure hunt, but the prize is saving money!

5. Invest in Your Skills

In uncertain times, your skills are your greatest asset. Look for opportunities to learn something new, update your existing skills, or get a certification that makes you more valuable in your field (or a new one!).

Actionable Tip: Explore free or low-cost online courses (Coursera, edX, LinkedIn Learning). Even dedicating an hour a week to skill development can pay dividends down the line.

6. Diversify Your Income (If Possible)

This is a more advanced strategy, but if you have a skill that can be monetized on the side, it can provide a valuable buffer. Think freelancing, selling crafts, or offering consulting services.

Actionable Tip: Start small! Test the waters with a few freelance gigs on platforms like Upwork or Fiverr. It’s a great way to explore new income streams without a huge commitment.

7. Stay Informed, Not Overwhelmed

It’s important to know what’s happening, but avoid constantly doomscrolling. Too much negative news can be paralyzing.

Actionable Tip: Choose a reliable source for economic news and check it once a day. Then, focus on what you can control in your own life.

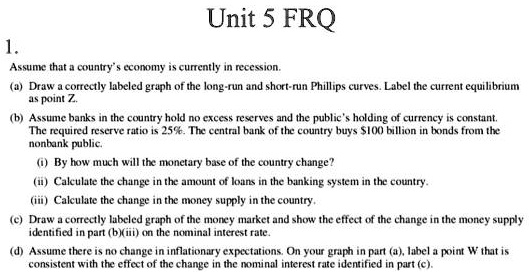

The Bigger Picture: When Governments and Central Banks Step In

Recessions aren’t just left to individual resilience. Governments and central banks have tools to try and soften the blow. They might:

- Lower Interest Rates: Making it cheaper for businesses and individuals to borrow money, encouraging spending and investment. Think of it as the central bank trying to make borrowing feel like a more comfortable proposition.

- Fiscal Stimulus: This could involve things like tax cuts or increased government spending on infrastructure projects. The idea is to inject money into the economy. Think of it as a collective boost to keep things moving.

- Support for Businesses: Programs might be put in place to help struggling businesses stay afloat.

Fun Fact: The term "central bank" is often used because these institutions are usually independent from the government and are responsible for managing a nation's currency, money supply, and interest rates. They’re the guardians of the economy’s plumbing!

A Little Perspective: Recessions Aren't Forever

The most important thing to remember is that recessions, like all economic cycles, are temporary. The economy has a remarkable ability to bounce back. Think of it like a marathon runner hitting a tough patch – they might slow down, but they don’t stop entirely. Eventually, they find their rhythm again.

Historically, economic expansions tend to last longer than recessions. So, while it might feel challenging right now, there is light at the end of the tunnel. This is a time for being prudent, adaptable, and perhaps even a little creative.

A Moment of Reflection

Navigating an economic downturn can feel like trying to steer a ship through choppy waters. It's easy to get caught up in the worry. But if we focus on the immediate, tangible steps we can take – managing our budget, saving diligently, investing in ourselves – we build resilience. It’s a reminder that while external economic forces are powerful, our own personal agency and smart decision-making are incredibly impactful. And sometimes, the most profound lessons in life come when we’re challenged to be a little bit smarter, a little bit more resourceful, and a little bit more appreciative of what we have. So, take a deep breath, make a plan, and remember, you’ve got this. One sensible step at a time.