Average Age To Buy A House Australia: Latest Updates, Details, And Key Facts

Alright, gather 'round, you soon-to-be homeowners, you wistful renters, and you seasoned property moguls who probably bought their first mansion with a bag of marbles and a firm handshake. We're diving headfirst into the age-old question, the one that keeps Aussies up at night, staring at their ceiling fans and dreaming of a deposit: "When can I actually afford to buy a house in this country?!" Forget the dating scene, folks, this is the real commitment!

The average age to buy a house in Australia is a number that gets thrown around like a boomerang, often returning with slightly different results depending on who you ask and which crystal ball they consulted. But fear not! We've done the digging, sifted through the spreadsheets, and bravely faced the terrifying world of real estate reports, all so you can finally get a semi-clear picture. Think of me as your friendly neighbourhood property guru, armed with caffeine and a healthy dose of skepticism about the housing market.

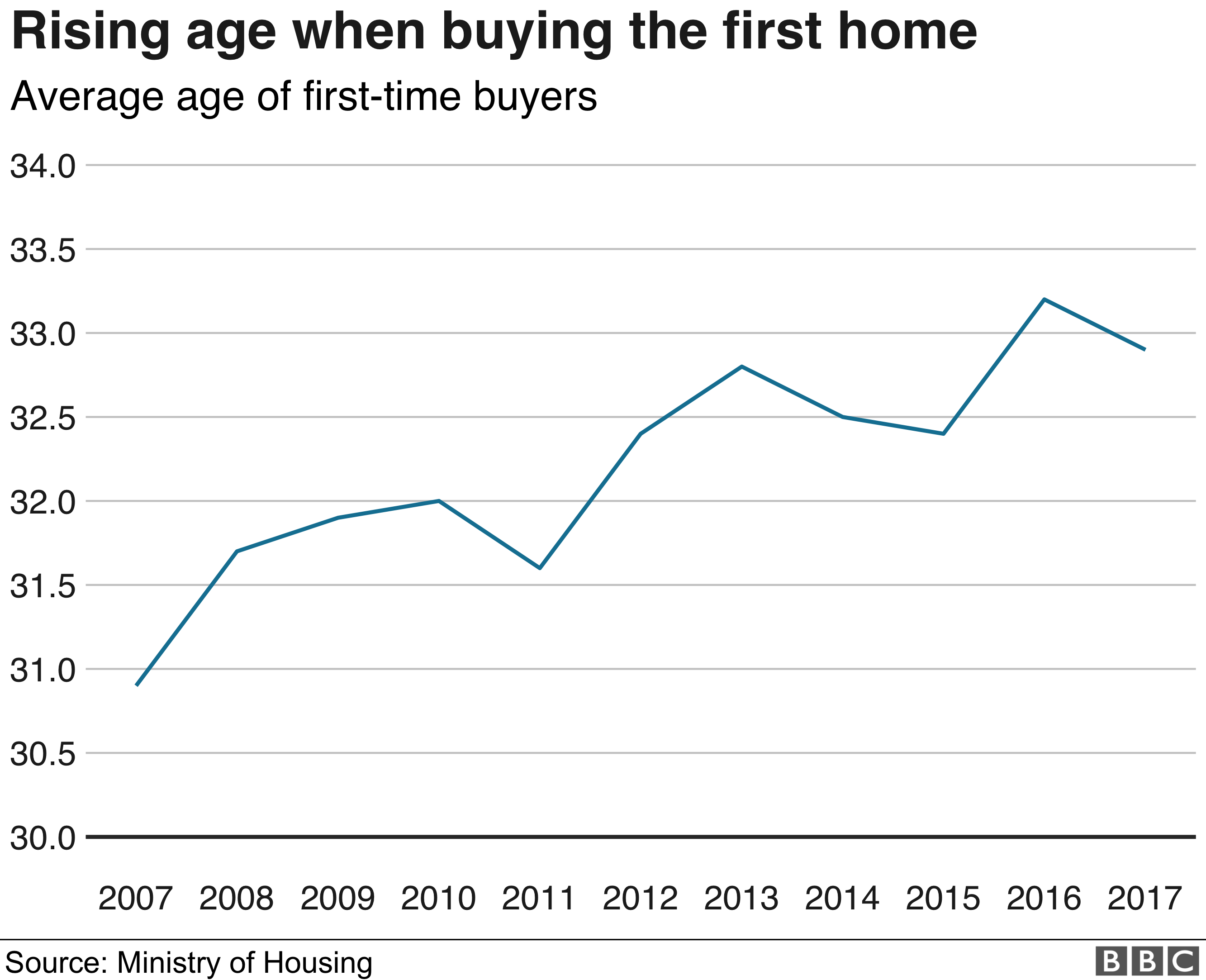

So, what's the magic number? Drumroll please... it's hovering somewhere around the late 30s. Yep, you heard that right. Late thirties! Now, before you start weeping into your avocado toast, let's break this down. This isn't some strict, government-mandated age limit. It's an average, a statistical average, which means some legends are buying their dream pad in their early twenties, and some are still valiantly renting in their forties, perfectly happy with their freedom (or just really good at finding decent share houses).

Why the Big Wait? The Great Australian House Hunt Saga

The obvious question, of course, is "Why so late?!" Well, it’s a bit like trying to herd cats through a laser maze, isn't it? Several big players are in this game. First off, there's the rather substantial price tag attached to Aussie real estate. We're talking about a market that’s made millionaires out of people who thought investing in a pet rock collection was a solid plan. Houses here aren't exactly cheap. Unless you've been secretly printing your own money in the backyard, you're going to need a serious amount of cash.

Then there's the deposit. Ah, the dreaded deposit. It's the gatekeeper of homeownership, the Everest of early adulthood. Saving for a deposit in Australia can feel like trying to save a single grain of sand on a beach during a hurricane. It requires discipline, sacrifice, and possibly selling a kidney. This is where the late thirties average really starts to make sense. By then, people have had more time to climb the career ladder, earn a decent salary, and, hopefully, squirrel away enough cash to convince a bank that they’re not going to spontaneously combust when the repayments start.

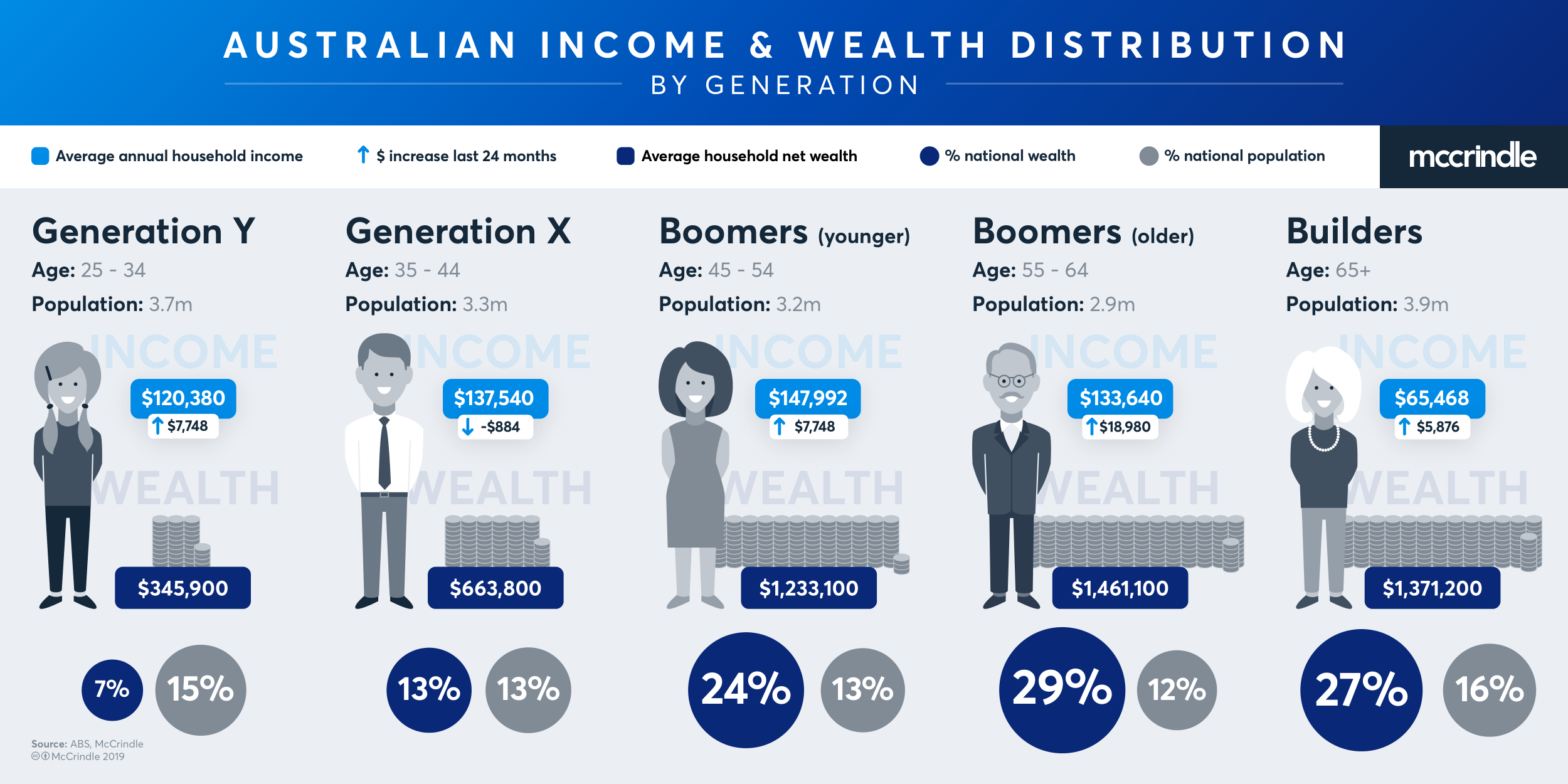

The Latest Intel: What the Numbers Are Saying

Recent reports suggest the average age is nudging closer to 37 or 38. Some analyses even point to older figures, especially in our pricier capital cities. Think Sydney and Melbourne, where buying a shoebox might require a loan from the Reserve Bank itself. It’s enough to make you want to pack up your ute, head bush, and buy a vast expanse of land for the price of a fancy coffee machine. (Disclaimer: This is not financial advice, and you might end up with more flies than equity.)

But here’s a surprising twist: while the average age is creeping up, there’s also been a surge in first-home buyer activity in certain segments of the market. This often involves government schemes, like the First Home Owner Grant or stamp duty concessions. These are like little life rafts in the choppy seas of property ownership. They can shave off a few years, helping younger folks get a foot in the door before they’ve even mastered the art of a truly impressive sourdough starter.

Key Facts You Need to Know (Without the Jargon Overload)

Let's boil it down to the essentials, shall we? Think of these as your essential cheat sheet for the property game.

- The Average Age: It's generally accepted to be in the late 30s, so around 37-38 years old.

- It's a Statistic, Not a Statute: This is an average. Your personal timeline might be totally different! Don't let it discourage you.

- Deposit is King (or Queen): Saving for that initial chunk of cash is usually the biggest hurdle. The more you save, the less you borrow, and the less time you spend crying over mortgage statements.

- Location, Location, Location (and Price!): Buying in major cities like Sydney or Melbourne will almost certainly mean a later average age compared to regional areas. Supply and demand, my friends, it's a powerful force.

- Government Help Exists: Look into grants and concessions for first-home buyers. They can be absolute game-changers. Think of them as a friendly dragon guarding the treasure hoard.

- Interest Rates Matter: Lower interest rates can make borrowing more affordable, potentially bringing that average age down a smidge. Higher rates? Well, let's just say the average might start demanding a walking stick.

So, What Does This Mean for YOU?

If you're in your twenties and feeling the pressure, take a deep breath. You've got time. Focus on building your career, saving a bit here and there, and maybe cutting back on those daily $7 coffees. Or, you know, embrace the renter life for a while longer. There are perks! No leaky gutters to fix at 2 am. No aggressive magpies dive-bombing your garden gnomes.

If you're in your thirties and starting to feel like the property market is a train you've just missed, don't despair. You're right in the thick of it! This is the age group that's most likely to be actively pursuing homeownership, and the average age is built around you. You’ve likely got more savings, a steadier income, and a better understanding of your financial needs.

And for those of you who are, shall we say, "chronologically blessed" (a.k.a. older), well, you might be able to buy outright or have a significantly smaller mortgage. You've probably weathered a few economic storms and know the value of a good avocado (and a good investment!).

Ultimately, the average age to buy a house in Australia is a snapshot, a trend, a conversation starter. It doesn't define your journey. Your journey is yours! It's about your financial preparedness, your personal goals, and whether you can tolerate the sound of your neighbour’s lawnmower at 7 am on a Sunday. So, go forth, plan, save, and may your deposit be ever in your favour!