Average Cost Of Home Insurance In Missouri

Hey there, Missouri homeowners! Ever find yourself staring at your mail, wondering what all those numbers mean? Especially the ones related to your humble abode? Let's talk about something that might sound a bit dry, but trust me, it's got its own kind of quirky charm: the average cost of home insurance in Missouri. Think of it as the behind-the-scenes magic that keeps your castle safe and sound, even when Mother Nature decides to put on a show!

Now, I know what you're thinking. "Insurance? Exciting!" But hear me out. It's not about the nitty-gritty policy details (though those are important, later!). It's about the story behind those numbers. It's about understanding why your cozy cottage in Columbia might have a different insurance price tag than your sprawling ranch in Springfield. It’s like figuring out the secret ingredients in your grandma’s famous fried chicken – a little bit of this, a little bit of that, all coming together to create something truly special.

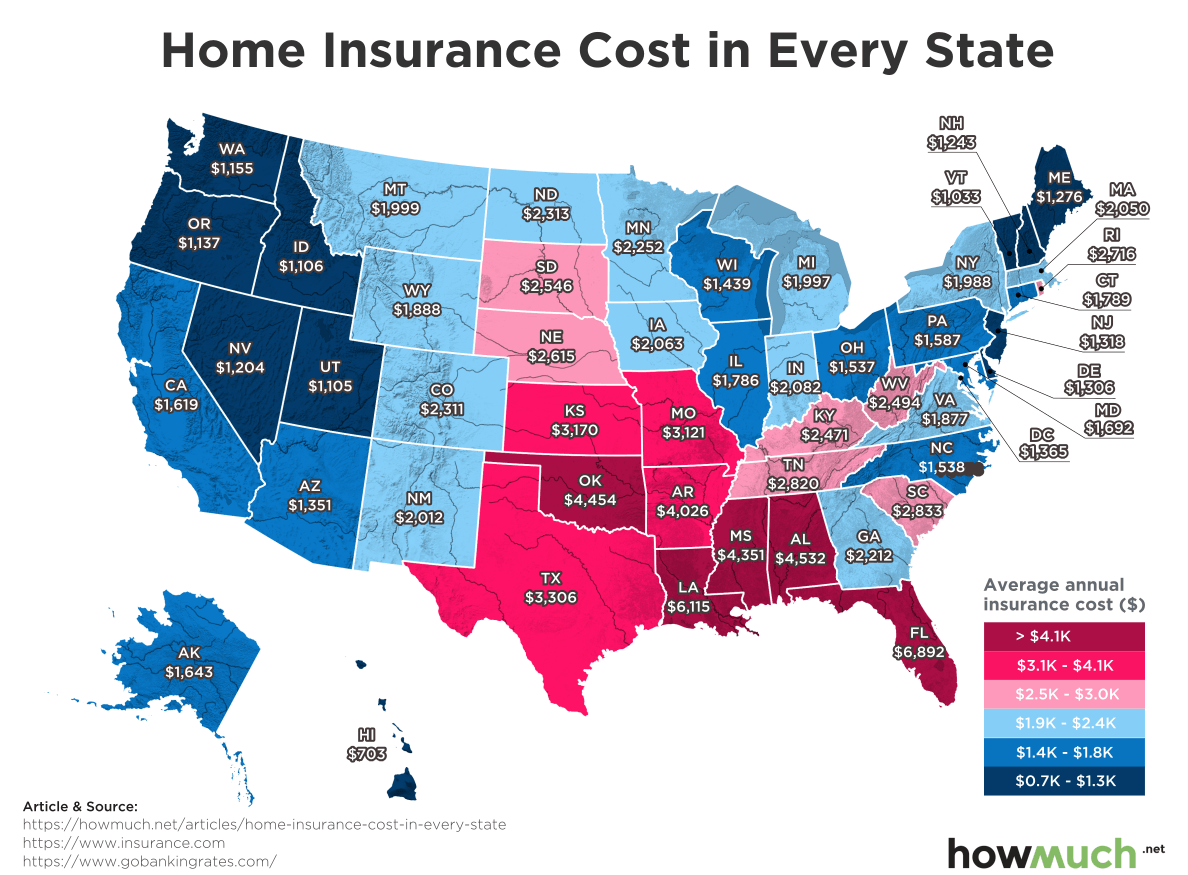

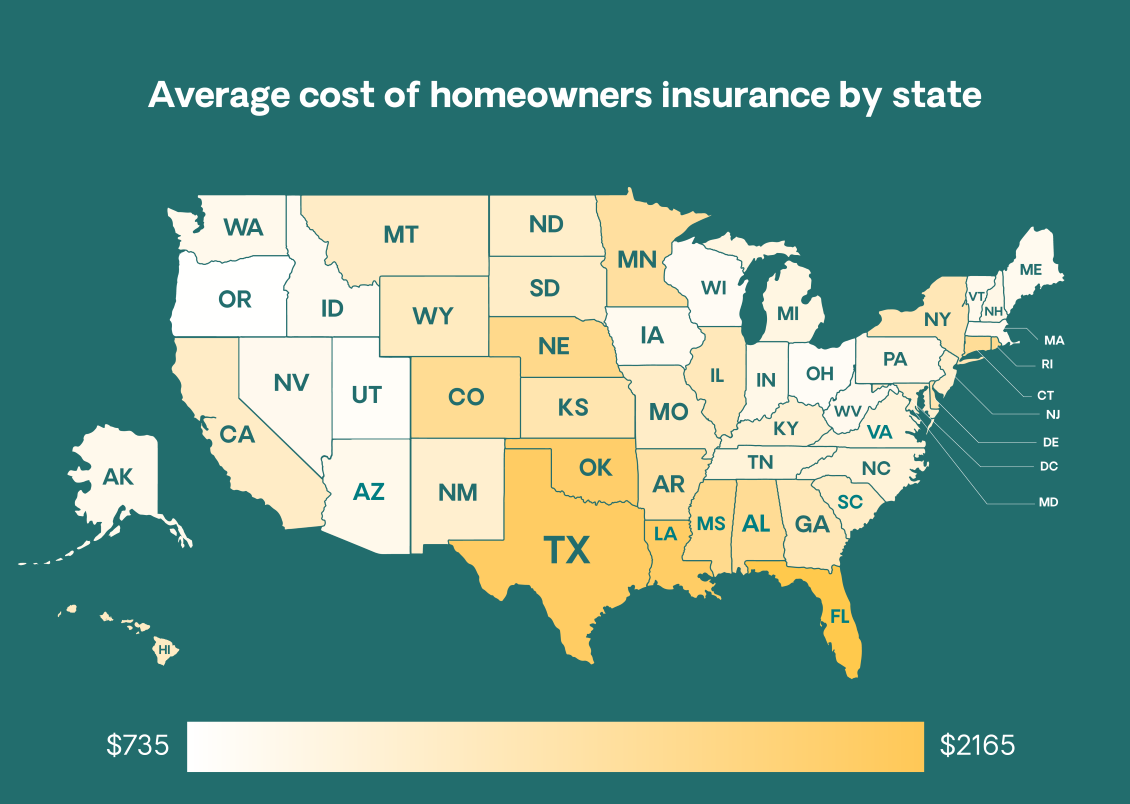

So, what's the big number we're talking about? Well, for starters, the average cost of home insurance in Missouri is generally considered to be somewhere around $1,600 to $2,000 per year. But hold your horses! That's just a ballpark figure, like saying the average person likes a good barbecue. It doesn't tell the whole story, does it? This number is influenced by a whole cast of characters!

Think about Missouri itself. It’s a state with a bit of everything, right? We’ve got those beautiful rolling hills, the mighty Mississippi River, and yes, sometimes, some pretty impressive weather. From hailstorms that can make your roof sing a percussive tune to the occasional tornado that reminds us who’s really in charge, these natural events play a big role. And guess what? Your insurance company has to factor those possibilities into the price. It’s like packing an umbrella for a picnic, just in case. Better safe than sorry, as they say!

Let's break down some of the key players that shape your premium. One of the biggest factors is the value of your home. A bigger, fancier house naturally costs more to insure. Imagine trying to replace a mansion versus a cute little bungalow – the price tag for rebuilding would be vastly different! So, if you've got a place that whispers "luxury," your insurance might reflect that.

Then there's the location, location, location! This is a huge one. Are you living in an area prone to severe weather? Closer to the coast (okay, not really in Missouri, but you get the idea!) or in a place where wildfires are a concern? Even within Missouri, different regions have different risk levels. Areas that frequently deal with strong winds or heavy snowfall might see higher premiums. It’s all about understanding the local risks, like knowing which farmers' market has the best sweet corn.

And what about the age and condition of your home? An older home with outdated wiring might raise some eyebrows for insurance companies. They want to know that your house is in good shape and less likely to have problems. Think of it as a health check-up for your house! A well-maintained home is a happy home, and usually, a cheaper one to insure.

Now, let’s talk about your deductible. This is the amount you agree to pay out-of-pocket before your insurance kicks in if you have a claim. Choosing a higher deductible can often lower your annual premium. It’s like deciding if you want to pay a little more upfront to have less to worry about later. It’s a balancing act, and a very personal one at that!

Don’t forget your credit score! Yes, even your financial habits can play a part. Insurance companies often see a good credit history as a sign that you're responsible. It’s a bit of a head-scratcher for some, but it’s part of how they assess risk. So, keeping those bills paid on time might just save you some dough on your homeowner’s policy!

And then there are the coverage options you choose. Do you want the basic package, or are you looking for all the bells and whistles? Things like extended replacement cost coverage, which ensures you have enough to rebuild even if costs skyrocket, can add to your premium. It’s all about tailoring your policy to your specific needs and peace of mind.

It’s also worth noting that the average cost can fluctuate. It’s not like a fixed price on a menu that never changes. Market conditions, claims history in your area, and even the overall economic climate can influence these numbers. So, that $1,600 to $2,000 average is a starting point, a friendly guide to get you in the neighborhood.

What makes this topic so… well, interesting? It’s about understanding the layers of protection we build around our lives. Your home is more than just four walls and a roof; it’s your sanctuary, your basecamp for life’s adventures. Home insurance is the silent guardian, the protector of those memories and the future dreams you build within its walls. And knowing the general cost in a place like Missouri, with its unique blend of charm and occasional weather drama, gives you a sense of context. It’s like understanding the secret handshake of homeownership in the Show-Me State!

So, instead of just seeing a number on a bill, try to see the story behind it. It’s a story of risk assessment, of community protection, and of making informed choices for your family’s security. And if this little chat has piqued your curiosity, why not take a moment to actually check? You might be surprised at what you discover. It’s an easy step, and it could lead to some real peace of mind. After all, who doesn't want to feel a little more in control of their castle, right?

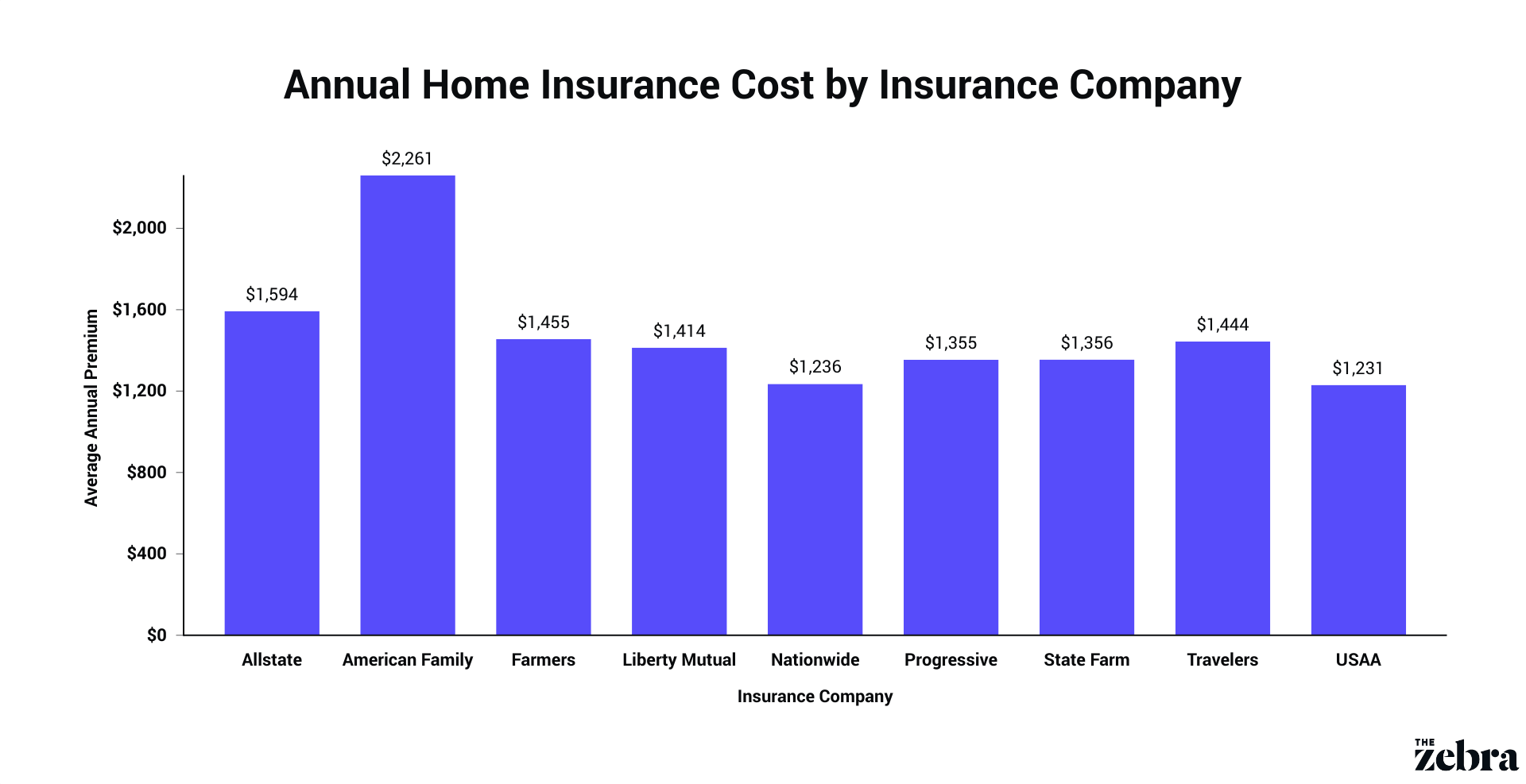

Remember, these are just general ideas. The best way to know your specific costs is to get personalized quotes from different insurance companies in Missouri. Many offer online tools that make it super simple to get an idea. It's a bit like window shopping for your perfect home, but for your insurance! You can compare different options and find what fits your budget and your needs best.

So, go ahead, be a home insurance detective! Uncover the secrets of your premium. It might just be more engaging than you think. Happy house-protecting!