Average Cost Of Homeowners Insurance In Massachusetts: Price, Costs & What To Expect

So, you're dreaming of that charming New England abode, the one with the gingerbread trim and a cozy fireplace perfect for those chilly Massachusetts nights. We get it! But before you start picturing yourself sipping cider on your porch, let's chat about a little something called homeowners insurance. It's like the superhero cape for your house, protecting it from all sorts of unexpected baddies.

Now, you might be wondering, "What's this superhero gonna cost me?" Well, buckle up, buttercup, because we're about to dive into the wonderful world of Massachusetts homeowners insurance costs. Think of it as a treasure hunt, but instead of gold doubloons, we're looking for affordable peace of mind.

The Big Reveal: What's the Damage? (Or Rather, the Cost!)

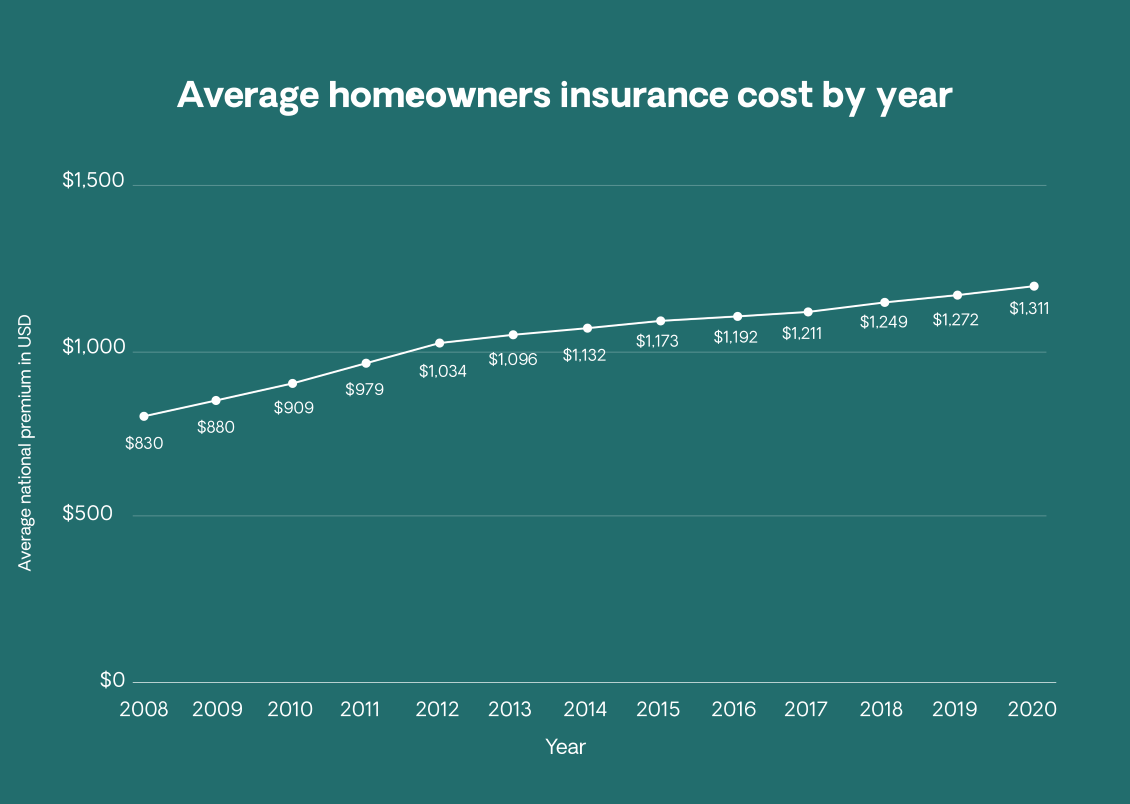

Let's get down to brass tacks. The average cost of homeowners insurance in Massachusetts can feel like a bit of a mystery. But don't you worry, we're here to shed some light on it! On average, you're looking at something in the ballpark of $1,200 to $1,500 per year. That's not some insane, house-on-the-moon price, right?

Imagine it like this: for the price of a few fancy lattes a week, you've got a whole team of insurance ninjas ready to swoop in if disaster strikes. Pretty sweet deal, if you ask us!

Why Does It Cost What It Costs? The Secret Sauce!

Okay, so why that specific range? It's not like insurance companies are just pulling numbers out of a hat (though sometimes it feels like it!). Several super-important factors play a role in your premium, and understanding them is like getting a secret decoder ring.

First up, there's the value of your home. If you've got a mansion that could rival a royal palace, your insurance is obviously going to be a bit more. Conversely, a cozy cottage will likely have a lower premium. It just makes sense – more house, more coverage needed!

Then there's your location, location, location. Massachusetts has its quirks, right? If you're living in an area prone to, say, blizzards that could bury your car up to its windshield, or perhaps you're a tad too close to the ocean for comfort (hello, hurricane season!), your rates might tick up a bit. It’s all about managing those potential risks, like a super-smart financial strategist.

Think about it: if you lived in a place where the biggest threat was a rogue squirrel stealing your picnic, your insurance would be a steal! But in the Bay State, we have a few more dramatic weather patterns to contend with, and that plays into the cost.

Coverage is King: What's Actually Included?

So, what exactly are you getting for your hard-earned cash? Your homeowners insurance policy is like a buffet of protection for your beloved dwelling. You've got coverage for the physical structure of your home – the roof, walls, foundation, the whole shebang.

But it doesn't stop there! It also covers your personal belongings. That vintage vinyl collection? Your grandmother's antique china? Your slightly questionable but deeply loved collection of garden gnomes? They're all generally covered up to a certain limit. Phew!

And here's a biggie: liability protection. This is crucial! If, by some wild chance, a guest trips on your perfectly placed welcome mat and sprains an ankle, this part of your policy can help cover their medical bills. It's like having a personal bodyguard for awkward social situations.

We're talking about protection from things like:

- Fire: The dreaded inferno that can turn your dream home into a pile of ash. No thanks!

- Windstorms: Those powerful gusts that can make your shutters do a samba.

- Hail: When the sky decides to throw tiny ice marbles at your roof. Ouch!

- Theft: Because nobody wants their prized possessions to vanish into thin air.

- Vandalism: When someone decides your lawn gnome collection needs a "makeover."

What to Expect When You're Expecting... to Buy Insurance!

Ready to embark on this insurance adventure? Here's a sneak peek at what the journey might look like. First, you'll need to gather some intel. Think of it as pre-game research!

You'll want to know the age and condition of your home. Is it a sprightly young thing or a seasoned veteran with a few creaks and groans? This information helps insurers assess potential risks. They'll also want to know about any recent renovations or upgrades you've made. Did you just install that fancy new kitchen? That's probably a good thing for your premium!

Then comes the fun part: getting quotes! You'll want to shop around. Think of it like comparing prices for your favorite pizza – you want the best bang for your buck. Don't be afraid to reach out to multiple insurance companies in Massachusetts. Each one might have slightly different offerings and pricing.

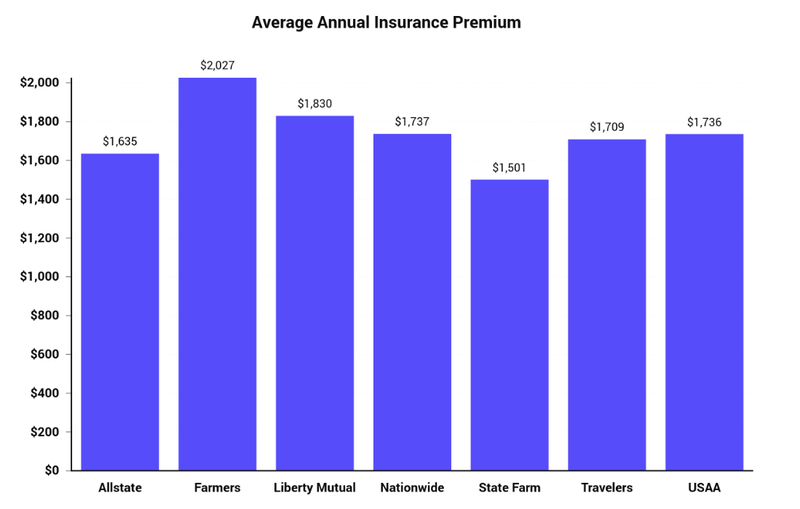

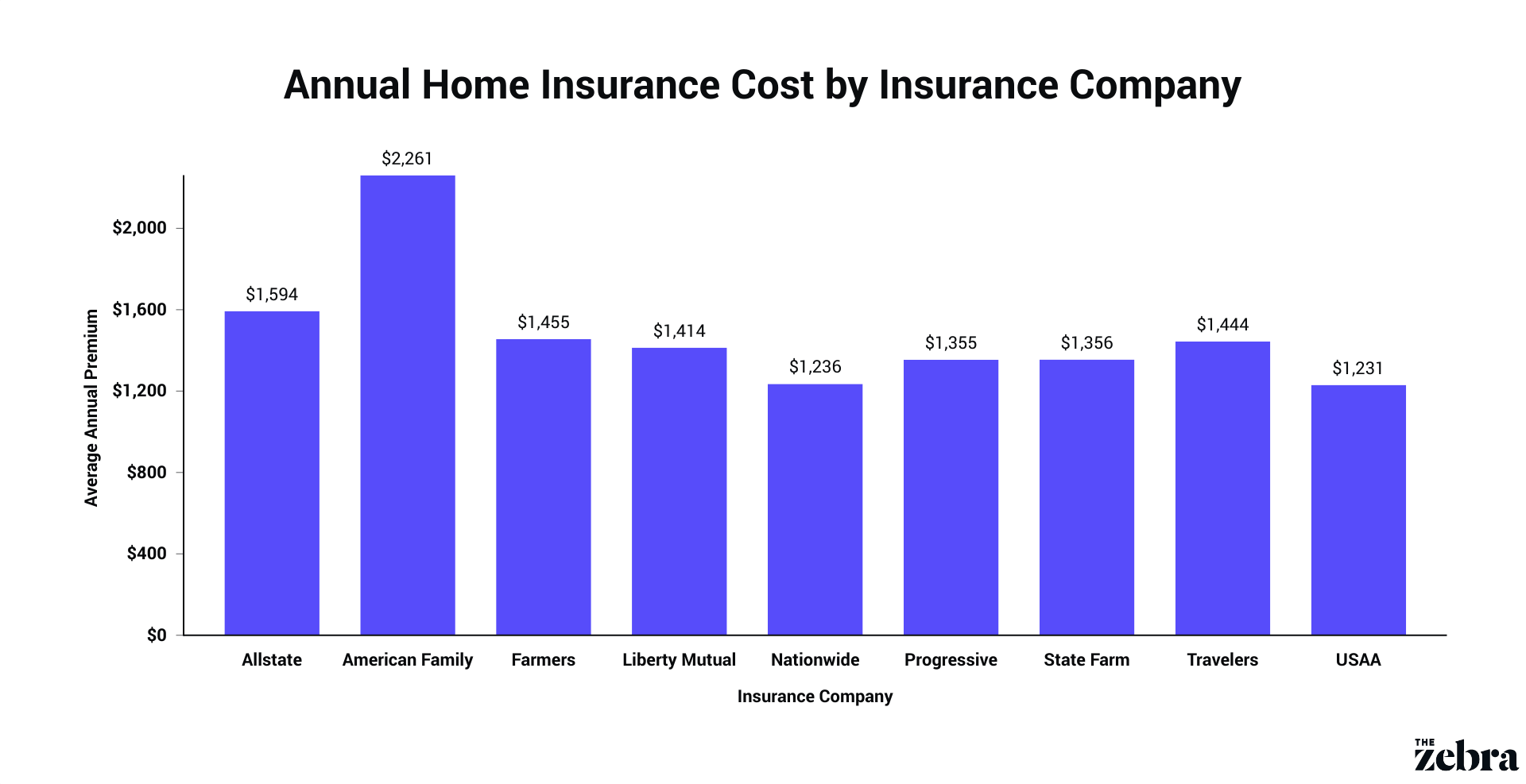

Some popular names you might encounter include companies like Geico, Progressive, State Farm, and many more local heroes. It’s like a buffet of choices, and you get to pick the tastiest one!

Can You Actually Save Some Dough? Absolutely!

Who doesn't love saving money? The good news is, there are definitely ways to keep your homeowners insurance costs from skyrocketing. One of the easiest ways is to bundle your policies. If you already have auto insurance with a particular company, see if they offer a discount for adding your homeowners insurance. It's like getting a "buy one, get one half off" deal for your protection!

Another trick? Consider increasing your deductible. Your deductible is the amount you pay out of pocket before your insurance kicks in. A higher deductible usually means a lower premium. Just make sure you can comfortably afford to pay that deductible if you ever need to file a claim. It's a balancing act, like a tightrope walker!

Maintaining a good credit score can also make a difference. Insurers often see a good credit score as an indicator that you're a responsible homeowner, which can lead to lower rates. So, pay those bills on time, and your insurance company might just reward you!

And don't forget to ask about discounts! Many companies offer them for things like having a security system, living in a gated community, or even being a non-smoker. Every little bit counts, and you might be surprised at how many ways you can shave off some dollars.

So there you have it! The average cost of homeowners insurance in Massachusetts might seem like a number that can cause a bit of a furrowed brow, but when you break it down, it's all about protecting your precious nest. With a little research, a dash of savvy shopping, and a sprinkle of understanding, you can secure a policy that keeps your home safe and your wallet happy. Now go forth and secure that dream home – with its insurance cape firmly in place!