Average Cost Of Homeowners Insurance In Massachusetts: Price/cost Details & What To Expect

Alright, gather 'round, my fellow Bay Staters, and let's talk about something that makes most of us groan louder than a Boston fan after a Red Sox loss: homeowners insurance in Massachusetts. It’s like that one relative who shows up unannounced – necessary, a bit of a drag on the wallet, and you can’t quite figure out how to get rid of them.

So, you've finally snagged your slice of the Massachusetts dream – a house! Congrats! Now comes the paperwork, and somewhere in that glorious pile is the homeowner's insurance policy. Before you start imagining setting it on fire to save money (don't do that, seriously, it’s probably a fire hazard and void your policy), let's break down what you can expect to pay. Think of me as your friendly, slightly caffeinated tour guide through the labyrinth of Massachusetts insurance premiums. We're going to spill the tea, or more accurately, the Dunkin' iced coffee.

The Not-So-Shocking Truth: It Ain't Cheap!

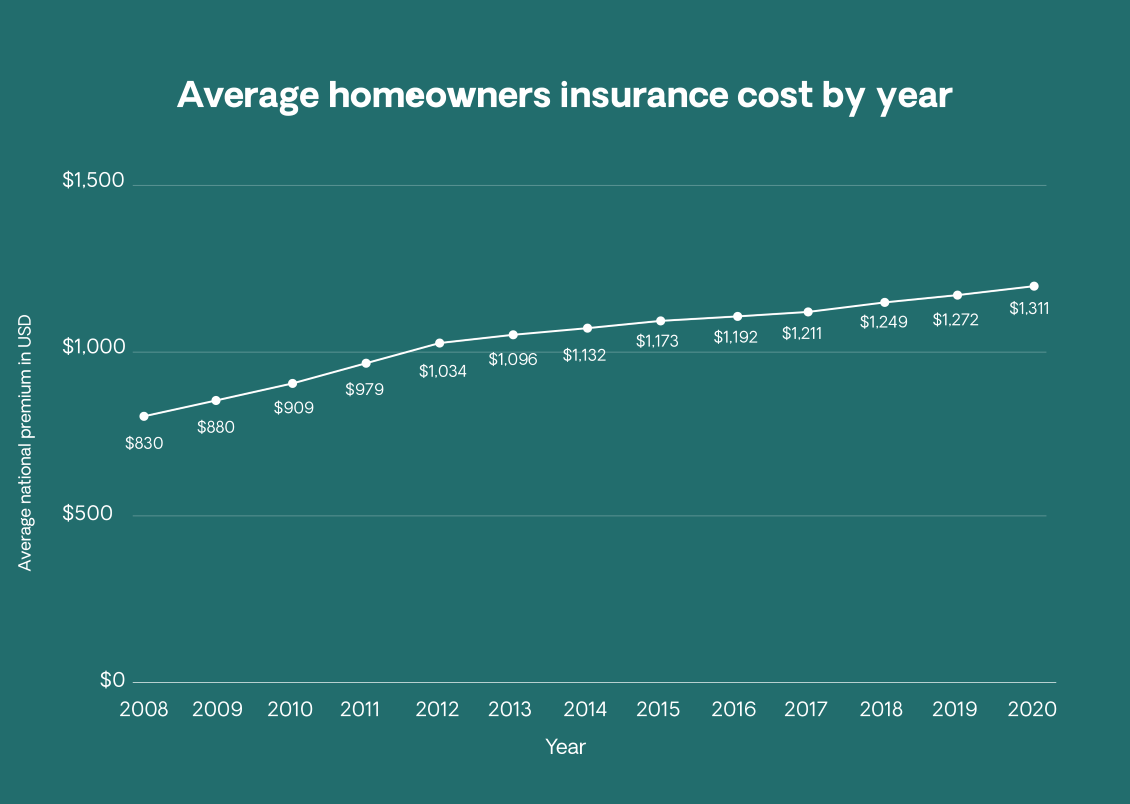

Let’s just rip off the Band-Aid, shall we? Massachusetts isn't exactly known for being the cheapest place to live, and that extends to insuring your humble abode. The average cost of homeowners insurance in Massachusetts hovers around $1,200 to $1,500 per year. Now, that’s just the average, folks. Your actual bill could be higher, lower, or somewhere in between, depending on a whole smorgasbord of factors. It’s like trying to predict the weather in Boston – you’re going to be wrong at least half the time.

But wait, there's more! Some sources might tell you the average is closer to $1,300, while others nudge it up to $1,600. This is where things get fun, like trying to find parking in the North End on a Saturday. It depends on who you ask and how they calculate it. Think of it as a choose-your-own-adventure of insurance pricing. Don't get too hung up on the exact number; focus on understanding the players involved in this high-stakes game.

What's Driving Your Premium Up (Besides the Ghosts in Your Attic)?

So, why does it cost more to insure a charming colonial in Concord than, say, a shack in the desert? Well, it’s a multi-pronged attack on your bank account. Here are the main culprits:

1. Location, Location, Location (and the Blizzards It Brings)

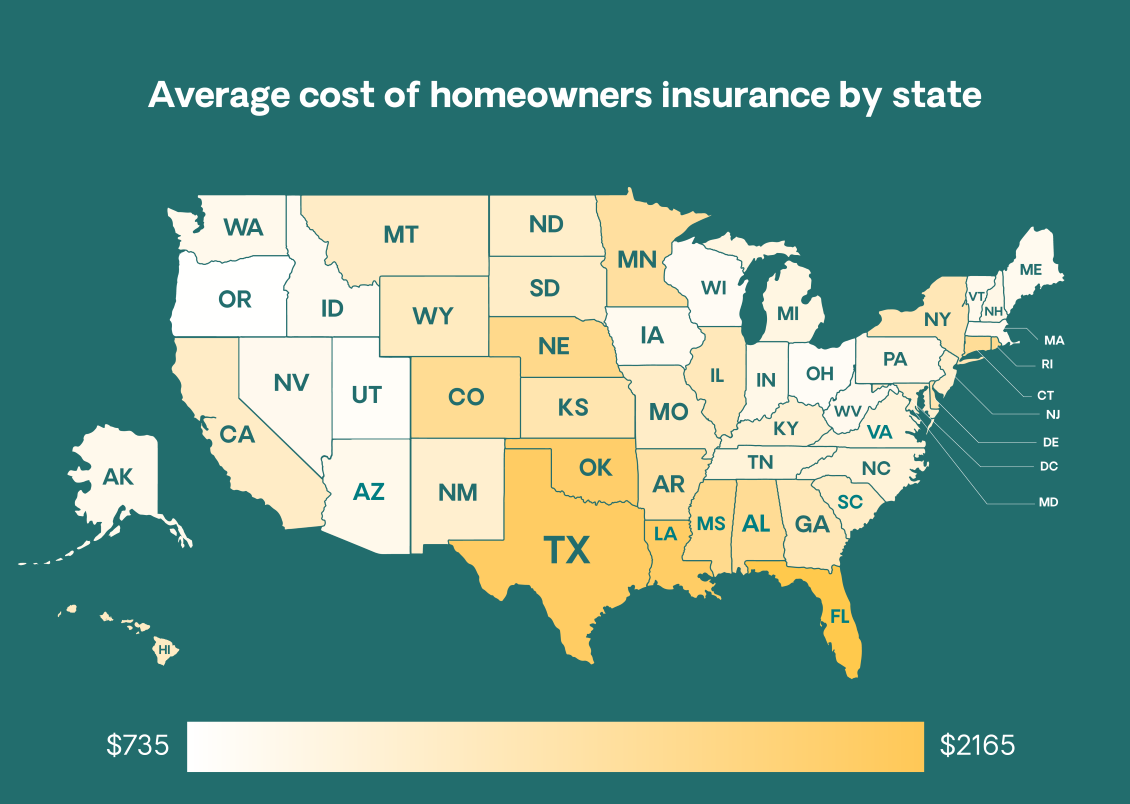

This is the big one, folks. Where you live in Massachusetts matters. Coastal towns? Expect to pay more because, well, hurricanes and Nor'easters are no joke. They can turn your lovely beachfront property into a charming pile of driftwood faster than you can say "norovirus."

Areas prone to high crime rates will also see higher premiums. It’s a harsh reality, but insurers factor in the likelihood of, shall we say, "uninvited guests." Even something as seemingly innocent as being near a fire hydrant can sometimes affect your rate, though usually in a good way. Think of it as a little insurance kiss from the city. And let's not forget the risk of flooding. If you live in a flood zone, you might need separate flood insurance, which is like getting a second mortgage just to keep your basement dry.

2. The Size and Age of Your Castle

Bigger house, bigger problems, bigger insurance bill. It’s a simple, albeit expensive, equation. A sprawling Victorian with six bedrooms and three bathrooms will naturally cost more to insure than a cozy two-bedroom bungalow. More square footage means more to rebuild if disaster strikes. And let’s be honest, more room for your ever-growing collection of Beanie Babies.

The age of your home is another major factor. Old homes can be charming, but they can also be ticking time bombs of outdated wiring, leaky pipes, and structural issues that would make an engineer weep. Insurers see older homes as higher risk, so expect your premiums to reflect that. It’s like dating someone significantly older – they come with more history, and potentially, more expensive repairs.

3. What's Inside Your Walls? (And What's Under Your Roof?)

We're not just talking about your Aunt Carol's questionable macrame collection. We’re talking about your roof's age and condition. A brand-new roof? Your insurer will give you a pat on the back and maybe a slight discount. A roof that’s seen better days (and a few too many seagulls)? Prepare for a premium increase that will make you want to start a GoFundMe for roof repairs.

Similarly, the condition of your plumbing and electrical systems matters. Old, dodgy wiring is a fire hazard waiting to happen. If your pipes are older than your grandmother’s secret cookie recipe, you’re looking at increased risk. It’s like having a toddler with a permanent marker – you just never know when disaster will strike.

4. Your Deductible: The Amount You're Willing to Lose (Theoretically)

This is where you get a little more control. Your deductible is the amount of money you'll pay out-of-pocket before your insurance kicks in. A higher deductible usually means a lower premium, and vice-versa. It's a trade-off. Do you want to pay a bit more each month for peace of mind, or are you willing to gamble a larger sum if something goes wrong?

Think of it like this: a lower deductible is like having a tiny umbrella in a hurricane. It might do something, but you’re still going to get soaked. A higher deductible is like bringing a full-on poncho and a raincoat. You’ll be drier in the long run, but you might regret not having that cash for a celebratory lobster roll if nothing happens.

5. Your Insurance History: Are You a Claims Magnet?

If you’ve had a history of filing claims, insurers might see you as a riskier customer. It’s like going on a few too many Tinder dates that ended in a dramatic public argument – people start to get a little wary. The more claims you have, the higher your premiums are likely to be. So, try to avoid turning your home into a disaster movie set.

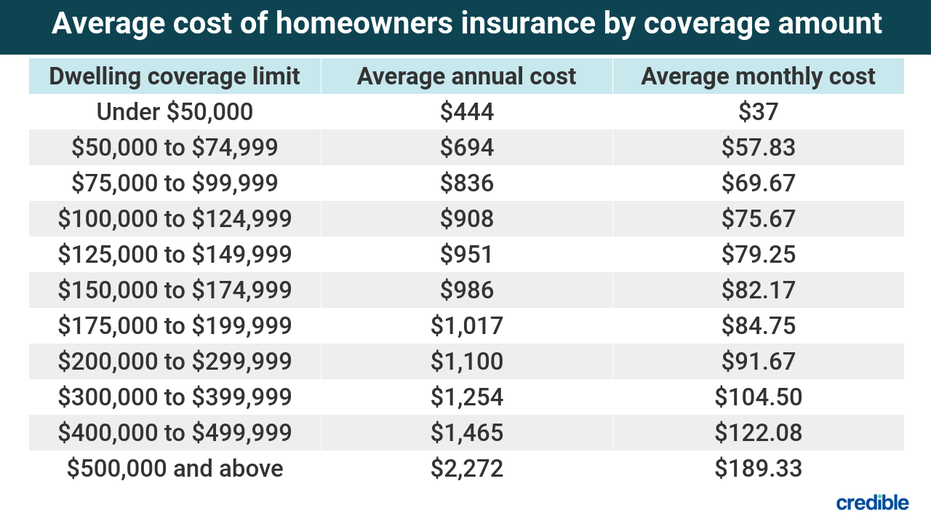

6. The Coverage You Choose: Gold Plating or Basic Cable?

This is a biggie! The more comprehensive your coverage, the more it's going to cost. Think about dwelling coverage (the cost to rebuild your home), other structures coverage (sheds, fences, etc.), personal property coverage (your stuff!), and liability coverage (if someone gets hurt on your property). If you have priceless Ming vases or a collection of rare, first-edition comic books, you’ll need to insure them appropriately, and that will cost extra.

Are you insuring your home for the current market value or the cost to rebuild? These are different beasts! Rebuilding costs can sometimes be higher than what you paid for the house, especially if there have been significant price increases in building materials or labor. It’s like that time you thought you were getting a good deal on a renovation, and then the contractor started talking about "unforeseen circumstances" – spoiler alert: they're always foreseen by the contractor.

Surprising Massachusetts Insurance Quirks

Now, for some fun facts that might make you do a double-take. Massachusetts has some unique insurance regulations. For example, we have a "fair plan" which is basically a fallback for people who can't get insurance through normal channels. It’s like the last resort buffet – not always the most appealing, but it’s there.

Also, unlike some states, Massachusetts doesn’t have a state-run FAIR plan for homeowners insurance. So, if you’re in a high-risk area and can’t get a standard policy, you might be looking at a more expensive option from a private insurer specializing in high-risk properties. It’s like trying to get a prime parking spot at Fenway on game day – good luck!

How to Keep Your Premiums From Soaring Higher Than a Seagull Stealing Your Fries

Don't despair! There are ways to manage your Massachusetts homeowners insurance costs. Think of these as your secret weapons:

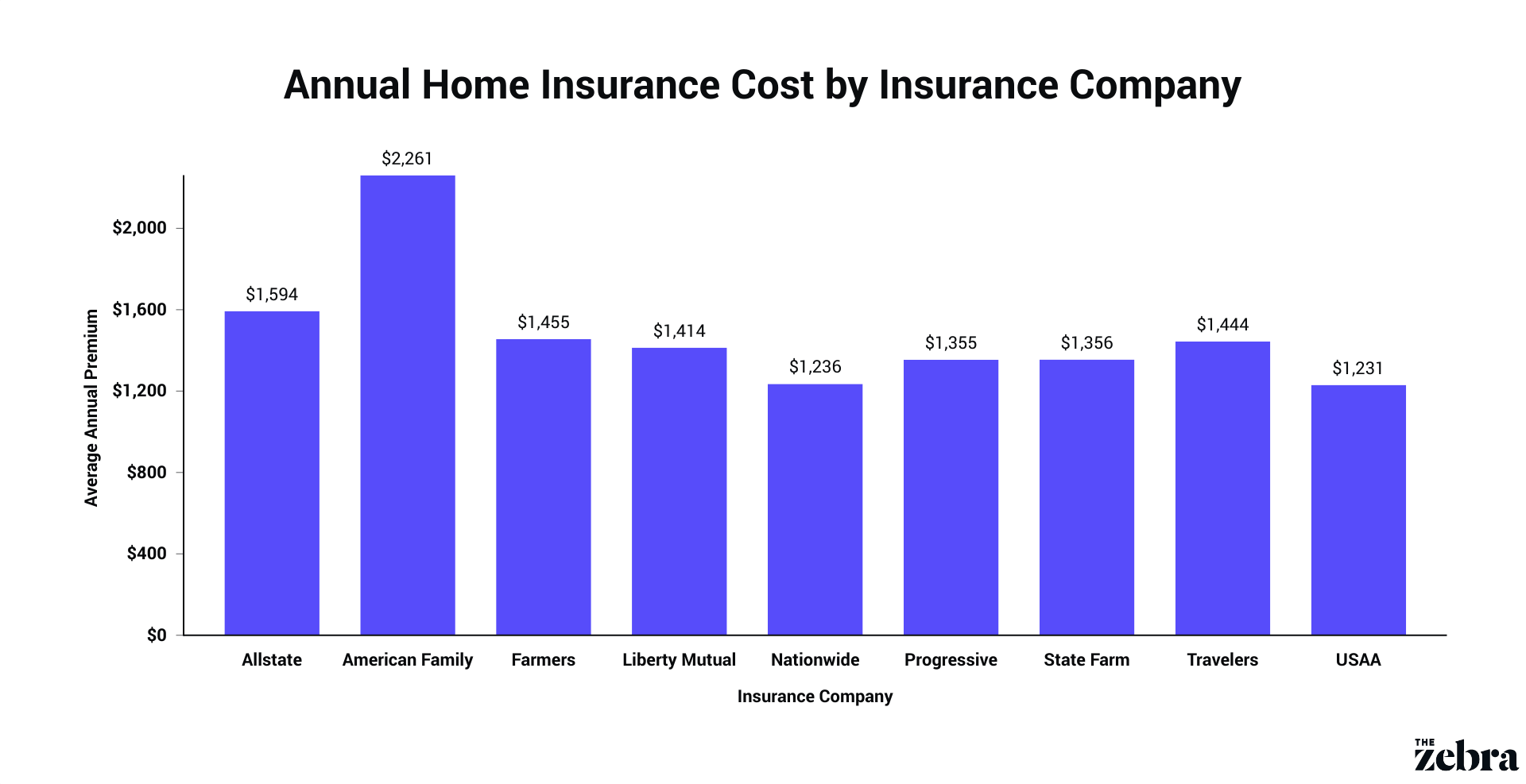

- Shop Around: This is the golden rule! Get quotes from multiple insurance companies. Don't just stick with your first offer. Rates can vary wildly! It's like comparing prices for that perfect chowder – you wouldn't settle for the first one you find.

- Bundle Up: Many insurers offer discounts if you bundle your homeowners insurance with your auto insurance. It's like getting a two-for-one deal on your insurance bills. Who doesn't love a deal?

- Improve Your Home's Defenses: Upgrades like a new roof, updated electrical or plumbing systems, and security systems can earn you discounts. Think of it as investing in your home’s health and your wallet’s happiness.

- Increase Your Deductible (Wisely): If you have a healthy emergency fund, consider a higher deductible. Just make sure you can comfortably afford it if the worst happens.

- Ask About Discounts: Seriously, ask! There might be discounts for being a long-time homeowner, for not having any claims, for being a member of certain professional organizations, or even for being a non-smoker! You never know until you ask.

So there you have it, folks. The nitty-gritty, the highs, the lows, and the occasional chuckle-inducing realities of homeowners insurance in Massachusetts. It’s a complex beast, but with a little knowledge and some diligent shopping, you can tame it and protect your precious New England nest without breaking the bank. Now, if you'll excuse me, I need another coffee. All this talk of premiums has made me thirsty. And maybe a little anxious about my own roof. You know, just in case a rogue Nor'easter decides to redecorate.