Bank Of America Corporation Analyst Price Target Disagreement: Price/cost Details & What To Expect

Ever peeked at your bank statement and felt a little dizzy? That’s pretty much how I feel when I look at the grown-ups discussing Bank of America stock. They're like a bunch of folks arguing over pizza toppings, but with way more fancy words.

These smarty-pants are called analysts. They’re supposed to know all the secrets of the financial world. They look at numbers. Lots and lots of numbers.

And lately, they’ve been looking at Bank of America Corporation, or BAC as the cool kids call it. It's a huge bank, like a financial giant.

Now, here’s where the fun starts. These analysts can’t seem to agree on what BAC’s stock price should be. It’s like they’re all looking at the same painting, but one sees a masterpiece and another sees a toddler’s scribble.

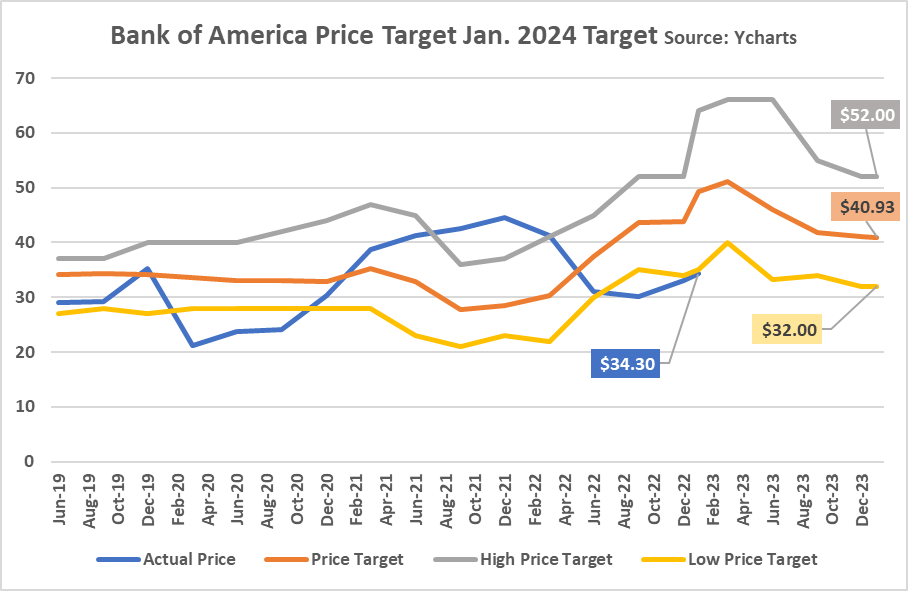

This disagreement is called a price target disagreement. It’s a fancy way of saying they’re all over the place with their predictions. Some think BAC is going to be worth a ton. Others… well, not so much.

The Pricey Part: What’s the “Price/Cost Details”?

When they talk about “price/cost details,” they’re not talking about the price of a cup of coffee at their fancy office. They’re talking about the actual dollar amount they think the stock will hit.

Think of it like this: one analyst might say, “I bet BAC will be at $40 next year!” Another might scoff and say, “Nah, I’m thinking more like $30.” And a third might be somewhere in the middle, muttering about $35.

It’s like a bidding war, but instead of money changing hands, it’s opinions. And these opinions are based on a whole bunch of things they think will happen.

They look at how much money the bank is making. They check out how much debt it has. They even consider how the economy is doing overall. It’s a whole detective operation, but with spreadsheets instead of magnifying glasses.

Sometimes, they talk about the bank's fundamentals. That's a big word for the basic health of the company. Is it strong? Is it weak? Is it… just okay?

And then there are the comparables. They look at other big banks. How are they doing? Is BAC better? Worse? The same? It's like comparing apples and oranges, but everyone agrees they should all be in the same fruit basket.

What to Expect When Analysts Can’t Agree

So, what does it all mean for us regular folks who just want to know if our money is safe and maybe make a little extra? It’s a bit of a mixed bag.

When there’s a lot of disagreement, it can make the stock price jump around like a nervous squirrel. One day it might be up, and the next day it could be down. It’s enough to make your head spin.

It also means that the information out there is kind of… fuzzy. It’s hard to get a clear picture when everyone has a different idea of what’s going on. It's like trying to navigate a foggy day with a map that has scribbles on it.

However, this disagreement can also be a good thing. It means that the market is doing its job. It’s taking in all sorts of different opinions. It’s trying to figure out the real value of BAC.

It can also mean that there are opportunities. If one group of analysts is way too pessimistic, and another is way too optimistic, the real price might be somewhere in between. You just have to do your homework. Or, you know, just nod and smile.

Think about it this way: if everyone agreed that a particular restaurant had the absolute best pizza in town, the line would be around the block. But if some people said it was amazing and others said it was just okay, you might get a table without waiting too long.

Sometimes, the analysts who are a bit more optimistic about BAC are looking at future growth. They see new products, new customers, and new ways the bank can make money. They're like fortune tellers, but with financial charts.

On the flip side, the more cautious analysts might be worried about upcoming problems. Maybe they're thinking about interest rate changes. Or maybe they're worried about the economy slowing down. They’re the ones wearing their raincoats just in case.

It's also important to remember that analysts are just people. They have their own biases. They have their own ways of looking at things. Their predictions are not gospel. They're more like educated guesses.

So, when you see headlines about Bank of America analysts disagreeing about the price target, don’t panic. It’s just the financial world doing its usual dance. It’s a sign that things are not so simple, and that's kind of interesting.

My own "unpopular opinion"? Sometimes, the best advice comes from just watching how the bank actually performs. Are people using their services? Is the bank helping people with their money? That's the real story, right?

Forget the crazy numbers for a second. Think about your own banking experience. Do you like using Bank of America? Do you feel like they’re helping you? That’s a pretty strong indicator, don’t you think?

So, next time you see those analyst targets all over the place, just take a deep breath. Maybe have a little chuckle. And then go back to what matters to you. The world of finance can be a wild ride, but it doesn’t have to be a scary one.

It's all about the big picture, isn't it? And sometimes, the analysts’ squabbles are just a noisy distraction from the actual story.

It’s kind of like watching a bunch of chefs argue about the perfect amount of salt for a dish. We all just want it to taste good in the end. And for BAC, we all just want it to be a healthy, reliable place for our money.

So, while the analysts are busy crunching numbers and debating price points, we can keep an eye on the real performance. That’s where the true story often lies, away from the fancy jargon and the confusing forecasts.

And if you ever feel overwhelmed by all the financial talk, remember that a good cup of coffee and a clear head can go a long way. Maybe even further than some of those price targets. Just saying.