Bank Of America International Wire Transfer Fee Inbound: Complete Guide & Key Details

Ah, the thrill of a bank wire transfer! It might not sound as exciting as a roller coaster or a new video game, but for many, receiving an international wire transfer from Bank of America is a moment of pure, unadulterated relief and joy. Whether it's a loved one sending funds for your birthday, a business payment finally arriving, or even a bit of freelance income from across the globe, that notification that money is on its way can truly brighten your day!

International wire transfers, especially inbound ones to Bank of America accounts, are incredibly useful for bridging geographical distances and making financial connections seamless. In our increasingly globalized world, they serve as a vital tool for:

- Supporting family and friends: Sending or receiving money for living expenses, emergencies, or special occasions is a common and heartfelt use. Imagine helping your child studying abroad or receiving a generous gift from a relative overseas.

- Business transactions: For freelancers, small businesses, or even larger corporations, receiving payments from international clients or suppliers is crucial for smooth operations.

- Investments and property purchases: Sometimes, large sums need to be transferred internationally for significant purchases or investments, and wire transfers are the go-to method for their speed and security.

- Personal remittances: Many people rely on these transfers for their livelihood, sending money back to their home countries or receiving it from abroad.

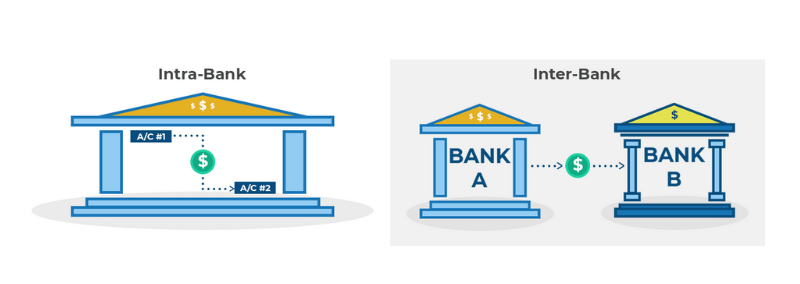

Now, let's talk about the nitty-gritty: the inbound wire transfer fees. While the sender typically incurs the primary fee for initiating the wire, there can sometimes be a fee for receiving an international wire transfer into your Bank of America account. It's essential to be aware of this so there are no unwelcome surprises. While specific fees can vary based on the sending institution, the currency, and any intermediary banks involved, Bank of America generally aims to make the process as transparent as possible. Always check with the sending institution about their outbound fees, and if you're unsure about potential inbound charges, a quick call to Bank of America's customer service or a visit to their website can provide the most up-to-date information.

To make your international wire transfer experience as smooth and enjoyable as possible, here are a few practical tips:

- Communicate clearly: Ensure the sender has all your correct banking information, including your full name as it appears on your account, your account number, and Bank of America's SWIFT/BIC code (which is essential for international transfers).

- Inquire about fees upfront: Before the wire is sent, both you and the sender should have a clear understanding of all associated fees. This prevents any "sticker shock" on either end.

- Allow for processing time: While wire transfers are generally fast, they aren't always instantaneous. Factor in a day or two for the funds to clear, especially over weekends or holidays.

- Keep records: Save any confirmation numbers or transaction details provided by the sender. This is invaluable for tracking your transfer if any issues arise.

- Consider alternatives for smaller amounts: For smaller sums, services like PayPal, Wise (formerly TransferWise), or other digital payment platforms might offer more competitive rates and lower fees compared to traditional wire transfers.

Receiving international funds through Bank of America can be a fantastic way to stay connected and manage your finances globally. By being informed about potential fees and following these simple tips, you can ensure a positive and hassle-free experience every time!