Bank Of America's Unrealized Losses Could Approach $100 Billion.: Complete Guide & Key Details

Hey there, finance curious folks! Ever heard the phrase "unrealized losses" and felt your eyes glaze over? Yeah, I get it. It sounds super jargon-y, like something only Wall Street wizards whisper about. But honestly, when we're talking about a number as massive as Bank of America's potential unrealized losses, which some reports are hinting could be nudging towards a whopping $100 billion, it's actually pretty darn interesting. Think of it less like a dry textbook and more like a fascinating puzzle piece in the big, complex picture of how our economy ticks.

So, what's the big deal? And why should you, the average person who's probably more concerned with their grocery bill or planning their next vacation, even care about this? Well, stick around, because we're going to break it down in a way that's hopefully as chill as sipping iced coffee on a sunny afternoon. We're not diving into complex equations or anything that'll make your brain hurt. We're just exploring what's up, why it matters, and maybe even have a little fun with some analogies along the way.

What Exactly Are "Unrealized Losses"? Let's Get Real (Without the Jargon!)

Okay, imagine you bought a house a few years back for, say, $500,000. You love it, it's your little slice of heaven. Then, the housing market dips a bit. Now, if you were to try and sell that house today, you might only get $450,000 for it. That's a $50,000 loss, right? But here's the kicker: if you're not actually selling it, you're not realizing that loss. It's just sitting there on paper. That's essentially what an unrealized loss is for a bank.

Banks, you see, don't just keep cash under their mattresses. They invest a LOT of money in all sorts of things, including bonds. Bonds are basically like loans you give to governments or corporations. They pay you interest, and you get your original money back when the bond matures. It's usually a pretty safe bet. But, like anything in finance, the value of these bonds can go up and down based on market conditions, especially interest rates.

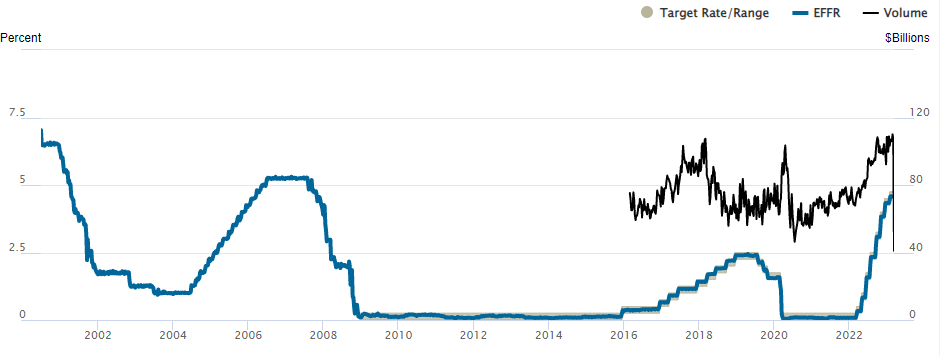

When interest rates go up (which they have been doing lately!), the value of existing, lower-interest-rate bonds tends to go down. It's kind of like having an old CD that pays a really low interest rate when all the new CDs are offering way more. Nobody's going to pay top dollar for your old CD, right? So, the bank's bond portfolio, which might have seemed super solid and profitable a while ago, can suddenly have a lower market value. That difference between what they paid for the bonds and what they could sell them for today is the unrealized loss.

So, Bank of America is Sitting on a Giant Pile of Paper Losses?

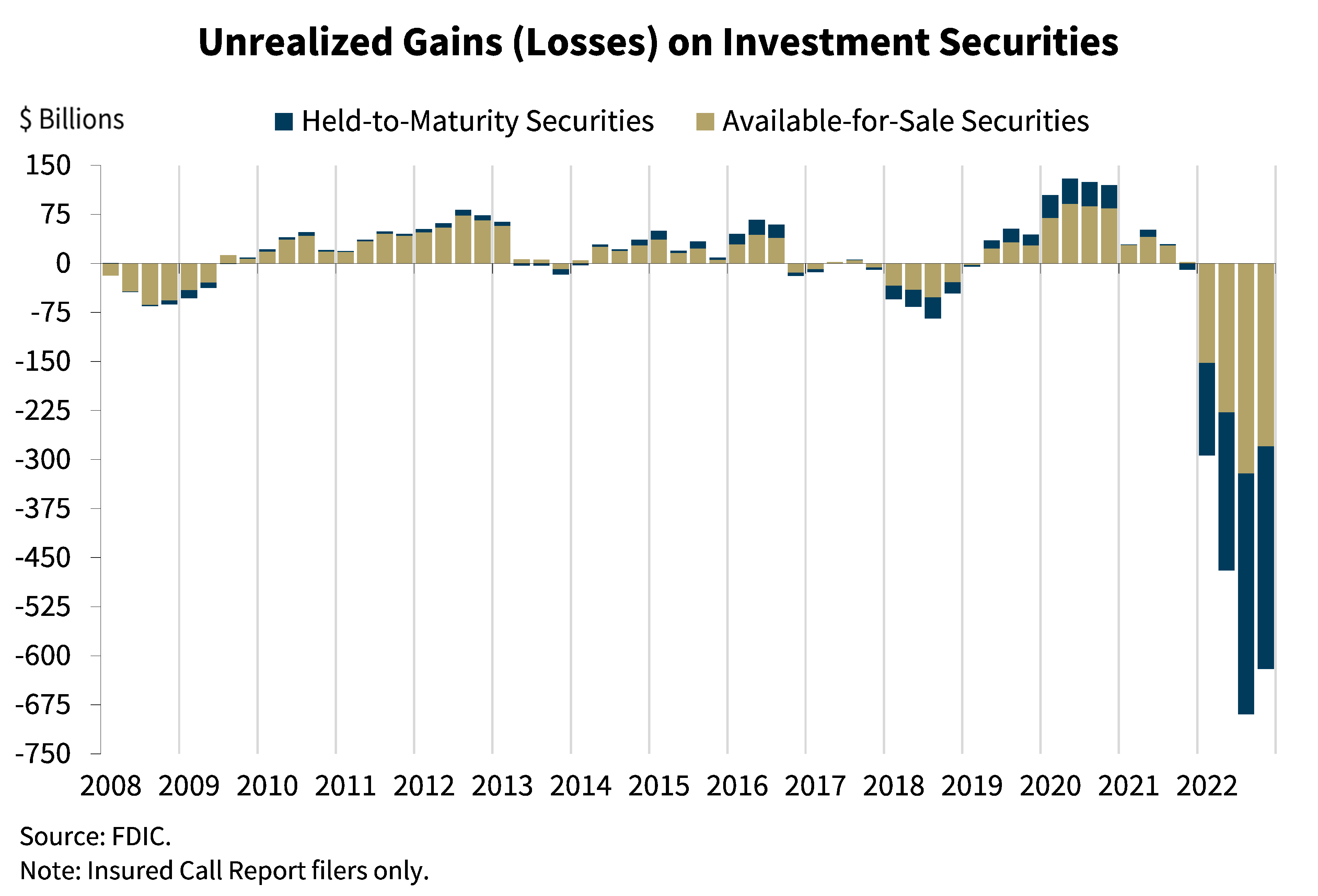

That's the gist of it! Reports are swirling that Bank of America, a giant in the banking world, might have a substantial amount of these unrealized losses on its books. We're talking about figures that could be approaching $100 billion. That's a mind-boggling number. To put it in perspective, that's more than the entire GDP of some small countries!

It's important to remember that this doesn't mean Bank of America is suddenly going to go bankrupt. Banks have a lot of buffers and regulations in place. Think of it like this: if you bought a bunch of stocks and the market went south, your investment portfolio might look a lot smaller on paper. But unless you sell those stocks at a loss, that loss is still unrealized. The bank is in a similar boat with its bonds.

Why is This Such a Hot Topic Right Now?

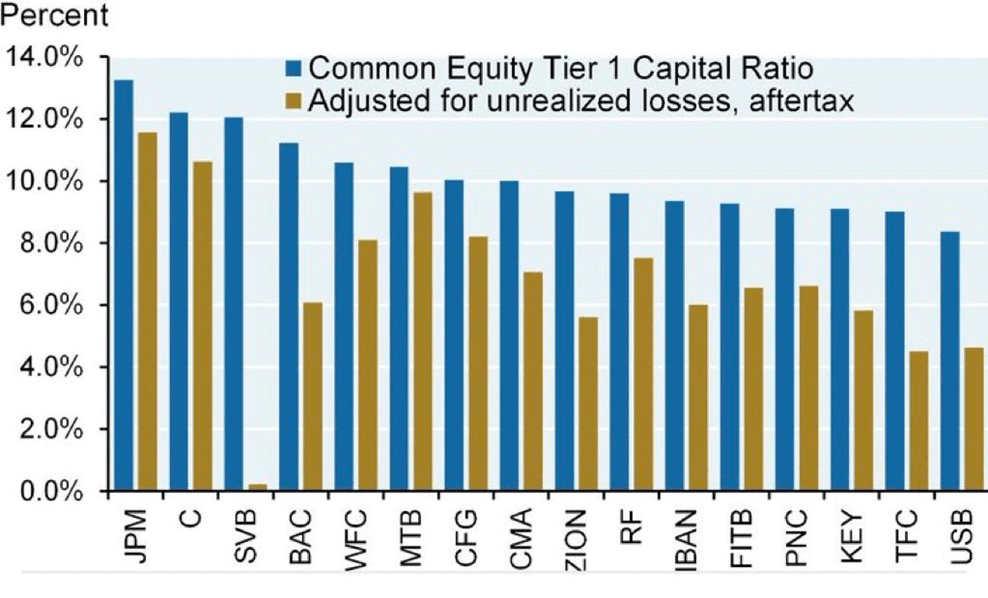

Well, the reason it's grabbing headlines is twofold. First, the sheer size of the potential losses is eye-popping. It makes people sit up and take notice. Second, it's happening in the context of a slightly shaky economic environment. We've seen some other banks have a bit of a wobble recently, and any news about big banks and big numbers like this tends to get people talking and maybe even a little nervous.

Think of it like this: if you're at a party and someone mentions that their very large, usually very stable friend, is suddenly feeling a bit under the weather, you're going to be curious, right? You'll want to know what's going on. It's the same with big financial institutions. Their health is kind of a barometer for the broader economy.

What Does This Mean for You and Me? (The Practical Bit!)

Honestly, for most of us, the direct impact of Bank of America's unrealized losses on our daily lives is probably going to be minimal. Here's why:

- Not Selling = Not Realizing: As we've talked about, these are unrealized losses. If Bank of America plans to hold onto these bonds until they mature, they will eventually get their original principal back, assuming the issuer of the bond doesn't default (which is rare for the kinds of high-quality bonds banks typically hold). So, the paper loss doesn't necessarily translate into an actual cash loss for the bank if they don't sell.

- Bank Stability: Banks are required to hold a certain amount of capital to absorb potential losses. They're not operating on the razor's edge. They have significant reserves to weather these kinds of market fluctuations. It’s like having a really strong umbrella during a sudden downpour.

- Economic Indicator: The main reason it's interesting for us is as an indicator of broader economic trends. Rising interest rates, which cause these bond values to drop, are a deliberate tool used by central banks (like the Federal Reserve) to fight inflation. So, these unrealized losses are a symptom of efforts to cool down the economy.

It's kind of like looking at the weather forecast. You might not be directly involved in the atmospheric pressure systems, but knowing that a storm is coming might make you decide to bring an umbrella or reschedule your picnic. In this case, the "storm" is the impact of higher interest rates on financial assets.

The "Key Details" You Might Want to Know

So, let's wrap up with some of the most important things to keep in mind about this whole situation:

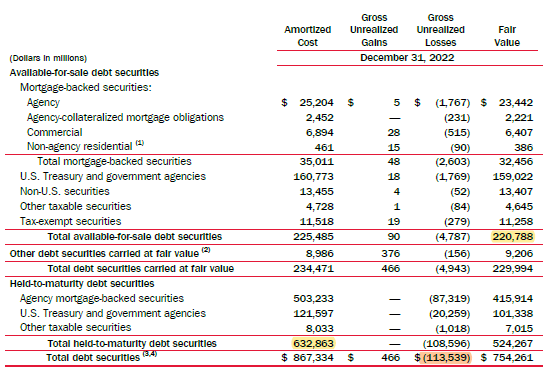

- What are they holding? Bank of America, like many banks, holds a significant portfolio of Treasury securities and mortgage-backed securities. These are generally considered safe investments, but their market value fluctuates with interest rates.

- The Interest Rate Connection: The Federal Reserve's aggressive interest rate hikes to combat inflation are the primary driver behind the declining value of these older, lower-yield bonds.

- Regulatory Oversight: Banks are heavily regulated and supervised by authorities like the Federal Reserve and the Office of the Comptroller of the Currency. These regulators keep a close eye on banks' financial health.

- It’s Not Just BofA: It's important to note that many banks are facing similar situations with unrealized losses on their bond portfolios due to rising interest rates. Bank of America's size just makes their potential losses more prominent in the news.

- Focus on Capital: What truly matters for a bank's stability is its capital. This is the cushion of money it has to absorb losses. Even with large unrealized losses, if a bank has strong capital reserves, it can typically weather the storm.

Think of it like a baker who has a lot of amazing ingredients in their pantry. Some of those ingredients might have slightly changed in texture or appearance due to the humidity (like the bonds), but the baker still has the fundamental ability to create delicious bread (meaning the bank can still operate and fulfill its obligations).

The Bottom Line: Interesting, But Not Panic-Worthy

So, there you have it! Bank of America's potential $100 billion in unrealized losses is a significant number, and it's certainly an interesting indicator of how rising interest rates are impacting financial markets. It's a reminder that even the biggest institutions are not immune to market fluctuations. But at the end of the day, it’s largely a paper phenomenon unless those assets are actually sold at a loss.

It’s cool to understand these concepts, not because you need to be a financial guru, but because it helps you make sense of the world around you. So, next time you hear about "unrealized losses," you can nod knowingly and think about your own hypothetical house or maybe even that slightly sad-looking jar of pickles in your fridge that you haven't opened yet – a loss, but not one you've fully experienced until you've tried it!