Baytex Energy Corp. Analyst Price Target Disagreement: Price/cost Details & What To Expect

Ever wonder what makes the financial world tick? It's not always about stuffy boardrooms and complex jargon. Sometimes, it's about a spirited debate among experts, and when those experts are talking about a company like Baytex Energy Corp., it can be surprisingly fun and incredibly useful to peek behind the curtain. Think of it like a lively discussion at a coffee shop where everyone has an opinion on where things are headed. That's exactly what we're diving into today – a disagreement among analysts about the future price of Baytex Energy's stock, and what that means for you and me.

The Price Target Puzzle

So, what exactly is a "price target" in the stock market? Imagine you're looking at a house for sale. A real estate agent might give you their best guess of what the house will be worth in a year, based on market trends, recent sales, and the house's condition. In the stock world, analysts do something similar. They're professionals who study companies, like Baytex Energy Corp., which is involved in the oil and gas industry. They look at everything from how much oil they're producing, to their operating costs, to global energy demand, and they come up with an educated guess – a price target – for what they think the stock will be worth in the future, usually within the next 12 months.

Now, here's where the fun begins: what happens when these smart folks don't all agree? That's the case with Baytex Energy Corp. You'll find some analysts with a more optimistic outlook, setting higher price targets, believing the stock has room to climb. Then, there are others who might be a bit more cautious, offering lower price targets. This disagreement isn't a sign of chaos; it's a sign of a healthy market where different perspectives are at play. It’s these differing viewpoints that provide a richer understanding of the potential risks and rewards.

Why This Matters to You

Why should you, a general audience member, care about analyst price target disagreements? Because it’s a fantastic way to get a glimpse into the potential future of a company and, by extension, the sector it operates in. When you see analysts debating Baytex Energy Corp., it often boils down to their expectations about a few key things:

- Oil and Gas Prices: This is the big one for an energy company. If analysts expect oil prices to go up, they're likely to set higher price targets for energy stocks. Conversely, if they see prices falling, their targets might be lower.

- Production Levels: How much oil and gas is Baytex Energy Corp. producing? Are they increasing their output, or is it staying steady? More production, generally speaking, can lead to more revenue.

- Cost of Operations: This is where price/cost details become crucial. Energy companies have significant expenses, from drilling and extraction to transportation and refining. If analysts believe Baytex Energy Corp. can keep its operating costs low or even reduce them, that's a positive sign for profitability and, subsequently, the stock price. Think about it like running a lemonade stand: if you can get your lemons and sugar cheaper, you make more profit on each cup!

- Debt Levels: Companies often borrow money. Analysts will scrutinize how much debt Baytex Energy Corp. has and how effectively they are managing it. High debt can be a burden, especially if revenues decline.

- Global Demand: The world's appetite for energy is constantly shifting. Factors like economic growth, geopolitical events, and the transition to cleaner energy sources all play a role in shaping future demand.

When analysts disagree, it's often because they weigh these factors differently. One analyst might be a strong believer in rising oil prices due to supply constraints, while another might be more concerned about a global economic slowdown impacting demand. This divergence creates an opportunity for us to learn.

What to Expect from Baytex Energy Corp.

So, what can we specifically expect when looking at the price target disagreements for Baytex Energy Corp.? It suggests that the future performance of the company isn't a sure bet. Instead, it's likely a situation with potential upsides and downsides.

If you see a wide range of price targets from different analysts, it generally means there's a lot of uncertainty about the company's future. This could be due to:

Unpredictable oil market fluctuations, or

Questions surrounding the company's ability to manage its operational costs effectively in the coming periods.

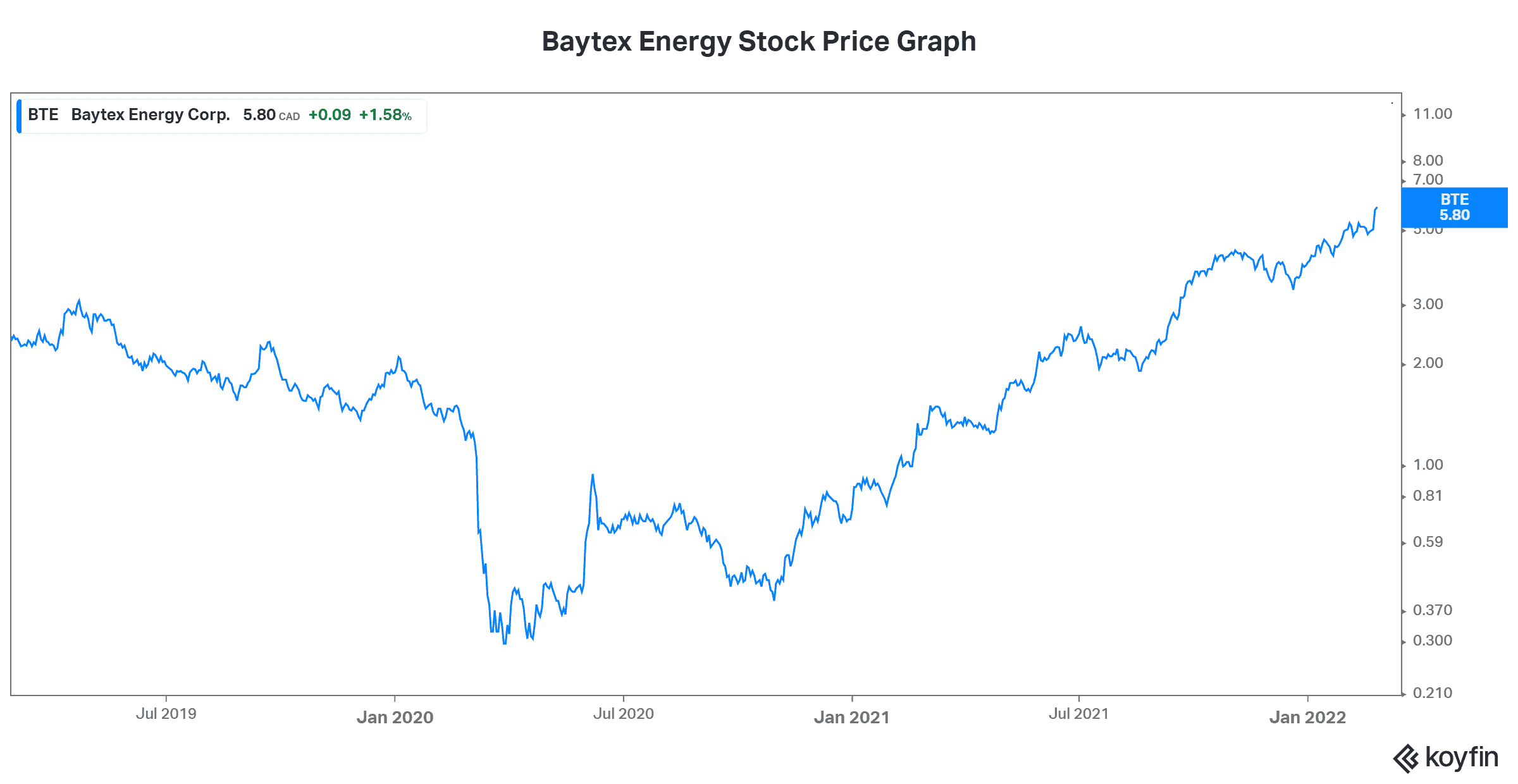

BTE Stock Price and Chart — TSX:BTE — TradingView

On the flip side, if the price targets are clustered closely together, it might suggest a more unified view among analysts about the company's prospects. For Baytex Energy Corp., a disagreement in price targets means investors should pay close attention to the specific reasons behind each analyst's projection. Are they focusing on the company's strong production capabilities? Or are they worried about rising extraction costs impacting profit margins?

Understanding these nuances allows you to make more informed decisions, whether you're a seasoned investor or just curious about how the business world works. It's a reminder that even the experts have different opinions, and that's what makes the journey of understanding a company like Baytex Energy Corp. so engaging!