Berkshire Hathaway 13f Q3 2024 Apple Shares 300 Million: Complete Guide & Key Details

Guess what? We've got some juicy gossip from the land of finance! And it involves two of the biggest names in the game: Berkshire Hathaway and Apple. Yep, Warren Buffett's legendary company just dropped its latest filing, and we're here to spill the tea on all the nerdy, but kinda cool, details.

It's the Q3 2024 13F filing. Fancy, right? Basically, it's a report card for big investment firms. They have to tell us what stocks they bought and sold. And this one is a doozy!

Berkshire's Apple Obsession Continues!

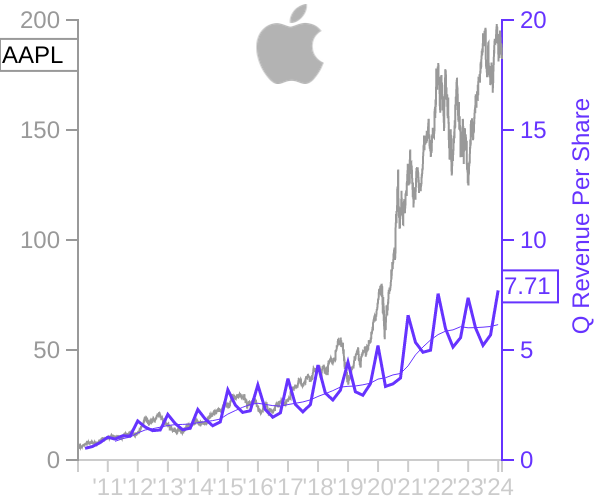

So, the big news? Berkshire Hathaway is still totally into Apple. Like, seriously, we're talking 300 million shares of Apple. Let that sink in. That's a lot of iPhones, iPads, and Macs they're invested in!

This isn't new, mind you. Berkshire has been a massive Apple shareholder for ages. But the sheer number they hold? It's kinda like the ultimate celebrity endorsement, but for stocks. If Warren Buffett thinks Apple is a good bet, well, who are we to argue?

Why 300 Million Shares is a Big Deal

Why should you care about 300 million shares? Well, it's not just a random number. It represents a huge chunk of Berkshire's portfolio. We're talking billions and billions of dollars. It shows how much faith they have in Apple's future. Even after all these years!

Think of it this way: if Apple sneezes, Berkshire Hathaway feels a chill. It's that kind of relationship. And honestly, it’s pretty fun to watch. It’s like a financial fairy tale. The wise old investor and the tech titan.

What's a 13F Filing Anyway?

Okay, let's break down the 13F filing a bit. It's a document that investment managers with over $100 million in assets have to file every quarter. It's like a peek behind the curtain of Wall Street's biggest players.

These filings are released about 45 days after the quarter ends. So, the Q3 2024 filing covers the period from July 1st to September 30th, 2024. And everyone, from seasoned investors to us curious onlookers, waits with bated breath for these reports.

Berkshire's Quirky Habits

What makes Berkshire's filings so fun? For starters, Warren Buffett himself isn't the one picking every stock. He has a couple of brilliant portfolio managers, Ted Weschler and Todd Combs, who make a lot of the decisions. But the overall philosophy? That's all Uncle Warren.

And sometimes, there are little surprises. A new company popping up, a big sell-off. It's like a treasure hunt for financial clues. You never quite know what you're going to find.

The Apple and Berkshire Love Story

This Apple investment isn't just about money. It's about a philosophical alignment. Berkshire Hathaway is known for its value investing approach. They like companies with strong fundamentals, good management, and a durable competitive advantage – what Buffett calls an "economic moat."

Apple, despite being a tech giant, has a lot of these qualities. They have a fiercely loyal customer base. They create products that people love. And they’ve built an ecosystem that’s hard to break away from. It’s not just a phone; it's an experience.

Is Apple a "Value" Stock?

Now, some folks might scratch their heads. "Apple? A value stock?" you might wonder. And that's the fun part of this story! It shows how investing strategies can evolve. Or how a company can be so dominant that it transcends traditional definitions.

Berkshire sees the enduring brand power, the recurring revenue from services, and the sheer innovation. They see a company that can keep reinventing itself. And that, my friends, is the kind of thing that makes investors smile.

What Else Did Berkshire Do?

While the Apple news is the headliner, it's not the whole story. The 13F filing reveals other moves. Did they buy more of something? Did they trim their stake in another company? These are the side quests of the financial world!

For example, you might see them adding to their position in a bank or a consumer staple company. Or perhaps they've been slowly divesting from an industry they see facing challenges. It’s a constant dance of buying and selling.

The Power of Observation

Why is it fun to follow these filings? Because it’s a chance to learn. To see how incredibly smart people think about the world of business. You might pick up a new company to research, or a new way of looking at an industry.

It's also a little bit of a reality check. These are real companies, with real products, employing real people. And the decisions made by folks like Warren Buffett have a ripple effect. It’s fascinating stuff!

The "Why Should I Care?" Section

Okay, okay, so you’re not planning on becoming a billionaire investor overnight. But why should this even be on your radar? Think of it as financial pop culture.

It’s like following your favorite band’s new album release, but instead of music, it’s about company performance and investment strategies. It’s a glimpse into the minds of some of the most successful business minds in history.

A Tiny Bit of Financial Literacy

Plus, it’s a subtle way to boost your own financial literacy. You’re learning about investment terms, about market trends, and about how the big money flows. It’s like osmosis for your brain. You might not even realize you’re learning!

And who knows, maybe one day you’ll be analyzing your own 13F filing. Or at least you’ll sound super smart at your next dinner party when someone mentions Warren Buffett.

The Apple Takeaway

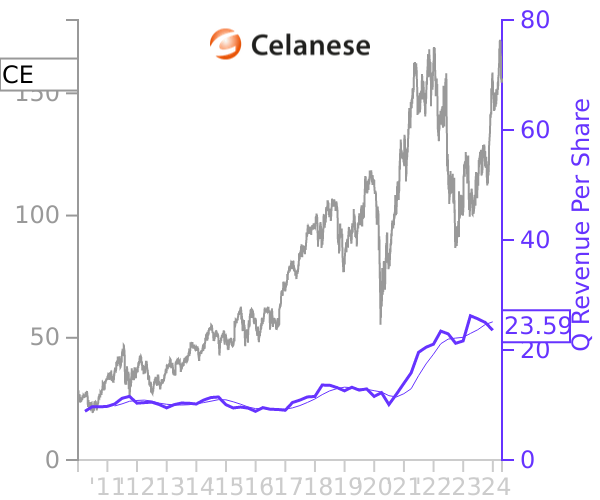

So, back to Apple. 300 million shares. It’s a bold statement. It says Berkshire Hathaway believes in Apple’s ability to keep delivering value, keep innovating, and keep making products that the world wants.

It’s a testament to Apple’s resilience and its deep, deep moat. And for us observers, it’s a fun little nugget of information that makes the sometimes-dry world of finance a little more exciting. Keep an eye on those filings, folks!