Best High Yield Savings Account In The United States: Top Picks & Buying Guide

Let's talk about money! Specifically, where to stash your hard-earned cash so it can make a little extra money for you. We're not talking about get-rich-quick schemes or anything that requires a spreadsheet and a calculator for breakfast. We're talking about the humble, yet surprisingly mighty, High Yield Savings Account (HYSA).

Think of it as a cozy little vacation home for your dollars, where they can relax, spread out, and maybe even bring home a few extra pennies from their travels. While your regular checking account is like a bustling city street, always on the go, an HYSA is more like a tranquil garden, where things grow a little more peacefully. And the "high yield" part? That's just a fancy way of saying it earns a bit more interest than your average savings pot.

Now, you might be thinking, "Savings accounts? Is this a joke?" But bear with us! We're about to uncover some surprisingly delightful corners of the financial world. It’s like finding a secret stash of cookies in the pantry – a pleasant little surprise that makes life a tiny bit sweeter.

Unveiling the Champions of Coin-Growing!

So, who are these champions, these wizards of wealth-building, these… well, these banks offering the best HYSA rates? It’s not as glamorous as spotting a celebrity at a coffee shop, but trust us, spotting a good HYSA rate can feel just as rewarding.

We've scoured the land (digitally, of course) to find some top contenders. These are the banks that are actively trying to woo your money with better interest rates. They understand that when your money works harder, you can relax a little more. And who doesn't love a little extra relaxation?

One of our favorites, for its sheer straightforwardness and impressive rates, is Ally Bank. They’re like the friendly neighbor who always has a spare cup of sugar, but instead of sugar, they’re offering a sweet interest rate. Their online platform is super easy to navigate, so you won't need a decoder ring to understand your statements.

Then there’s Discover Bank. You might know them for their credit cards, but they also have a fantastic HYSA. It's like finding out your favorite pizza place also makes amazing ice cream – a delightful bonus!

And let’s not forget about Capital One 360. They’ve been around for a while, and their savings accounts are reliably good. It’s like a well-loved armchair; comfortable, dependable, and always there when you need it.

These are just a few shining examples, of course. The world of HYSAs is vast and ever-changing, like a lively marketplace where prices are always being adjusted. But these are the ones consistently offering a good deal.

Why Your Piggy Bank Deserves a Mansion

So, what’s the big deal about a “high yield”? Imagine your savings account as a small seedling. A regular savings account is like planting it in slightly damp soil. It might grow a little, but it won’t exactly be a towering oak.

:max_bytes(150000):strip_icc()/how-to-open-a-high-yield-savings-account-4770631-final-c7f448b5c0bc48658a3c6a4c7afa0a3d.jpg)

An HYSA, however, is like planting that seedling in super-rich, perfectly watered soil, with a little bit of sunshine and encouragement. It’s designed to help your money grow at a much faster, more noticeable pace. This extra growth isn’t just a tiny sprout; it can actually add up significantly over time.

Think of it this way: that extra interest is like finding money in your coat pocket after a long winter. It’s a little unexpected bonus that brightens your day. And when it comes to your savings, that little bonus can turn into a significant boost, especially if you’re saving for a big goal, like a down payment on a house or a dream vacation.

It’s also incredibly low-risk. Unlike investing in the stock market, where things can go up and down like a roller coaster, your money in an HYSA is generally very safe. The Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 per depositor, per insured bank, for each account ownership category. So, your money is protected, which is a big sigh of relief for many.

Your Personal HYSA Shopping Cart: A Handy Guide

Now that you're excited about the prospect of your money making more money, how do you pick the perfect HYSA for you? It's not like choosing a pet; you can't just pick the one with the cutest wagging tail. You need to consider a few things.

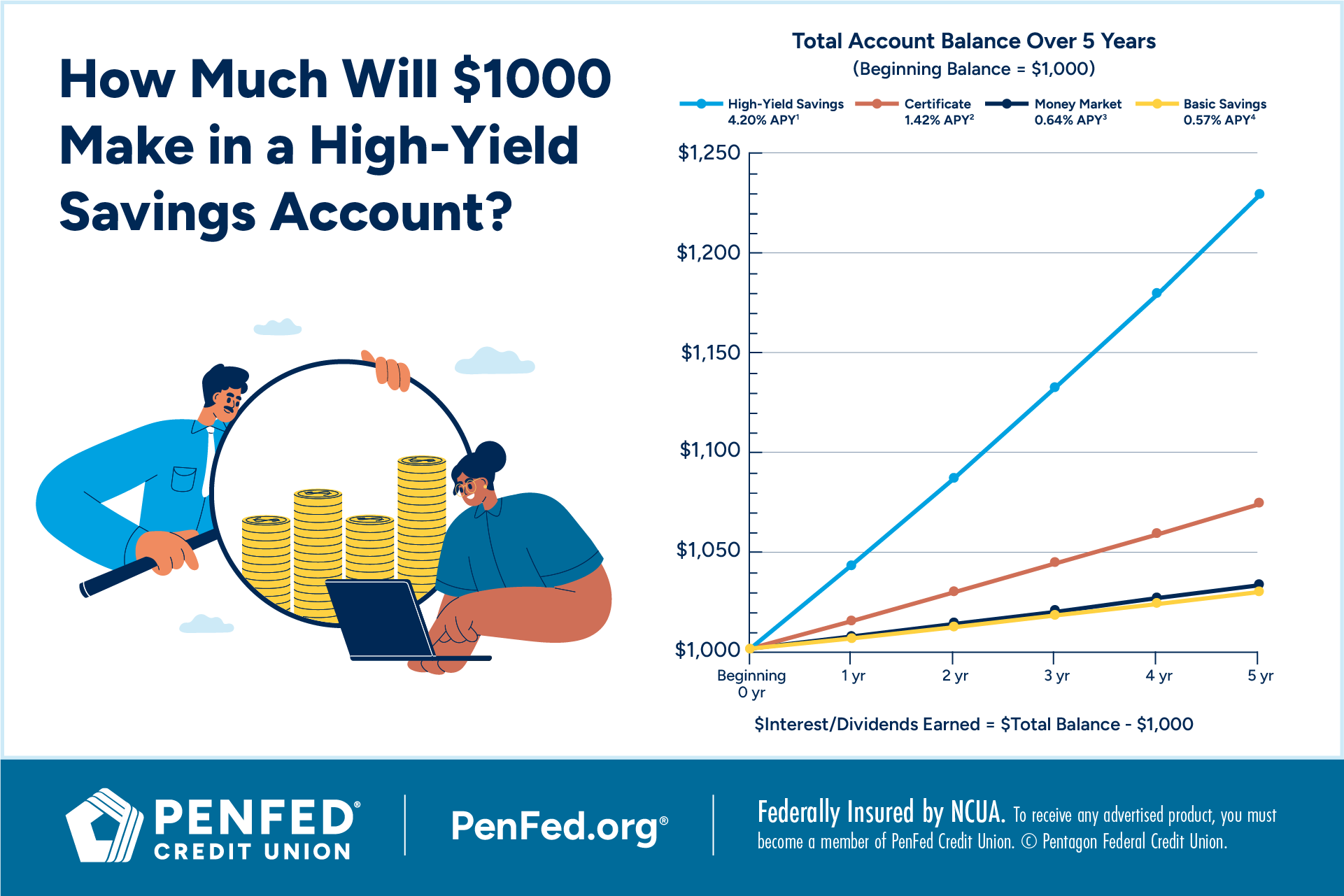

First up, the Annual Percentage Yield (APY). This is your golden ticket, the main attraction. It’s the percentage rate of return you can expect your money to earn over a year. The higher the APY, the more money your money makes! It's like comparing the sweetness of two different kinds of fruit – you want the one that’s bursting with flavor.

Next, consider minimum balance requirements. Some banks might ask you to keep a certain amount of money in your account to earn that sweet APY. Others are more relaxed and have no minimums at all. This is like choosing between a fancy restaurant with a strict dress code and a cozy diner where you can wear whatever you want. For most people, the diner experience is more appealing!

Then there’s the ease of access. How easily can you get your money if you need it? Most online HYSAs offer easy online transfers and mobile apps. You want to be able to get to your money without having to jump through hoops or solve a Rubik's Cube. It should be as simple as ordering your favorite takeout.

Don't forget about fees. While HYSAs are generally low-fee accounts, it's always good to double-check. Are there monthly maintenance fees? Fees for exceeding a certain number of withdrawals? You want to avoid any sneaky charges that eat into your earnings. It’s like making sure there are no hidden anchovies on your pizza if you’re not a fan.

Finally, think about the bank itself. Is it a reputable institution? Do they have good customer service? You want to feel comfortable and confident with where you’re keeping your money. It's like choosing a reliable friend to look after your plant when you're on vacation – you want someone you can trust.

A Heartwarming Thought to Carry With You

In a world that can sometimes feel unpredictable, having a healthy savings account, especially one that's working a little harder for you, can be a source of immense comfort. It's like having a warm blanket on a chilly evening.

It’s not about hoarding cash or becoming a millionaire overnight. It’s about creating a little bit of financial breathing room, a safety net, and the ability to say "yes" to opportunities that might arise. It's about giving your future self a little gift, a little peace of mind, and the power to make your dreams a reality.

So, go forth and explore the wonderful world of High Yield Savings Accounts! Your wallet will thank you, and who knows, you might just find yourself humming a happy little tune as your money grows. It's a small step, but it can lead to big, wonderful things. Happy saving!