Best Life Insurance For Seniors Over 75 No Medical Exam: Best Picks & Buying Guide

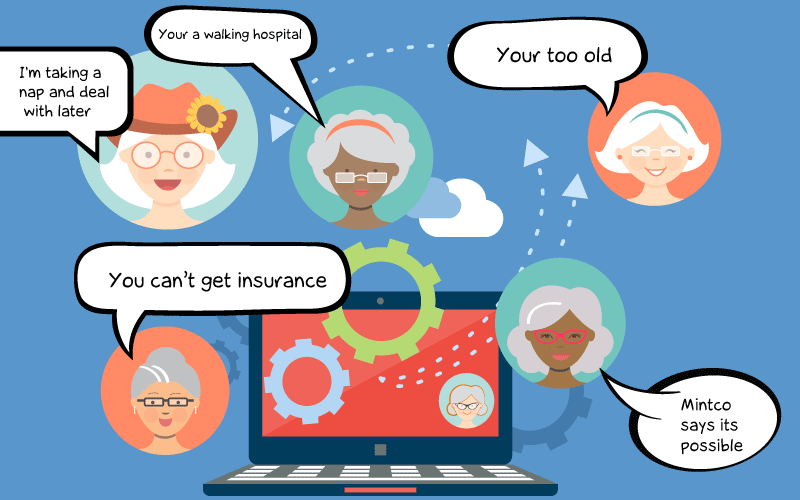

Ah, the golden years! A time for rocking chairs, remembering the good old days, and maybe even perfecting that sourdough starter. For our wonderful seniors who've hit the fabulous 75+ mark, life is certainly full of wisdom and charm. And just like a well-loved recipe book, it's also a good time to think about protecting those you love, making sure they're taken care of, no matter what. Now, when we talk about life insurance for folks over 75, especially those who'd rather skip the doctor's office drama, it can sound a bit like a riddle wrapped in an enigma. But fear not, dear reader, for we're about to uncover some delightful secrets, sprinkle in a little humor, and find some truly heartwarming solutions that are surprisingly straightforward.

Let's be honest, who wants to be poked and prodded when they've already lived a full and vibrant life? The idea of a medical exam can feel like being back in school, and not in a fun, reunion kind of way. Thankfully, for our amazing seniors over 75, there are options that say, "No thank you!" to those stethoscopes and blood pressure cuffs. We're talking about no-medical-exam life insurance. Think of it as a "hug in a policy" – a way to show your love and leave a legacy without the fuss.

So, what are these magical policies that let you bypass the doctor? Mostly, they fall into a couple of friendly categories. The first is often called guaranteed issue life insurance. The name says it all, doesn't it? It's pretty much guaranteed, as long as you meet the age and residency requirements. These are fantastic for folks who might have some health conditions that would normally make getting traditional life insurance a bit tricky. It’s like getting an invitation to the party, no questions asked! The premiums might be a little higher because there's no medical exam to assess risk, but the peace of mind? Priceless.

Then, you might stumble upon something called simplified issue life insurance. This is a bit like the "lite" version of traditional insurance. You'll answer a few health questions, but it's usually a quick and easy questionnaire, not a full-blown medical deep dive. Think of it as checking a few boxes instead of writing a novel. For many healthy seniors over 75, this is a sweet spot, offering a good balance of coverage and affordability without needing to book an appointment with the doc.

Now, who are some of the cheerful providers making these options available? While we can't name just one "best" because everyone's situation is as unique as their favorite armchair, some names tend to pop up in conversations. Companies like AARP (which isn't just for bingo nights, you know!) often have partnerships offering guaranteed issue or simplified issue policies. They understand the needs of their members and aim for ease. Then there are companies like Colonial Penn, which has been around for ages and is known for its direct marketing and straightforward approach. You might also hear about Fidelity Life or Mutual of Omaha, who have a reputation for solid customer service and a range of options. It's less about finding a superhero company and more about finding the one that feels like a friendly neighbor, ready to help.

It's not about how much you leave behind, but how much love you leave behind. And sometimes, a life insurance policy is just a tangible way to show that love.

So, how do you go about picking the right policy? Think of it like choosing the perfect companion for a leisurely stroll. First, figure out why you need the insurance. Is it to cover final expenses, like funeral costs (which, let's face it, can be surprisingly hefty)? Or perhaps to leave a little something for a grandchild's education fund, or to help your spouse with ongoing expenses? Knowing your goal helps you determine the coverage amount you need. Don't go overboard; it's about thoughtful protection, not winning the lottery of leftovers.

Next, consider the cost. As we mentioned, guaranteed issue policies might have higher premiums. Compare quotes from different companies. It’s like window shopping for the best deal at your favorite boutique. Don't be afraid to ask questions! A good insurance agent or company will be patient and clear. They’re there to guide you, not to rush you into something you don't understand. Think of them as friendly advisors, like your favorite librarian who always knows where to find the perfect book.

One of the most heartwarming aspects of this kind of insurance is the peace of mind it offers. Imagine knowing that when you're no longer around, your loved ones won't have to worry about sudden, unexpected bills. It's a final act of kindness, a whisper of comfort from beyond. It's about ensuring that your legacy is one of love and security, not of financial strain.

Remember, the goal isn't to become an insurance guru. It's to find a simple, reliable way to protect your family. These no-medical-exam policies for seniors over 75 are like a warm blanket on a cool evening – providing comfort, security, and the reassurance that everything will be alright. So, pour yourself a cup of tea, sit back in your favorite chair, and explore these options. You might be surprised at how easy and even pleasant it can be to secure that final, loving gesture.