Best Stocks To Buy On Cash App Right Now

Hey there, fellow money-movers and dream-chasers! So, you’ve got a little cash sitting in your Cash App, and your mind’s starting to wander. You know, that little voice that whispers, “What if this money could, like, do more?” Well, you’re not alone. In this fast-paced world, we’re all looking for smart ways to make our money work for us, without needing a PhD in finance. And let’s be real, who has the time for that? We’ve got brunch plans, that new series to binge, and that ever-growing to-do list. The good news? Navigating the stock market, especially with user-friendly platforms like Cash App, is more accessible than ever. Think of it less like a stuffy boardroom and more like your favorite coffee shop – approachable, with a vibe you can get into.

Now, before we dive into the juicy stuff, a quick disclaimer, because you know, responsible adulting. I’m not your financial advisor (yet!). This is purely for entertainment and informational purposes. Think of me as your stylish friend giving you the lowdown, not your accountant telling you to eat your veggies. Always do your own research, trust your gut, and remember that investing always comes with a dash of risk. But hey, a little calculated risk is what makes life exciting, right? Like trying that new restaurant without reading any reviews.

So, What’s the Vibe with Cash App Investing?

Cash App has totally revolutionized how many of us interact with our money. It’s slick, it’s easy to use, and suddenly, investing in stocks doesn't feel like some arcane secret reserved for the Wall Street elite. It’s right there, on the same app where you might be sending your friend money for pizza or buying Bitcoin. This democratization of investing is a total game-changer. You can start with small amounts, test the waters, and get a feel for how the market moves. It’s like learning to ride a bike – a few wobbles, a lot of momentum, and eventually, you’re cruising.

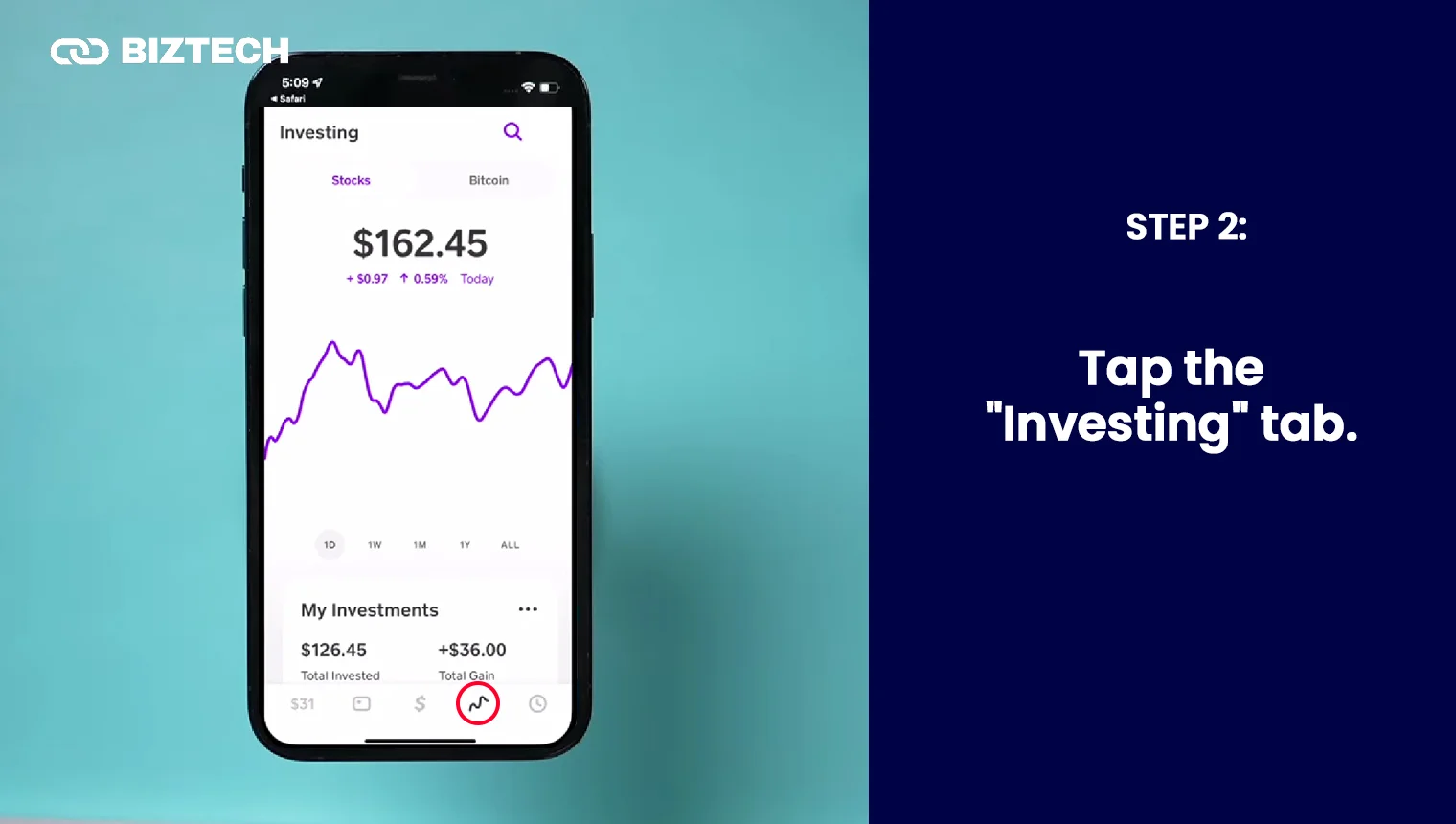

One of the coolest things about Cash App's investing feature is its simplicity. You can browse popular stocks, search for specific companies, and make your moves with just a few taps. No confusing jargon, no overwhelming charts (unless you go looking for them, which you can do!). It’s designed for the everyday person who wants to dip their toes into the investment pool without feeling like they’re drowning in financial lingo. It's the digital equivalent of a friendly bartender explaining your options.

Let’s Talk About What’s Buzzing Right Now

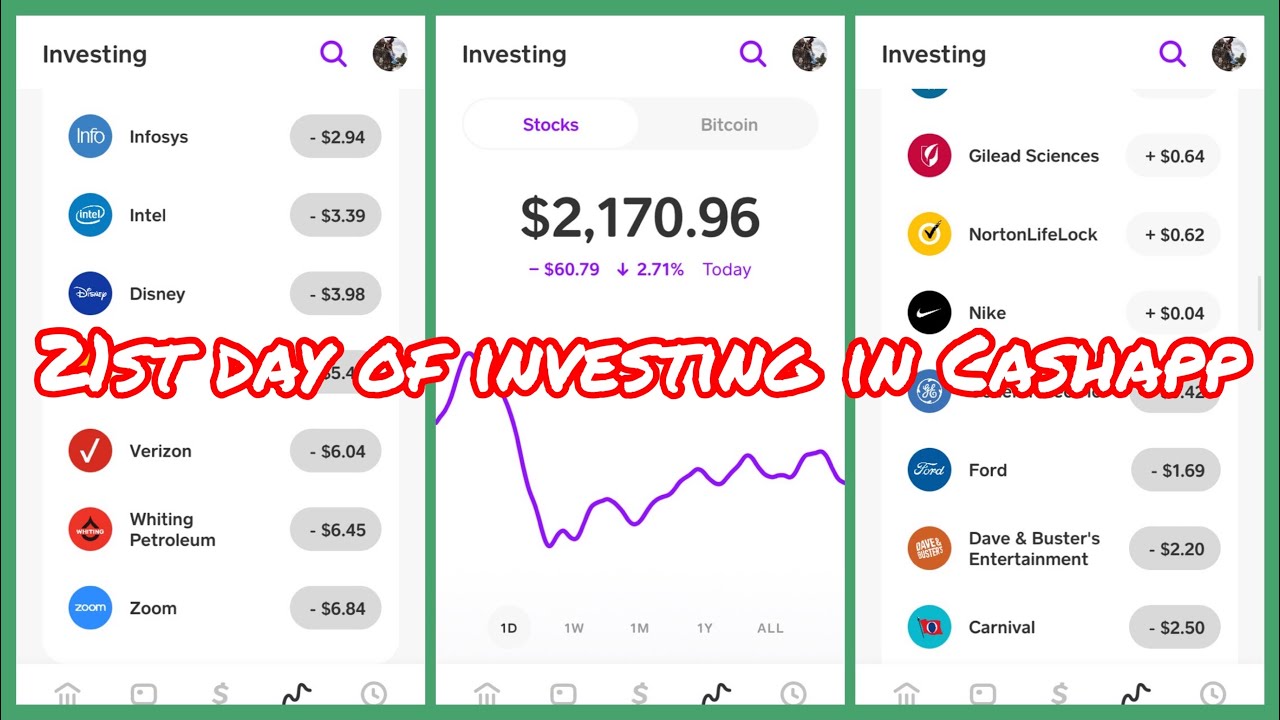

Okay, so you’re ready to scroll. But where do you even start? The market is a vast ocean, and picking the right fish can be tricky. We’re going to look at some sectors and specific companies that are generating a lot of buzz, are generally seen as stable-ish (because, you know, market fluctuations are a thing), and are readily available on Cash App. Think of these as your potential starter pack, your curated playlist of investment ideas.

Remember that meme about the stock market? Yeah, it can feel like that sometimes. But when we talk about "best stocks," we're often looking for a blend of established giants and innovative up-and-comers. It’s about finding companies with a solid foundation and a clear vision for the future. It’s like choosing your favorite band – you love the classics, but you’re also excited about discovering new artists who are pushing boundaries.

The Tech Titans: Always a Good Bet?

Let’s start with the obvious, shall we? Technology. It’s literally everywhere, powering our lives from our morning coffee maker to our late-night scrolling. Companies that are at the forefront of innovation tend to have a strong pull. Think about how much our lives have changed in the last decade. That’s driven by tech.

Apple (AAPL): Seriously, who doesn't have an Apple product? From the iPhone to the MacBook, Apple is a global phenomenon. They’ve built an incredible ecosystem, and their brand loyalty is off the charts. Plus, they’re constantly innovating with new products and services. It’s like the reliable friend who always shows up with the best snacks. Apple is a behemoth, and while growth might not be as explosive as it once was, its stability and consistent revenue make it a popular choice for many investors. They’ve got their fingers in so many pies – from hardware to software to services like Apple Music and Apple TV+. That diversification is key.

Microsoft (MSFT): From Windows to Azure to the Xbox, Microsoft is another tech giant that’s deeply ingrained in our daily lives. They’ve successfully pivoted and are now a major player in cloud computing, a sector with massive growth potential. Think of them as the steady, dependable colleague who’s always got your back. Microsoft’s cloud services (Azure) are a huge revenue driver, and their continued dominance in the enterprise software space provides a strong foundation. They’re also making waves in AI, which is pretty much the future of everything.

Alphabet (GOOGL/GOOG): Google. The search engine that knows everything, the operating system that powers most smartphones (Android), and the video platform that entertains billions (YouTube). Alphabet is a juggernaut. Their advertising revenue is immense, and they’re investing heavily in future technologies like AI and self-driving cars (Waymo). It’s like the friend who knows all the best trivia. Alphabet’s core search and advertising business remains incredibly strong, and their investments in areas like cloud computing (Google Cloud) and AI position them well for the future. Plus, who can resist the endless entertainment of YouTube?

The Retail Revolution: Shopping Smart

We all shop, right? And companies that understand how we shop, both online and in-store, are often winners. The retail landscape has changed dramatically, with e-commerce becoming king. Companies that have mastered the digital-to-physical experience are thriving.

Amazon (AMZN): The undisputed king of e-commerce. But Amazon is so much more than just online shopping. They're a massive player in cloud computing (AWS), a streaming service (Prime Video), and even have a growing presence in physical retail (Whole Foods). It’s the everything store, and then some. Amazon's AWS is a cash cow, and their e-commerce dominance continues to grow. Their ability to innovate and adapt to changing consumer behavior makes them a perennial favorite.

Target (TGT): While some retailers struggled with the shift to online, Target has really stepped up its game. They’ve invested heavily in their app, curbside pickup, and same-day delivery, making them incredibly convenient. Plus, they offer a great mix of affordable essentials and trendy in-house brands. They’re like the friend who can always find a great deal. Target has shown impressive resilience and growth by focusing on their omnichannel strategy and offering a curated selection of products that appeal to a wide range of consumers. Their store experience is also a significant draw.

The Everyday Necessities: The Staples of Your Portfolio

Sometimes, the best investments are in the things people always need, regardless of the economic climate. Think about food, drinks, and everyday household items. These companies tend to be more stable and less susceptible to big swings.

Coca-Cola (KO): Who doesn’t know Coca-Cola? It’s a global icon. While it might not be the most exciting growth stock, Coca-Cola offers stability and a consistent dividend. It’s like the classic rock anthem of the stock market – always there, always comforting. Coca-Cola’s strong brand recognition and global distribution network are incredibly powerful. They also own a diverse portfolio of beverage brands, providing a degree of diversification within the company.

Procter & Gamble (PG): This company is behind a ton of everyday products you probably use – Tide, Pampers, Crest, Gillette. They are the definition of consumer staples. Their products are essential, making them a relatively safe bet. It’s like the pantry in your kitchen – always stocked. Procter & Gamble’s broad portfolio of household brands provides a consistent revenue stream. Consumers continue to buy their products even during economic downturns, making it a defensive stock choice.

The Future is Now: Emerging Trends

While established giants are great for stability, it’s also smart to keep an eye on companies tapping into the next big things. These might have a bit more volatility, but the potential for growth can be significant.

Tesla (TSLA): Okay, so maybe not super stable, but undeniably influential. Tesla has revolutionized the electric vehicle market and is expanding into energy solutions. Their innovation is undeniable, and their cult following is something else. It’s the rockstar of the automotive world. Tesla's continued innovation in electric vehicles, battery technology, and autonomous driving makes it a company to watch. While it can be volatile, its impact on the automotive and energy sectors is profound.

Nvidia (NVDA): If you're into gaming, AI, or high-performance computing, you've heard of Nvidia. They are powering the next generation of technology. Think of them as the engine behind the digital revolution. Nvidia's graphics processing units (GPUs) are essential for AI development, data centers, and gaming, putting them at the forefront of several high-growth industries. Their role in the AI revolution is particularly significant.

Practical Tips for Your Cash App Investment Journey

Alright, we’ve tossed around some company names. But how do you actually do this without feeling overwhelmed?

Start Small: Seriously, don't go all in on day one. Cash App lets you buy fractional shares, meaning you can buy a piece of a stock for as little as $1. This is a brilliant way to get started and learn the ropes without risking a huge chunk of change. Think of it as a taste test before ordering the whole meal.

Do Your Homework (Even a Little Bit): Before you hit that buy button, take a few minutes to read up on the company. What do they do? What are their recent earnings like? A quick Google search can tell you a lot. You don't need to become an expert overnight, but a little knowledge goes a long way. Check out their website, read a few recent news articles. It’s like checking the weather before you plan an outing.

Diversify, Diversify, Diversify: This is the golden rule. Don’t put all your eggs in one basket. Invest in a mix of different companies and sectors. If one stock goes down, others might go up, balancing things out. Think of it like building a really cool playlist – you want a mix of genres and artists, not just one song on repeat.

Long-Term Vision: Investing is often a marathon, not a sprint. Try not to get too caught up in the day-to-day market fluctuations. Focus on the long-term growth potential of the companies you invest in. Patience is a virtue, especially when it comes to making your money grow. Think of it like growing a beautiful garden – it takes time and consistent care.

Understand Your Risk Tolerance: How much are you comfortable losing if things go south? Be honest with yourself. If you’re a thrill-seeker, you might explore more volatile stocks. If you prefer a smoother ride, stick to more established, dividend-paying companies. It's about finding your investing groove.

Set Alerts: Cash App often allows you to set price alerts. This is super handy for keeping an eye on your investments without constantly refreshing the app. It's like having a helpful reminder pop up on your phone.

Don't Forget the Fun: Investing shouldn't feel like a chore. Celebrate your small wins, learn from your mistakes, and enjoy the process of growing your wealth. It’s part of your financial glow-up!

A Little Reflection

Looking at these stocks, whether it's the dependable comfort of Coca-Cola or the electrifying future of Nvidia, you start to see a pattern. These companies are all about meeting needs, solving problems, or creating experiences that resonate with people. They’re woven into the fabric of our modern lives, just like our smartphones, our morning coffee, and that favorite pair of jeans. Investing a little bit of your Cash App balance into these companies isn't just about making money; it's about becoming a tiny shareholder in the world you interact with every day. It’s like owning a small piece of the story that unfolds around you, and that, in its own way, is pretty cool. So, go ahead, do your research, make a move, and let your money start its own adventure. Your future self will thank you, probably with a really good cup of coffee.