Can I Open A Bank Account In A Different Country? What To Know

Ever found yourself gazing at those travel brochures, picturing yourself sipping gelato in Rome or navigating the bustling souks of Marrakech, and then a little voice in your head whispers, "But what about my money?" It's a valid question, isn't it? The world feels smaller than ever, thanks to Wi-Fi and budget airlines, but when it comes to our hard-earned cash, it can still feel a bit… terrestrial. So, the burning question on many a globetrotter's mind (or future globetrotter’s mind, to be precise) is: Can I open a bank account in a different country? And if so, what’s the lowdown?

The short, sweet, and slightly cheeky answer is: Yes, you absolutely can! Think of it as adding a little international flair to your financial portfolio. It's not some mythical quest reserved for James Bond or wealthy magnates. For many of us, it’s a perfectly achievable, and sometimes incredibly useful, step.

The Wanderlust-Fueled Financial Frontier

Let's face it, the idea is exciting. Imagine a Swiss account, conjuring images of pristine mountains and impeccable security. Or perhaps a vibrant account in Lisbon, ready for your spontaneous weekend trips to Portugal. Or even a pragmatic account in Singapore, known for its efficiency and forward-thinking financial sector. The possibilities are as vast as your wanderlust.

But before you start packing your bags and mentally redecorating your new digital wallet, there are a few things to unpack. This isn't just about picking a pretty flag and hitting "apply." It's about a bit of research, some paperwork, and understanding the landscape. Consider this your friendly, no-nonsense guide to navigating the exciting world of international banking.

Why Bother? The Perks of Going Global with Your Funds

So, why would you even want to do this? Beyond the sheer thrill of it, there are some seriously practical reasons:

- Travel Convenience: This is the big one for most people. Having local funds in the country you visit drastically simplifies transactions. No more awkward ATM declines, hefty conversion fees, or trying to decipher foreign currency. It’s like having a VIP pass to the local economy.

- Investment Opportunities: Different countries offer different investment landscapes. Perhaps you’re eyeing the burgeoning tech scene in Estonia or the real estate market in a picturesque corner of Italy. An account in that country can be the gateway to these opportunities.

- Currency Diversification: Relying on just one currency can be risky. By holding funds in different currencies, you can hedge against economic fluctuations and potentially benefit from favorable exchange rates. It's like having a financial safety net woven with multiple threads.

- Business Expansion: If you’re thinking of starting a business abroad or working with international clients, a local bank account is often a necessity. It streamlines payments, makes tax compliance easier, and signals legitimacy to local partners.

- Privacy and Security (with caveats): While the days of impenetrable secret bank accounts are largely over, some countries still offer robust privacy laws and stable financial systems. This can be appealing for those seeking an extra layer of financial security.

- Living Abroad: If you're planning to relocate, even temporarily, a local bank account is practically non-negotiable. It's how you’ll pay rent, utilities, and generally participate in daily life.

Think of it this way: your current bank account is like your trusty bicycle. It gets you around your neighborhood perfectly. An international bank account is like upgrading to a sleek, fuel-efficient scooter that can take you across borders with ease.

The "What To Know" Handbook: Your Essential Checklist

Alright, the allure is real. Now, let's get down to the brass tacks. Here’s what you need to have on your radar before you embark on your international banking adventure:

1. Residency: The Golden Ticket (Usually)

This is often the biggest hurdle. Many countries, especially those with stricter financial regulations, require you to be a resident of that country to open an account. This means you’ll likely need to prove you live there with a utility bill, a lease agreement, or a residency permit.

But wait! Don't despair if you're not a full-fledged resident yet. There are exceptions:

- Non-Resident Accounts: Some countries, particularly those that rely heavily on international finance (think Switzerland, Singapore, or the Channel Islands), do allow non-residents to open accounts. However, these often come with higher minimum deposit requirements and sometimes stricter scrutiny.

- Student Accounts: If you're heading abroad for your studies, many universities have partnerships with local banks, making it easier for students to open accounts.

- Business Accounts for Foreign Companies: If you have a registered business in a foreign country, opening a business bank account is usually straightforward.

The takeaway: Research the specific residency requirements of your target country and the banks within it. Don't assume the rules are the same everywhere.

2. Identification: Your Global Passport (for Your Money)

Just like at home, banks need to know who you are. This usually involves a valid passport. But expect more.

You’ll likely need:

- Proof of Address: This is where that residency requirement comes in. A recent utility bill or bank statement from your home country might be accepted for non-resident accounts, but for resident accounts, you’ll need local proof.

- Proof of Income/Source of Funds: Banks are legally obligated to know where your money comes from, especially for larger sums. This could mean pay stubs, tax returns, or letters from your employer. This is part of the "Know Your Customer" (KYC) regulations, designed to prevent money laundering and fraud.

- Bank Reference Letter: Some banks might ask for a letter from your current bank stating you're a good customer.

- Tax Identification Number (TIN): This could be your home country's TIN or, if you’re opening an account as a resident, your new country's TIN.

Fun fact: The concept of "Know Your Customer" rules became much more stringent after the September 11th attacks, as governments sought to track financial transactions more effectively.

Pro tip: Have digital copies of all these documents ready. It will save you a lot of time and stress.

3. Minimum Deposits: The "Welcome Mat" Fee

This is where things can get a little… varied. Some banks are happy to open an account with a nominal deposit, while others, especially those catering to international clients or offering premium services, might require a substantial minimum deposit. We're talking anywhere from a few hundred to tens of thousands of dollars, or even more.

Consider this:

- Standard Accounts: These are usually more accessible with lower minimums.

- Premium/Private Banking: These accounts come with dedicated relationship managers, exclusive services, and often require significant assets under management.

- Non-Resident Accounts: As mentioned, these often have higher minimums to offset the increased administrative effort.

The practical bit: Factor in the minimum deposit when choosing a bank. Don't open an account you can't comfortably fund, as you might face fees for falling below the threshold.

4. Fees and Charges: The Fine Print of Global Finance

Just like at your local bank, international accounts come with fees. These can include:

- Monthly Maintenance Fees: A regular charge for keeping the account open.

- Transaction Fees: For international wire transfers, ATM withdrawals (especially foreign ones), and sometimes even for exceeding a certain number of free transactions.

- Currency Conversion Fees: When you move money between different currencies, there's usually a spread or a fee applied.

- Dormancy Fees: If your account is inactive for a prolonged period.

- Account Closure Fees: Sometimes, there's a fee to close an account, especially if it's done within a certain timeframe.

Cultural Insight: In countries like Germany, where a strong emphasis is placed on transparency and clarity, bank fee structures are often presented very clearly. In contrast, some jurisdictions might be a bit more opaque, so diligent research is key.

Your mission, should you choose to accept it: Scrutinize the fee schedule. Read the fine print and ask questions. Compare fees between different banks. This is where you can save a surprising amount of money.

5. Online Banking and Accessibility: Your Digital Lifeline

In today's world, online banking is a must. Ensure the bank you choose offers a robust, user-friendly online platform and a mobile app.

Think about:

- Language: Is the online portal available in English or a language you're comfortable with?

- Features: Can you easily make transfers, pay bills, check statements, and manage your funds remotely?

- Customer Support: How accessible is their customer service? Do they offer phone support, email, or chat? What are their operating hours?

Traveler's Tale: I once heard from a friend who was backpacking through Southeast Asia. Their local bank's app was so intuitive, they could manage their entire finances, pay rent back home, and even send money to fellow travelers, all from a beach in Thailand. Talk about freedom!

Key question: Can you manage your account effectively from afar? This is crucial if you plan to travel extensively.

6. Tax Implications: The Unavoidable Conversation

This is a big one, and it’s where things can get complex. Opening a bank account in another country might have tax implications both in your home country and in the country where you open the account.

- Reporting Requirements: Many countries, like the US (with its FATCA - Foreign Account Tax Compliance Act), have laws requiring citizens to report their foreign financial accounts and income earned abroad.

- Tax Treaties: Your home country and the foreign country might have tax treaties in place to avoid double taxation.

- Local Taxes: Depending on the type of income earned and the country, you might be liable for local taxes.

Disclaimer: I am not a tax advisor. This is a crucial area where you absolutely must seek professional advice. Consult with a tax advisor who specializes in international taxation. They can help you understand your obligations and ensure you're compliant.

Serious note: Ignorance of tax laws is rarely a valid defense. It's better to be upfront and informed.

7. Choosing the Right Country and Bank: Your Personal Quest

So, where do you even start? The “right” country and bank depend entirely on your personal needs and goals.

Consider these popular options and what they’re known for:

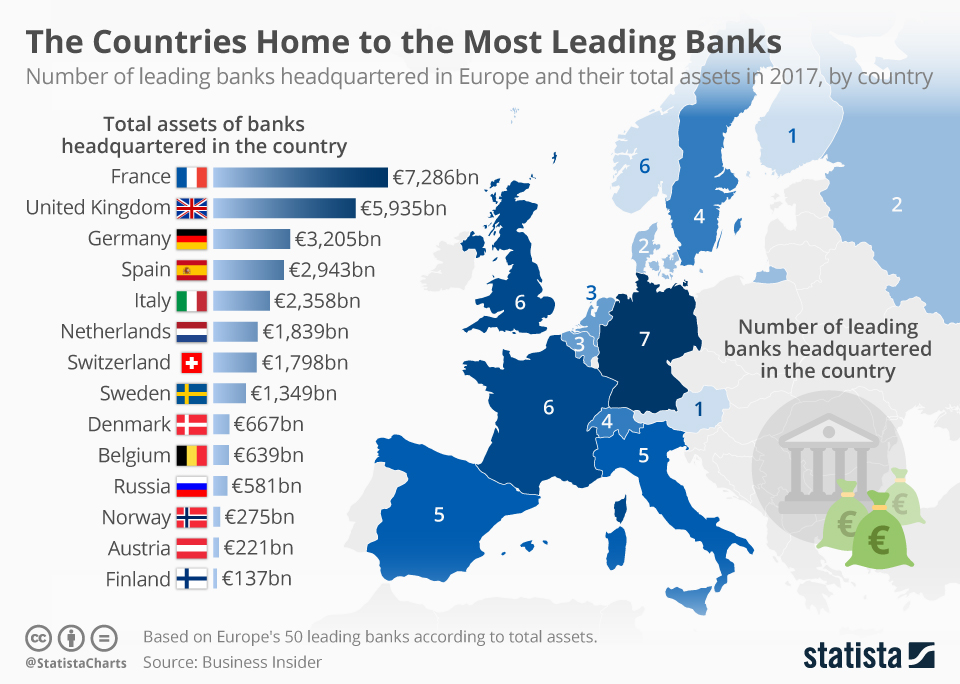

- Switzerland: Renowned for its stability, discretion, and high-quality banking services. Often a go-to for private banking and wealth management. Minimums can be high.

- Singapore: A major financial hub in Asia, known for its efficiency, technological advancement, and strong regulatory framework. Excellent for businesses and those looking for a gateway to Asian markets.

- Estonia: A pioneer in e-residency and digital governance. If you're looking to start an online business or appreciate a cutting-edge digital experience, Estonia is worth a look.

- Portugal: Increasingly popular for digital nomads and expats, with a relatively accessible banking system and a welcoming attitude towards foreigners.

- Canada: Known for its stable economy and customer-friendly banking system. Can be a good option for those looking for a reliable, no-fuss account, especially if they plan to visit or immigrate.

- European Union (general): The EU’s robust financial regulations and the ease of movement of capital within the bloc make many EU countries attractive.

A little anecdote: I have a friend who opened an account in Iceland purely because they were fascinated by the country and wanted to support local businesses during their extended stays. It wasn't for complex financial reasons, but more about feeling connected to the place they loved.

Your action plan: Define your "why." Are you traveling extensively? Investing? Starting a business? Your motivation will guide your choice of country and the type of bank.

The Process: A Peek Behind the Curtain

Generally, the process will involve:

- Research: Identify potential countries and banks that meet your criteria.

- Application: Most banks will have an online application form, or you might need to visit a branch in person.

- Document Submission: Upload or provide all necessary identification and supporting documents.

- Verification: The bank will verify your identity and documents. This can take time.

- Approval and Account Opening: Once approved, your account will be opened, and you’ll receive your account details and debit card.

Patience is a virtue. International banking processes can sometimes be slower than what you're used to, so factor in some waiting time.

A Final Thought: It's More Than Just Money

Opening a bank account in a different country is more than just a financial transaction; it’s a step towards a more connected and empowered global lifestyle. It's about saying, "Yes, I can participate fully in the world, no matter where my adventures take me."

Think about your daily routine. How often do you interact with your bank? Paying bills, transferring money, checking your balance. Expanding that to a global scale means you’re not just a tourist passing through; you're a participant. You can seamlessly integrate into the fabric of a new place, even if it's just for a holiday.

It’s about unlocking a new level of freedom and possibility. It’s about making that dream trip to Tuscany not just a dream, but a financial reality that’s as easy to manage as your grocery bill. So, go ahead, do your research, be prepared, and maybe, just maybe, your next adventure will start with a simple click of an international bank's "open account" button.