Can My Parents Give Me My Inheritance Before They Die? What To Know

Hey there, lovely reader! Ever find yourself daydreaming about that sweet, sweet inheritance? I know, I know, it sounds a bit morbid to talk about money your parents might leave you, but let's be honest, it's also a natural curiosity. And what if I told you there’s a way to maybe, just maybe, get your hands on some of that goodness before they shuffle off to the great beyond? Sounds exciting, right? It can actually make life a whole lot more fun!

So, the big question is: Can my parents give me my inheritance before they die? And the answer, in a nutshell, is a resounding YES! Isn't that a cool thought? It’s not some far-off, mystical thing. It’s a totally viable option, and one that can actually bring a whole lot of joy and practicality to everyone involved. Let’s dive in, shall we?

Unlocking the "Living Inheritance" Magic!

Think of it as a living inheritance or an early inheritance. Instead of waiting for a will to be read (which, let's face it, can feel like an eternity and involve a whole lot of paperwork), your parents can choose to gift you assets or money while they're still around. This opens up a world of possibilities!

Imagine your parents gifting you a down payment for your first home. How amazing would that be? Or maybe they want to help you start that dream business you've been talking about. Or, hey, perhaps they just want to see you enjoy a fantastic once-in-a-lifetime trip. These are the kinds of things that a living inheritance can facilitate, and honestly, it’s way more fun to share the good times and memories than to just wait for a check, wouldn't you agree?

Why Would Parents Do This? More Than Just Generosity!

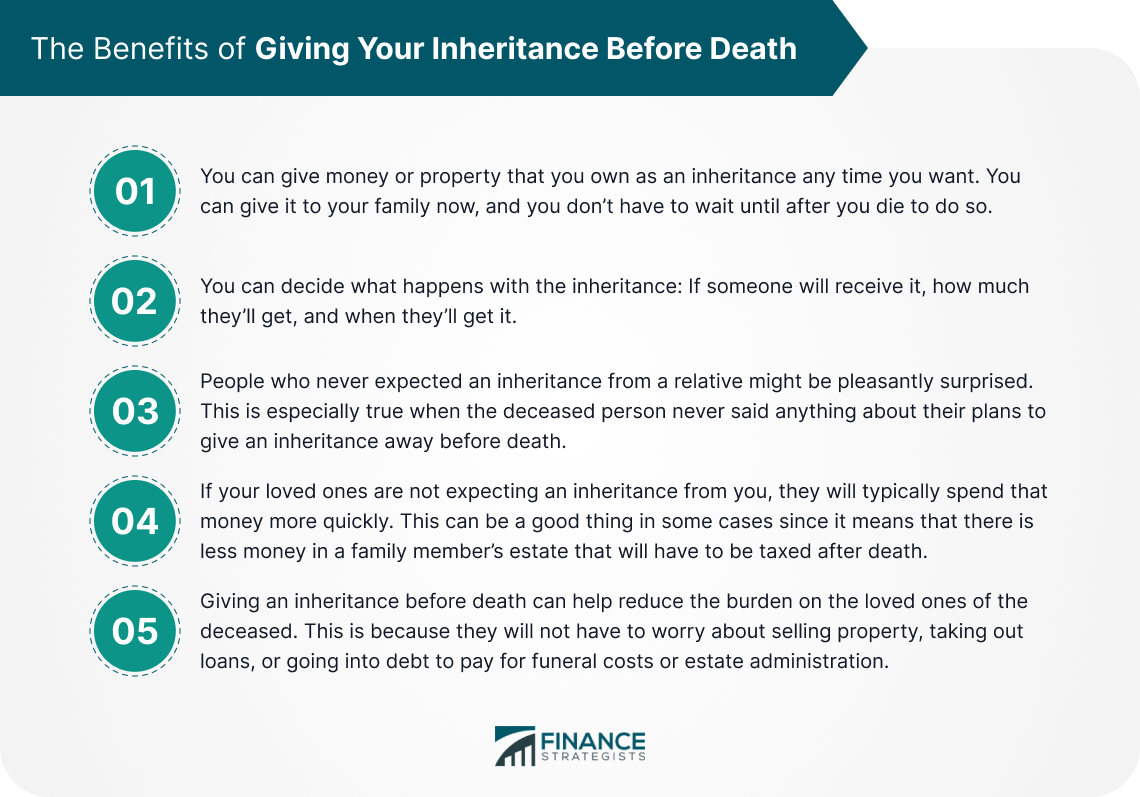

Now, you might be thinking, "Why would my parents want to do this now?" Well, there are some pretty smart reasons, beyond just being super-duper generous (though that's a big part of it, of course!).

One of the biggest advantages is estate tax planning. Depending on where you live and the size of the estate, there can be taxes involved when someone passes away. By gifting money or assets during their lifetime, your parents might be able to reduce the overall taxable estate, meaning more of their hard-earned money actually ends up with their loved ones, not the government. It's like a strategic money move that also helps family!

Another fantastic reason is to help you out when you might need it most. When you’re younger, you might be building your career, saving for a house, or raising a family. Having some financial support can be a game-changer during these crucial life stages. Your parents get to see the positive impact of their giving, and you get a helping hand when you really need it. Win-win!

It also allows your parents to witness your joy and success. Honestly, what's better for a parent than seeing their child thrive? Being able to contribute to your milestones – your wedding, your first home, your children's education – is incredibly rewarding for them. It's a way to share in your life's journey, not just at the end, but throughout it.

How Does This "Early Inheritance" Thing Actually Work?

So, how do you go from a hopeful thought to a tangible early inheritance? It’s not usually as simple as just asking for cash (though sometimes that can happen!). There are generally a few common ways this plays out:

Gifts, Gifts, and More Gifts!

The most straightforward way is through outright gifts. Your parents can literally give you money or assets. There are often annual gift tax exclusions, meaning they can give a certain amount each year to each person without triggering any gift tax. So, if your parents are feeling generous and your parents are in a good financial position, this can be a fantastic way to transfer wealth gradually.

For example, if the annual exclusion is $17,000 per person (as of 2023 in the US, but always check current regulations!), they could gift you and your spouse $34,000 each year without any tax implications. Over several years, that adds up! It’s a slow and steady win for everyone.

Setting Up Trusts

Another popular method is through trusts. A trust is like a legal arrangement where your parents (the grantors) transfer assets to a trustee, who then manages those assets for the benefit of you (the beneficiary). Trusts can be set up in various ways, and they offer a lot of flexibility. Your parents can specify exactly when and how you receive the funds, which can be helpful for long-term goals like education or for ensuring funds are used responsibly.

Think of it as a structured way for your parents to pass on their wealth, ensuring it’s used for specific purposes or distributed over time. It can be a great way to protect assets and provide for future needs.

Transferring Ownership of Assets

Your parents might also choose to transfer ownership of specific assets. This could include things like real estate (a vacation home, perhaps?), stocks, or even business interests. This is often done through a deed of gift for property or by changing the account ownership for financial assets. Again, there can be tax implications to consider, so professional advice is often a good idea here.

This can be particularly useful if your parents have assets that they know you'd benefit from or would like to manage sooner rather than later. Imagine inheriting a classic car that’s been in the family for years, but getting to drive it and enjoy it now!

Things to Chat About (Because Honesty is the Best Policy!)

Now, as fun and exciting as this all sounds, it's super important to have an open and honest conversation with your parents. This isn’t a topic to shy away from, but rather one to approach with respect and love.

Here are a few things you might want to discuss:

- Their intentions and comfort level: Are they comfortable discussing this? What are their goals in gifting early?

- Financial situation: Ensure they are in a good place financially and that any gifting won't negatively impact their own retirement or future needs. This is paramount!

- Your needs and plans: How would this inheritance help you? What are your goals? This helps them understand the impact of their generosity.

- Tax implications: As mentioned, taxes can be a factor. It's wise for everyone to be aware and consider professional advice.

- Fairness among siblings (if applicable): If you have siblings, how will this be handled? Are there concerns about fairness that need to be addressed? Open communication here is key to keeping family harmony intact.

Remember, this is a journey you take together. It’s about ensuring their legacy is enjoyed and appreciated, not just after they’re gone, but throughout their lives too. It’s about creating more happiness and reducing stress for everyone.

Making Life a Little Brighter, Today!

The idea of an early inheritance isn't just about the money; it’s about the opportunities and experiences it can unlock. It’s about being able to say "yes" to life's adventures, to build security for your future, and to feel the tangible love and support of your parents in a truly meaningful way. It’s about celebrating life, both theirs and yours.

So, if this sparks a little curiosity in you, or if you’ve been wondering about this possibility, don't be afraid to explore it further. Talk to your parents, do some research, and consider speaking with a financial advisor or estate planning professional. Understanding your options can be incredibly empowering, and who knows? You might just find a way to make life a whole lot more fun and fulfilling, starting right now!

Isn't that an inspiring thought? To know that the legacy of love and support can be shared and enjoyed in the here and now. Keep exploring, keep dreaming, and keep that conversation starter handy!