Can You Get A Money Order From Chase Bank

Ever been in that weird money situation? You know, the one where you need to send some cash, but a personal check feels like you're sending a carrier pigeon with a vague apology attached, and cash is just… well, it's cash. Risky business, right? It's like trying to mail a glitter bomb; you're not entirely sure it'll arrive intact or if it'll just explode somewhere in the postal service's break room. That’s where the humble, yet surprisingly useful, money order waltzes in. And a big question that pops up, especially when you're juggling bills and life's little financial surprises, is: Can you snag a money order from Chase Bank?

Let's be honest, navigating the world of banking can sometimes feel like trying to assemble IKEA furniture without the instructions, while blindfolded, and with a toddler enthusiastically "helping." You just want to get the darn thing done, and you're hoping your chosen bank is the magical portal that makes it happen. Chase Bank, being one of the giants, often comes to mind when you're thinking about all things financial. So, if you're standing there, maybe at a grocery store checkout with a pile of goods, and you suddenly remember, "Oh shoot, I need to pay rent!" or "My cousin's birthday is tomorrow, and I promised them a little something!" and the thought of dealing with a complicated wire transfer or waiting for a check to clear feels like an expedition to Mars, the money order is your trusty spaceship.

Think about it. You're handing over a specific amount of money, and in return, you get this little slip of paper that's basically a prepaid promise. It's like a gift card for grown-ups, but instead of buying a fancy candle you don't really need, you're buying peace of mind. And the question about Chase Bank is totally valid. After all, they're everywhere, right? They've got those sleek branches that look like they belong in a sci-fi movie, and ATMs that seem to be on every corner, blinking their friendly green lights. So, it's natural to assume they’d have this basic, yet essential, financial tool in their arsenal.

Now, let's cut to the chase – pun intended, of course! – and answer that burning question. Can you get a money order from Chase Bank? The short, sweet, and slightly disappointing answer is: not directly from a Chase branch anymore.

I know, I know. It's like finding out your favorite pizza place suddenly stopped making your go-to topping. A little bit of a bummer, right? For a long time, Chase Bank did offer money orders. You could pop into a branch, tell them how much you needed, pay them, and walk out with your little financial guarantee. It was as easy as, well, ordering a latte. But like fashion trends, banking services can change. And in the case of Chase and money orders, they’ve shifted their focus.

So, what happened? Think of it this way: banks are constantly evolving, like Pokémon. They’re adding new features, maybe trading out some older ones to stay competitive. For Chase, it seems the money order service just wasn't as central to their strategy anymore. They're more focused on digital banking, mobile apps, and all those fancy investing tools. The good old money order, while still super useful for many, probably fell into the "legacy service" category for them. It’s not a bad thing, it’s just a change. It’s like when your favorite band releases a new album that’s totally different from their early stuff. Some people love it, some miss the old sound. In this case, Chase decided to play a different tune.

But don't despair! This doesn't mean you're stranded in the financial desert without a camel. There are still plenty of ways to get a money order, even if Chase isn't your direct source anymore. It's just a matter of knowing where else to look. Think of it as discovering a hidden gem of a coffee shop after your usual place closed. Sometimes the new spot is even better!

One of the most common and convenient places to snag a money order is at your local grocery store. Yep, those places where you go to buy milk, bread, and that questionable impulse buy at the checkout. Many major grocery chains, like Walmart, Kroger, and Safeway, have a customer service desk or a specific counter where they sell money orders. It's like a little financial oasis in the land of produce and frozen pizzas.

You can also try your luck at pharmacies. Think CVS, Walgreens, Rite Aid. These places are like a Swiss Army knife of errands. Need prescriptions? Check. Need some snacks? Check. Need to send a money order? Often, check! It’s incredibly convenient when you're already running other errands. You can knock out multiple tasks in one go, saving you time and probably a little bit of gas money. Imagine the efficiency: pick up your dry cleaning, grab some toothpaste, and secure your money order, all in one fell swoop. It’s the adult equivalent of a power-up in a video game.

Another reliable spot is the post office. The United States Postal Service (USPS) has been a trusted provider of money orders for ages. They’re reliable, and you know what you’re getting. Plus, if you’re already mailing a letter or a package, it’s a no-brainer to grab a money order while you’re there. It's like getting a bonus feature with your regular postal service!

And what about other financial institutions? While Chase may have opted out, other banks and credit unions might still offer them. It’s worth a quick call to your local bank or credit union if you're already a customer there. You never know, they might be the knights in shining armor you're looking for. It’s always a good idea to check with your specific financial provider, as services can vary from branch to branch and institution to institution. Think of it as asking around at a neighborhood block party; someone’s bound to have the answer you need.

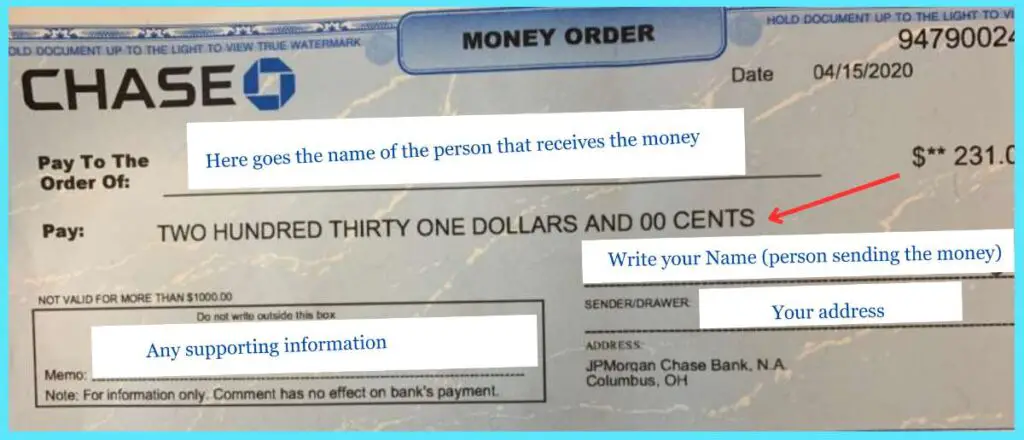

So, how does this whole money order thing work, anyway? It's pretty straightforward. You go to one of these designated places (grocery store, pharmacy, post office, etc.), tell them the amount you want the money order for. You’ll pay them that amount, plus a small fee, which is usually just a dollar or two. The fee is their charge for providing this service, kind of like the tip you leave for good service at a restaurant. Then, you'll fill out the money order, usually with the payee's name (who you're sending the money to) and your own name. You keep the stub as your receipt, and the money order itself goes to the lucky recipient.

The beauty of a money order is its security. Unlike a personal check, which can bounce if there are insufficient funds in your account, a money order is prepaid. When you buy it, the money is already accounted for. This makes it a much safer option for sending money to people you don't know well, or for situations where you need absolute certainty that the payment will go through. It’s like sending a highly trained secret agent instead of a guy who might get distracted by a shiny object on the way.

And for landlords? Oh boy, do some landlords love money orders. If you've ever rented an apartment, you might have encountered a landlord who's very particular about how they receive their rent. Some prefer money orders because it guarantees they'll get paid on time, without the hassle of waiting for a check to clear or worrying about insufficient funds. It’s their way of saying, "I like my money in a nice, neat, guaranteed package, please and thank you."

What about when you're sending money to someone far away? Say, your kid is off at college and needs a little financial boost for textbooks, or you’re sending a birthday gift to a relative in another state. A money order is a fantastic way to do it. It's more secure than cash, and often faster and simpler than setting up a complex bank transfer. It's like a little financial care package that travels reliably through the mail.

When you're getting a money order, it's always a good idea to have your identification ready. Many places will ask for a driver's license or another form of photo ID, especially for larger amounts. It’s just a standard security measure, like showing your boarding pass at the airport. And speaking of amounts, there are usually limits on how much you can purchase in a single money order. Typically, it's around $500, but this can vary. If you need to send more, you can simply buy multiple money orders.

So, while Chase Bank might not be your go-to for money orders anymore, the world hasn't ended. It's just a reminder that sometimes, the services we're used to can change. But the need for secure, reliable ways to send money? That's a constant. And luckily, there are still plenty of places ready and willing to help you out. Think of it as a quest for financial treasure, and the grocery store or post office are your trusty maps!

The key takeaway is that you can absolutely still get a money order, and it’s a fantastic tool for many situations. It’s just about knowing where to look. So next time you're faced with that "how do I pay for this?" dilemma, remember the humble money order. It might just be the perfect, easy-going solution you're looking for, even if you have to pick it up at a place that also sells discounted socks and questionable snack cakes.

It’s all about being adaptable and knowing your options. Chase moving away from money orders is just another chapter in the ever-evolving story of banking. But for us everyday folks trying to get things done, the alternatives are still readily available and incredibly useful. So, go forth and get that money order! Your landlord, your relative, or your college student will thank you.