Can You Purchase Prepaid Cards With A Credit Card? What To Know

So, you're wondering about buying prepaid cards with a credit card? It sounds like a magic trick, right? Like juggling flaming chainsaws while doing calculus. But it's actually a thing! And it's kind of… fascinating. Let's dive in.

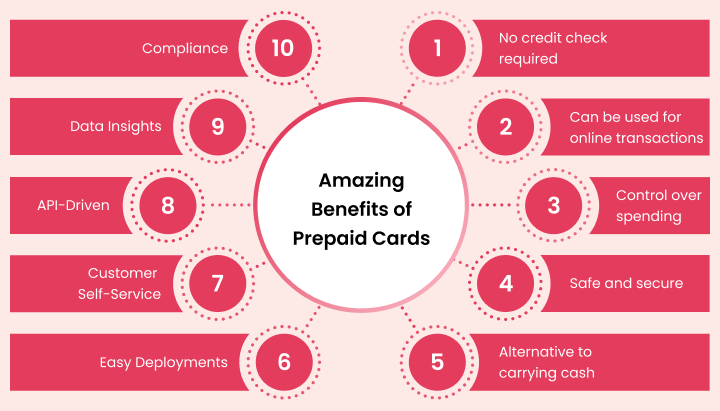

Think of it this way. You've got your trusty credit card. It's like your plastic bestie for life. And then you've got prepaid cards. They're like little money-loaded gift cards, but for anything. So, can you connect these two awesome things? The answer is… sometimes. It's not a simple "yes" or "no." It's more of a "well, that depends!"

Why is this even a conversation starter? Well, it's all about convenience and maybe a little bit of clever money management. We love options! And this is definitely an option.

The Credit Card Conundrum

Okay, so your credit card. It’s plastic magic. It buys you stuff. It can even get you points or cashback. Pretty sweet deal. But when it comes to buying prepaid cards, there’s a little snag. Or maybe a few snags.

Most places that sell prepaid cards, like big box stores or grocery stores, they have rules. They don't always want you using your credit card to buy another card that you can then spend like cash. Why? It gets a bit… circular.

Imagine this: You buy a prepaid card with your credit card. Then you use that prepaid card to pay your credit card bill. Whoa. Mind. Blown. Retailers get a little antsy about that. They're not in the business of facilitating abstract financial loops. They want to sell you stuff, not create paradoxes.

It's kind of like trying to use a coupon for a free item to buy more coupons. The system kinda breaks down, you know?

Where the Magic Might Happen

So, where can you pull off this credit card-to-prepaid-card feat? It’s not impossible, but you have to be a bit of a detective. Or a seasoned shopper. Or both!

Some places are more flexible. Think about online retailers. Sometimes, the rules are a little looser when you're clicking away from your couch. It depends on the retailer's specific terms and conditions. They're the gatekeepers of this particular financial playground.

Also, some specific types of prepaid cards might be more amenable to credit card purchases. We're talking about things like general-purpose reloadable cards. These are the ones you can load up and then use anywhere Visa or Mastercard is accepted. They're the chameleons of the prepaid world.

The "Why Bother?" Factor

You might be thinking, "Why go through all this trouble?" Good question! It’s not always about trying to pull a fast one. Sometimes, it’s about strategy.

Let's say you have a credit card with a fantastic rewards program. Like, really fantastic. You want to maximize those points or that cashback. Buying a prepaid card with your credit card could be a way to do that. You're essentially buying spending power, and getting a little something extra back in the process.

:max_bytes(150000):strip_icc()/_How-does-a-prepaid-card-work-960201_Final2-a914cdbc7901430d80de45153461af0a.png)

It’s like getting paid to go shopping. Who wouldn't want that?

Another reason? Budgeting. Prepaid cards are great for sticking to a budget. You load a set amount, and that's all you can spend. So, if you want to buy a prepaid card with your credit card to allocate funds for a specific purchase or a trip, it can be a neat way to do it. You're using your credit card's flexibility to lock in your spending limit elsewhere.

The Catch-22 (It's a Thing!)

Now, for the juicy bits. The things you absolutely need to know. Because there are always things to know. It's the universe's way of keeping things interesting.

First up: Fees. Oh, the fees! Buying a prepaid card often comes with a purchase fee. Then, there might be activation fees. And sometimes, even inactivity fees if you don't use the card. It’s like a financial obstacle course.

If you're using a credit card to buy a prepaid card, you're essentially paying those fees with your credit card. So, you need to factor that in. Are the rewards you're getting worth the fees? It’s a math problem, but with more plastic involved.

Secondly: Cash Advance Fees. This is a biggie. Some credit card companies might see buying a prepaid card with your credit card as a cash advance. And guess what? Cash advances come with hefty fees and sky-high interest rates. Starting from the moment you make the transaction. Yikes! This is the financial equivalent of stepping on a Lego in the dark. Painful and unexpected.

You have to check your credit card agreement. It's not the most exciting bedtime reading, but it's crucial. Look for terms related to purchasing monetary instruments or prepaid card purchases.

The Quirky Side of Things

Let’s talk about the fun stuff. This whole topic is a little quirky, isn't it? It’s like a financial scavenger hunt.

Imagine the sheer ingenuity of people trying to game the system, or just be a bit more efficient. It’s a testament to human creativity, applied to… money cards. We're a funny bunch.

And think about the cashiers! They might have a raised eyebrow when you whip out a credit card to buy a gift card. They’ve seen it all. They’re the unsung heroes of retail, navigating these sometimes-odd transactions with practiced ease.

Plus, there’s the thrill of the hunt. Finding a place that allows it. Getting that perfect combination of rewards and a prepaid card. It’s a small victory, but a victory nonetheless!

To Buy or Not to Buy?

So, can you buy prepaid cards with a credit card? Yes, but with caveats. It's not a universal "go ahead!" It requires research. It requires understanding the fees. And it requires knowing your credit card's rules like the back of your hand.

If you’re looking for a way to rack up rewards or strictly manage your budget, it can be a smart move. But always, always, always do your homework. Check those fees. Understand the terms. Avoid those dreaded cash advance fees like they’re a swarm of angry bees.

It’s a financial dance, and knowing the steps is key. Now go forth, and be the most informed prepaid card purchaser you can be!