Can You Take Money From 401k To Buy House

So, you've got that little nest egg, that glorious 401(k), just sitting there, growing like a magic beanstalk! And then BAM! The dream house, the one with the big backyard for the dog and the killer kitchen for your world-famous cookies, pops into view. A thought sparks: "Can I, oh wise money wizards of the internet, dip into my 401(k) to snag this slice of paradise?" Well, hold onto your hats, folks, because the answer is a resounding, albeit complicated, "Maybe!"

Imagine your 401(k) is like a super-secret treasure chest, meticulously filled with gold coins by your employer and your own brilliant self. Buying a house is like needing a ridiculously large amount of gold coins to unlock the gates of your very own castle. It's not as simple as just waltzing up and saying, "Here, take all my shiny doubloons!" There are rules, like a grumpy dragon guarding the loot, and sometimes, penalties that feel like being tickled by a very sharp feather.

One of the most common ways people peek into their 401(k) for a down payment is through a loan. Think of it as borrowing from your future self. You're basically saying, "Hey, future me, I'm going to need some of this money back sooner than planned, but I promise to pay you back with a little extra for your trouble!" It's like lending your friend a twenty-dollar bill and they promise to give you back twenty-five for the inconvenience.

The beauty of a 401(k) loan is that you pay yourself back, usually with interest. This means the money stays within your retirement account, continuing to grow (hopefully!). Plus, the interest you pay goes right back into your own pocket, which is a pretty neat trick. It’s like giving yourself a high-five and a bonus all at once.

However, there's a tiny catch, and it’s a big one. If you, for any reason, lose your job while you still owe money on your 401(k) loan, poof! That outstanding balance can become due very quickly. Often, you'll have a short window, like 60 days, to pay it all back. If you can't, consider those coins taken by the grumpy dragon, and you might owe taxes and a hefty 10% early withdrawal penalty. Ouch!

This is where things can get a little hair-raising, like watching a tightrope walker without a net. Imagine the joy of buying your dream home turning into a mini-financial heart attack because you couldn't repay the loan. It's the ultimate "be careful what you wish for" moment, but with more paperwork and less fairy dust.

Another option, and this is where things can get really tempting, is an early withdrawal. This is like opening that treasure chest and just grabbing a handful of gold coins. It's direct, it's simple, and it feels like a financial superpower!

But here’s the dragon’s roar: when you take a withdrawal before age 59½, it's usually subject to both income tax and that dreaded 10% early withdrawal penalty. So, if you pull out $10,000, you might instantly owe Uncle Sam a chunk of change, plus that extra ten percent. It's like finding a secret stash of gold, only to discover it's been eaten by a very hungry financial monster.

Think of it this way: that 10% penalty is the universe's way of saying, "Hey, you're messing with your future retirement fun! That's not cool, dude." And the income tax is just the regular price of admission to the financial world. Combine them, and it’s like paying double to get into the party, and the party’s just starting for your retirement.

Some plans offer a way around these penalties for specific "hardship withdrawals." These are generally reserved for truly dire situations, like needing to pay for medical expenses, prevent eviction, or even, sometimes, for a down payment on your first home. It’s like the dragon has a secret stash of emergency gold for truly worthy adventurers.

However, even a hardship withdrawal is still a withdrawal. You'll likely still owe income tax on the money you take out. The good news is, you might be able to dodge that nasty 10% early withdrawal penalty, which is a huge relief. It's like the dragon saying, "Okay, you're in a pickle, I'll let you have this without the tickle penalty."

The key here is that your 401(k) plan documents are your ultimate guide. They are the ancient scrolls that contain all the secrets and spells for using your retirement treasure. Every plan is a little different, with its own set of rules and magical incantations.

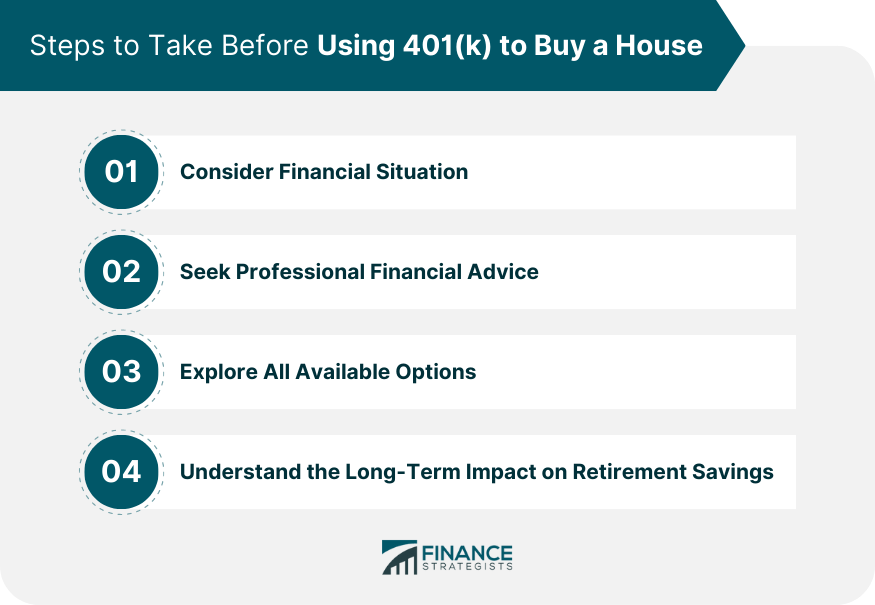

You absolutely, positively, must talk to your HR department or the administrator of your 401(k) plan. They are the wise sages who can tell you exactly what your plan allows, what the rules are, and what the consequences might be. Don't just guess! Guessing in the world of 401(k)s is like playing Jenga with your financial future.

It’s also super important to remember that your 401(k) is for your golden years, your relaxation time, your "I've earned this" moments. Dipping into it early can feel like a shortcut to your dream home, but it might also mean a less comfortable retirement later on. It’s a trade-off, like choosing between a delicious but unhealthy dessert and a nutritious meal that will make you feel good long-term.

So, can you take money from your 401(k) to buy a house? Yes, often, through loans or withdrawals. But is it always a good idea? That's the million-dollar question, or rather, the potential ten-thousand-dollar-penalty question! Weigh the pros and cons carefully, consult the wise ones, and make sure you're not sacrificing your future comfort for your present desire.

Think of it like this: your 401(k) is a magnificent oak tree that will provide shade and acorns for decades. Taking money out early is like chopping off a few branches. You might get some immediate firewood, but the tree won't be as strong or as fruitful in the long run. It’s a tough choice, but a necessary one to consider.

Ultimately, the decision is yours, and it's a big one. Getting into your dream home is an incredible feeling, the stuff of dreams and happy dances. Just make sure that when you're dancing in your new kitchen, you're not also doing a panicked jig about your retirement savings. Plan wisely, my friends, and may your homeownership dreams come true responsibly!