Can You Transfer Stock To A Family Member

Ever found yourself staring at your brokerage account and thinking, "You know what would be really neat? If I could just, like, beam some of these shares over to my sibling or parent." It’s a thought that pops into many people's heads, especially when you're feeling generous or maybe just a little bit sick of explaining how to invest to your Aunt Carol. So, the big question is: Can you actually do that? Can you transfer stock to a family member?

And the answer, my friends, is a resounding and surprisingly easy, yes! It’s totally possible. Think of it like handing over a really cool toy you’ve outgrown, but instead of a worn-out action figure, it's a piece of ownership in a company. Pretty neat, right?

So, How Does This Magical Stock Transfer Thing Work?

It's not quite as simple as a Hogwarts spell, but it's definitely not rocket science either. There are a few different ways you can go about it, each with its own little quirks and benefits. Let's break them down.

The Direct Transfer – Think of it as a Gift

This is probably the most straightforward method, and it's essentially a gift. You’re literally giving shares of stock to someone else. Imagine you have 100 shares of your favorite coffee company, and your daughter is just starting to get interested in saving. You could gift her 20 of those shares. Easy peasy.

But here's where it gets a bit interesting. For this to happen, your family member usually needs to have their own investment account. Unless you're talking about something like gifting a car where you physically hand over the keys, you can't just hand over a certificate. So, if your cousin Brenda is still stubbornly keeping her money under a mattress (we all know someone like that, right?), she'll need to set up a brokerage account first.

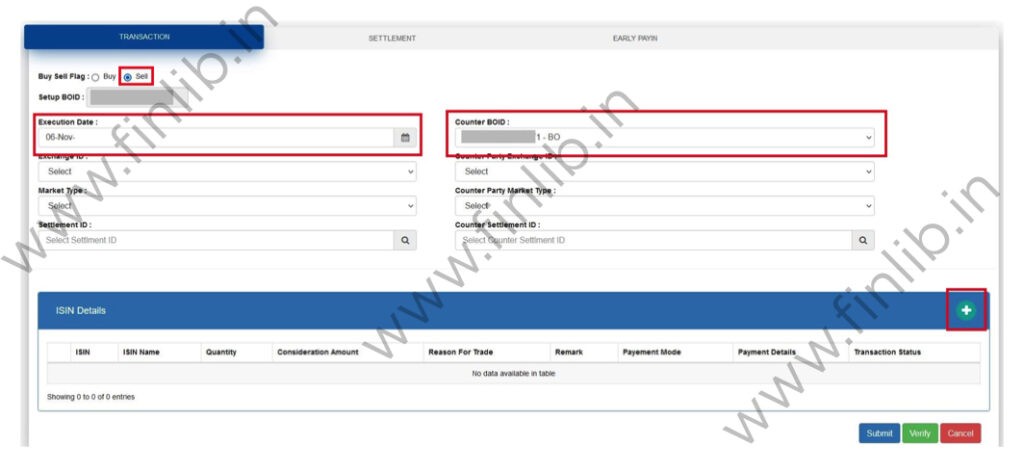

Once they have an account, the process generally involves filling out some paperwork with your brokerage firm. You’ll need to specify the stock, the number of shares, and the recipient's information. Your brokerage will then work with the recipient's brokerage to move those shares. It's like an inter-brokerage handshake, but with shares instead of hands.

What's cool about this? Well, you're not just giving money; you're giving them the potential for that money to grow over time. It's like planting a little seed of financial independence for them. And honestly, helping a family member get a head start on investing? That’s a pretty awesome feeling, like being a financial fairy godparent.

What About Selling Shares to a Family Member?

Okay, so maybe "gift" isn't quite the right word. Perhaps you want to sell some of your shares to your brother for a fair price. This is also totally doable! It’s essentially like any other sale, but the buyer and seller are related. Think of it as a private transaction, kind of like selling your old bike to your neighbor's kid.

The key here is the fair market value. You can't just sell your shares for a dollar if they're worth hundreds. The IRS likes to keep an eye on these things, and you want to make sure everything is on the up and up. So, you'd typically need to determine the current market price of the stock and conduct the transaction based on that.

This can be a good option if you need some cash, and your family member wants to invest in a specific company you own. It’s a way to move assets around within the family while still adhering to financial regulations.

The In-Kind Transfer – For the Super Organized

This is a term you might hear, and it essentially means transferring the actual assets (in this case, stock) rather than cashing them out and giving cash. It's a bit more technical, but it's the underlying principle of many stock transfers, including gifts.

If you're transferring stock from one brokerage account to another owned by you (say, moving your investments from one bank to another), that's often called an in-kind transfer. When you're gifting to a family member, it’s also an in-kind transfer – you're transferring the stock itself.

Why is this important? Because it can have tax implications. We’ll touch on that a bit more in a sec, but for now, just know that moving the actual stock is the goal.

The Tax-y Bits – Gotta Keep Uncle Sam Happy

Alright, let's talk about the part that might make some people’s eyebrows do a little dance: taxes. When you give or sell stock to a family member, there can be tax considerations. Don't let this scare you away, though! It's usually manageable, especially if you're organized.

Gifts: The IRS has an annual gift tax exclusion. This means you can give a certain amount of money or assets to any individual each year without having to worry about gift taxes. For 2023, this was $17,000 per person. So, if you're gifting stocks valued at less than that, you're likely in the clear for gift tax purposes.

However, even if your gift exceeds the annual exclusion, you generally don't pay gift tax unless you've exhausted your lifetime gift tax exclusion (which is a really large amount). What does matter is the cost basis. When you gift stock, the recipient inherits your original cost basis. This means if you bought shares for $10 and they're now worth $100, and you gift them, your family member's cost basis is still $10. When they eventually sell, they'll owe capital gains tax on the full $90 profit.

Sales: If you sell stock to a family member at a price different from the fair market value, the IRS might treat it as a part gift, part sale. This can get complicated. That's why sticking to the fair market value for sales is generally the cleanest approach. You'll owe capital gains tax on any profit you make from the sale, and the buyer will have a cost basis equal to what they paid.

Inheritance: And what if you’re receiving stock as an inheritance? That's a whole other cool party! When you inherit stock, you generally receive a "stepped-up basis." This means your cost basis becomes the fair market value of the stock on the date of the original owner's death. This can significantly reduce or even eliminate capital gains tax when you eventually sell. Pretty sweet deal, right?

Why Would You Even Want to Do This?

Beyond the sheer coolness of being able to share your financial wins, there are some practical reasons:

- Early Financial Education: Gifting stock to a child or grandchild is a fantastic way to introduce them to investing and the concept of long-term wealth building. It's hands-on learning!

- Estate Planning: Gifting stock over time can be a smart way to reduce the size of your taxable estate, potentially saving your heirs a lot of money down the line.

- Helping Out Family: Maybe your sibling needs a little boost to get started on their own investment journey, or your parents could use a hand with their retirement funds.

- Consolidating Assets: Sometimes, family members might want to pool their resources or consolidate investments in a particular way.

Think of it like passing down a family recipe. You're not just giving them the ingredients; you're giving them the knowledge, the potential, and a piece of something valuable that can be nurtured and grown.

Things to Keep in Mind – The Small Print

While it's generally straightforward, it's always a good idea to:

- Talk to Your Brokerage: Every firm has its own procedures for transfers. Call them up and ask about their process for gifting or transferring stock to family members.

- Consider a Financial Advisor or Tax Professional: Especially if you're dealing with larger sums or are unsure about the tax implications, consulting a pro is a wise move. They can help you navigate the specifics and ensure everything is done correctly.

- Be Mindful of Account Types: Is the recipient's account a taxable brokerage account, an IRA, or a Roth IRA? The type of account can influence how the transfer is handled and its tax consequences.

So, can you transfer stock to a family member? Absolutely! It's a practical, potentially beneficial, and surprisingly accessible way to share your financial journey and help your loved ones build their own future. It's like sharing your favorite playlist, but instead of tunes, it's the sweet sound of growing wealth!