Can You Withdraw Money From Chime Credit Builder Card? What To Know

Ah, the Chime Credit Builder card! It's like that helpful friend who always seems to have your back, quietly working to boost your credit score without making you jump through a million hoops. But then, the age-old question pops into your head: can you actually snag some cash out of this magical little plastic rectangle?

Imagine this: you're out and about, maybe grabbing your favorite latte or browsing that charming little bookstore. Suddenly, you realize you're a little short on cash. Your heart sinks, but then you remember... your Chime Credit Builder card is right there in your wallet!

So, can you do it? The short answer is: not directly like a typical credit card. This is where things get a tiny bit quirky and, dare I say, a little bit funny.

The "No Cash Back" Surprise

Think of your Chime Credit Builder card as a superhero with a very specific superpower. Its main mission is to build your credit, and it excels at that! It reports your on-time payments to the credit bureaus, which is fantastic news for your financial future.

However, it's not designed to be your personal ATM. You won't find those little "Cash Advance" options on it, and you can't just waltz into a bank and ask to withdraw cash using it. It’s like asking a superhero to do laundry – they could, but it's not what they're built for!

This can be a bit of a head-scratcher at first. You might be thinking, "But it's a card! Cards usually give you cash, right?" Well, this one is a bit of a rebel in the card world.

Why the "No Cash" Rule? The Heart of the Matter

The reason behind this cash-withdrawal limitation is actually quite heartwarming and clever. The Chime Credit Builder card is designed with one primary goal in mind: to help you build credit responsibly. It's all about showing lenders that you can manage credit well.

By preventing direct cash advances, Chime is essentially removing a common pitfall that can lead to debt. It keeps you focused on using the card for purchases that you can afford to pay off, thus building a positive credit history.

It’s like having a patient, wise guardian looking out for your financial health. They’re saying, "Let’s focus on the long game here, my friend!" This focus on responsible credit building is what makes the Chime Credit Builder card so special.

It's all about building a stronger financial foundation, brick by responsible brick.

So, How Can You Access Your Money?

Even though you can't swipe your Chime Credit Builder card at an ATM, that doesn't mean your money is locked away forever. Remember, the money you put into your Credit Builder Secured Account is your money. You're essentially securing your credit line with your own funds.

The key is to think about how you normally access your bank account. If you have a Chime Checking Account linked to your Credit Builder, that's your golden ticket!

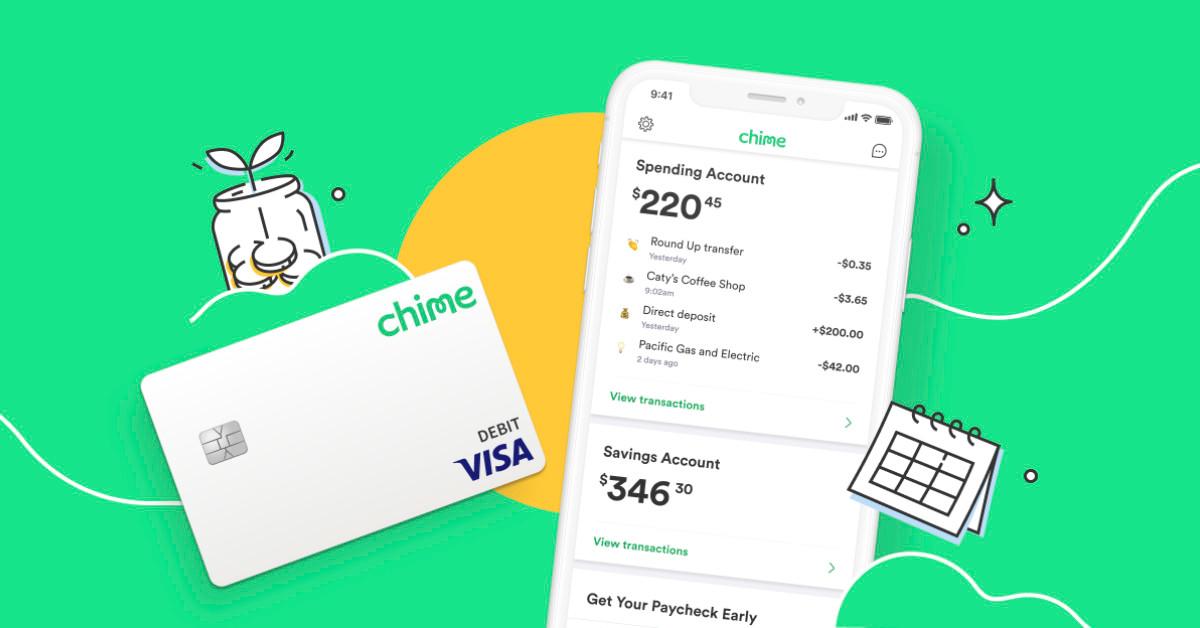

You can use your Chime Visa® Debit Card (which is often associated with your checking account) to withdraw cash from ATMs. This is the standard way most people get cash from their bank accounts.

So, while the Credit Builder card itself doesn't dispense cash, the funds that back it are very accessible through your other Chime accounts and their associated debit cards.

The "Chime Ecosystem" Magic

This is where the brilliance of the Chime ecosystem really shines. It's designed to work together like a well-oiled machine, or perhaps more charmingly, like a happy family.

You deposit money into your Credit Builder Secured Account. This money then helps secure your credit limit for the Chime Credit Builder card. When you make purchases with the Credit Builder card, those funds are essentially drawn from your secured deposit, and Chime reports your activity.

Now, if you also have a Chime Checking Account, that's where your regular paycheck might land, or where you keep your day-to-day spending money. And that account comes with a Chime Visa® Debit Card. This is the card you use at ATMs!

So, the money you deposit into your Credit Builder account is still yours and accessible, just not directly through the Credit Builder card at an ATM. It's a subtle but important distinction that unlocks the full utility of Chime.

Think of the Credit Builder card as a training wheel for credit, and the debit card as your everyday driver.

A Little Humor in the Confusion

It's easy to get a bit flustered when you expect one thing and find another. Imagine trying to unlock your front door with your car keys – it’s the right tool for a different job!

Many people might have that moment of "Wait, what?" when they realize their Credit Builder card isn't going to spit out dollars. It's a common reaction, and it's part of the learning curve.

But once you understand the system, it's quite elegant. It's like discovering a secret passage in your favorite house – it was there all along, you just needed to know where to look!

The "Aha!" Moment

The "aha!" moment usually comes when you realize that your Credit Builder Secured Account is just that – an account. And like any bank account, the money in it can be moved or accessed through its associated banking services.

Chime makes it super easy to transfer funds between your Chime accounts. So, if you needed some cash from your secured deposit for an unexpected expense, you could theoretically transfer it to your Chime Checking Account and then withdraw it via your debit card at an ATM.

It’s a bit like having a personal financial assistant who helps you manage your money efficiently. The system is designed to keep you on track with your credit building goals while still giving you access to your funds when needed.

The Heartwarming Takeaway

The Chime Credit Builder card isn't just a piece of plastic; it's a tool with a purpose. Its inability to dispense cash directly is a feature, not a bug. It's a gentle nudge towards financial discipline.

It’s a testament to Chime's commitment to helping people, especially those who might be struggling to establish or rebuild their credit. They’ve created a product that’s both effective and supportive.

So, next time you reach for your Chime Credit Builder card, remember its mission. It’s there to help you build a brighter financial future, one responsible purchase at a time. And if you need cash, your trusty Chime Visa® Debit Card is ready to serve!