Credit Cards With Low Interest Rates For Good Credit: Complete Guide & Key Details

Hey there, fellow humans navigating the wild and wonderful world of finances! Let's chat about something that might sound a little dry, but trust me, it's actually a superhero in disguise: credit cards with low interest rates, especially when you've got a stellar credit score.

Now, I know what you're thinking. "Credit cards? Interest rates? Sounds like homework!" But stick with me, because understanding this little gem can save you a whole lot of cash and a whole lot of headaches. Think of it like this: you're at the grocery store, and you've got two carts. One is overflowing, and the cashier tells you, "That'll be $100, but we'll add a 'thank you' fee of $20!" The other cart is also full, but the cashier says, "That'll be $100, and because you're awesome, we'll knock off $10!" Which cart are you choosing? The low-interest credit card is like that second cashier – it's rewarding you for being responsible!

Why Should You Even Care About Low Interest Rates?

This is where the magic happens, folks. When you carry a balance on a credit card – meaning you don't pay off the whole amount you owe each month – interest starts ticking. It's like a little hamster on a wheel, running faster and faster the longer you leave it. And that hamster can get expensive!

Imagine you have a credit card with a super high interest rate, maybe 25%. If you owe $1,000, that's an extra $250 you're paying just for the privilege of not paying it all at once! Ouch. Now, compare that to a card with a low interest rate, say 10%. That same $1,000 would only cost you an extra $100. That's a whooping $150 saved!

It's like the difference between buying a fancy coffee every day for a year ($365!) versus making your own at home ($100!). Over time, those small savings add up to some serious moolah. And with a good credit score, you're in the prime position to snag those lower rates.

So, What Exactly is a "Good Credit Score"?

Think of your credit score as your financial report card. It's a three-digit number that lenders use to decide how risky it is to lend you money. A higher score means you're a super responsible borrower, someone who pays bills on time and doesn't go wild with debt.

![Average Credit Card Interest Rates [Statistics by Issuer, Card Type]](https://upgradedpoints.com/wp-content/uploads/2022/02/Average-Credit-Card-Interest-Rates-by-Credit-Score-732x491.png)

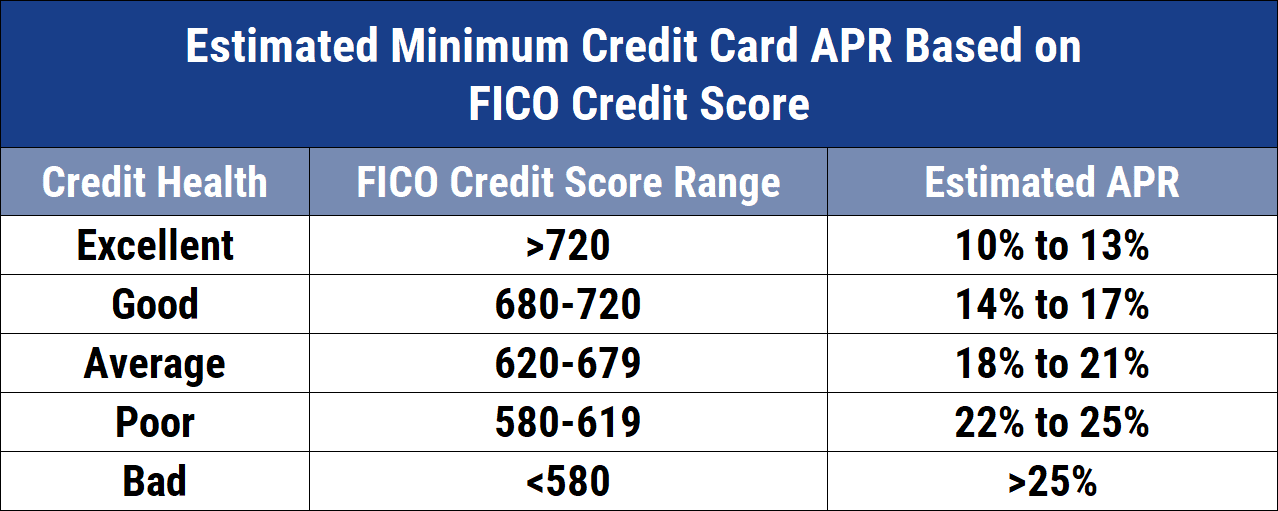

Generally, a score of 700 and above is considered good to excellent. If you're in this range, congratulations! You've earned your superhero cape in the financial world. This makes you a very attractive customer to credit card companies, and they're eager to offer you their best deals – including those coveted low interest rates.

The Low-Interest Sweet Spot: What to Look For

When we talk about low interest rates, we're usually looking at something called the Annual Percentage Rate (APR). This is the yearly cost of borrowing money.

For people with good credit, you might see APRs for purchases in the range of 10% to 18%. Some cards even offer introductory 0% APR periods, which are like a temporary financial vacation! These are amazing for large purchases or if you need to consolidate debt.

But here's a little secret: not all APRs are created equal. Credit card companies often have different APRs for purchases, balance transfers, and cash advances. For everyday spending, you'll want to focus on the purchase APR. Cash advances usually come with sky-high rates, so steer clear of those if you can!

When Do Low-Interest Cards Shine the Brightest?

These cards are like your financial Swiss Army knife. They're useful in all sorts of situations:

- Big Purchases: Planning to buy a new TV, a fridge, or maybe even a down payment on a car? A low-interest card can save you a bundle in interest charges if you can't pay for it all upfront. Instead of your appliance costing $1,000, it might end up costing you $1,050 instead of $1,150!

- Unexpected Expenses: Life throws curveballs, right? A flat tire, a surprise vet bill – these things happen. A low-interest card can be a lifesaver, allowing you to cover these costs without drowning in debt.

- Balance Transfers: Got high-interest debt lurking on other cards? A balance transfer to a low-interest card can be a game-changer. You can move that debt over and pay it down faster without the crippling interest charges. It's like taking a debt from a steep hill and moving it to a gentle slope.

- Building Credit (Carefully!): For those just starting out or looking to improve their credit score, a responsible approach with a low-interest card can be beneficial. Just remember to use it wisely and pay it off on time!

Finding Your Perfect Low-Interest Card

So, how do you find these financial treasures? It's not about digging through a dusty attic; it's about doing a little online sleuthing!

Comparison Websites: There are tons of websites dedicated to comparing credit cards. These are your best friends! They'll show you a whole buffet of options, sorted by APR, rewards, fees, and more. Think of it like a dating app for your wallet.

Read the Fine Print: This is crucial, even though it sounds less fun. Pay attention to:

- Introductory APRs: Are there 0% periods? How long do they last? What's the rate after the intro period?

- Regular APR: What's the ongoing interest rate for purchases?

- Fees: Are there annual fees? Balance transfer fees? Late payment fees? These can sneak up on you.

- Credit Score Requirements: Most low-interest cards are for people with good to excellent credit.

Look for Cards Specifically Advertising Low APRs: Some cards are designed with lower rates as their main selling point. These are often good choices if your primary goal is to minimize interest costs.

A Word to the Wise: The Responsibility Factor

Now, before you go running off to sign up for every low-interest card you see, let's have a little heart-to-heart. Low interest rates are a fantastic tool, but they're not a magic wand. The real superpower comes from responsible credit card use.

Here's the golden rule, etched in the annals of financial wisdom: Pay your balance in full and on time, every single month. If you can do this, you'll rarely, if ever, pay a cent in interest. You'll get all the benefits of the card – rewards, purchase protection, convenience – without the cost.

If you find yourself consistently carrying a balance, even on a low-interest card, it might be time to re-evaluate your spending habits. These cards are a great help, but they're not an invitation to spend more than you can afford.

In a Nutshell

So, there you have it! Credit cards with low interest rates for good credit are like a well-trained bodyguard for your finances. They protect you from the sting of high interest charges, offering a more affordable way to manage your money. By understanding your credit score, knowing what to look for, and most importantly, using your cards responsibly, you can unlock some serious savings and make your financial journey a whole lot smoother (and happier!). Happy spending – and saving!