Credit Score Dropped 100 Points After Opening Credit Card: Complete Guide & Key Details

So, you opened a shiny new credit card, feeling all grown-up and financially responsible. You imagined building a little credit empire, brick by virtual brick. Then, BAM! You check your credit score, and it's done a dramatic swan dive, down a whopping 100 points. It’s like you just discovered your credit score has a secret life as a daredevil.

Before you start practicing your sad trombone music, let's get one thing straight: this is actually a pretty common story. It’s not a sign you've somehow angered the credit gods. Think of it less as a disaster and more as a quirky plot twist in your financial journey.

This big score drop isn't usually about a sudden financial meltdown. It's often a temporary, albeit dramatic, wobble. It’s your credit score’s way of saying, "Whoa there, what’s this new thing? I need a moment to process!"

Let’s dive into the nitty-gritty, but don't worry, we're keeping it as light as a feather. Imagine your credit score is like a social butterfly at a party. When a new credit card shows up, it’s like meeting a whole new group of friends. The butterfly needs to get acquainted, and that initial mingling can sometimes feel a little chaotic.

The Mystery of the Vanishing Points: Unpacking the Drop

The most common culprit for this dramatic score dip is the "hard inquiry." When you apply for a new credit card, the credit card company asks to peek at your credit report. This peek is recorded as a hard inquiry.

Each hard inquiry is like a little mark on your credit report, a tiny red flag saying, "Someone's interested in your financial well-being." Too many of these little flags popped up in a short period can make lenders a tad nervous. They might think you’re desperately trying to borrow money, which, in the credit world, can be seen as a risk.

Think of it like this: if you suddenly start asking all your friends for money, they might get a little concerned about your financial stability. Your credit score is just a really, really big group of lenders and institutions giving you a stern, but usually well-meaning, look.

Another sneaky factor can be the "average age of your accounts." When you open a new credit card, it's brand new. This lowers the average age of all your credit accounts. Lenders generally like to see a long history of responsible credit use, so a younger average age can be a temporary hiccup.

It’s like when you introduce a baby into a family of seasoned adults. The family dynamics shift a bit until everyone finds their groove. Your credit history is the same; it’s adjusting to the new addition.

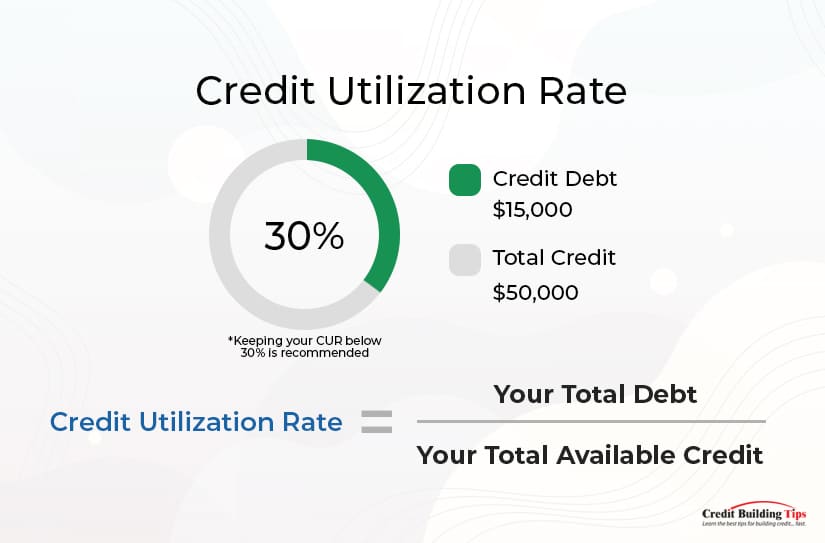

Finally, there’s the impact on your "credit utilization ratio." This is the amount of credit you're using compared to the total credit you have available. When you open a new card, your total available credit goes up. If you immediately start spending on that new card, even if you pay it off quickly, your utilization ratio can temporarily jump.

Imagine you have a big, empty pantry. Suddenly, you get a new shelf. If you immediately fill that new shelf with a bunch of snacks, your pantry might look fuller than before, even though you still have plenty of space. Credit utilization is similar; it's about how "full" your credit is.

The Silver Lining: More Than Just a Number

While a 100-point drop sounds scary, it's important to remember that your credit score is not your identity. It's a tool, a snapshot, and it's always changing. This little drop is just a temporary character blip in your financial narrative.

In fact, opening a new credit card is often a smart move in the long run! It’s the first step towards building a stronger credit profile. You’re actively engaging with the credit system, which is what you want to do for financial success.

Consider this: you've just taken on a new responsibility. It’s like learning to ride a bike. You might wobble a bit, maybe even take a little tumble, but you learn, you adjust, and soon you’re cruising down the road. Your credit score is just getting used to your new cycling skills.

Keys to Recovery: Steering Back Upwards

So, what do you do now? Panic? Absolutely not! Think of this as an opportunity to become a credit score whisperer.

The absolute golden rule: pay your bills on time, every single time. This is the bedrock of good credit. Even with a new card, making on-time payments is the most powerful signal you can send to lenders. It’s like consistently showing up to a party with a smile and a good attitude – everyone likes that!

Next, keep your credit utilization low. Don't max out your new card. Ideally, aim to keep your utilization below 30%, but even lower is better. Think of it as leaving plenty of room for more fun and flexibility down the line. It's about being smart with your resources.

Be patient. Credit scores don't skyrocket overnight. They are built over time with consistent good behavior. Think of it as nurturing a garden; you water, you weed, and eventually, you see the beautiful blooms.

Avoid opening too many new credit accounts at once. Space out your applications. This helps minimize the impact of hard inquiries. It’s like not trying to make friends with an entire convention of people all in one day; it can be overwhelming for everyone involved.

Monitor your credit report regularly. You can get free copies from the major credit bureaus. It’s like checking the rearview mirror while driving; it helps you see what’s going on and make necessary adjustments.

This experience, while initially jarring, is a learning curve. It's a chance to understand how the credit game works. You're not a victim; you're a student, and the credit bureaus are your rather strict but ultimately helpful teachers.

Embrace the journey. This 100-point drop is likely a temporary blip, a funny anecdote you'll tell later. You’re on your way to a stronger financial future, and sometimes, the path to success has a few unexpected bumps.

The key is to use this as a motivator. It’s not about punishment; it’s about education. You're learning to dance with credit, and sometimes, you step on a few toes before you find your rhythm.

So, take a deep breath, remember your goals, and keep making those smart financial choices. Your credit score will thank you for it, and you'll feel a sense of accomplishment that's worth far more than any number.