Credit Score Needed For Chase Sapphire Reserve: Complete Guide & Key Details

Okay, let's talk about a credit card that's like the VIP pass to awesome travel perks: the Chase Sapphire Reserve. It's the card that gets people talking, and for good reason! But here's the burning question on everyone's mind: what kind of credit score do you need to snag this coveted piece of plastic?

Think of your credit score as your financial report card. It tells lenders how reliable you are with borrowed money. A higher score means you're a responsible borrower, and that opens doors to some seriously cool credit cards, including this one.

The Magic Number: What's the Deal?

So, what's the magic number for the Chase Sapphire Reserve? Chase, like most banks, doesn't officially tell you the exact score needed. They look at your entire financial picture, not just one number.

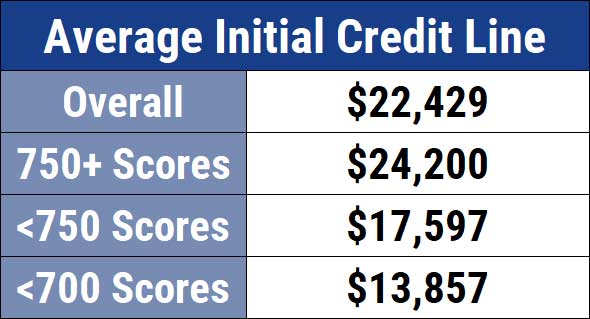

However, general wisdom and countless credit card enthusiasts suggest you'll want a credit score of at least 700. Some even say aiming for 720 or higher is a safer bet. This puts you in the "very good" to "excellent" credit range, which is exactly what Chase likes to see.

Why the High Bar? It's a Premium Card!

This isn't just any old credit card. The Chase Sapphire Reserve is packed with amazing benefits. We're talking about travel credits, lounge access, and awesome rewards that can make your trips feel like a million bucks (without actually spending it!).

Because of these incredible perks, Chase wants to make sure they're offering it to people who are likely to manage their credit responsibly. It's a way for them to minimize risk and ensure everyone gets to enjoy the amazing features of the card.

It's like wanting the keys to a sports car; you need to prove you can handle the ride!

What If My Score Isn't Quite There Yet?

Don't despair if your credit score is currently below that magical 700 mark! This is a marathon, not a sprint. There are plenty of steps you can take to boost your score.

Start by making all your payments on time, every single time. This is the biggest factor in your credit score. Even one late payment can ding your score significantly.

Also, try to keep your credit utilization low. This means not maxing out your credit cards. Aim to use less than 30% of your available credit on each card.

Another helpful tip is to check your credit reports for any errors. Sometimes, mistakes happen, and correcting them can give your score a nice little boost.

Building Credit is a Game

Think of building credit as playing a video game. Each positive action you take is like earning points. The more points you get, the higher your score climbs!

You could consider getting a secured credit card. This is a card where you put down a deposit, which usually becomes your credit limit. Use it responsibly, and it can help you build a positive credit history.

Alternatively, a credit-builder loan can also be a good option. You make payments on the loan, and once you've paid it off, you get the money. It shows lenders you can handle repayment.

Beyond the Score: Other Things Chase Considers

While your credit score is a huge piece of the puzzle, it's not the only thing Chase looks at. They also consider your credit history length and your overall debt-to-income ratio.

How long have you been using credit? A longer history of responsible credit use is generally a good thing. It shows a consistent pattern of reliability.

Your debt-to-income ratio is essentially how much debt you have compared to how much money you earn. A lower ratio is always preferred by lenders.

They'll also look at how many credit cards you currently have and how recently you've opened new ones. Opening too many cards in a short period might make them think you're a bit of a risk.

The "Chase Trifecta" Consideration

It's also widely believed that Chase likes to see you have a history with them. This often means having other Chase cards already, like the Chase Freedom Unlimited or the Chase Sapphire Preferred.

Having a few successful Chase accounts under your belt can significantly improve your chances of approval for the Sapphire Reserve. It's like proving you're a loyal customer who they can trust with their premium product.

It's like getting invited to the exclusive club after proving you know the ropes!

The Perks That Make It Worth It

So, why all the fuss about the credit score? Because the rewards are seriously amazing. The Chase Sapphire Reserve is famous for its travel benefits.

You get a substantial annual travel credit. This is money you can use for flights, hotels, or even ride-sharing services. It's like getting a discount on your adventures!

Then there's the Priority Pass Select membership. This grants you access to over 1,300 airport lounges worldwide. Imagine chilling in a comfortable lounge with free snacks and drinks while waiting for your flight. Bliss!

The card also offers incredible points earning opportunities. You earn a lot of points on travel purchases and dining. These points can then be redeemed for more travel, gift cards, or even cash back.

Redeeming Your Points is Half the Fun

The way you can redeem your points is where the magic really happens. Your points are worth more when you use them through the Chase Ultimate Rewards portal. This can lead to some incredible travel deals.

You can transfer your points to various airline and hotel partners. This allows for even more flexibility and potentially greater value. It's like having a secret cheat code for booking your dream vacation.

The ability to get so much value out of your rewards makes the annual fee for the card feel like a bargain. You can easily earn back the fee through the perks alone!

What if You Get Denied?

If you apply for the Chase Sapphire Reserve and get denied, don't panic! A denial isn't the end of the road. It's simply a sign to take a step back and re-evaluate.

First, check the denial letter. It will usually tell you the specific reasons for the rejection. This information is crucial for understanding what you need to improve.

If it's your credit score, focus on the steps we discussed earlier to build it up. If it's other factors, like your debt-to-income ratio, work on improving those areas.

Sometimes, a denial is just a matter of timing. Maybe you've opened too many accounts recently. Give it some time, improve your credit, and try again later.

Patience is a Virtue

The journey to getting the Chase Sapphire Reserve is often about patience and strategic credit building. It’s not just about having a high score; it’s about demonstrating responsible financial habits over time.

So, if you're dreaming of those travel perks and amazing rewards, focus on improving your credit. Be consistent, be diligent, and soon enough, you might just be sipping a fancy drink in an airport lounge, thanks to your savvy credit management!

The Chase Sapphire Reserve is a fantastic card for savvy travelers. While the credit score requirement is on the higher side, it's achievable with a bit of effort and dedication. Keep working on your credit, and who knows, that premium travel experience might be closer than you think!