Delta Community Credit Union Savings Account Interest Rate: Complete Guide & Key Details

Alright, let's talk about something that might sound as exciting as watching paint dry, but trust me, it's way more important for your wallet: savings account interest rates. Specifically, we're going to dive into what Delta Community Credit Union is offering. Think of it like this: your savings account is a little piggy bank, and the interest rate is like the magic sprinkle that makes your money grow all by itself. Wouldn't it be cool if every time you put a dollar in, it magically turned into a dollar and a few extra cents without you doing anything? Well, that's essentially what interest is trying to do for you.

We've all been there, right? You've got a few bucks stashed away, maybe for that impulse vacation to Bora Bora (hey, a girl can dream!), or perhaps for a more practical reason, like building up a cushion so you don't have a mini heart attack every time your car decides to make that weird new clunking noise. Whatever your savings goal, the bigger that "magic sprinkle" (the interest rate) is, the faster your money gets to work for you. It's like giving your money a little workout, and it's coming back stronger and fatter!

The Lowdown on Delta Community Credit Union Savings Accounts

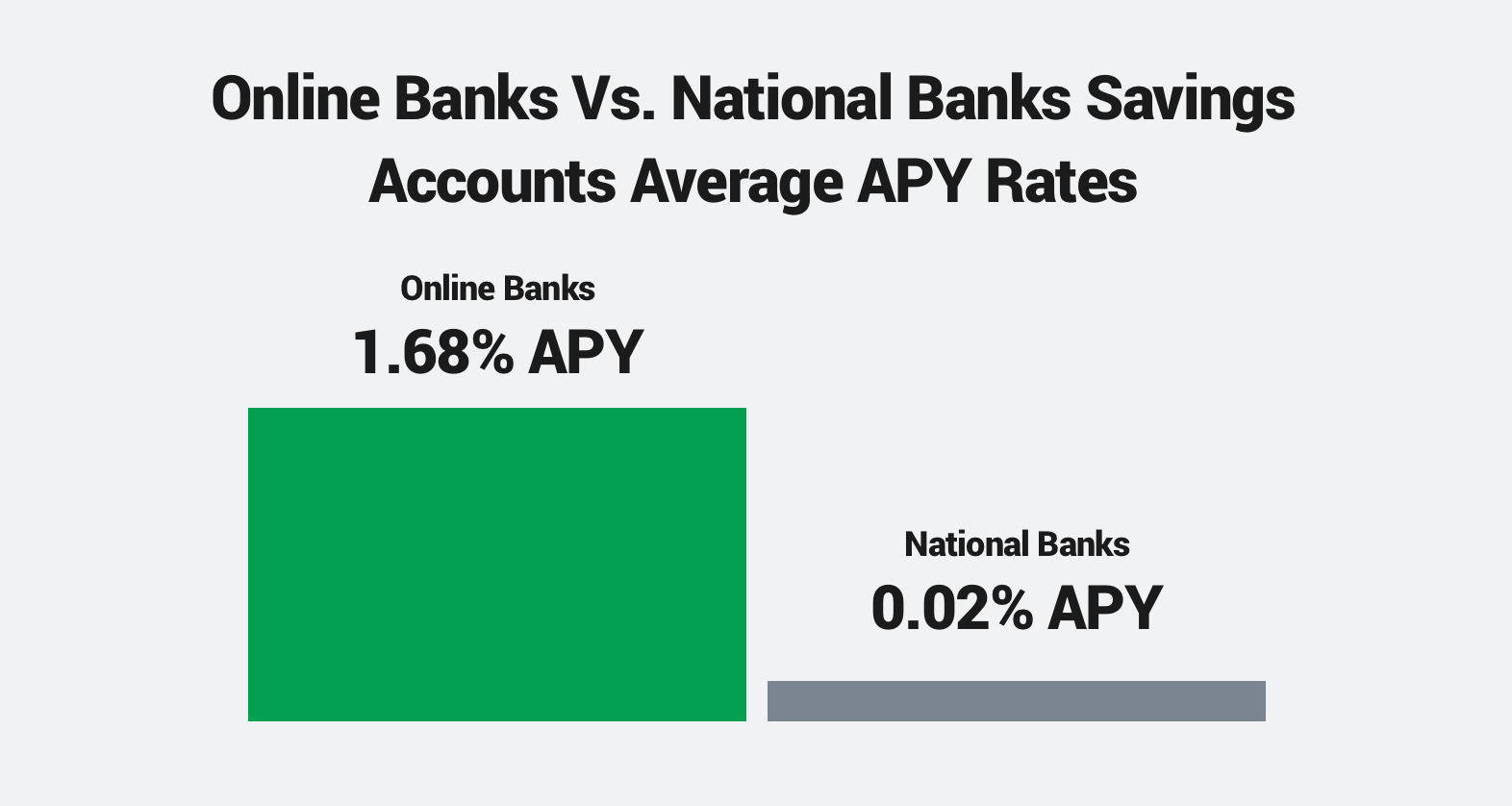

So, what's the deal with Delta Community Credit Union? Think of them as your friendly neighborhood bank, but with a bit more of a community vibe. Credit unions are member-owned, which is a fancy way of saying you are part of the ownership. This often translates into better rates and lower fees compared to big, faceless banks. It's like choosing to buy your coffee from the local cafe that knows your name versus a giant chain where you're just another number in line.

When it comes to their savings accounts, Delta Community Credit Union is trying to give your money a fighting chance. They're not just letting your cash sit there collecting dust; they're offering an interest rate that aims to help it grow. Now, is it going to make you a millionaire overnight? Probably not. But it's definitely better than those places where your money is basically earning… well, nothing. It's like planting a seed versus just leaving it in the packet. One will eventually bloom (with a little sunshine and water, aka your deposits), the other just… stays a seed.

Why Does the Interest Rate Even Matter? Let's Get Real.

Imagine you have $1,000 saved. If your savings account has an interest rate of, say, 0.05% (which, let's be honest, is pretty sad), after a year, you'd earn a whopping 50 cents. Fifty cents! That's barely enough to buy a gumball. You might as well just leave it in your pocket. Now, if Delta Community Credit Union is offering, let's say, 1.00% interest on that same $1,000, you're looking at $10 earned in a year. That's ten whole dollars! That could buy you a decent cup of coffee and a pastry, or maybe contribute to that new pair of shoes you've been eyeing. It starts to add up, especially over time.

Think of it like this: your savings account is a bucket. Some buckets have a tiny little hole at the bottom, and your money just slowly drips out, or at least doesn't fill up much. Other buckets have a gentle stream of water flowing in – that's your interest. The higher the interest rate, the stronger that stream is. And who doesn't want a fuller bucket? We all want our savings to be like a well-watered plant, growing lush and strong, not a wilting flower that’s about to give up the ghost.

Plus, let's not forget about inflation. This sneaky little beast is like a gremlin that nibbles away at the value of your money. If your money isn't growing through interest, it's actually losing purchasing power over time. So, that $1,000 you saved five years ago might not buy you as much today as it did then, unless it's been earning interest. It's like trying to run a race with a parachute on – you're not moving as fast as you could be.

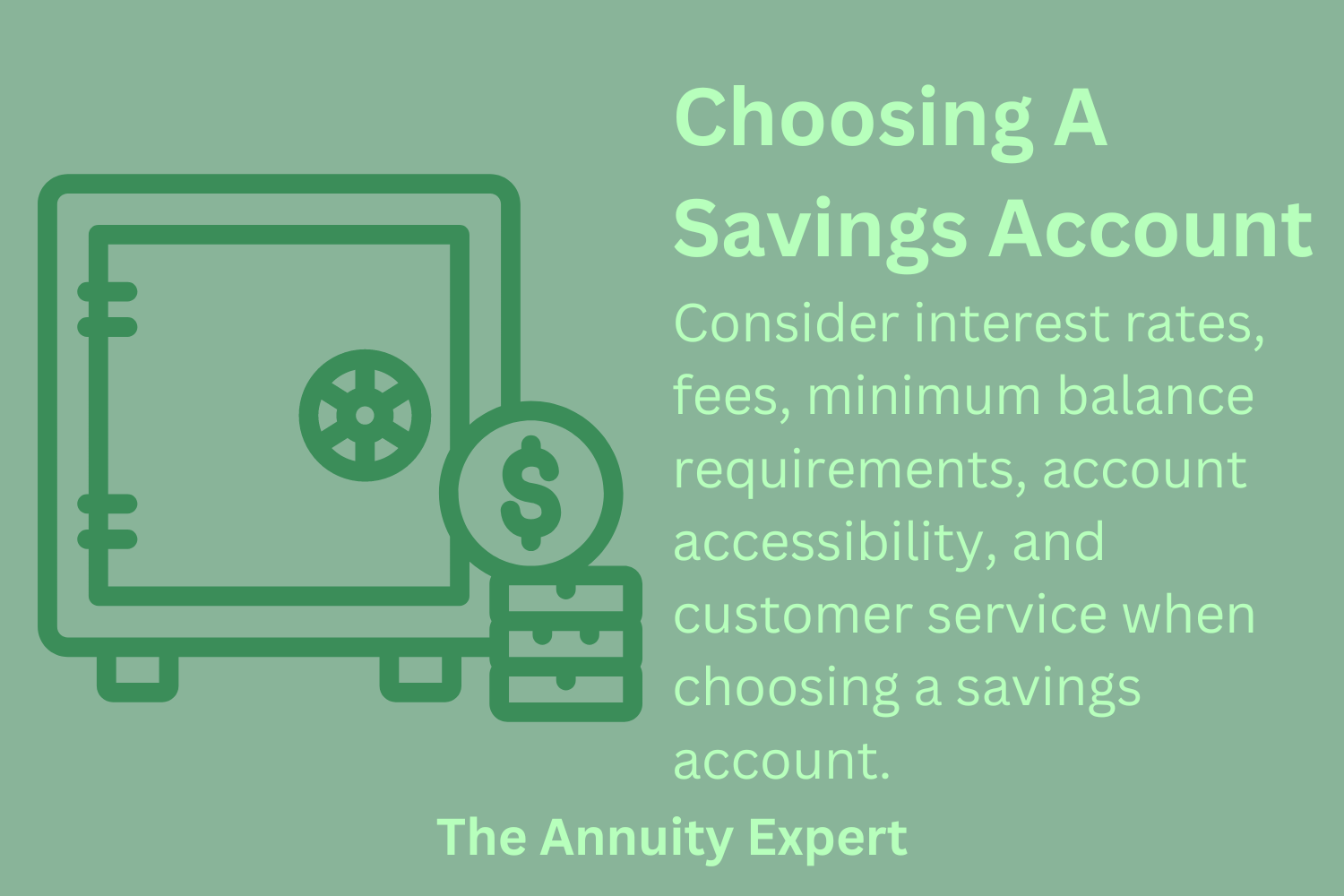

Key Details to Keep Your Eyes Peeled For

Now, when you're looking at Delta Community Credit Union's savings account interest rates, it's not just about the headline number. There are a few other things to consider, like a seasoned detective examining clues.

Annual Percentage Yield (APY) vs. Annual Percentage Rate (APR)

This is a super important distinction, and honestly, it trips a lot of people up. For savings accounts, you'll usually see the APY. APY takes into account the effect of compounding interest. What's compounding? It's like a snowball rolling downhill, picking up more snow as it goes. Your interest earns interest! It's the most magical part of earning money. If you earn interest today, and then tomorrow you earn interest on that original deposit plus the interest you earned yesterday, that's compounding. It's exponential growth, folks!

APR is more commonly used for loans and credit cards, and it generally doesn't account for compounding. So, when you're comparing savings accounts, always look at the APY. It's the most accurate picture of how much your money will actually grow. Think of APY as the "all-inclusive" package for your money's vacation, while APR is just the flight ticket. You want the full experience, right?

Minimum Balance Requirements

Some savings accounts have a minimum balance requirement. This means you have to keep a certain amount of money in the account to avoid fees or to earn the advertised interest rate. It's like a gym membership – you have to show up regularly (or in this case, keep a certain balance) to get the full benefits. If you're just starting out with your savings, or if you prefer to keep smaller amounts readily accessible, you'll want to make sure Delta Community Credit Union's accounts don't have a super high minimum that's going to stress you out. You don't want your savings account to feel like a high-stakes poker game where you're constantly worried about going bust.

Interest Compounding Frequency

How often is that magic sprinkle applied? Does it happen once a year, or is it more frequent, like monthly or even daily? The more often your interest compounds, the faster your money grows. Daily compounding is the golden ticket, my friends. It means your money is working for you almost all the time. It's like having a tiny, very diligent worker in your account, chipping away and adding to your balance every single day.

Fees and Other Charges

While Delta Community Credit Union is known for being member-friendly, it's always wise to be aware of any potential fees. Are there fees for excessive withdrawals? What about account maintenance fees? Read the fine print, or at least skim it like you're looking for the dessert menu. You don't want hidden fees to eat into your hard-earned interest. It's like finding a surprise bill in your mail – nobody likes that!

Access to Your Funds

Savings accounts are meant for saving, but we all have those moments where we need to dip into our funds. How easy is it to access your money with Delta Community Credit Union? Are there ATM networks? Online transfers? Mobile banking? The easier it is to get your money when you need it, the more likely you are to use the account consistently. It’s like having a well-stocked pantry – you can whip up a meal whenever you want.

Delta Community Credit Union's Offerings: A Closer Look

Now, let's get down to the nitty-gritty. Delta Community Credit Union typically offers a few different types of savings accounts, and their interest rates can vary. You might find a standard savings account, and then perhaps a money market account or even certificates of deposit (CDs) which often offer higher rates in exchange for locking your money away for a set period.

Standard Savings Accounts

These are your bread-and-butter savings accounts. They're usually pretty straightforward, with a decent APY that's better than what most big banks offer. They're great for building your emergency fund, saving for a down payment, or just having that peace of mind knowing you have a little nest egg. Think of it as your financial safety net, but one that’s actually growing!

Money Market Accounts

These can sometimes offer a higher interest rate than a standard savings account, and they often come with check-writing privileges or a debit card. It's like a hybrid – you get a little more access and potentially a bit more earning power. However, they might have higher minimum balance requirements. So, if your savings are already looking pretty robust, a money market account could be a good step up. It’s like upgrading from a comfortable sedan to a slightly more luxurious SUV – a bit more capacity and a smoother ride.

Certificates of Deposit (CDs)

CDs are where you agree to leave your money untouched for a specific period – say, six months, a year, or even five years. In return, you usually get a higher, fixed interest rate. The longer you commit, the higher the rate tends to be. This is fantastic for money you know you won't need for a while, like for a future major purchase or long-term goal. It's like planting a tree that you know will provide shade for years to come. You're sacrificing immediate access for long-term growth. Just be sure you don't need that cash before the CD matures, or you might face early withdrawal penalties – and nobody wants that!

Tips to Maximize Your Savings Interest

So, you've picked out your perfect Delta Community Credit Union savings account. Now what? Here are a few tricks to make sure your money is doing its happy dance:

- Deposit Regularly: The more you deposit, the more interest you'll earn. Set up automatic transfers from your checking account. Treat it like a bill you have to pay – to yourself! It's like feeding your savings account a steady diet of delicious money.

- Keep an Eye on Rates: Interest rates can change. Periodically check Delta Community Credit Union's website or contact them to see if they've updated their rates. You want to make sure your money is always in the best possible "home" for growth.

- Understand the Terms: Read all the fine print related to your account. Know the APY, any minimum balances, and fee structures. Knowledge is power, and in this case, it's also money in your pocket.

- Consider Different Account Types: If you have a significant amount saved and don't need immediate access, explore their CD options. A well-placed CD can give your savings a nice little boost.

- Use Online Tools: Delta Community Credit Union likely has online calculators or tools that can help you estimate how much interest you'll earn. Play around with them! It's like a fun game where you win money.

The Bottom Line: Making Your Money Work for You

At the end of the day, choosing a savings account with a competitive interest rate, like what Delta Community Credit Union aims to provide, is a smart financial move. It's not about getting rich quick; it's about letting your money work for you, steadily and surely. It's about building a secure future, one dollar (and a little extra from interest!) at a time.

So, whether you're saving for a rainy day, a sunny vacation, or just want the comfort of a healthy bank balance, take a few minutes to explore what Delta Community Credit Union has to offer. Your future self, enjoying that extra coffee or that down payment, will thank you. It's the financial equivalent of finding a twenty-dollar bill in your old jeans – a little unexpected bonus that makes your day a whole lot better.