Difference Between A Fico Score And Credit Score: Clear Comparison (no Confusion)

Let’s talk about credit. It’s that mysterious thing that seems to follow us around. And when it comes to credit, two words pop up a lot: FICO Score and Credit Score. They sound so similar, don't they? Like two peas in a very responsible pod. But are they exactly the same? My deeply scientific research (aka Googling and a quick chat with my slightly-less-confused friend Brenda) suggests… well, not quite.

Think of it this way. Imagine you're at a giant party, the "Credit World" party. Everyone's mingling, trying to get a loan or a new credit card. Now, the term Credit Score is like the general idea of how cool you are at this party. It’s the overall vibe. It’s the handshake. It’s whether people think you’re the type to borrow a cup of sugar or, you know, a small nation’s GDP.

So, Credit Score is the big umbrella. It's the whole concept of your creditworthiness.

It's a number that tells lenders, "Hey, this person is probably going to pay us back." Or, maybe, "This person might have a slightly shaky track record with their borrowed Monopoly money." It’s your financial reputation, distilled into a neat little number. Lots of companies calculate these general credit scores. They're like the party hosts, keeping an eye on everyone.

Now, where does our friend FICO Score fit into this shindig? Ah, FICO! That's a specific brand. A very famous, very important brand. You see, FICO (which stands for Fair Isaac Corporation, but honestly, who has time for full names at a party?) is like the VIP guest. The one everyone really wants to impress. They developed one of the most popular, and frankly, the most talked-about, ways to calculate a Credit Score.

So, when someone casually mentions their "credit score," they might very well be talking about their FICO Score. It's like when you say you're going to the "supermarket." You might mean Kroger, or Walmart, or Safeway. They all sell groceries, but they’re distinct places. Similarly, a FICO Score is a type of Credit Score. It’s a very popular, very widely used brand of Credit Score.

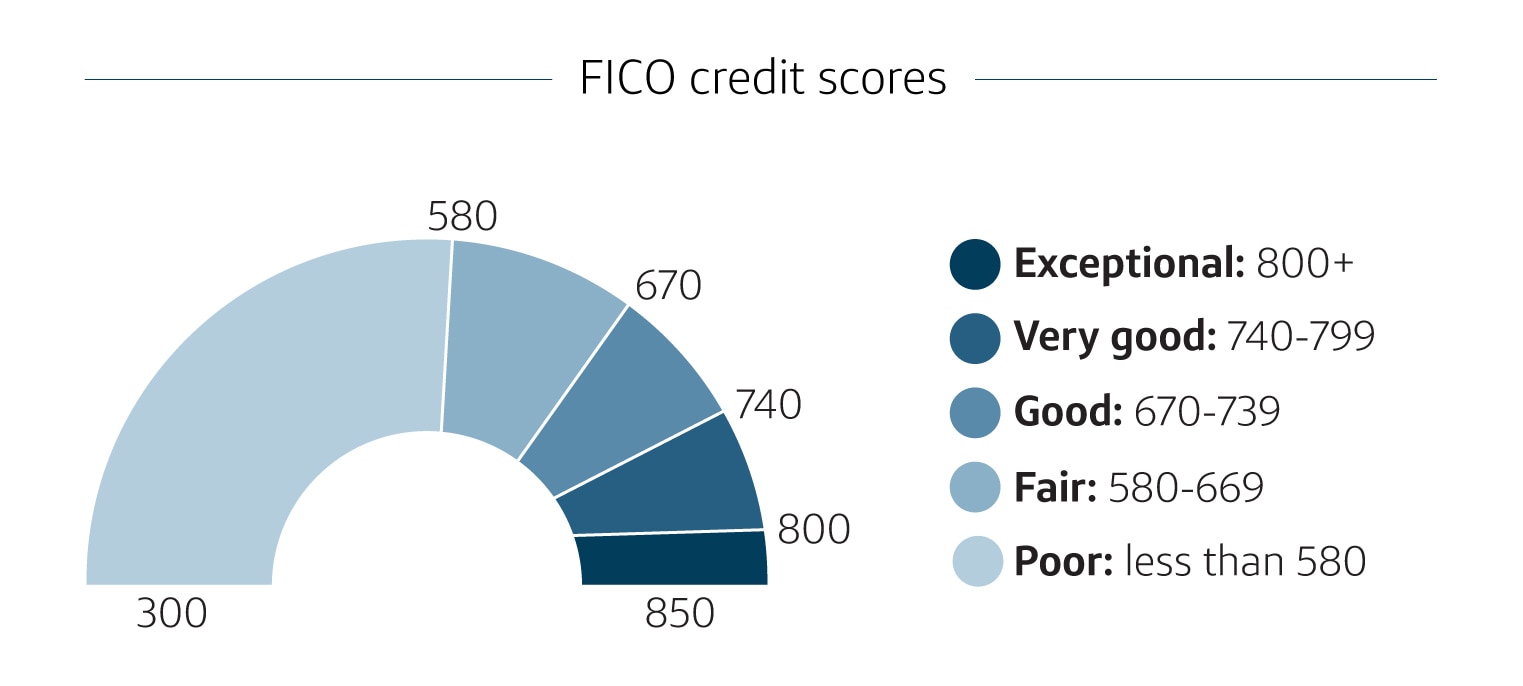

Here's where it gets a tiny bit confusing, and where I think most of us start to nod along with a vague sense of understanding. Most lenders, the people who hold the keys to your dreams (or at least your new apartment), tend to rely heavily on FICO Scores. They trust them. They’ve been using them for ages. It's like their favorite, comfy pair of shoes. They just work.

So, while there are other companies that create Credit Scores (and yes, they are also legitimate Credit Scores!), the FICO Score is the one that often gets the spotlight. It’s the celebrity of the credit scoring world. The one your bank asks about. The one that makes your heart do a little flip when you check it.

Think of it as a Venn diagram. The big circle is Credit Score. And a significant, brightly colored part of that circle is FICO Score.

They're related, but not interchangeable in the strictest sense. All FICO Scores are Credit Scores. But not all Credit Scores are FICO Scores. Mind-bending, right? It's like saying all apples are fruit, but not all fruit are apples. Apples are a specific, delicious kind of fruit, just like FICO is a specific, widely used kind of Credit Score.

Why the fuss? Well, different scoring models use slightly different information or weigh things differently. A FICO Score is calculated using a specific formula. Other credit scoring companies have their own formulas. The numbers might be close, or they might be a smidge different. It’s like different chefs making the same dish; they might use the same ingredients, but the final taste can vary.

So, when you’re diligently checking your credit report (because, let's be honest, who isn't?), you might see a score. That score is likely a Credit Score. And if it’s presented as a FICO Score, well, that's a specific, very influential kind of Credit Score. It's the one that often carries the most weight with lenders.

My unpopular opinion? We often just say "credit score" when we really mean "FICO Score" because it's easier. It rolls off the tongue. And in everyday conversation, for most people, the distinction doesn't cause a mortgage application to spontaneously combust. But for clarity? For the sake of knowing? Yes, there’s a difference. One is the general concept, the other is a very popular, very trusted brand within that concept.

So next time you hear about your credit score, you can smile, knowing you’re part of the in-crowd who understands the subtle, yet significant, difference between the general idea and the superstar performer. It’s a small victory, but hey, in the world of credit, we'll take it!