Difference Between Expansionary And Contractionary Fiscal Policy: Clear Comparison (no Confusion)

Hey there, fellow economic adventurers! Ever find yourself wondering how the big picture of our nation’s economy gets nudged and tweaked? It’s a bit like steering a giant ship, and the captain uses some pretty fancy tools. Today, we're diving into two of those essential tools: expansionary and contractionary fiscal policy. Think of them as the economy's gas pedal and brake, designed to keep things running smoothly.

Why should you care about these seemingly abstract concepts? Well, they have a huge impact on your everyday life! From the jobs available to the prices you pay for groceries, these policies are constantly at play. Their primary purpose is to manage the overall health of the economy, aiming for steady growth, low unemployment, and stable prices. Imagine a car: you want it to accelerate when needed and slow down when it's going too fast. Fiscal policy does the same for our economy.

So, what’s the difference? It’s all about when and how the government intervenes. Let's break it down:

Expansionary Fiscal Policy: The "Let's Go!" Button

This is like giving the economy a boost when it’s feeling sluggish or heading towards a recession. The goal is to increase economic activity. How do they do this? Primarily in two ways:

- Cutting Taxes: When taxes go down, individuals and businesses have more money to spend or invest. Think of it as a tax refund in your pocket – you're more likely to go out for dinner or buy that new gadget.

- Increasing Government Spending: The government can directly inject money into the economy by investing in infrastructure projects (like building roads or bridges), increasing social programs, or hiring more people. This creates jobs and stimulates demand for goods and services.

Think of it this way: If your local economy feels a bit quiet, the government might implement expansionary policy to get things buzzing again. It’s about putting more money into the hands of people and businesses.

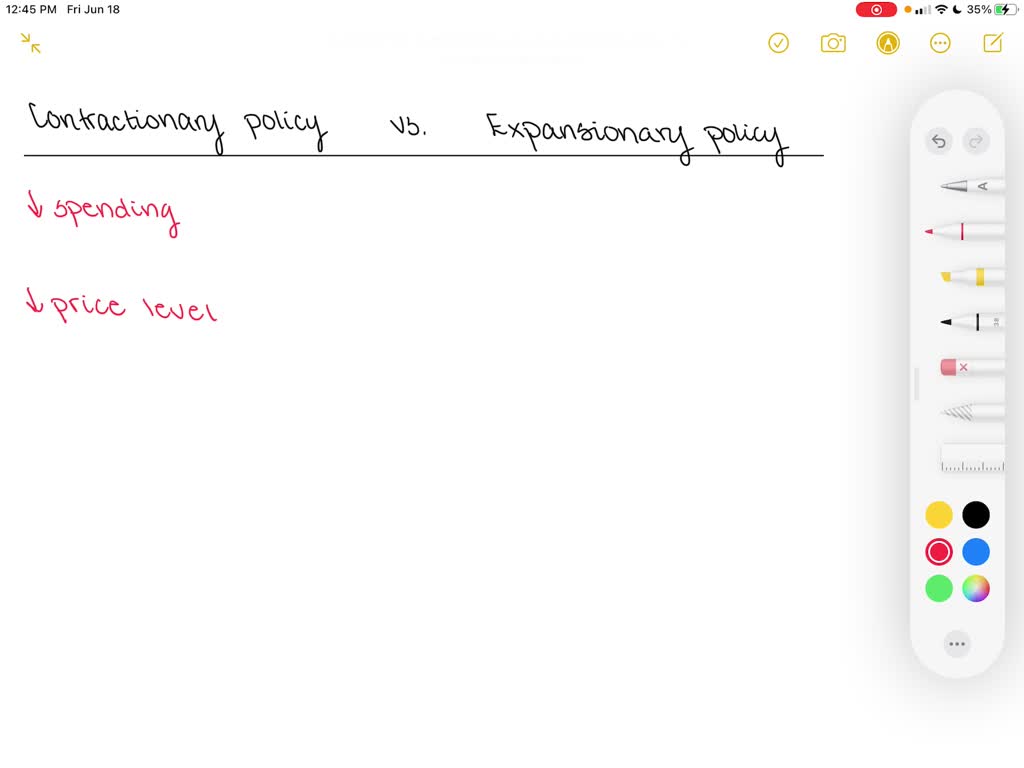

Contractionary Fiscal Policy: The "Whoa, Slow Down!" Button

On the flip side, this policy is used when the economy is overheating, leading to inflation (prices rising too quickly). The goal is to decrease economic activity and cool things down.

- Raising Taxes: When taxes go up, people and businesses have less disposable income, which naturally leads to less spending.

- Decreasing Government Spending: The government can cut back on its own expenditures, slowing down the rate at which money enters the economy.

Imagine this: If your favorite coffee shop’s prices keep jumping every week, it might be a sign of an overheating economy. Contractionary policy aims to curb that rapid price increase. It's about taking some money out of circulation to prevent runaway inflation.

The Big Picture Comparison:

The key difference is the direction of the policy. Expansionary policy aims to stimulate growth, while contractionary policy aims to slow down growth. They are tools used in response to different economic conditions, much like a doctor prescribes different medicines for different ailments.

Enjoying This Economic Ride More Effectively:

Understanding these concepts isn't just for economists! When you hear about tax cuts or new government spending initiatives, you can better grasp their potential impact. Pay attention to economic news, and you'll start to see these policies in action. It's about being an informed participant in the economic conversation, understanding how decisions made in government can affect your wallet and your future.