Difference Between Nominal Interest Rate And Real Interest Rate: Clear Comparison (no Confusion)

Okay, so picture this: my Uncle Barry. Barry’s a legend, right? Always got some wild scheme brewing. Last year, he decided he was going to become the king of homemade jam. Not just any jam, mind you. He was talking artisanal, locally sourced, organic elderberry and fig jam. Sounds fancy, and he was so proud of his projected profits. He kept flashing these numbers at me, all excited. “5% interest!” he’d exclaim, waving a crumpled napkin. “I’m gonna make a killing!”

Now, Barry’s a great guy, but sometimes his grasp of… well, numbers beyond his jam recipes can be a little fuzzy. And that’s exactly where we’re going to dive in today. Because that 5% he was so thrilled about? It’s only half the story. The real story, the one that actually tells you if Barry’s gonna be richer or just have a whole lot of expensive jam, involves something called the real interest rate.

So, grab a cuppa, get comfy, and let’s untangle this whole nominal vs. real interest rate thing. Trust me, it’s not as scary as it sounds, and understanding it is like unlocking a secret level in personal finance. You’ll be able to see through all those flashy marketing slogans and understand what’s really going on with your money.

Nominal Interest Rate: The Headline Figure

Let’s start with the easy one, the one Uncle Barry was so fond of. The nominal interest rate is basically the stated interest rate. It’s the number you see advertised on a savings account, a loan, a credit card, or, in Barry’s case, his projected jam profits. It’s the number that sounds good on paper.

Think of it as the "sticker price" of borrowing or lending money. If a bank offers you a savings account with a 3% nominal interest rate, it means they promise to pay you 3% of your deposited amount over a year, before considering any other factors. Simple enough, right?

Or, if you take out a loan with a 7% nominal interest rate, that’s the percentage of the loan amount you’ll be charged in interest each year. Again, straightforward. This is the number that gets all the headlines and makes people do a little happy dance (or a sad one, depending on whether it’s for saving or borrowing).

Why "Nominal"? It's Kind Of In Name Only.

The word "nominal" itself hints at something being in name only, or being a superficial or stated amount. And that’s pretty much what it is in this context. It’s the number as it’s presented, without any adjustments for the actual purchasing power of that money.

It’s like looking at the price tag of a chocolate bar and seeing $1. That’s the nominal price. But what if the chocolate bar used to cost $0.50 last year? Now, that $1 tag tells a different story about how much more you have to shell out for your sweet treat. See where we're going with this?

The Sneaky Serpent: Inflation

Now, here’s where Uncle Barry’s napkin math started to unravel. He completely forgot about the invisible thief in the night: inflation.

Inflation is the general increase in prices and the fall in the purchasing value of money. It means that over time, the same amount of money buys you less stuff. That $1 chocolate bar that cost $0.50 last year? If inflation is high, that $1 today might only buy you, say, half a chocolate bar. And next year, it might cost $1.50!

So, while your money is technically growing at a certain rate (the nominal interest rate), its ability to buy things is shrinking due to inflation. It’s a bit like running on a treadmill that’s set to a slightly faster speed than you are. You’re moving, but you’re not actually getting any further ahead.

Inflation: The Silent Killer of Purchasing Power

This is the crucial part. If the inflation rate is higher than the nominal interest rate you’re earning, you are actually losing purchasing power. Your money might be increasing in number, but its ability to buy goods and services is decreasing.

Imagine you have $100 and a nominal interest rate of 2% per year. After a year, you’ll have $102. Sounds great! But what if inflation over that year was 4%? That means the things you could buy for $100 last year now cost $104. So, even though you have $102, you can’t afford what you could have bought for $100 a year ago. You’ve gone backwards!

This is why Uncle Barry, bless his jam-making heart, was so focused on just the 5%. He wasn't accounting for the fact that the cost of elderberries, sugar, jars, and even his special fig supplier might have also gone up by, say, 7% that year. His 5% profit wouldn't even cover the increased costs, let alone make him a richer man.

Real Interest Rate: The True Measure of Your Wealth

And this, my friends, brings us to the star of the show: the real interest rate. This is the interest rate that has been adjusted to remove the effects of inflation.

It tells you the actual increase in your purchasing power. It’s the rate that reflects how much more stuff you can actually buy with your money after accounting for rising prices.

The Formula: Not Scary, I Promise!

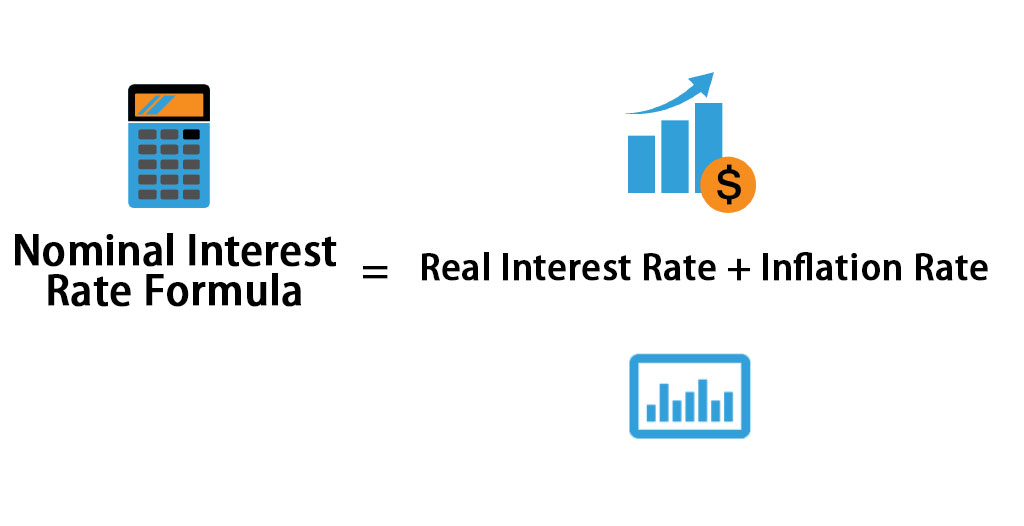

The formula for the real interest rate is surprisingly simple:

Real Interest Rate ≈ Nominal Interest Rate - Inflation Rate

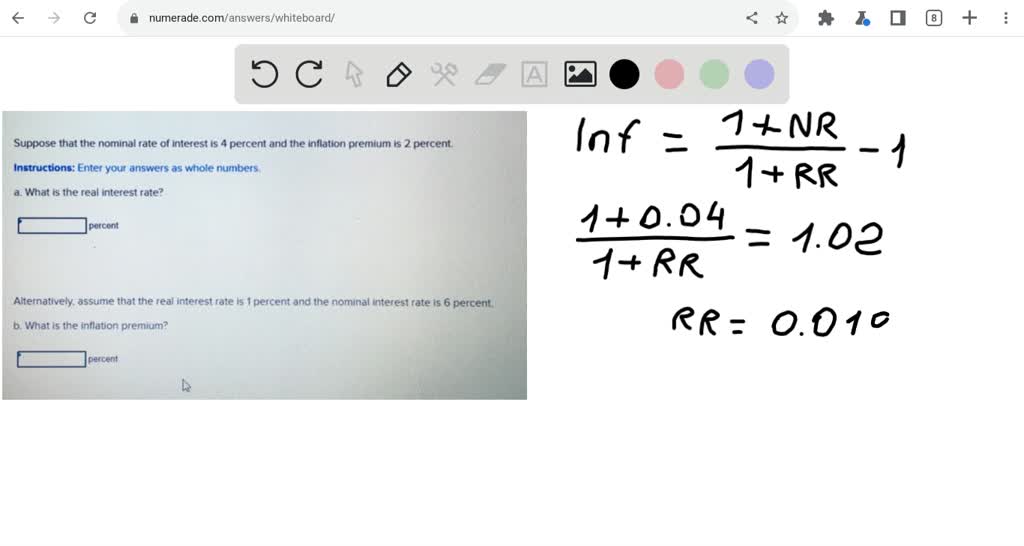

Now, I’m not a mathematician, and I’m pretty sure Uncle Barry isn’t either. This is a simplified version, but it’s incredibly useful for understanding the core concept. (For the super-precise folks out there, the Fisher equation is a bit more involved: (1 + nominal rate) = (1 + real rate) * (1 + inflation rate). But for everyday purposes, the subtraction method gives you a fantastic approximation. Don’t get bogged down in the jargon; focus on the meaning!).

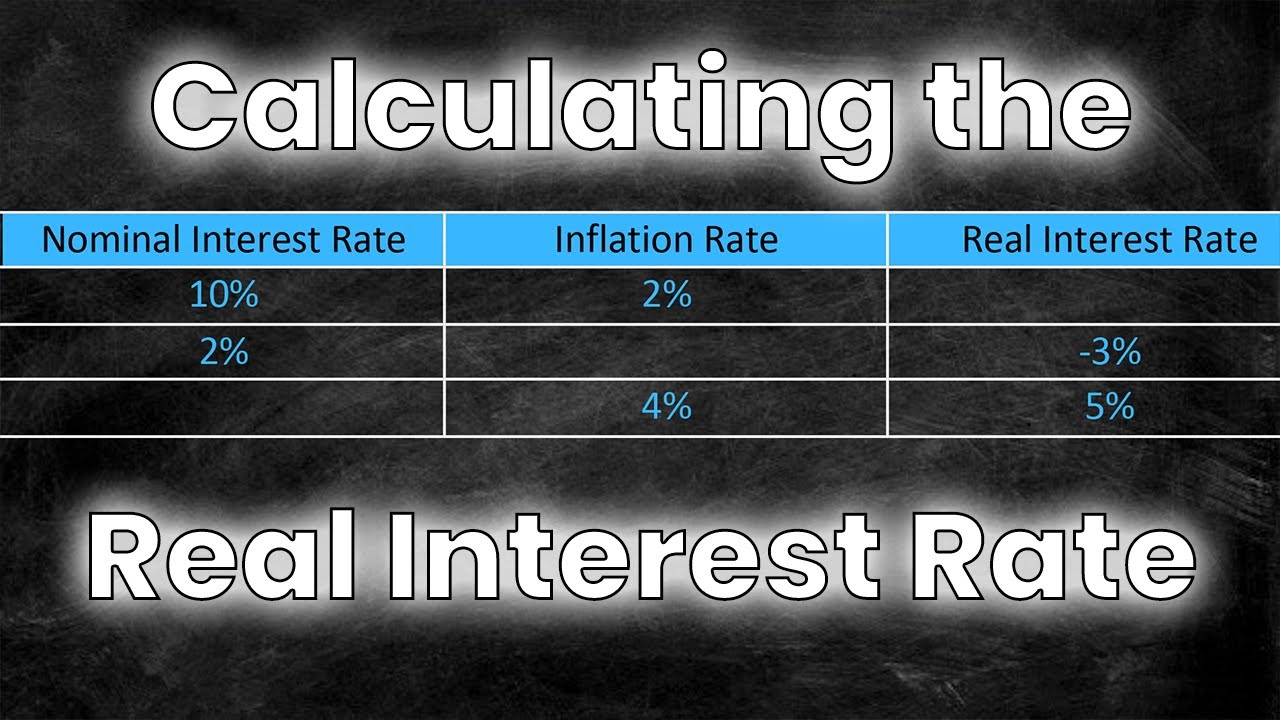

Let’s use our previous example. If your nominal interest rate is 3% and the inflation rate is 2%, your real interest rate is:

3% (nominal) - 2% (inflation) = 1% (real)

This means your purchasing power has actually increased by 1%. You can buy 1% more goods and services than you could before. That’s a genuine gain!

When Real Interest Rates Go Negative

Here’s where things get really interesting, and a little bit worrying if you’re a saver. If the inflation rate is higher than the nominal interest rate, your real interest rate becomes negative.

Let’s say you have a savings account that pays a 1% nominal interest rate, but inflation is running at 4%. Your real interest rate is:

1% (nominal) - 4% (inflation) = -3% (real)

Ouch. This means that even though your bank balance is growing by 1% each year, the cost of living is increasing by 4%. You are, in effect, getting poorer in terms of what your money can buy. Your $100 now buys less than it did last year, despite earning interest!

This is a critical point for anyone trying to save for the future. If your savings are just sitting in an account earning a nominal rate that’s being eaten alive by inflation, you’re not really growing your wealth. You’re just treading water, and probably sinking a little.

Nominal vs. Real: A Clear Comparison

Let’s lay it all out side-by-side so there’s absolutely no confusion. Think of it like comparing a menu price to the actual cost after taxes and tips. The menu price is the nominal figure; the total bill is closer to the real cost.

Nominal Interest Rate:

- The advertised rate.

- The headline figure.

- Doesn’t account for inflation.

- It’s the number your bank or lender tells you directly.

- Can be misleading if inflation is high.

Real Interest Rate:

- The adjusted rate.

- The true measure of purchasing power.

- Accounts for inflation.

- Tells you how much your wealth has actually grown in terms of what you can buy.

- Is the more important figure for making financial decisions.

When Does It Matter Most?

For Savers: You want a positive real interest rate. This means your money is growing faster than prices are rising, so you can afford more in the future. If your nominal rate is low and inflation is high, you might want to look for investments that offer a better chance of outperforming inflation.

For Borrowers: Negative real interest rates can actually be a good thing for borrowers. If you’re paying back a loan with money that’s worth less than when you borrowed it (due to inflation), you’re effectively paying less in real terms. Think of it as getting a discount on your debt!

For Investors: Understanding both is crucial. You need to know the nominal return of an investment, but you absolutely need to know the real return to see if you’re actually making a profit that beats the cost of living.

Uncle Barry’s Jam-tastic Revelation

So, I sat down with Uncle Barry, armed with a calculator and a healthy dose of patience. I explained about inflation and how it eats away at the value of money.

“Barry,” I said, “that 5% you’re projecting? That’s your nominal profit. But what if the cost of your figs went up 8% this year? And your sugar cost 6% more? And your jars are 4% pricier? Your 5% nominal profit might actually be a negative real profit. You might end up with more jars of jam, but less actual buying power than you started with!”

His eyes went wide. He grabbed his crumpled napkin, scrawled some numbers, and his face fell. “So… I’m not gonna be jam king of the world?” he mumbled.

“Not yet, Barry,” I reassured him. “But now you know! You can adjust your prices, find cheaper suppliers, or, dare I say, focus on a jam with better profit margins relative to its input costs. Or maybe just focus on making delicious jam and enjoy the process, without expecting to get rich overnight.”

He let out a sigh, then a chuckle. “Well, at least the jam tastes good!” he declared, and honestly, that’s a win in my book. But for anyone dealing with their own money, understanding the difference between nominal and real interest rates is way more than just jam-making math. It’s about understanding the true value of your efforts and your earnings.

The Bottom Line: Don’t Get Fooled by the Sticker Price

So, the next time you see an interest rate advertised, whether it's for your savings, a loan, or an investment, remember to ask yourself: what about inflation?

The nominal rate is the enticing headline, the shiny object. But the real interest rate is the substance, the actual impact on your financial well-being. It’s the number that truly tells you if your money is working for you, or if you’re just getting by.

It’s the difference between looking richer on paper and actually being able to afford more of the things you want and need. And in this ever-changing economic landscape, that’s a pretty powerful insight to have in your toolkit. Now go forth and be financially savvy! You’ve got this.