Does A Business Line Of Credit Affect Personal Credit? Answered

Ah, the mysterious world of business finances! It’s like trying to assemble IKEA furniture without the instructions, right? You're juggling invoices, chasing payments, and somewhere in the back of your mind, you’re wondering about this thing called a business line of credit. It sounds fancy. It sounds… adult. And then, the big question pops into your head, the one that makes your palms a little sweaty: Does this business line of credit actually mess with your personal credit score?

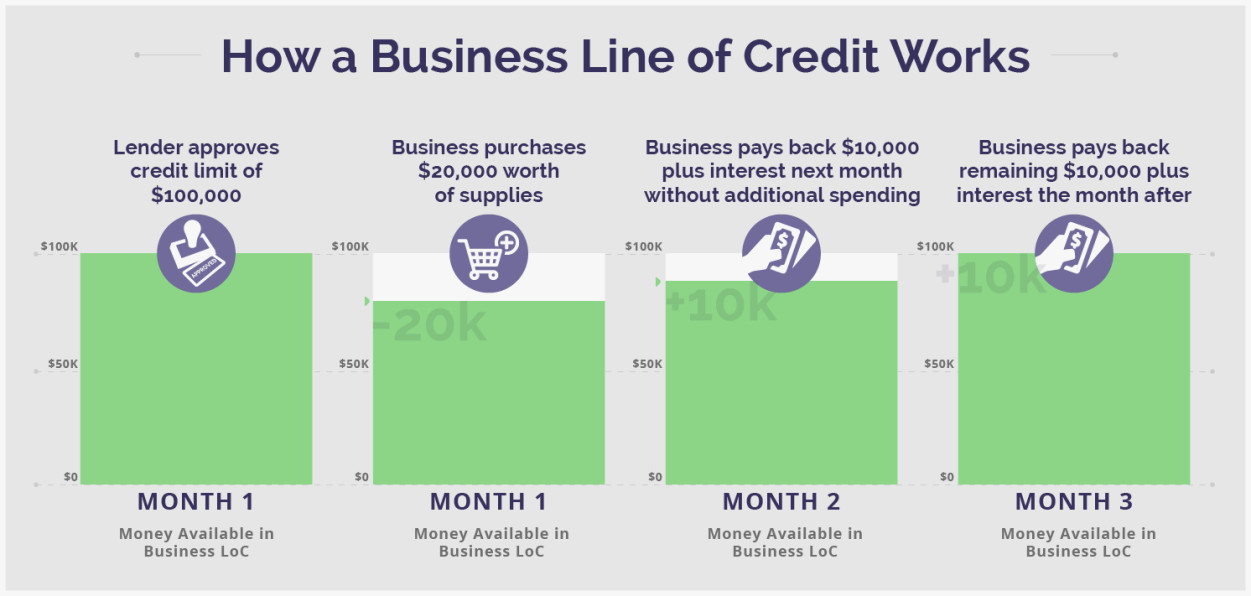

Let’s be honest, we’ve all been there. You’re building your empire, one amazing product or service at a time, and suddenly you need a little breathing room. Maybe it's for that unexpected surge in demand, or perhaps to snag a bulk discount on those essential widgets. A business line of credit seems like the superhero your business didn’t know it needed. It’s like a flexible friend for your cash flow. You can borrow, repay, and borrow again. It’s the financial equivalent of having a magic money tree that you can prune as needed.

But then, the parental alarm bells start ringing in your brain. You’ve worked hard on that glorious personal credit score. You've nurtured it like a prize-winning rose bush, carefully watering it with timely payments and avoiding any credit-score-eating pests. The thought of a business thing somehow trampling all over your personal financial garden is enough to make you want to hide under your desk. And who can blame you? We’ve all heard the horror stories. Or maybe we’ve just invented them in our heads to avoid thinking about it too hard.

So, let’s dive in, shall we? And by "dive in," I mean tiptoe around it cautiously, because let's face it, credit can be a tricky beast. The short, sweet, and utterly (almost) relieving answer is: usually, no, but sometimes, yes. Yep, I know. Not exactly the clear-cut "YES!" or "NO!" you were hoping for. It’s like asking if your cat judges your questionable dance moves. Probably, but it's not going to explicitly tell you.

Think of it this way. Your personal credit score is like your personal diary. It’s all about your financial habits. Your rent payments, your credit card bills, that car loan you're diligently paying off. It’s your financial autobiography. A business line of credit, on the other hand, is like a separate chapter written specifically for your business. It’s your business’s financial autobiography. They are (supposed to be) distinct entities.

When you apply for a business line of credit, the lender will look at your business’s financial health. They’ll want to see your business plan, your revenue, your existing business debts. They want to know if your business can stand on its own two feet. They're essentially saying, "Okay, business, you seem cool. We'll lend you money."

However, there’s a little asterisk. Sometimes, especially for newer businesses or those with a thin credit history, lenders might ask for a personal guarantee. This is where things get a tiny bit fuzzy. A personal guarantee is basically you saying, "Look, business is a bit wobbly right now, so if it can't pay you back, I will." It’s like your business’s financial safety net. And guess what? If you have to cough up cash because your business couldn’t, that can show up on your personal credit report.

It’s not that the business line of credit itself is a bad guy. It’s more about the safety net you might have to provide. If your business defaults on the line of credit and you have to make good on that personal guarantee, that default will be a rather unhappy note in your personal credit diary. Imagine your diary suddenly having a giant, red, exclamation-pointed entry about a bounced check. Not ideal.

But here’s the comforting thought: most of the time, if your business is chugging along nicely and you're making your payments on time, that business line of credit is just minding its own business. It’s doing its job for your business, and your personal credit score is happily humming along, none the wiser. It’s like your business having its own little secret wallet, and your personal wallet is completely separate. Unless, of course, you spill some of its contents, or it needs a bailout.

So, the next time you’re eyeing that business line of credit, don’t immediately picture your personal credit score doing the Macarena in a dumpster. It’s more likely to be a quiet observer. Just remember to keep your business finances healthy and your personal guarantee situation clear. Your future self, and your credit score, will thank you. And maybe, just maybe, you can avoid that awkward conversation with your credit score about its judgment of your dance moves.