Does Citibank Report Authorized Users To Credit Bureaus? Answered

Hey there! Grab a comfy seat, maybe pour yourself another cuppa. We're about to dive into something that might seem a tad dry, but trust me, it’s actually pretty darn important if you’ve ever been added as an authorized user on someone else’s Citibank card. Like, really important. Think secret decoder ring stuff, but for your credit score. So, what’s the burning question on everyone’s lips when it comes to Citibank and authorized users? Does Citibank actually report these folks to the credit bureaus? Like, do they tell Equifax, Experian, and TransUnion, “Yup, Sarah’s swiping this card too!”? Let’s get to the bottom of it, shall we?

Okay, so let’s cut to the chase. The answer is a big, fat, resounding YES. Citibank does report authorized users to the credit bureaus. Boom. Mic drop. Now, before you start picturing some shadowy figure at Citibank headquarters diligently typing your name into a giant computer, let’s unpack what that actually means for you. It’s not quite as dramatic as a spy thriller, but the implications? Oh, they can be pretty significant. So, if you’re an authorized user, or thinking of becoming one, this is for you. Don't hit that back button just yet!

Think about it. You’re cruising along, living your life, and suddenly someone you know – maybe your spouse, a parent, a super generous (and financially responsible!) friend – adds you to their Citibank credit card. You get a shiny new card with your name on it. It’s like a little badge of honor, right? You can use it! But here’s the kicker: with that shiny card comes a little bit of responsibility, even if you’re not the one paying the bill. And that responsibility, my friends, can show up on your credit report. Spooky, huh?

So, why on earth would Citibank bother telling the credit bureaus about you? Well, it’s all about painting a full picture. The credit bureaus, bless their data-loving hearts, want to know everything about your financial habits. They want to see how you handle credit, how much you owe, and if you pay your bills on time. When you’re an authorized user, you're essentially linked to the primary cardholder's account. And that link, according to the powers that be at Citibank and the credit bureaus, tells a story.

This is where things get really interesting. Because Citibank reports authorized users, the activity on that card can impact your credit score. Yes, your own credit score. If the primary cardholder is a financial superhero, rocking a low credit utilization ratio and making every single payment on time, then awesome! You, my friend, are likely getting a little boost to your creditworthiness. It’s like getting a free pass to borrow more money in the future, just by association! How cool is that? It's like being invited to the cool kids' table for credit scores.

Imagine this: your parent has a Citibank card, has had it for years, always pays it off like a champion, and keeps their utilization super low. They add you as an authorized user. Suddenly, your credit report starts showing a positive, established credit history from that card. This can be a huge advantage, especially if you're just starting out with your own credit or trying to rebuild it. It’s like getting a head start in the credit race, and who doesn't love a head start? It’s practically a gift from the financial gods, bestowed upon you by a responsible primary cardholder.

But here’s the flip side, and we have to talk about this. What if the primary cardholder… isn't quite a financial superhero? What if they’re a bit… less than perfect? Maybe they have a tendency to max out the card. Or, heaven forbid, they miss a payment or two. Uh oh. That’s when being an authorized user can go from a blessing to a bit of a curse. Because, and this is the crucial part, Citibank reports the entire account activity. All of it.

So, if that primary cardholder is racking up a huge balance, that high credit utilization can show up on your credit report too. And high credit utilization? That’s a big no-no for your credit score. It tells lenders, "Hey, this person might be a little too close to their credit limit, maybe they're struggling to manage their debt." And that's the opposite of what you want, right? It’s like suddenly finding yourself in the passenger seat of a car that’s swerving a little too much. You’re not driving, but you’re definitely feeling the bumps.

And let’s not even get started on late payments. If the primary cardholder misses a payment, guess what? That negative mark can land squarely on your credit report. This can seriously damage your credit score, making it harder to get approved for loans, apartments, or even some jobs in the future. It's like your friend forgetting to water their plants and suddenly your entire apartment looks sad and droopy. You didn't forget, but you’re still stuck with the consequences.

This is why it’s absolutely, positively, 100% essential to have a frank and honest conversation with the primary cardholder before you become an authorized user. Don’t just waltz in and grab the card like it’s free candy. Ask about their spending habits. Ask about their payment history. Are they diligent? Are they responsible? Are they the kind of person who uses a credit card like a debit card, meaning they pay it off in full every month? Or are they the kind of person who sees that credit limit as a suggestion, a dare, a challenge to be conquered?

It’s not just about the monetary aspect; it’s about the trust factor. You’re essentially entrusting your credit reputation to someone else. That’s a big deal! Imagine lending your favorite sweater to someone, and they return it with a coffee stain the size of Texas. Not ideal, right? Your credit score is a bit like that favorite sweater, but way more important for your financial future.

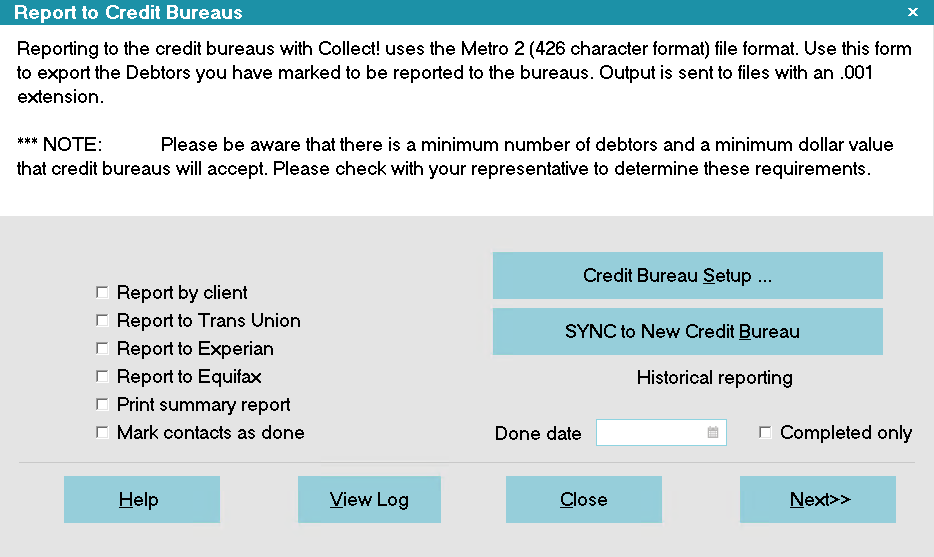

Now, let’s talk about the nitty-gritty of what gets reported. When Citibank reports an authorized user account, they typically send over a bunch of information. This includes the account number (though usually masked, for your privacy, thankfully!), the credit limit, the current balance, and the payment history. So, yes, they're sharing the whole financial saga of that card. It’s like a financial biography, and you’re a co-author, whether you like it or not.

The payment history is the biggie. Every month, Citibank will report whether the account is current, if there are any delinquencies, and how many days past due it is. This is the part that has the most direct impact on your credit score. A consistent history of on-time payments from the primary cardholder is pure gold for your credit file. Conversely, any missed payments can be a real drag.

So, when you check your credit report, you’ll likely see the Citibank account listed, just like any other credit account you might have. It might say something like "Authorized User Account" or be clearly linked to the primary cardholder’s name (again, often masked for privacy). The key is that the payment behavior associated with that account will be factored into your credit score. It’s like getting a grade on a group project where you did all the research, but someone else presented it, and they stumbled over their words. Your good work might be overshadowed.

Here’s a little tip for the road: you can actually see how this is affecting you. Get a copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion). You’re entitled to a free one from each every year, so use that perk! Look for the Citibank account. See what the balance is. See what the payment history looks like. If it’s all good, celebrate! If it’s not so good, well, you know what you need to do: have that honest conversation.

Sometimes, people get confused about whether they are an authorized user or a co-signer. It's super important to know the difference, and Citibank is pretty clear on this. As an authorized user, you are not legally responsible for the debt on the card. That responsibility lies solely with the primary cardholder. They are the one who signed on the dotted line and promised to pay. You, as the authorized user, are just along for the ride, credit-wise.

But a co-signer? That’s a whole different ball game. A co-signer is legally responsible for the debt. If the primary applicant defaults, the co-signer is on the hook. So, if someone is asking you to co-sign for a Citibank card, you need to understand the full implications. It’s like agreeing to be the backup driver if the main driver suddenly decides to take a nap. You're actively agreeing to take over if things go south.

Citibank, like most major credit card issuers, operates this way. They report authorized users because it's standard practice in the credit reporting world. It allows them to provide a more comprehensive picture of an individual's credit usage. And for you, it means you have a vested interest in the financial habits of the primary cardholder. It’s a shared financial destiny, in a way, at least on paper.

So, to recap, in case you were doodling during the important bits (no judgment, I’ve been there!): Yes, Citibank absolutely reports authorized users to the credit bureaus. This means the activity on the card, both good and bad, can and will impact your credit score. It’s not just about having a card to spend with; it’s about your credit report and your future financial opportunities.

The biggest takeaway here? Communication is key. If you're thinking of becoming an authorized user on a Citibank card, have a serious chat with the primary cardholder. Understand their financial habits, their payment history, and their approach to credit. If you’re the primary cardholder adding someone, be mindful that their credit can be influenced by your actions. It’s a two-way street, even if one person is doing all the driving.

And if you’re already an authorized user and things aren’t looking great on your credit report, don’t despair! You can always ask to be removed from the account. Just a simple request to the primary cardholder, and they can contact Citibank to have you taken off. This will stop any further activity from being reported under your name. It’s like hitting the reset button on that particular financial connection.

Ultimately, being an authorized user can be a fantastic way to build or improve your credit score, provided the primary cardholder is responsible. It’s a powerful tool. But like any powerful tool, it needs to be used wisely and with full awareness of how it works. So, there you have it. The mystery is solved. Now go forth, armed with this knowledge, and make some smart financial decisions!