Does Home Owner Insurance Cover Dog Bites

So, you've got a furry friend, huh? Awesome! They’re the best, aren't they? Always there with a wagging tail or a purr. But let's be real for a second, shall we? Sometimes, even the sweetest pups can, well, get a little nippy. Maybe it’s a stranger at the door, or a squirrel that really pushed their buttons. And that brings up a big question, doesn't it? If your adorable Fido or Luna ever gives someone a little nibble, does your homeowner's insurance have your back? It's a question that keeps some pet parents up at night, right?

It’s like, you’re just chilling, sipping your coffee, thinking about belly rubs and walks in the park. Then BAM! A little thought creeps in: "What if…?" And that "what if" often involves a scenario where your beloved dog makes an unexpected friend… in the form of a lawsuit. Yikes!

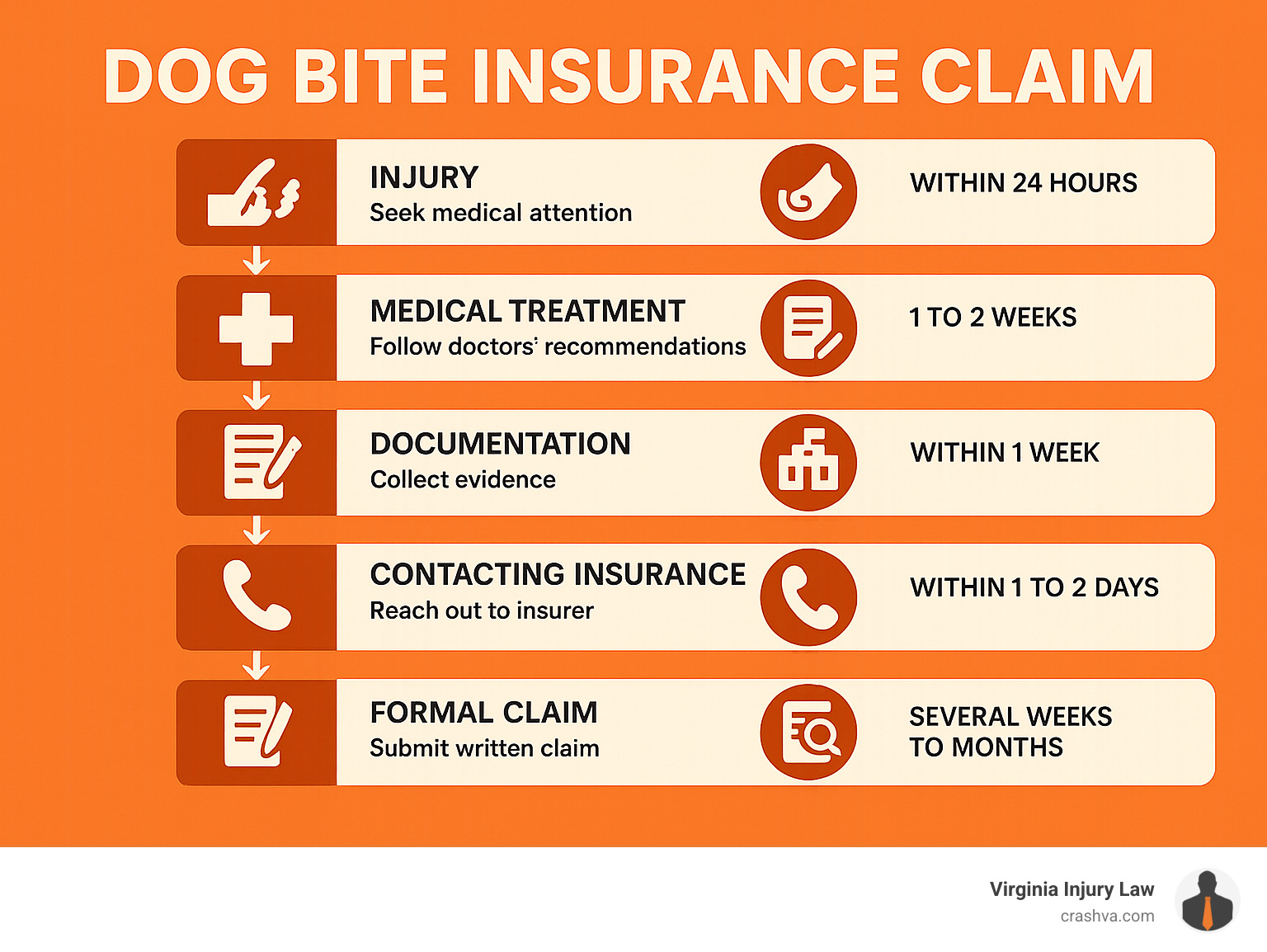

Okay, so let's dive into this, shall we? It’s not always a straightforward "yes" or "no." Think of it as a bit of a legal maze, but don't worry, we'll navigate it together. We're talking about liability coverage here. That's the magic words, the stuff that protects you if someone gets hurt on your property. And guess what? Dog bites definitely count as someone getting hurt on your property. Unless, of course, they're a ninja climbing over your fence in the middle of the night, but let's not get into those unlikely scenarios.

Most standard homeowner's insurance policies do include some form of dog bite liability coverage. Phew, right? It’s usually part of the general liability section. This is the part that covers you if someone is injured and sues you. So, if Mr. Henderson from next door trips on your garden gnome and breaks his hip, or if your neighbor's kid has a little "woof" encounter that ends with stitches, your insurance company is generally on the hook to cover the medical bills and legal fees. Big sigh of relief for many!

But here’s where it gets a little… fuzzy. It’s not a free-for-all, a blanket of protection for every single dog-related incident. Insurers are, after all, in the business of assessing risk. They look at things. And your dog’s breed can be a pretty big factor in their risk assessment. It’s a controversial topic, I know. It feels unfair, doesn't it? Your sweet little fluffball might be part pit bull, and suddenly, the insurance company sees a different picture. It's like judging a book by its cover, but with teeth. So frustrating!

The Breed Factor: A Sensitive Subject

This is where things can get a little dicey. Many insurance companies have breed restrictions. They might refuse to cover certain breeds altogether, or they might charge you a heck of a lot more. We’re talking about dogs that are often perceived as having a higher risk of biting or causing serious injury. Think breeds like Pit Bulls, Rottweilers, Doberman Pinschers, and sometimes even German Shepherds, depending on the company. It’s a tough pill to swallow for owners of these beautiful, often misunderstood animals. It’s like they have a scarlet letter embroidered on their collars, just because of what they look like, not necessarily what they are.

So, what does this mean for you? Well, if you have one of these breeds, you might need to do some extra digging. Some insurers will simply say "no" to covering your dog. Others might be okay with it, but they'll want extra documentation. Think vet records showing a good temperament, maybe even proof of obedience training classes. It's like your dog needs a spotless report card to get insurance approval. And sometimes, they'll simply exclude coverage for dog bites altogether from your policy. That means if your dog bites someone, you’re on your own. A very scary thought, especially if you’re in a state with strict dog bite laws.

It’s also worth noting that sometimes it's not just about the breed, but also about the dog's history. Has your dog ever bitten someone before? Even a minor nip can show up in your vet records or in local animal control reports. If your dog has a bite history, you can bet your insurance company is going to have some serious questions. They might even refuse to cover you, or they'll charge you a premium that's so high it makes your eyes water. It’s like your dog’s past indiscretions are a permanent black mark. Talk about holding a grudge!

What If Your Dog Isn't on the "Forbidden" List?

Okay, so let's say you have a golden retriever, a beagle, or a very fluffy Pomeranian. You might think you’re in the clear, right? For the most part, yes! Most insurance companies are generally more comfortable covering breeds that aren’t on their restricted lists. Your standard homeowner's policy should cover dog bite liability. You’ll likely have a certain amount of coverage, say $100,000 or $300,000, for medical expenses and legal fees if your dog bites someone. That sounds like a lot, but trust me, medical bills and lawsuits can add up faster than a squirrel hoarding nuts for winter.

But even with these "safer" breeds, there are still caveats. The specific circumstances of the bite matter. Was the person trespassing? Were they provoking your dog? These factors can play a role in whether your insurance will cover the claim. It's like the law tries to figure out who was being the most sensible (or not sensible) in the situation. So, if someone is taunting your dog with a stick, and then gets bitten, your insurance might not be as quick to pay up. It’s a legal gray area, and it often depends on the state and the specific details.

And let's not forget about your state's laws. Every state has different laws regarding dog bites. Some states have "strict liability," meaning the owner is responsible for any damage or injury caused by their dog, regardless of whether the dog had a history of biting or whether the owner was negligent. Other states have "one-bite" rules, where the owner is only liable if they knew or should have known their dog was dangerous. This can significantly impact how your insurance company handles a claim. It’s like a whole different set of rules depending on where you hang your leash.

So, what’s the takeaway here? The best thing you can do is to be proactive. Don’t wait until an incident happens to figure out your insurance coverage. Read your homeowner's policy carefully. Seriously, pull it out. It might be buried under a pile of junk mail, but it’s important. Look for the section on liability. Does it mention anything about dog bites? Are there any breed exclusions? If you’re not sure, call your insurance agent. Don't be shy! They're there to answer your questions, even the slightly embarrassing ones about your dog's potential for mischief. It's way better to have a slightly awkward conversation now than a massively expensive one later.

What if Your Insurance Company Won't Cover Dog Bites?

This is where things get a little more… adventurous. If your current homeowner's insurance policy excludes dog bite liability, or if they won't insure you because of your dog's breed, what are your options? Don't despair! There are still ways to get coverage. It might just require a little more effort and, let’s be honest, probably more money. It’s like finding a hidden gem, but it costs a bit more than you were expecting.

One option is to look for specialized pet liability insurance. These policies are designed specifically to cover incidents involving your pet, including dog bites. They can be purchased separately from your homeowner's insurance. It's like getting a tailored suit for your dog's liability needs. These policies can be a lifesaver for owners of breeds that are commonly excluded from standard policies. They're designed for the unique risks associated with pet ownership.

Another approach is to shop around for different insurance companies. Not all insurers have the same breed restrictions or the same underwriting guidelines. You might find a company that is more accommodating to your specific dog breed. It’s like going on a dating app for insurance companies. You gotta kiss a few frogs (or read a few policy documents) before you find your perfect match. And be prepared for potentially higher premiums. Insurers who are willing to cover breeds with a perceived higher risk will often charge more. It's the price of peace of mind, I guess.

Some owners even opt for an umbrella policy. This is an extra layer of liability insurance that kicks in after your homeowner's insurance coverage has been exhausted. It provides additional financial protection and can extend to cover dog bite incidents. Think of it as a super-powered shield for your assets. It’s a good idea if you have significant assets to protect, or if you’re particularly concerned about liability. It's the ultimate safety net, just in case.

It’s also worth considering building a strong record of good behavior for your dog. Consistent obedience training, socialization, and regular vet check-ups can all contribute to a dog's good temperament. While this might not always override an insurance company's breed restrictions, it can certainly help in negotiations or if you're applying for specialized coverage. It's like building a good reputation for your dog, one wagging tail at a time. And who doesn't love a well-behaved pup?

Preventing Bites: The Best Defense is a Good Offense

Honestly, the absolute best way to deal with dog bite liability is to prevent bites from happening in the first place. It sounds simple, but it’s the most effective strategy. Your dog’s safety and the safety of others should always be your top priority. It’s not just about insurance; it’s about being a responsible pet owner. And that, my friends, is something we can all strive for, right?

Supervise your dog, especially around children and strangers. You know your dog best. If you see them getting anxious or stressed, it's time to intervene. Don't let them get into a situation where they feel they have to resort to nipping. It’s like being a watchful parent for your furry kid. Keep an eye on their body language. Are their ears back? Are they showing the whites of their eyes? These are all signs of stress.

Proper training and socialization are crucial. Enroll your dog in obedience classes from a young age. Expose them to different people, places, and other animals in a positive and controlled way. This helps them become well-adjusted and less likely to react fearfully or aggressively. A well-trained dog is a happy dog, and a happy dog is usually a safe dog. It's a win-win situation. They learn good manners, and you get fewer worries.

Secure your yard. Make sure your fences are in good repair and tall enough to prevent your dog from escaping. If you have a known escape artist, consider adding extra security measures. You don't want your dog to go on an impromptu adventure and end up in a situation where a bite could occur. It's like giving them their own little safe zone, where they can roam and play without getting into trouble.

And finally, educate yourself and others. Teach children how to interact safely with dogs. Never let a child approach a dog that is eating, sleeping, or playing with a toy. Always ask permission before petting someone's dog. It’s about mutual respect, for both humans and canines. A little education goes a long way in preventing misunderstandings and potential incidents. It's about creating a more harmonious coexistence.

So, there you have it. Homeowner's insurance and dog bites. It's a topic that can feel a bit overwhelming, but with a little knowledge and some proactive steps, you can protect yourself and your furry family. Remember to always check your policy, talk to your insurance agent, and prioritize your dog's well-being and training. Because at the end of the day, we all want our dogs to be happy, healthy, and, of course, well-insured!