Dow Jones U.s. Dividend 100 Index List Of Companies: Complete Guide & Key Details

Ever feel like your wallet needs a little pep talk? Like it’s looking a bit… thin? We’ve all been there. Staring at our bank account like it owes us an explanation. Well, guess what? There’s a secret handshake in the investing world. It’s all about getting paid just for owning a piece of the pie. And one of the coolest clubs for this is the Dow Jones U.S. Dividend 100 Index. Fancy name, right? But the idea is super simple.

Think of it like this: Instead of just hoping a stock goes up in price, which is like playing the lottery, these companies actually send you a little thank-you note every so often. And that thank-you note is cash. Cold, hard cash. It’s called a dividend. It’s like getting a tiny rent check from the companies you’re invested in. Pretty sweet, huh?

So, what exactly is this Dow Jones U.S. Dividend 100 Index? Imagine a big buffet of really, really good dividend-paying companies. Not just any companies, mind you. These are the grown-ups. The ones that have been around the block, paid their dues, and are known for sharing the profits. The index picks the top 100 of these dividend stars.

Why 100? Well, it’s a nice round number. And it gives you a good variety without being overwhelming. It’s like picking the best 100 cookies from a massive bakery. You’re bound to find some delicious ones in there.

Now, for the juicy part: the complete guide & key details. What are the key details? Firstly, these aren’t just any companies. They have to be solid. They’ve got to have a history of paying dividends, and not just paying them, but growing them. That’s the magic sauce. A company that consistently increases its dividend payments is like a plant that keeps on growing bigger and better. You want to be holding onto that plant!

The index looks at a few things. One, how much dividend are they paying? Two, have they been paying it for a while? Three, are they actually growing that dividend? They want companies that are like your reliable friend who always shows up on time and maybe even brings a treat. Not the friend who says, "Oops, forgot my wallet!"

So, who are these dividend superstars? You’ll find some familiar names. Think of companies that make the stuff you use every day. The companies that keep the lights on, the food on the shelves, and your phone working. They’re often in sectors like utilities, consumer staples (think food and toothpaste), and healthcare. These are the businesses that people need, rain or shine. People still need to brush their teeth when the economy is doing a little jig, right?

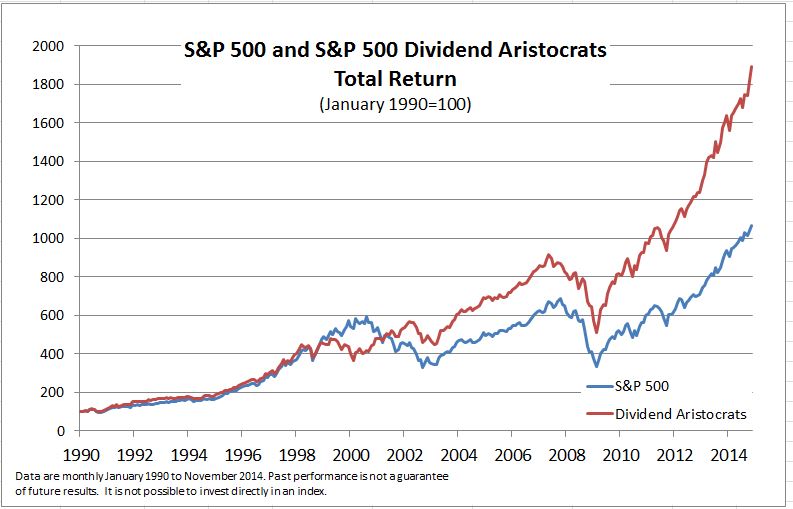

This is where my unpopular opinion might come in. While everyone else is chasing the next big tech stock that might go to the moon (or crash back to Earth), I’m over here, quietly sipping my tea, watching my dividend stocks do their thing. It’s like the tortoise and the hare, but the tortoise is getting paid. And the hare is probably stressed out. Don’t get me wrong, growth is great. But steady, predictable income? That’s like a warm blanket on a chilly evening.

The Dow Jones U.S. Dividend 100 Index List Of Companies isn’t static. It’s not like they pick 100 companies and then go on vacation. Nope. They rebalance it. This means they check it regularly to make sure the top 100 are still the top 100. If a company’s dividend starts to wobble, it might get the boot. And a new, dividend-loving company gets a chance to shine. It’s like a revolving door, but instead of people, it’s companies getting in and out based on their dividend prowess.

What are the key details you need to know? Well, it’s an index. This means you can’t directly buy the index. You buy something that tracks the index. Think of an index fund or an ETF (Exchange Traded Fund). These are like pre-packaged baskets of all the companies in the index. You buy one share of the ETF, and boom, you own a tiny piece of all 100 dividend giants. It’s like buying a variety pack of the best dividends.

This is great for people who don’t have tons of time to research individual stocks. Or for people who like to sleep at night knowing their investments are in relatively stable hands. It’s not about getting rich quick. It’s about building wealth steadily. It’s about getting that consistent income stream. Imagine your portfolio sending you little postcards from all over the world, each with a dividend payment inside.

The Dow Jones U.S. Dividend 100 Index: Because your bank account deserves a standing ovation, not a sad trombone.

So, if you’re looking for an investment strategy that’s less about adrenaline rushes and more about… well, getting paid, then this index is definitely worth a peek. It’s a collection of companies that understand the value of sharing the wealth. And in a world that can feel a bit stingy sometimes, that’s a pretty darn appealing idea. It’s about being smart, being patient, and letting the companies do the hard work of making money and then sharing it with you. Now, if you'll excuse me, I think I hear my dividend mailbox calling.