Evaluate The Online Travel Agency Company Vrbo On Travel Insurance: Complete Guide & Key Details

Planning a getaway, whether it's a cozy cabin for two or a sprawling beach house for the whole gang, is often one of the most exciting parts of life. And these days, many of us are turning to online travel agencies (OTAs) like Vrbo to find our perfect home away from home. But what about those unexpected bumps in the road? That's where travel insurance comes in, and understanding how Vrbo handles it can make your trip planning a whole lot smoother and less stressful.

So, why is it important to chat about Vrbo and travel insurance? Think of it as your trip's safety net. It's not the most glamorous topic, perhaps, but it's incredibly practical. For beginners just dipping their toes into the world of vacation rentals, it offers peace of mind. You’ve invested time and money into finding that ideal spot, and knowing you’re covered if something unforeseen happens can be a huge relief. Families, especially those with little ones, often have more moving parts to their trips – think last-minute illnesses or flight delays. Travel insurance can be a lifesaver in these situations, protecting your hard-earned vacation funds.

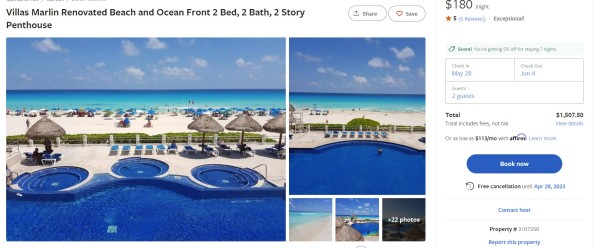

For the seasoned traveler, the "hobbyist" of vacation planning, you might already appreciate the value of comprehensive coverage. You understand that sometimes, even the best-laid plans can go awry. Vrbo, being a platform that connects travelers with individual property owners, doesn't directly sell its own branded travel insurance. Instead, they typically offer protection plans or integrate with third-party insurance providers at checkout. These plans can vary widely. Some might cover trip cancellation due to illness, severe weather, or even job loss. Others might offer assistance if your luggage gets lost or if you need emergency medical care. It’s important to read the fine print, as coverage details can differ significantly between providers and policies.

Let’s say you’ve booked a charming lakeside cottage for a week. A common scenario is a family member getting sick right before you leave, making travel impossible. A good travel insurance policy would likely reimburse you for non-refundable costs like your Vrbo rental fee and any pre-paid excursions. Another variation might be during your stay; imagine a sudden storm makes the roads impassable, forcing you to extend your stay unexpectedly. Some policies can help cover those additional accommodation costs.

Getting started with understanding Vrbo and travel insurance is simpler than you might think. First, always look for the insurance options when you're completing your booking on Vrbo. They usually present these choices clearly during the checkout process. Second, take a moment to read the description of the protection plan offered. What exactly does it cover? What are the exclusions? If you’re unsure, don’t hesitate to click on the links for more detailed policy information. Third, compare. If Vrbo offers a specific protection plan, you might also consider getting quotes from other reputable travel insurance providers to ensure you're getting the best value and coverage for your needs. Many travelers find that purchasing insurance directly from a dedicated insurance company can sometimes offer more comprehensive options.

Ultimately, navigating the world of vacation rentals and travel insurance with Vrbo is about smart planning. It's not about expecting the worst, but about being prepared so you can truly relax and enjoy your well-deserved break. Having that understanding and perhaps a little extra protection can turn a potentially stressful situation into a minor inconvenience, allowing the joy of your vacation to shine through.