Evaluate The Progressive Insurance Company The Hartford On Competitive Rankings: Complete Guide & Key Details

Alright folks, gather 'round, because we're about to dive into the thrilling world of insurance companies! Yes, I know, "thrilling" might not be the first word that pops into your head when you think about insurance, but stick with me! Today, we're putting two giants under the microscope: Progressive Insurance and The Hartford. Think of it as a friendly showdown, a battle of the bean counters and customer service champions, all to help YOU figure out who's got your back when life throws a curveball. We're talking about who's rocking the competitive rankings and what makes them tick. So, grab a comfy seat, maybe a snack, and let's get this insurance party started!

The Progressive Powerhouse: Flo's Got Your Back (Probably!)

First up, let's talk about the one and only Progressive. You know them, right? That cheerful lady, Flo, always ready with a smile and a surprisingly good deal. Progressive has built an empire on being super accessible and, let's be honest, pretty darn innovative. They were early adopters of a lot of tech that made getting insurance feel less like pulling teeth and more like, well, maybe a brisk walk in the park. They're constantly looking for ways to make things easier for us, the everyday drivers and homeowners.

When you look at the competitive rankings, Progressive often lands with a solid thud in the top tier. Why? Well, it's a combination of things. They're known for their aggressive pricing, especially for those who are good drivers or have a clean record. Think of it like finding that perfect parking spot right in front of the store when you're already running late – pure bliss! Plus, they offer a whole buffet of discounts. It's like a buffet, but instead of endless plates of questionable mini-quiches, you get savings on your premium. We're talking discounts for being a good student (hello, straight A's!) or for bundling your policies. They've also made a big splash with their online tools and mobile app. You can get a quote, manage your policy, and even file a claim with just a few taps. It’s like having a tiny insurance wizard in your pocket!

Their claims process? Generally speaking, it's pretty smooth sailing. They’ve invested a lot in making it efficient, and people often report feeling well-taken care of. Of course, no insurance company is perfect, and sometimes things can get a little bumpy. But overall, Progressive has earned its spot as a go-to for many, thanks to its blend of affordability, convenience, and a healthy dose of customer-centricity.

The Hartford: Dependability with a Touch of Class

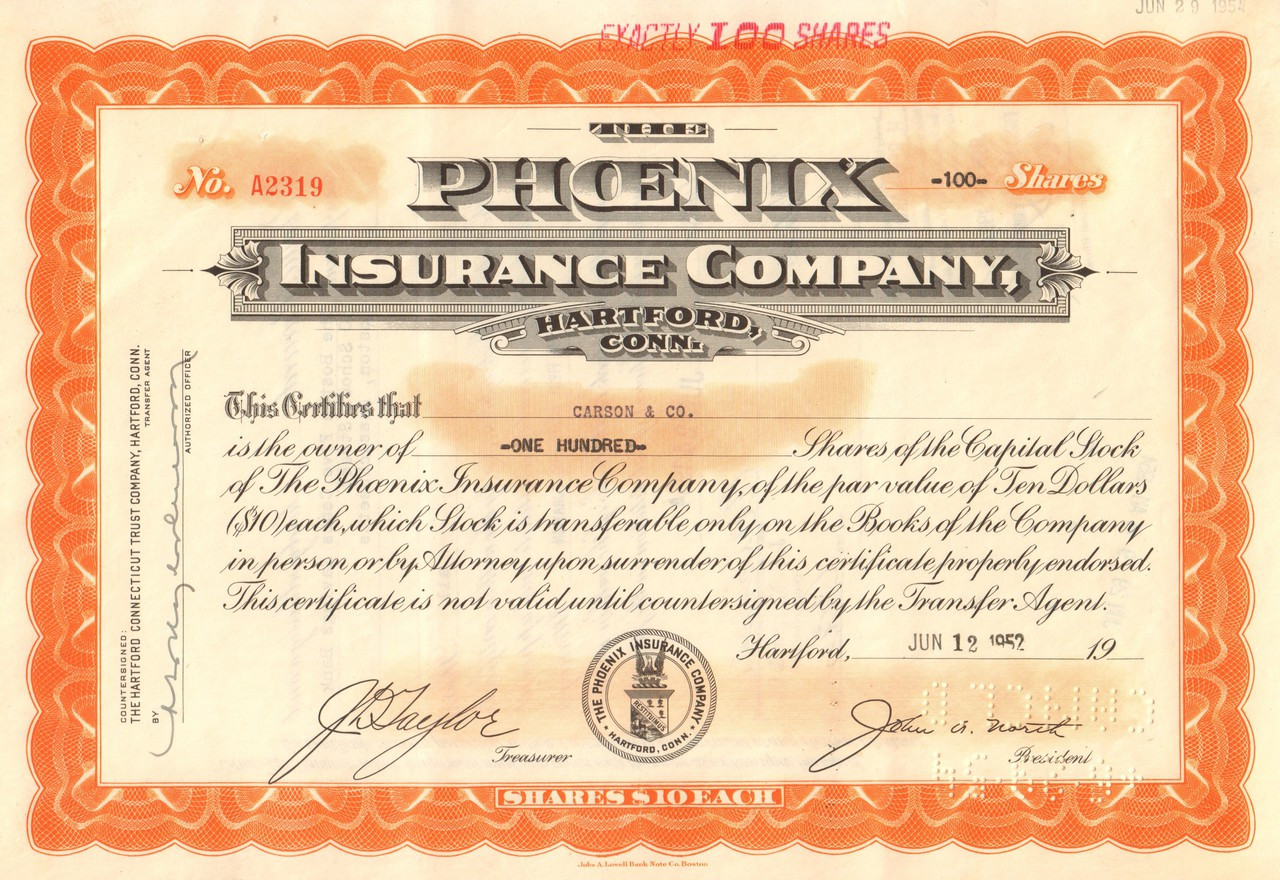

Now, let's shift gears and talk about The Hartford. This is another big player, a company with a long history and a reputation for being a bit more… let's say, established. They’re not as flashy as Progressive with their marketing campaigns (no singing mascots here, folks!), but don't let that fool you. The Hartford is a powerhouse when it comes to offering a wide range of insurance products, from your standard auto and home to more specialized coverage like small business insurance and even life insurance.

In the competitive rankings, The Hartford often shines for its financial strength and its commitment to customer service, especially for certain segments. Think of them as the reliable friend who always shows up on time, the one you know you can count on when things get serious. They're particularly well-regarded for their service to small businesses, offering tailored solutions that help entrepreneurs sleep soundly at night. For individuals, they provide a comprehensive suite of policies, and many customers appreciate their attentive support and the feeling of being in good hands.

What sets The Hartford apart is their focus on building strong relationships with their policyholders. They might not always be the absolute cheapest option on the block, but you're often paying for that extra layer of personalized service and the peace of mind that comes with dealing with a company that has a deep understanding of risk and coverage. Their claims handling is generally praised for being thorough and fair. It’s like getting that home-cooked meal from your grandma – it might take a little longer, but it’s made with love and expertise, and you know it's going to be good.

They also offer a variety of bundles and discounts, though perhaps with a slightly different emphasis than Progressive. It’s less about snagging the absolute lowest price through a dizzying array of options and more about creating a well-rounded insurance plan that fits your life. The Hartford is a solid choice for those who value stability, comprehensive coverage, and a company that’s been around the block and knows its stuff.

So, Who Wins the Insurance Crown?

Here's the million-dollar question: who comes out on top in the epic clash between Progressive and The Hartford? The truth is, there's no single, definitive winner. It's like asking if pizza is better than tacos – it totally depends on what you're craving!

If you're a bargain hunter, love tinkering with online tools, and want the latest tech to manage your insurance, Progressive might just be your jam. They excel at offering competitive prices and making the whole process as painless as a warm hug. Their digital savvy and discount galore can be incredibly appealing, especially for younger drivers or those looking to maximize savings.

On the other hand, if you're looking for a company with a long-standing reputation, a strong emphasis on customer relationships, and a comprehensive range of products, particularly if you're a small business owner, The Hartford could be your champion. They offer a sense of security and personalized attention that many policyholders deeply value.

Ultimately, the best insurance company for you is the one that best fits your individual needs, budget, and preferences. It's always a good idea to get quotes from both (and maybe a few others!) and really dig into what each policy offers. Don't be afraid to ask questions, compare apples to apples, and trust your gut. Because at the end of the day, having the right insurance is all about peace of mind, and that’s a win-win in my book!