Exchange Rate Of Australian Dollar To Indian Rupee Today: Complete Guide & Key Details

Hey there, globetrotters and savvy savers! So, you're eyeing a trip down under, dreaming of kangaroos hopping across sun-drenched plains, or maybe you're just curious about how your hard-earned rupees stack up against the Aussie dollar. Well, you've landed in the right spot! Today, we're diving deep into the fascinating world of the Australian Dollar (AUD) to Indian Rupee (INR) exchange rate. Think of this as your chill guide to understanding the numbers that make international transactions tick, sprinkled with a dash of Aussie charm and Indian spice!

It's pretty wild to think about, isn't it? That little piece of plastic or those crisp notes you hold in your hand can morph into something else entirely when you cross borders. The exchange rate is basically the price of one currency in terms of another. For us, it’s about how many Indian Rupees you’ll need to buy one Australian Dollar, or vice versa. And trust me, this number isn't static; it's a bit of a drama queen, constantly fluctuating based on a whirlwind of global events, economic vibes, and even the latest cricket scores (okay, maybe not the last one, but you get the idea!).

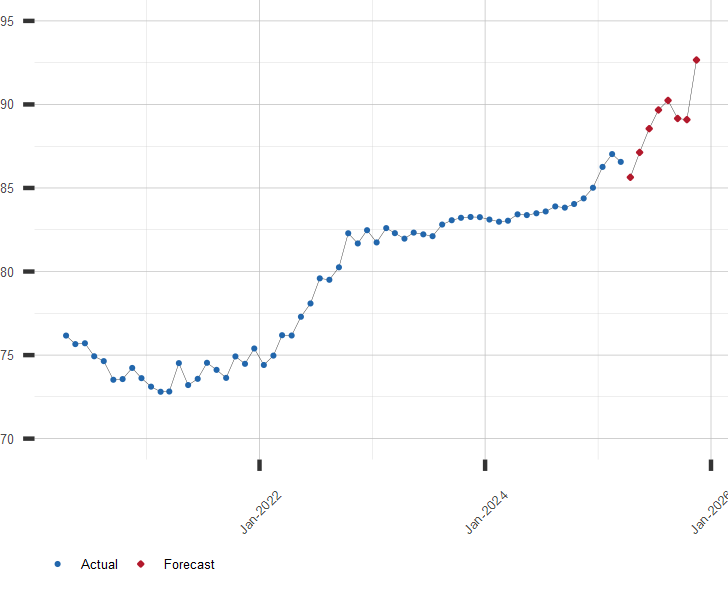

Let's get straight to it: what's the Australian Dollar to Indian Rupee exchange rate today? Well, like a chameleon adapting to its surroundings, this rate changes by the minute. You can find the most up-to-the-second figures on reputable financial news websites, currency exchange platforms, or even your bank's app. For the sake of this article, let's imagine it’s hovering around 1 AUD = 55 INR. Remember, this is just an example, and the actual rate will vary! Always check the live rate before making any major decisions. It's like checking the weather before a picnic – crucial for a smooth experience.

Why Should You Even Care About This Magic Number?

Fair question! Beyond the obvious need for planning your next adventure, understanding the AUD to INR exchange rate is like having a secret superpower for your finances.

For Travellers: Planning that epic backpacking trip through the Outback, a sophisticated city break in Sydney, or perhaps a family holiday filled with whale watching? Knowing the exchange rate helps you budget like a pro. If the AUD is strong against the INR, your trip will cost more rupees. If it's weaker, you might find your money stretching further. Imagine buying souvenirs – a cute koala plushie could feel like a steal or a splurge depending on the day's rate!

For Investors and Businesses: Are you an entrepreneur eyeing opportunities in Australia, or an investor looking to diversify your portfolio? The AUD/INR rate is a critical factor in determining the profitability of international investments and trade. It affects import and export costs, making it a vital cog in the global economic machine.

For Migrants and Expats: Sending money home to family in India or receiving funds from Australia? The exchange rate directly impacts the amount that arrives in the recipient’s account. A favourable rate can mean more rupees for your loved ones or a bigger nest egg for you!

For the Simply Curious: Let's be honest, there's a certain intellectual thrill in understanding how the world’s economies interact. Plus, it’s a great conversation starter at your next dinner party – “Did you know the Aussie dollar has been doing a little jig against the rupee lately?”

The Aussie Dollar: More Than Just Greenbacks

The Australian Dollar, often affectionately called the 'Aussie' or 'Aussie dollar', is the official currency of Australia and its external territories. It’s known for being a commodity currency, meaning its value is often influenced by the prices of raw materials that Australia exports, like gold, iron ore, and coal. Think of it this way: when the world is booming and needs a lot of these resources, the Aussie dollar tends to get stronger. It’s like Australia is the ultimate provider of the building blocks for global growth!

A fun fact: The Australian Dollar was the first currency in the world to feature a transparent polymer (plastic) banknote, starting in 1988! These notes are not only durable and water-resistant but also incorporate advanced security features. So, next time you handle an Aussie dollar, appreciate the high-tech innovation it represents!

The AUD is subdivided into 100 cents. You'll see coins in denominations of 5, 10, 20, and 50 cents, and $1 and $2 coins. The $1 and $2 coins are gold-coloured, while the others are silver. Paper notes come in denominations of $5, $10, $20, $50, and $100. They are also polymer, with vibrant colours making them quite cheerful!

The Mighty Indian Rupee: A Story of Tradition and Transformation

The Indian Rupee (INR), the official currency of India, has a rich history that stretches back centuries. Its symbol, ₹, is a beautiful blend of the Devanagari letter 'Ra' and the Roman letter 'R'. It was officially adopted in 2010, adding a distinct identity to India's financial power.

The Rupee is subdivided into 100 paise. You'll commonly encounter coins in denominations of 1, 2, 5, and 10 rupees. Banknotes come in denominations of ₹10, ₹20, ₹50, ₹100, ₹200, ₹500, and ₹2000 (though the ₹2000 note is being phased out). The design of Indian currency often features portraits of Mahatma Gandhi and significant landmarks or cultural motifs, making them a miniature canvas of India's heritage.

India's economy is a fascinating mix of traditional sectors and a rapidly growing modern economy, driven by services and technology. This dynamic can influence the Rupee's performance on the global stage.

What Makes the AUD/INR Rate Dance?

So, what's behind the curtain, pulling the strings of the AUD to INR exchange rate? It’s a complex tango of factors:

- Economic Performance: This is the big one. Strong economic growth in either Australia or India tends to strengthen their respective currencies. If Australia’s economy is booming with high exports and low unemployment, the AUD might rise against the INR. Conversely, if India’s GDP is soaring, the INR might strengthen.

- Interest Rates: Central banks, like the Reserve Bank of Australia (RBA) and the Reserve Bank of India (RBI), set interest rates. Higher interest rates in one country can attract foreign investment seeking better returns, thereby increasing demand for that country's currency and pushing its value up.

- Inflation: High inflation erodes the purchasing power of a currency. If India experiences higher inflation than Australia, the INR might weaken against the AUD, as it takes more rupees to buy the same amount of goods.

- Trade Balance: Australia’s trade surplus (exporting more than it imports) can boost the AUD. India’s trade deficit might put downward pressure on the INR.

- Geopolitical Events: Global events, political stability, and even natural disasters can cause market uncertainty, leading investors to flock to perceived 'safe-haven' currencies or away from riskier ones.

- Commodity Prices: As a major commodity exporter, Australia's currency is particularly sensitive to global commodity prices. A spike in gold or iron ore prices could send the AUD soaring.

- Market Sentiment: Sometimes, it’s simply about what traders think will happen. Fear or optimism can drive currency movements, creating short-term fluctuations.

Navigating the Exchange Rate Maze: Practical Tips

Alright, enough theory! Let's get practical. How can you make this knowledge work for you?

When Travelling from India to Australia:

1. Monitor the Rate: Before you even book your flights, keep an eye on the AUD/INR rate. If it’s favourable, consider exchanging some of your money in advance. Many online currency exchange services offer better rates than airport kiosks.

2. Use a Travel-Friendly Credit/Debit Card: Look for cards that offer low or no foreign transaction fees. Some cards also offer competitive exchange rates automatically.

3. Consider a Multi-Currency Account: Services like Wise (formerly TransferWise) or Revolut allow you to hold money in multiple currencies and exchange it at near-market rates when you need it.

4. Avoid Airport Exchanges: As a general rule, airport currency exchange booths offer the worst rates. It’s a convenience fee you’ll definitely feel in your wallet.

5. Factor in Hidden Costs: Beyond the headline rate, be aware of potential transfer fees or commissions charged by banks or exchange services.

When Sending Money to India from Australia (or vice versa):

1. Compare Providers: Don't just go with your bank. Online money transfer services are often cheaper and faster. Compare rates and fees across platforms like Wise, Remitly, Western Union, or your bank’s international transfer service.

2. Look for Promotions: Many services offer first-time transfer fee waivers or better rates for new customers.

3. Understand the Transfer Time: Some services offer instant transfers, while others might take a few business days. Factor this into your needs.

4. Check the Recipient’s Options: Ensure the recipient can easily receive the funds, whether through bank deposit, cash pickup, or mobile wallet.

A Little Fun with Numbers: The Power of a Slight Shift

Let's say you're planning a trip to Australia and need to exchange ₹1,00,000.

If the rate is 1 AUD = 55 INR:

₹1,00,000 / 55 = ~AUD 1,818

Now, imagine the rate shifts slightly to 1 AUD = 54 INR (meaning the Rupee has weakened relative to the AUD):

₹1,00,000 / 54 = ~AUD 1,851

That’s an extra AUD 33 in your pocket! It might not sound like a fortune, but imagine this on a larger scale or over multiple transactions. Those few rupees can translate into an extra meal, a special souvenir, or even a short local tour. It’s a gentle reminder that even small fluctuations can add up.

And on the flip side, if the rate moves to 1 AUD = 56 INR (meaning the Rupee has strengthened):

₹1,00,000 / 56 = ~AUD 1,785

You’d have AUD 33 less. See? It’s a constant dance, and staying informed helps you waltz with it, not stumble!

The Cultural Connection

The exchange rate isn't just about numbers; it’s about connections. It links people, economies, and dreams across continents. When you're in Australia, enjoying a flat white from a trendy cafe in Melbourne or marveling at the Twelve Apostles, remember that the cost of that experience is shaped by the AUD/INR rate. Similarly, when you're enjoying a vibrant Indian festival or indulging in delicious street food in Delhi, the purchasing power of your Australian Dollars is a reflection of this global financial interplay.

Think about the joy of sending a gift to a relative in India from Australia. A well-chosen present, coupled with a favourable exchange rate, can amplify the happiness it brings. It’s about bridging distances, not just financially, but emotionally too.

A Short Reflection

In our fast-paced lives, it’s easy to get lost in the daily grind. But taking a moment to understand something like the AUD to INR exchange rate can be surprisingly grounding. It’s a small window into the interconnectedness of our world, a reminder that what happens in one corner of the globe can ripple outwards, affecting our ability to connect, to travel, and to dream. So, the next time you see those numbers flashing on a screen, don't just see figures. See the possibilities, the journeys, and the human connections they represent. It’s all part of the grand, unfolding story of our global village.

Stay curious, stay informed, and may your exchange rates always be in your favour!