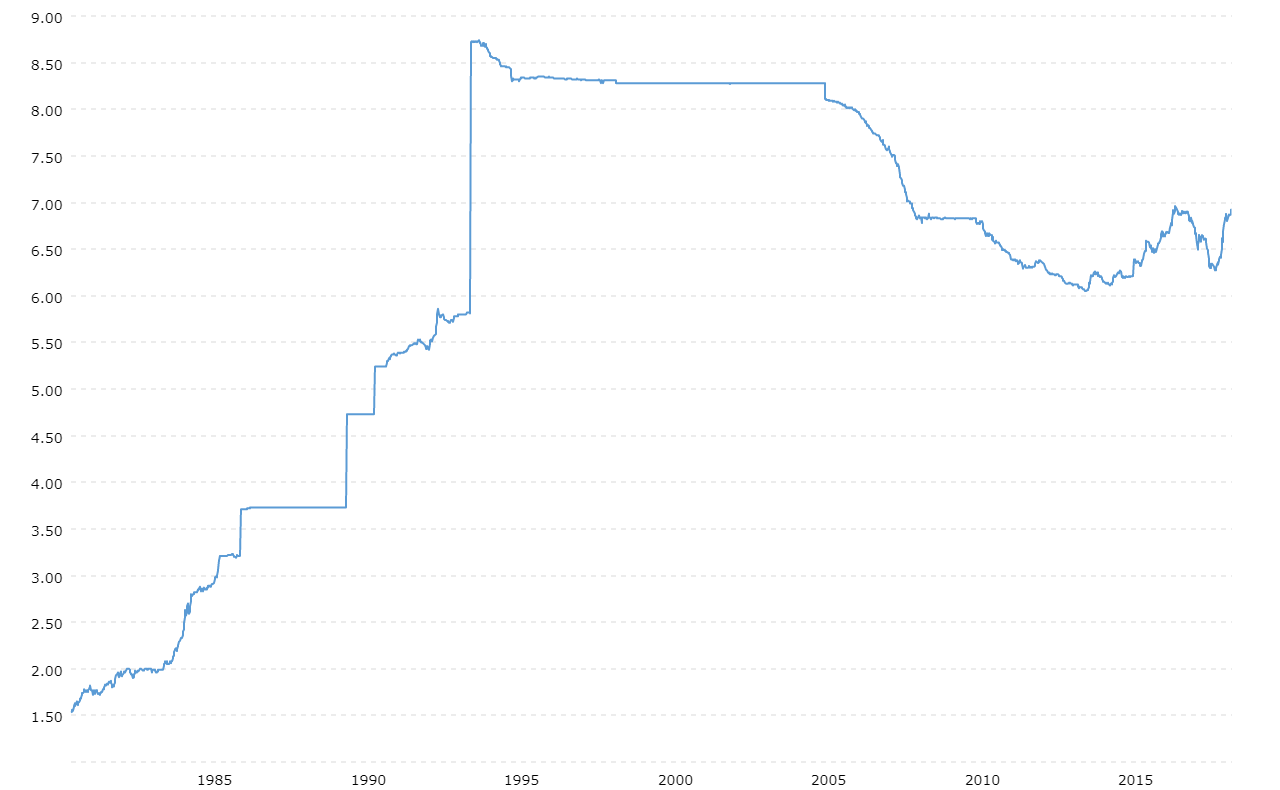

Exchange Rate Of Us Dollar And Chinese Yuan

So, I was at this little souvenir shop in Beijing a few years back, right? Looking for a ridiculously oversized "I Heart BJ" t-shirt (don't judge me), and the vendor quoted me a price in Yuan. I, being the typical American tourist with my head firmly in dollars, just nodded blankly. Then, I pulled out my phone, frantically trying to do the math in my head. Was it 6 Yuan to a dollar? 7? 8? The vendor patiently waited, a slight smile playing on his lips, probably used to us bewildered foreigners. It felt like a little riddle, a tiny economic puzzle I was failing miserably at. He ended up just taking my dollar bill and handing me back a bunch of change, probably a pretty good deal for him, let's be honest. That little exchange, as mundane as it was, really stuck with me. It was my first real encounter with the concept of the exchange rate between the US Dollar and the Chinese Yuan, and let me tell you, it’s a lot more complex than just converting t-shirt prices.

And that, my friends, is where we're diving in today. The fascinating, sometimes infuriating, and always important world of the US Dollar and the Chinese Yuan exchange rate. You see it in the news, you hear about it during trade talks, and it secretly impacts your online shopping sprees. It’s like this invisible hand guiding global commerce, and understanding even a little bit of it can feel pretty empowering. Think of it as a secret handshake with the global economy, and we're about to learn the moves.

The Dollar vs. The Yuan: A Tale of Two Titans

Alright, let’s get down to brass tacks. We’re talking about two of the world’s most influential currencies. The US Dollar (USD), long considered the world’s reserve currency, meaning it's held in significant quantities by central banks and used in international trade. It’s the… well, the king, for lack of a better word, of the global financial stage. It’s stable (mostly), widely accepted, and has a history that’s a bit like a comfortable old armchair – familiar and reliable.

Then there’s the Chinese Yuan (CNY), also known as the Renminbi (RMB). Now, the Yuan is a different beast entirely. It’s the currency of the world’s second-largest economy, and its influence is growing faster than a teenager during a growth spurt. For a long time, China kept a pretty tight grip on its currency’s value, which, and here’s where things get interesting, had a significant impact on how it traded with the rest of the world. Imagine trying to negotiate a price when one party has all the leverage to set their own terms – that was a bit like the situation for years.

Why Does This Exchange Rate Even Matter? (Besides My T-Shirt Debacle)

Okay, so beyond the personal embarrassment of not being able to calculate currency on the fly, why should you, sitting there with your coffee (or maybe tea, depending on your vibe today), care about the USD/CNY exchange rate? Well, it’s like the temperature gauge for global economic health, and it affects a surprising number of things.

For the US: When the Yuan is weaker relative to the Dollar, it means American goods become more expensive for Chinese buyers. This can hurt US exports. Conversely, if the Yuan strengthens, US goods become cheaper for China, which is generally good for American businesses wanting to sell there. On the flip side, for us as consumers, a stronger Dollar means imported goods from China (think electronics, clothes, toys – you name it!) become cheaper. That’s why you might see prices fluctuate on your favorite online stores. It’s not magic, folks, it’s the exchange rate!

For China: A weaker Yuan makes Chinese exports more competitive on the global market. This has historically been a key part of their economic growth strategy – making their products affordable and abundant. However, a Yuan that’s too weak can also lead to inflation within China and make imported goods more expensive for Chinese consumers and businesses. When the Yuan strengthens, it can make it harder for Chinese companies to export as much, but it also makes importing raw materials and technology cheaper, which can be beneficial for their own industrial development.

Globally: Because both the US and China are economic giants, their currency relationship impacts the entire global trade system. It influences commodity prices (like oil), investment flows, and even the competitiveness of other countries. It’s a bit like when two popular kids in school have a fight – everyone else notices!

The Art of Currency Control: China's Long Game

This is where things get really interesting. For a long time, China didn't just let its currency float freely on the market like most major economies. They managed it. This is called a managed float or, in earlier days, a more rigid peg to the US Dollar. What does this mean in plain English? It means the People's Bank of China (PBOC) had a lot of say in where the Yuan’s value stood.

Imagine you have a really valuable collectible. You wouldn't just toss it out for whatever anyone offered, right? You’d want to control its value to get the best return. China’s approach was similar. By keeping the Yuan relatively undervalued for extended periods, they made their manufacturing sector incredibly competitive. Factories could produce goods cheaply, and because those goods were priced attractively due to the favorable exchange rate, they sold like hotcakes worldwide.

But this strategy wasn't without its critics. Many countries, especially the US, argued that this manipulation gave China an unfair trade advantage. They claimed it hurt American manufacturers and led to job losses. It became a major point of contention in trade negotiations. You’d hear politicians huffing and puffing about how China was "playing currency games." Sound familiar?

The PBOC would intervene in the foreign exchange market by buying or selling dollars and Yuan to keep the rate within their desired band. If the Yuan started to strengthen too much, they’d sell Yuan and buy dollars. If it weakened too much, they’d do the opposite. It was a delicate balancing act, and for years, they got pretty good at it.

The Shift: Towards a More Market-Driven Yuan

However, the global economic landscape is constantly shifting, and China's economic power has also evolved. As China's economy matured and became more sophisticated, and as its companies started to invest more globally, there was increasing pressure, both internal and external, for the Yuan to become a more freely traded currency. Think of it as a kid growing up and wanting more independence. They don't want their parents making every single decision anymore.

Over the past decade or so, we’ve seen China gradually allow the Yuan to move more freely. They've introduced new trading mechanisms and adjusted their reference rates. The daily fixing of the Yuan's central parity rate against the US Dollar, set by the PBOC, is still a key factor, but the market now plays a larger role in determining its day-to-day fluctuations. It's not a full free float like the US Dollar, but it's a significant step towards greater market determination.

This shift has been driven by several factors: the desire to have the Yuan recognized as a major international currency (even aiming for inclusion in the IMF’s Special Drawing Rights basket, which it achieved!), the need for more flexible monetary policy, and the fact that a constantly undervalued currency can lead to asset bubbles and other economic distortions. Plus, let’s be real, the world was getting tired of the constant accusations. It’s like trying to keep a lid on a boiling pot – eventually, it’s going to overflow.

What Drives the Rate Today? A Million Little Factors

So, if China isn't strictly controlling the rate anymore, what is? Well, it's a complex dance of supply and demand, influenced by a dizzying array of factors. And honestly, sometimes it feels like predicting the weather in unpredictable climes. Here are some of the big players:

- Interest Rate Differentials: This is a huge one. If US interest rates are higher than Chinese rates, investors might be more inclined to hold US Dollars to earn that higher yield, increasing demand for USD and putting downward pressure on the Yuan. And vice-versa. It’s like a global treasure hunt for the best returns.

- Economic Growth: Strong economic growth in either country tends to strengthen its currency. If the US economy is booming, people want dollars. If China's economy is on fire, the Yuan often benefits. It’s a sign of confidence.

- Trade Balances: A country that exports more than it imports typically sees its currency strengthen because there's higher demand for its goods, and thus its currency. This is the classic engine of currency strength for export-driven economies.

- Inflation: High inflation in a country can erode the purchasing power of its currency, leading to depreciation. If prices are soaring in the US, the Dollar might weaken.

- Geopolitical Stability: Nobody likes investing in a country embroiled in conflict or uncertainty. Political stability and strong institutions are attractive to foreign investors, boosting demand for the currency. Think of it as the ultimate "safe haven" currency.

- Capital Flows: When foreign investors want to invest in a country's stocks, bonds, or real estate, they need to buy that country's currency, increasing its demand. The opposite is true when domestic investors want to invest abroad.

- Market Sentiment and Speculation: This is the fuzzy, often irrational part. If traders believe the Yuan is going to weaken, they might sell it, causing it to weaken. It’s a bit like a self-fulfilling prophecy sometimes.

- Government Intervention (Still!): While not as heavy-handed as in the past, central banks can still step in to manage extreme volatility or achieve specific economic goals. They're not completely out of the picture.

It’s a constant push and pull. One factor might be pushing the Yuan up, while another is pulling it down. It’s this intricate interplay that makes the exchange rate so dynamic. And honestly, trying to predict it with 100% accuracy is a fool's errand. Even the experts get it wrong!

The Yuan's Journey to International Prominence

One of the biggest stories in the last decade has been China’s push to make the Yuan a more significant player on the global stage. They want it to be used more in international trade and finance, challenging the Dollar’s dominance. This isn't just about national pride; it’s about giving China more influence and reducing its reliance on the US Dollar.

This effort involves several key strategies. Firstly, encouraging trade settlement in Yuan. Instead of companies having to convert Yuan to Dollars to pay for imports or exports, they can increasingly do so directly in Yuan. Secondly, promoting the Yuan as an investment currency. This means making it easier for foreigners to invest in Chinese financial markets and for Chinese investors to invest abroad using Yuan.

The big milestone was the International Monetary Fund (IMF) including the Yuan in its Special Drawing Rights (SDR) basket in 2016. The SDR is an international reserve asset, and its inclusion signaled a growing acceptance of the Yuan as a major global currency. It was a massive win for China, a testament to their economic progress and their strategic maneuvering.

This push for internationalization means that the Yuan's exchange rate will likely continue to be a topic of global importance. As more countries and businesses use the Yuan, its value will become more sensitive to a wider range of international economic and financial factors, moving away from being solely dictated by domestic Chinese policies or bilateral US-China relations.

The Future: What's Next for USD/CNY?

So, where does this leave us? The USD/CNY exchange rate is no longer a simple matter of the US Dollar being the undisputed global heavyweight and the Yuan being a tightly controlled challenger. It’s evolving.

We're likely to see a continued trend towards a more market-determined Yuan, although it's highly unlikely to be a completely free float anytime soon. China still values a degree of control to manage its economic transition and prevent excessive speculation. Expect the PBOC to remain an active player, guiding the Yuan’s path.

The US Dollar's role as the world's reserve currency is also being tested, not just by the Yuan, but by a general trend towards currency diversification. However, the Dollar’s deep liquidity, the size and openness of US financial markets, and its historical inertia mean it's not going to be dethroned overnight. It’s like an aging monarch – still in charge, but the younger generation is definitely making its presence felt.

For us, as consumers and observers, understanding the nuances of the USD/CNY exchange rate is becoming increasingly important. It affects the prices of goods we buy, the profitability of companies we might invest in, and the broader global economic narrative. It’s not just about funny numbers on a currency converter anymore; it’s a window into the shifting balance of global economic power.

And who knows, maybe the next time I’m in Beijing looking for that questionable t-shirt, I’ll be able to do the math in my head a lot faster. Or maybe I’ll just keep paying with my card and let the banks sort out the mess. Either way, it’s a journey worth paying attention to. The relationship between the Dollar and the Yuan is a defining economic story of our time, and it’s still very much being written. So, buckle up, folks!