Exchange Rate Us Dollar To Indian Rupees History: Complete Guide & Key Details

Hey there, global adventurers and finance curious folks! Ever find yourself gazing at your travel brochure, dreaming of vibrant Indian bazaars or perhaps pondering an investment across the ocean? If so, you've probably bumped into a rather important, and dare I say, fascinating number: the exchange rate between the mighty US Dollar and the colorful Indian Rupee. Sounds a bit dry, right? Wrong! This little number is like the secret handshake of international trade and travel, and understanding it can actually make your life a whole lot more fun!

Think of it this way: that exchange rate? It's the key that unlocks doors to new experiences, savvy savings, and even a bit of financial wizardry. And guess what? Learning about its history isn't like wading through a dusty old textbook. Oh no, it's more like uncovering a hidden treasure map, revealing how the world of money has danced and twirled over the years. So, grab a chai (or a coffee, no judgment!), and let's dive into the wonderful world of USD to INR!

The Dollar and the Rupee: A Love Story (Mostly!)

Our story begins, as many good stories do, with a bit of history. For ages, the world's currencies have been like a big, boisterous family, each with its own personality. The US Dollar, for a long time, has been the popular kid in class, the one everyone looks up to. The Indian Rupee, on the other hand, has its own rich heritage, deeply intertwined with India's economic journey. Their exchange rate is basically how these two pals decide to play with each other financially.

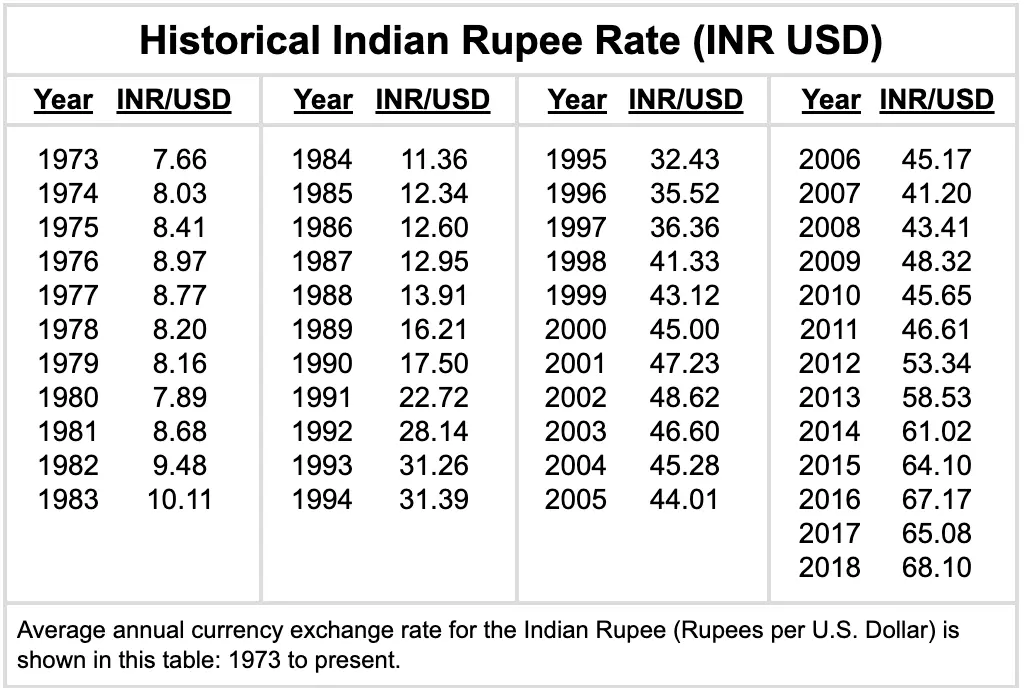

Back in the day, and we're talking way back, exchange rates were often fixed, like a strict parent setting the rules. But then, the world got a bit more adventurous! We saw shifts, fluctuations, and a whole lot of economic ballet. It's been a journey, from gold standards to floating rates, and each step tells a story about what was happening in both America and India, and indeed, the wider world.

When the Dollar Was King (and the Rupee Followed Suit)

In the not-so-distant past, you'd find that the exchange rate was often pegged, meaning it was tied to a fixed value, often the US Dollar itself or even gold. Imagine this: for a long time, the Indian Rupee had a pretty stable relationship with the Dollar. If you were a traveler or a business person back then, things were relatively predictable. You knew that a certain amount of Rupees would always get you a certain amount of Dollars, and vice-versa. It was like having a reliable compass.

However, as economies evolve and global events unfold, these rigid systems can start to feel a bit… restrictive. Countries want the flexibility to manage their own economies, to respond to inflation, growth, and all sorts of economic ups and downs. And that's where things started to get more interesting!

The Great Float: When Currencies Got Their Freedom!

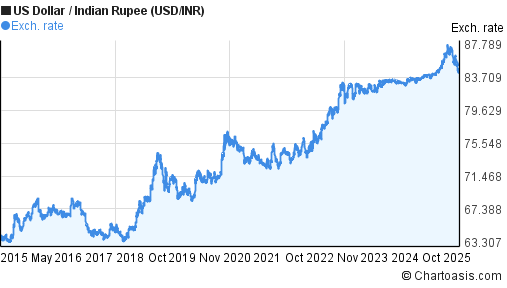

Fast forward to the latter half of the 20th century, and the world started to embrace a more flexible approach. This is when the concept of a "floating exchange rate" really took off. Think of it like letting your kids go play in the park unsupervised for the first time – a little scary, but also exciting and full of potential! For the USD to INR, this meant that the value of the Rupee against the Dollar wasn't fixed anymore. It started to move, up and down, based on supply and demand, just like any other commodity in the market.

What drives these fluctuations? Oh, a whole bunch of things! Economic growth in India, interest rate changes in both countries, political stability (or instability!), trade balances, and even global sentiment can all play a role. It’s like a complex recipe where every ingredient affects the final taste.

Key Details to Keep Your Eyeballs On!

So, what are the key details that you, as a smart and curious individual, should be aware of? It's not just about the current number; it's about understanding the forces behind it.

- Economic Performance: When India's economy is booming, its currency, the Rupee, tends to strengthen. More jobs, more investment, more demand for Rupees – you get the picture! Conversely, if the US economy is doing exceptionally well, the Dollar might get a boost.

- Interest Rates: Central banks in both countries play a huge role. If India raises its interest rates, it can attract foreign investment, making the Rupee more attractive. The same logic applies to the US Federal Reserve. It’s all about making your money work harder!

- Inflation: High inflation in one country can erode the value of its currency. So, if India is battling inflation, its Rupee might weaken against the Dollar, assuming the US has better inflation control.

- Trade and Capital Flows: When India exports more than it imports, there's more demand for the Rupee. Similarly, foreign investment flowing into India will boost the Rupee. It’s a constant give and take!

- Global Events: Don't forget the big picture! Geopolitical tensions, oil prices, and major global economic shifts can all send ripples through currency markets.

Why Does This Even Matter to You?

Okay, okay, you’re thinking, "This is all very interesting, but how does it make my life more fun?" Ah, my friend, this is where the magic happens! Knowing the exchange rate history and its drivers can unlock a world of opportunities:

- Savvy Travel Planning: Want to plan that dream trip to India? Understanding the historical trends and current rates can help you decide the best time to go to get more for your travel budget. A stronger Rupee against the Dollar means your Dollars go further! Imagine more shopping, more delicious street food, and more incredible experiences!

- Smart Investments: Are you considering investing in Indian stocks or real estate? Understanding currency fluctuations is crucial for maximizing your returns. You might be able to buy low and benefit from a favorable exchange rate when you eventually convert your profits back.

- International Online Shopping: Ever found that perfect item on an Indian website, only to be put off by the conversion? Knowing how the rates have moved can give you confidence in your purchases.

- Just Plain Cool Conversations: Impress your friends at your next get-together with your newfound knowledge of international finance! Who knows, you might even start a trend.

The Unpredictable Dance Continues!

The beauty of the USD to INR exchange rate is that it's not static. It's a living, breathing entity, constantly reacting to the world around it. While it's impossible to predict with 100% certainty, understanding the historical context and the factors that influence it gives you a powerful advantage. It's like being a detective, piecing together clues to understand the market's next move.

So, the next time you see that exchange rate, don't just see a number. See a story. See an opportunity. See the vibrant tapestry of two economies intertwined. The journey of the US Dollar and the Indian Rupee is a testament to global interconnectedness and the ever-evolving nature of finance.

And remember, the more you learn, the more empowered you become. So, go forth! Explore the charts, read the news, and let this knowledge spark your curiosity. Who knows what exciting adventures and smart decisions await you simply by understanding the fascinating dance between the Dollar and the Rupee? Happy exploring!