Explain The Role And Importance Of The Promissory Note.: Complete Guide & Key Details

Hey there! So, let’s chat about something that sounds super official but is actually, like, your best buddy when money is involved. We’re talking about the promissory note. Ever borrowed money from a pal? Or maybe lent some out? Well, even in those casual situations, a promissory note is kind of the grown-up way of saying, "I promise to pay you back, and here are the deets!"

Think of it like this: you know how when you bake cookies, you follow a recipe? A promissory note is basically the recipe for repaying a loan. It’s not some scary, legal jargon monster designed to trip you up. Nope! It’s actually a super helpful tool to keep everyone on the same page. Imagine a world without it! Chaos, right? People forgetting, arguments, awkward family dinners… we don’t want that.

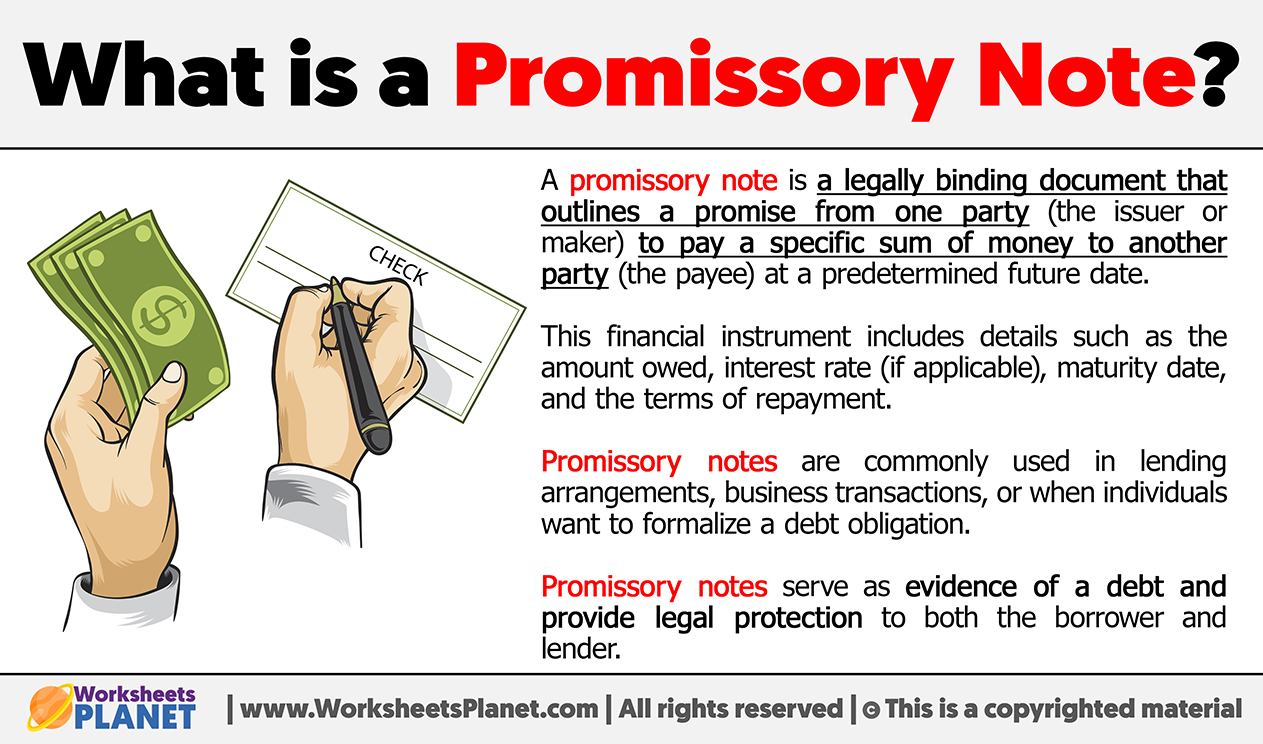

So, what is this thing, really? At its heart, a promissory note is a written promise from one person (the borrower) to another (the lender) to repay a specific sum of money. It’s like a fancy IOU, but with way more details and, you know, a bit more gravitas. It’s the backbone of many lending transactions, from your Uncle Bob lending you cash for that killer vintage motorcycle to big banks giving out mortgages. Seriously!

The Awesome Sauce of the Promissory Note

Why is this piece of paper (or digital document, these days!) so important? Oh, let me count the ways! It's like the unsung hero of financial fairness. Without it, things could get messy. Really messy.

First off, it provides clarity. Absolute, sparkling clarity. No more "Was it $500 or $1000?" debates. It lays out exactly how much is owed. This is crucial for both parties. The borrower knows their obligation, and the lender knows what they're getting back. It's like having a contract for your couch-surfing friend who owes you for all those pizza deliveries – but for actual money!

Then there’s the proof factor. Ever tried to prove you lent someone money without anything in writing? Good luck with that! A promissory note is solid evidence. It’s your best friend if things go south and you need to, you know, enforce the repayment. It’s the paper trail that says, "See? This is what we agreed upon!" It’s a shield, a sword, and sometimes, the only thing standing between you and financial frustration.

It also sets expectations. When will the money be paid back? In one lump sum? In installments? Will there be interest? All of this needs to be hammered out, and the promissory note is where it all gets written down. This prevents misunderstandings, which, let's be honest, are the bane of any relationship, especially when money is involved. You don't want your friend ghosting you because they forgot about that loan you gave them for their artisanal pickle business, do you?

And for lenders, especially businesses or banks, it’s legally binding. This means if the borrower doesn't hold up their end of the bargain, the lender has legal recourse. They can’t just shrug and say, "Oops, my bad!" The note is the document that empowers them to take further action. It’s their ticket to getting their hard-earned cash back.

Think about it this way: you wouldn't build a house without blueprints, right? A promissory note is the blueprint for a loan repayment. It ensures everyone is working from the same plan and understands the structure of the deal. Without it, the whole thing could crumble. And nobody wants a loan that's structurally unsound. Ew.

The Nitty-Gritty: What’s Inside This Magical Document?

Okay, so you’re convinced it’s important. But what actually goes into a promissory note? What are the key ingredients? It’s not just a scribble on a napkin, folks! There are some essential components that make it legit and functional.

The Principal Amount: The Big Kahuna!

This is the most obvious part, right? It's the actual amount of money being borrowed. This needs to be clearly stated. No "about" or "roughly." We're talking specifics here. For example, "$5,000" is good. "$5,000.00" is even better. Precise! It’s the foundation of the whole loan. Get this wrong, and you’re starting off on shaky ground. Like building a skyscraper on quicksand. Not ideal.

The Lender and Borrower: Who’s Who?

You need to know exactly who is giving the money and who is receiving it. Their full legal names and addresses should be included. This is crucial for identification. It’s like making sure you’re sending a package to the right person, not just some random stranger. You don't want to be chasing down your money from someone you didn't even lend it to, or worse, someone who claims they never got it because their name was misspelled!

The Repayment Terms: The Game Plan

This is where the magic really happens. How is this money going to be paid back? This section is like the detailed itinerary for your loan's journey. It can include:

Payment Schedule: When is the Dough Coming Back?

Is it a single payment on a specific date? Or are we talking installments? Monthly? Weekly? Bi-weekly? The note needs to clearly outline this. For example, "The borrower agrees to repay the principal amount in twelve (12) equal monthly installments of $450.00, commencing on October 1, 2023, and continuing on the first day of each month thereafter until the principal and interest are paid in full." See? Specific! No room for "Oh, I thought I had another month."

Due Date(s): The Finish Line

If it’s a lump sum, when is that big payment due? If it’s installments, when is the last installment due? This is the ultimate deadline. It’s the day the borrower officially breathes a sigh of relief (or the lender celebrates getting their money back!).

Interest Rate: The Cost of Borrowing

This is a big one, especially for larger loans or if there’s a significant time period involved. Is there interest being charged? If so, what's the rate? Is it simple interest? Compound interest? Is it a fixed rate or variable? This needs to be crystal clear. If there’s no interest, the note should ideally state that to avoid any assumptions. Imagine someone expecting interest and you thought it was interest-free! Awkward!

Late Fees and Penalties: The "Oops, I Forgot!" Clause

What happens if a payment is late? Most promissory notes include clauses for late fees. This is a little incentive for the borrower to pay on time. It’s usually a percentage of the late payment or a fixed amount. This can help compensate the lender for the inconvenience and potential financial loss due to the delay. It's the gentle nudge that says, "Don't be late!"

Signatures: The Official Stamp of Approval

This is the part that makes it official. Both the borrower and the lender (or their authorized representatives) need to sign the promissory note. Some notes might also require witnesses or a notary public. This is their way of saying, "Yep, this is me, and I agree to this!" It’s the ultimate commitment. Like signing a marriage license, but for money. Slightly less romantic, perhaps, but arguably more practical in the long run.

Other Important Details (The "Bonus Features")

Beyond the core stuff, there are a few other things that can make a promissory note even more robust. Think of these as the upgrade options!

Collateral: The Safety Net (Sometimes)

For larger loans, especially mortgages or business loans, the lender might require collateral. This is an asset (like a house or a car) that the borrower pledges as security for the loan. If the borrower defaults, the lender can seize the collateral to recover their losses. This makes the loan less risky for the lender. It’s like a backup plan for when the main plan goes… well, sideways.

Default Clause: What Happens When Things Go Wrong

This outlines what constitutes a "default" (e.g., missing multiple payments, declaring bankruptcy) and what the lender's rights are in such a situation. It clarifies the steps the lender can take to recover the money. It's the "what if" scenario, and it's super important to have it spelled out.

Acceleration Clause: The "Pay It All Now!" Option

This clause allows the lender to demand the entire outstanding balance of the loan be paid immediately if the borrower defaults. So, if you miss a few payments, suddenly the entire remaining amount is due. Ouch! This is a powerful tool for lenders.

Prepayment Clause: Paying it Off Early

Can the borrower pay off the loan early without penalty? Some notes allow this, while others might have a prepayment penalty to recoup some of the lost interest. It’s good to know if you can be a financial rockstar and pay it off ahead of schedule!

Governing Law: Which Rules Apply?

This specifies which state's or country's laws will govern the promissory note. This is important in case of legal disputes, as laws can vary significantly. It’s like choosing the referee for your money game.

When Do You Actually Need a Promissory Note?

You might be thinking, "Okay, this sounds useful, but when do I really need one?" Honestly? Pretty much anytime money is exchanged with a promise to repay.

Personal Loans: Lending money to friends or family. Even if you trust them immensely, a promissory note can prevent awkwardness down the line. It formalizes the agreement and protects both parties. It’s the responsible way to be a good friend and a smart lender.

Student Loans: These are classic examples of promissory notes in action. You’re promising to repay the educational institution or government body. They're pretty much packed with all the clauses we've discussed!

Mortgages: When you buy a house, the mortgage agreement is essentially a very complex promissory note, backed by the property itself (collateral!).

Car Loans: Similar to mortgages, your car is usually the collateral for the loan, and the loan agreement is a promissory note.

Business Loans: From small startups to larger enterprises, businesses rely heavily on promissory notes for various lending scenarios.

Real Estate Investments: When you're buying or selling property, seller financing often involves a promissory note.

Even for smaller amounts, if you're lending a significant sum to someone who isn't a close family member, a simple promissory note can be a lifesaver. It’s better to have a clear agreement upfront than to deal with a strained relationship and financial woes later.

Drafting Your Own: DIY or Professional?

Now, can you just whip up a promissory note yourself? Well, yes and no. For very simple, informal loans between close friends or family, a basic, clearly written document might suffice. You can find templates online. But here’s the catch: these templates might not cover all the nuances or comply with the specific laws in your area.

For anything involving a substantial amount of money, complex terms, or if you want absolute peace of mind, it’s always best to consult with a legal professional or use a reputable legal document service. They can ensure the note is legally sound, tailored to your specific situation, and protects your interests. It’s an investment in preventing future headaches, and trust me, that’s priceless.

Think of it like this: you can totally try to fix your own leaky faucet, but if you're not handy, you might end up with a flooded bathroom. Hiring a plumber is often the smarter move. Same principle applies here. Better safe than sorry, as they say!

So, there you have it! The humble, yet mighty, promissory note. It might not be the most exciting document you'll ever encounter, but it's a fundamental tool for responsible borrowing and lending. It’s the quiet guardian of financial agreements, ensuring that promises made are promises kept. And in the world of money, that's a really, really big deal. Keep it in mind next time you're about to lend or borrow, and you'll be doing yourself (and your wallet!) a huge favor. Cheers!