Fha And Va Mortgage Delinquencies Are Increasing Rapidly: Complete Guide & Key Details

Okay, so get this! You know how sometimes things in the news can sound a little… scary? Like, "Oh no, what's happening?!" Well, today we're going to chat about something that might sound a bit serious at first, but trust me, it's actually pretty interesting, and understanding it could even be a tiny bit empowering. We're diving into something called FHA and VA mortgage delinquencies. Sounds like a mouthful, right? But stick with me, because there's a cool story unfolding here!

Think of mortgages as the way most folks buy their dream homes. It’s like borrowing a huge chunk of money from a bank to make that dream a reality. Now, the FHA (that stands for the Federal Housing Administration) and the VA (which is for our amazing Veterans Affairs) are like special helpers for certain groups of people. The FHA helps people who might have a bit of a tricky credit score or not a ton of money saved for a down payment. And the VA? Well, they’re all about helping our heroes, our veterans and military families, get into homes.

So, what’s this “delinquency” business? It’s basically a fancy way of saying when someone is a little bit late on their mortgage payment. Not a full-blown crisis, just a little hiccup. And here’s the juicy bit: lately, there’s been a bit of a jump, a rapid increase, in these little hiccups for FHA and VA loans. It’s like noticing a few more people stumbling on their way to the finish line. Why is this even a thing to talk about? Because it tells us something about what’s going on in the bigger picture of homeownership and the economy!

Imagine you’re watching a big game. You don’t just look at the score; you watch how the players are moving, what strategies they’re using. This increase in delinquencies is like seeing a change in how some players are performing. It’s not necessarily a sign that the whole game is over, but it’s definitely something to pay attention to. And what makes it special is that these loans, the FHA and VA loans, are designed to be lifelines. They open doors that might otherwise be closed for many families. So, when we see a change in how these lifelines are being used, it’s worth a closer look.

Now, before you start imagining doomsday scenarios, let’s keep our cool. This isn’t about anyone doing anything wrong. Life happens! Sometimes, unexpected bills pop up, jobs change, or maybe that car repair bill was just a little bigger than anyone planned. These are the kinds of things that can cause someone to be a bit late on their mortgage. And for those with FHA and VA loans, who might have been stretching a little to get into their homes in the first place, these little bumps can feel a bit bigger.

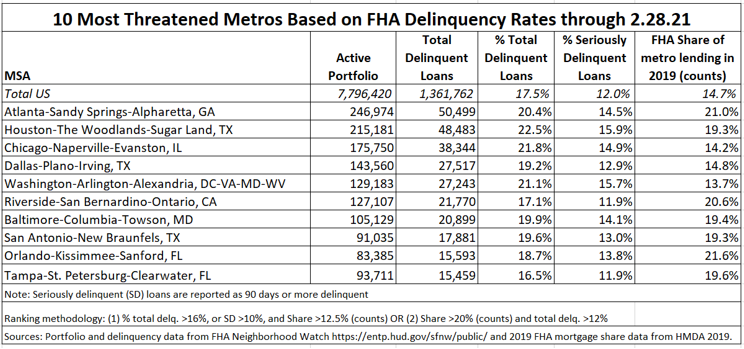

What’s particularly fascinating is the speed at which this is happening. It's not a slow, creeping change; it's more of a noticeable uptick. This rapid increase is what has experts and observers leaning in. It's like seeing a headline that catches your eye because it’s a bit different from the usual. It signals that there might be some underlying currents that are worth understanding. Think of it as a plot twist in a story you’re following!

So, what are the key details we should be aware of? Well, the government agencies that back these loans, like the FHA and the VA, are definitely keeping a close eye on this. They have systems in place to help people who are struggling. It’s not like they just say, "Tough luck!" They often have programs and options to assist homeowners. This is actually a really positive aspect of these loans – they come with a built-in safety net. This safety net is pretty special because it’s designed to help people stay in their homes during tough times.

"It's not just about the numbers; it's about the stories behind them. These are people's homes, their dreams."

And that’s what makes this topic so engaging, isn’t it? It’s about people, about families, about the fundamental human desire to have a place to call their own. The fact that these particular types of loans, which are crucial for so many, are showing this trend, makes it a story about accessibility and support. It highlights the importance of programs designed to help a wider range of people achieve homeownership.

Why should you care? Because understanding these trends helps you understand the world around you a little better. It might even make you think about your own financial journey or the journeys of people you know. It’s like getting a little peek behind the curtain of how the housing market works for everyday folks. And who doesn’t love a good peek behind the curtain?

The complete guide, in essence, is about recognizing that while these numbers might seem abstract, they represent real-life situations. The increase in FHA and VA mortgage delinquencies is a sign that the economic landscape is shifting, and it's impacting the very foundations of homeownership for many. It’s a story of challenges, yes, but also of resilience and the ongoing efforts to keep those dreams alive. So, next time you hear about these terms, remember there’s more to it than just jargon. There's a narrative of people striving for a home, and the systems in place trying to help them get there, even when things get a little bumpy.