First Advantage Debt Relief Consumer Reports Reviews: What To Expect (pros & Cons)

Ever feel like your debt is a mischievous gremlin that just won't leave you alone? You're not alone! Many of us have been there, staring at bills and wondering if there's a magical wand to make it all disappear. Well, not quite a wand, but there are companies that aim to help. Today, we're peeking behind the curtain at First Advantage Debt Relief, and yes, we're diving into what folks are saying about them in Consumer Reports reviews.

Think of this as a friendly chat about your financial sidekick. We're not just going to list dry facts. We're going to explore what makes checking out reviews for a debt relief company kinda like reading a fun, albeit serious, gossip column. You get the inside scoop, the good, the bad, and the "wait, what?!"

So, grab your favorite drink. We're about to unpack what First Advantage Debt Relief is all about, and what their Consumer Reports reviews are whispering. It's all about getting a clearer picture so you can make the best choices for your own money adventure. Let's get started on this financial exploration!

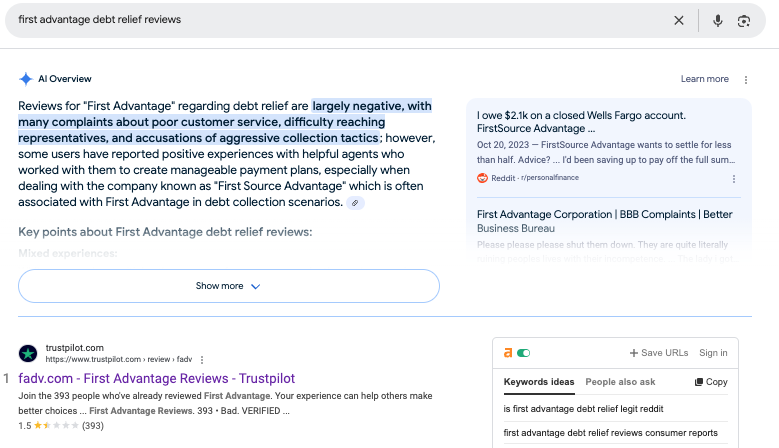

The Buzz About First Advantage Debt Relief

Alright, so who exactly is First Advantage Debt Relief? Imagine a helpful guide on your journey to ditching debt. They're a company that offers services designed to help you manage and potentially reduce what you owe. It's like having a navigator when you're feeling a bit lost on the open sea of finances.

Their main gig is to negotiate with your creditors on your behalf. This means they try to get your interest rates lowered or find a settlement for less than you originally owe. It's a process that can take time and a bit of effort, but the goal is to make your debt feel a whole lot more manageable. Think of them as your debt's new best (or maybe worst?) friend, depending on how you look at it!

The idea is to simplify things for you. Instead of juggling multiple payments and phone calls, you might make one payment to First Advantage Debt Relief, and they handle the rest. This can be a real relief for folks feeling overwhelmed. It’s like outsourcing the stress, which, let's be honest, sounds pretty appealing sometimes.

What the Consumer Reports Reviews Are Saying (The Good Stuff!)

Now for the juicy bits! Consumer Reports reviews are like the trusted friend who tells you honestly if that outfit looks good or if it's a fashion disaster. For First Advantage Debt Relief, the reviews often highlight some really positive aspects. People have found their services to be a genuine lifeline.

One of the most common compliments is about the feeling of regaining control. When debt weighs you down, it feels like a heavy blanket. Many users report that working with First Advantage Debt Relief helped them lift that blanket. They felt like they were finally making progress, which is a huge win in itself.

Another big plus often mentioned is the potential for savings. The core promise of debt relief is to save you money. Reviews frequently mention that First Advantage Debt Relief helped them achieve this by lowering interest rates and negotiating better terms. Imagine your debt shrinking faster than you thought possible – that’s the dream!

The customer service aspect also gets a nod. When you're dealing with something as sensitive as debt, you want to feel heard and supported. Many reviewers appreciate the helpfulness and understanding of the staff at First Advantage Debt Relief. It’s like having a friendly ear who knows exactly what they're talking about.

"It felt like a weight was lifted off my shoulders. I finally saw a light at the end of the tunnel." - A satisfied client, as per aggregated reviews

The transparency of the process is another common theme. While it's a complex journey, many users felt that First Advantage Debt Relief explained things clearly. They understood what was happening with their money and their creditors. This clarity is super important when you're entrusting your financial future to someone.

So, the good vibes from Consumer Reports reviews often center around reduced stress, actual financial savings, and feeling supported through the whole ordeal. It’s like getting a pat on the back and a roadmap all at once. For many, this has been the key to unlocking a debt-free future.

The Not-So-Great Stuff (The "Oops" Moments)

But wait, it can't all be sunshine and rainbows, right? Even the best services have their moments that leave people scratching their heads. When you're looking at Consumer Reports reviews for First Advantage Debt Relief, you'll find a few bumps in the road.

One common concern that pops up is the fees. Debt relief companies do have to make a living, of course. However, some reviews mention that the fees can add up and might feel a bit higher than anticipated. It’s like ordering a delicious meal, but then seeing the bill and doing a double-take.

There's also the element of time. Debt doesn't vanish overnight. While First Advantage Debt Relief aims to speed things up, some clients feel the process takes longer than they expected. Patience is definitely a virtue, but it's something to be prepared for.

Another point that sometimes surfaces is the impact on your credit score. While the goal is to improve your financial situation, the act of settling debts or closing accounts can temporarily affect your credit. It’s a bit of a trade-off, and some people are surprised by the short-term dip.

"I expected quicker results, and the fees were a bit more than I budgeted for." - A client's perspective found in reviews

Sometimes, communication can be an issue. While many praise the customer service, a few reviews hint at occasional difficulties in getting prompt responses or clear answers. It's like trying to reach someone on a busy day – you might have to wait a bit.

It’s important to remember that debt relief isn't a magic spell. It's a structured process. The "cons" you see in reviews are often about managing expectations and understanding the realities of financial restructuring. It’s like knowing that even the most exciting roller coaster has a few slow climbs.

What to Expect: Your First Advantage Roadmap

So, if you're thinking about taking the plunge with First Advantage Debt Relief, what's the actual journey like? Imagine it as a guided tour of your finances, with a helpful guide pointing out the sights and potential pitfalls.

First, you'll likely have an initial consultation. This is where you spill the beans about your debt – how much you owe, to whom, and what your current financial picture looks like. The team at First Advantage Debt Relief will then assess if their services are a good fit for you.

If you move forward, they'll start working on a plan. This might involve consolidating your debts, negotiating with your creditors, and setting up a repayment schedule. You'll then be making payments to First Advantage Debt Relief, who will disburse the funds to your creditors. It's like having a single point of contact for all your debt woes.

Throughout the process, you should expect to be involved. It's not a "set it and forget it" situation. You'll need to provide information, make your payments on time, and stay in communication. Think of it as a partnership for your financial well-being.

You should also brace yourself for the possibility of ups and downs. There might be moments of frustration, but also moments of triumph as you see your debt balance decrease. It’s a marathon, not a sprint, and First Advantage Debt Relief aims to be your trusty running coach.

The Verdict: Is It Worth a Look?

Here’s the million-dollar question: Is First Advantage Debt Relief worth exploring, especially with all the chatter in Consumer Reports reviews? The short answer is: it depends on your situation, but it's definitely worth considering.

If you're feeling crushed by debt and are looking for a structured way to tackle it, First Advantage Debt Relief could be a valuable tool. The positive reviews suggest that they can help people regain financial stability and save money in the long run. It's like finding a sturdy bridge over troubled financial waters.

However, it's crucial to go in with your eyes wide open. Understand the fees involved, the potential timeline, and the impact on your credit score. Don't expect instant miracles. Debt relief is a serious process that requires commitment from both you and the company.

Reading reviews, whether from Consumer Reports or other reputable sources, is your best bet. It's like getting intel before a big mission. Armed with that knowledge, you can have a more informed conversation with First Advantage Debt Relief and decide if they're the right partners for your debt-free journey. It’s about empowering yourself with information!