Goldman Sachs Q4 2023 Net Revenues Net Income Eps Roe: Complete Guide & Key Details

Alright folks, let's talk numbers. Not the kind of numbers that make you want to hide under your duvet, like the gas bill or that one time you accidentally ordered way too much online. No, we're diving into the world of Goldman Sachs and their big Q4 2023 report. Think of it like peeking behind the curtain of a fancy, super-secret cookie factory. What did they bake up in the last quarter? And more importantly, did it taste good?

Now, I know what you're thinking. "Goldman Sachs? Isn't that where people wear ridiculously expensive suits and talk in really serious voices about things I don't understand?" You're not wrong! But at its core, it's just a bunch of really smart people trying to make money. And when they report their earnings, it’s a bit like your favorite sports team giving you an update on their season. Did they win? Did they score a lot? Are they planning for the next big game? We’re going to break down their Net Revenues, Net Income, EPS, and ROE in a way that hopefully makes your brain do a little happy dance instead of a full-on sprint for the exit.

The Big Picture: How Goldman Sachs Did in Q4 2023

So, the headline figures are in, and it’s time to see if the wizards at Goldman Sachs pulled off some financial magic. Think of this as the annual report card, but for a giant, well-oiled money-making machine. They’ve been busy, that’s for sure. The last few months of 2023 were a whirlwind, and like everyone else, they had to navigate the ups and downs of the economy. Sometimes it feels like riding a rollercoaster with your eyes closed, right? You’re not quite sure when the drop is coming, but you’re hoping for a smooth ride.

When we talk about Net Revenues, that’s basically the total amount of money they brought in after paying for some of the direct costs of doing business. It’s like the total sales from all the lemonade stands you’ve ever run, minus the cost of the lemons and sugar. For Goldman Sachs, this covers a whole buffet of services – investment banking, trading, wealth management, you name it.

Then there’s Net Income. This is the real bottom line. After they’ve paid all their bills – salaries, rent, taxes, the fancy coffee machines – this is what’s left over. It’s the profit. The money they can decide what to do with. Imagine you’ve sold your amazing homemade cookies at the bake sale. Net Revenue is the cash in your hand from sales. Net Income is what you have left after buying more flour, sugar, and maybe even a new apron.

Decoding the Jargon: What Exactly Are These Fancy Letters?

Okay, let’s tackle those acronyms that sound like they belong in a secret agent briefing. Don’t worry, we’ll translate them into plain English. Think of these as the specific metrics that tell us how well they’re performing, not just if they’re performing.

Earnings Per Share (EPS): The Cookie Crumble Per Person

EPS, or Earnings Per Share, is a really important one. It tells you how much of the company’s profit is allocated to each outstanding share of its stock. So, if Goldman Sachs made a pile of money (Net Income), and they have a certain number of shares floating around, EPS is like dividing that pile of money into equal little portions for each share. It’s the cookie crumble per person, if you will. A higher EPS generally means the company is more profitable on a per-share basis, which is usually a good sign for investors. It’s like if your bake sale made a lot of money, and you’re giving each of your cookie-selling buddies a fair share of the profits.

In Q4 2023, Goldman Sachs’ EPS was a figure that analysts and investors were watching closely. Did it beat expectations? Did it come in as predicted? This number helps paint a picture of their profitability from a shareholder's perspective. It’s the little bit of deliciousness each shareholder gets from the company’s success.

Return on Equity (ROE): How Smart Are They With Your Dough?

Now for ROE, or Return on Equity. This one is super interesting because it tells you how effectively a company is using the money that its shareholders have invested to generate profits. Think of it as your return on investment, but for the shareholders. If you put $100 into a lemonade stand and it earned you $20 in profit, your ROE would be 20%. It’s a measure of how efficiently the company is turning shareholder money into more money. It’s the bank’s report card on how well they’re growing the money you’ve entrusted them with.

For Goldman Sachs, a strong ROE means they’re doing a good job of making money from the capital that their owners (the shareholders) have provided. It’s like them saying, "We took your investment, and look at all the amazing things we did with it to make even more money!" A healthy ROE is a sign of a well-managed and profitable business. It’s the sweet reward for trusting them with your hard-earned cash.

Goldman Sachs Q4 2023: The Nitty-Gritty Numbers

Alright, enough with the analogies, let’s get to the actual digits that came out of Goldman Sachs' Q4 2023 report. Remember, these numbers are like the scores in a really complex board game that lasts three months.

Net Revenues: The Big Dough Collected

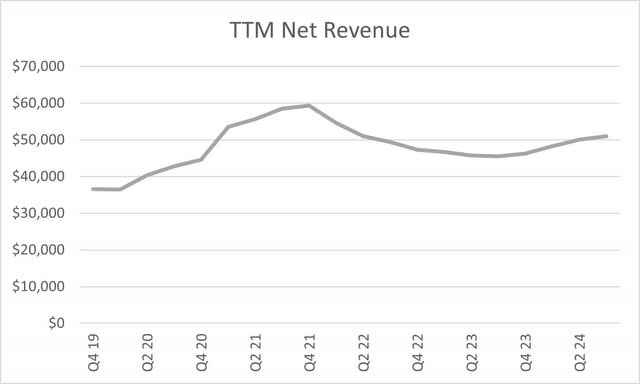

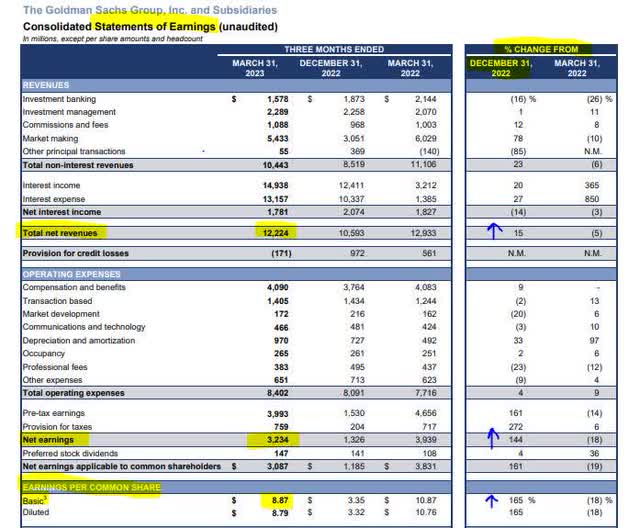

Goldman Sachs reported Net Revenues for Q4 2023. This is the top line, the gross amount they raked in. It’s like counting all the money you got from selling your entire stock of lemonade. For the last quarter of 2023, the figure was a whopping $14.2 billion. That’s a lot of zeros! To put it in perspective, that’s enough money to buy a small island, or, more realistically, to fund a whole lot of ambitious business ventures.

Now, how does this compare to previous periods? Well, this $14.2 billion was a bit of a mixed bag. It was actually a slight decrease compared to the same quarter in the previous year. Think of it like your lemonade stand having a slightly slower quarter because, you know, it was winter and nobody wanted lemonade. But don’t fret too much! They also managed to show an increase in net revenues when you look at the entire year compared to 2022. So, while that specific three-month period might have been a little less bustling, the overall year showed growth. It’s like having a few slow weeks, but then crushing it during the summer festival season.

Where did this revenue come from? A big chunk of it came from their Asset Management and Consumer & Wealth Management divisions. These are the folks who are good at, well, managing assets and wealth. They also have strong performance in their Global Banking & Markets segment, which is the engine that drives a lot of their deal-making and trading activities. It’s like different departments in a big company, each contributing their own flavor to the final pie.

Net Income: The Sweet Profit Leftover

Next up, Net Income. This is the real money-maker, after all the expenses are out of the way. For Q4 2023, Goldman Sachs posted a Net Income of $5.4 billion. Again, a significant number. This represents the profit they were able to pocket after a busy quarter of operations.

When comparing this to the previous year, it’s important to note that the Net Income also saw a decrease compared to Q4 2022. This is often linked to factors like higher operating expenses and provisions for credit losses. Think of it as: even though you sold a lot of lemonade (revenues), your costs for lemons and sugar went up, or maybe you had to give some refunds, so your final profit was a bit smaller than last year. It’s the reality of running a business; not every quarter is going to be a record-breaker.

However, the overall full-year Net Income showed an increase compared to 2022. This highlights that, despite some quarterly fluctuations, the company was generally more profitable over the entire year. It’s like saying, "Yeah, this month was a bit slow, but we totally killed it overall this year!" This is the kind of resilience that investors look for – the ability to bounce back and deliver strong performance over the long haul.

EPS: The Dividend Each Share Gets

Now let's talk EPS. For Q4 2023, Goldman Sachs reported an EPS of $5.48 per diluted share. This is the profit attributable to each share. So, if you own one share of Goldman Sachs stock, this is your little slice of the profit pie for that quarter. It’s the amount of cookie crumble each shareholder gets to enjoy.

This figure was an improvement compared to what many analysts were expecting. In the world of finance, beating expectations is like hitting a home run in the bottom of the ninth inning. It sends a positive signal to the market. So, while the top-line revenues and net income might have had their challenges, the EPS performance was a definite positive note. It shows that even with the existing expenses, they were able to distribute a healthy amount of profit per share.

It’s crucial to remember that EPS can be influenced by various factors, including share buybacks. When a company buys back its own stock, it reduces the number of outstanding shares, which can artificially boost the EPS. So, while $5.48 is a solid number, it’s always good to look at the bigger picture.

ROE: The Efficiency Scorecard

Finally, we have ROE. Goldman Sachs' ROE for Q4 2023 was approximately 8.1%. This means that for every $100 of shareholder equity, they generated about $8.10 in profit during that period. Think of it as the bank's score on how well they're using your invested money to make more money.

An ROE of 8.1% is decent, but it’s also important to compare this to their historical performance and to that of their competitors in the financial industry. Different industries have different typical ROE ranges. For financial institutions, this percentage is a key indicator of their profitability and efficiency. A higher ROE generally suggests that the company is more adept at generating profits from its shareholder investments.

It’s worth noting that ROE can fluctuate. Factors like market conditions, the company’s leverage (how much debt they use), and their overall profitability all play a role. For Goldman Sachs, this 8.1% shows they are generating a positive return, but it also leaves room for them to aim higher. They’re like a talented athlete who knows they can perform even better.

The Takeaway: What Does it All Mean?

So, what’s the big takeaway from Goldman Sachs’ Q4 2023 report? It's a story of mixed results, but with some strong underlying positives. They navigated a complex economic landscape, and while their top-line revenues and net income saw some dips compared to the previous year, their Earnings Per Share showed resilience and even beat expectations. Their Return on Equity, while not astronomical, still indicates a profitable operation.

Think of it like this: You’ve been baking up a storm all year. Some months, like November, were a bit slower because people were saving up for the holidays. But then December hit, and you absolutely smashed it with all your festive treats! Your overall profit for the year is up, and even though one month was a little light, the profit you made per cookie sold (EPS) was still impressive. And you know that the money people invested in your cookie ingredients (shareholder equity) is growing steadily.

For Goldman Sachs, Q4 2023 was a period where they demonstrated their ability to generate substantial revenue and profit, even amidst economic uncertainties. The slight year-over-year declines are not necessarily cause for alarm, but rather a reflection of the dynamic nature of the financial markets. The fact that they managed to achieve a solid EPS and maintain a positive ROE points to a well-managed institution that is focused on delivering value to its shareholders.

As always, in the world of finance, it’s about the long game. These quarterly reports are snapshots, important pieces of the puzzle, but they don’t tell the whole story. Goldman Sachs is a giant in the financial world, and like any giant, it has its powerful moves and its moments where it needs to regroup. The key is that they’re still standing tall, making money, and aiming for the stars. And that, in its own way, is a story worth telling. So, next time you hear about Goldman Sachs’ earnings, you’ll know it’s not just random numbers; it’s a glimpse into the engine room of global finance, and how they’re doing in the grand, never-ending game of making money.