How Do I Check My Credit Score On Discover

Ah, the elusive credit score. It’s like that one friend who’s always doing really well, while you’re just trying to remember if you paid that bill on time.

And if you’re one of the cool kids rocking a Discover card, you might be wondering, “Hey, how do I peek at my financial report card?”

Well, buckle up, buttercups, because we’re about to dive into the delightful (okay, maybe just necessary) world of checking your Discover credit score.

First things first, let’s acknowledge the elephant in the room. Checking your credit score can feel a bit like a pop quiz you didn't study for.

Will it be a dazzling A+ or a “maybe I should hide under the covers for a week” C-?

The suspense is real, folks.

But fear not! Discover actually makes this whole process surprisingly painless. Like, unexpectedly easy.

Seriously, it’s almost… enjoyable? (Okay, that might be pushing it, but we’re aiming for optimistic here.)

So, how do you get the scoop? It all starts with your trusty Discover online account.

If you’re not already signed up, what are you waiting for? Are you still using a carrier pigeon to track your expenses?

Get with the program, people!

Once you've bravely navigated the login page (which, let's be honest, is a feat in itself these days with all the password requirements), you'll want to find the magical section that holds your credit score.

It’s usually not buried too deep, thankfully. Think of it as the hidden treasure chest of your financial prowess.

Look for something that screams “Credit Score” or “Account Summary.”

Sometimes it’s right there on your dashboard, just begging for your attention. Other times, you might need to click a few more times.

But don't panic! It's not a scavenger hunt designed by a mischievous credit bureau.

And here's a little secret, an unpopular opinion maybe, but I think Discover is pretty good about showing you this information.

They don’t make you jump through flaming hoops or answer riddles about your mother's maiden name for the third time this week.

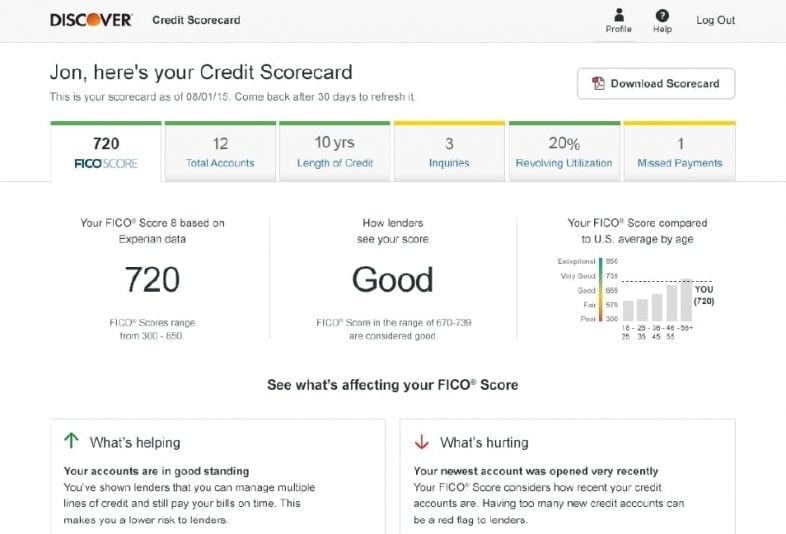

Usually, once you’re logged in, your credit score will be displayed prominently.

It might be a number, a range, or even a little visual representation. Whatever it is, it's your score!

You might also see some helpful information along with it.

This could include factors that are influencing your score. Think of it as your score’s personal trainer, telling you what exercises to do to get it in shape.

It’s like they’re saying, "Hey, you’re doing great with on-time payments, but maybe ease up on those impulse purchases at 2 AM."

Who am I to argue with my credit score’s fitness guru?

Now, let’s talk about the score itself. Don’t be disheartened if it’s not a perfect 850 right out of the gate.

Very few people have that kind of financial perfection.

It’s like being a unicorn in a field of very responsible horses.

The important thing is to know where you stand and what you can do to improve.

Think of your credit score as a living, breathing entity. It’s not set in stone forever.

It can go up! It can go down! It can do a little jig if you’re really good!

And with Discover, you can often check your score whenever you want.

This is a huge advantage, especially if you’re trying to monitor your progress after making some positive financial changes.

It's like having a personal progress tracker, but instead of steps, it's dollars and responsible financial decisions.

So, the next time you log into your Discover account, take a moment to find that credit score.

Don't just scroll past it like it's an unsolicited email from a Nigerian prince.

Give it some love. Give it some attention.

Your future self, the one who wants to buy a house or a fancy new widget, will thank you.

And hey, if your score is looking a little… sad, remember the advice that comes with it.

Discover often provides free credit score information, which is pretty darn awesome.

They’re not trying to hide it from you or charge you a fortune for a peek.

It’s a genuine effort to empower you with your financial data.

They’re basically saying, “Here’s the intel, now go forth and conquer!”

Consider it your free pass to financial self-awareness.

No need to pay a mysterious third party for a report that might or might not be accurate.

Discover has your back.

So, the process is simple:

- Log in to your Discover online account.

- Navigate to the Account Summary or Credit Score section.

- Voila! Your score is revealed.

It’s so straightforward, you might even have time to make a cup of tea and contemplate your financial journey.

Or, you know, do absolutely nothing and pretend you didn't see it. (But that’s not really recommended.)

The key takeaway here is that Discover makes it accessible.

They don't want you to feel lost in the credit score wilderness.

They’re offering you a map, a compass, and maybe even a snack for the journey.

So, go ahead. Be brave.

Check that score.

It’s your financial story, and you have the power to write the next chapter.

And who knows, you might just be pleasantly surprised.

Or at the very least, you’ll know what to work on.

Knowledge is power, especially financial knowledge.

And with Discover, that knowledge is just a few clicks away.

So go on, get your credit score.

It's not scary. It's just… information.

And information is power.

Especially when it comes to your money.

My unpopular opinion? Checking your credit score shouldn't feel like a root canal. And with Discover, it really doesn't.

So, embrace the process.

It's a small step that can lead to big financial wins.

And remember, you’ve got this.

Now go forth and conquer your credit score!