How Do Interest Earning Accumulate In A Deferred Annuity: Complete Guide & Key Details

Ever dreamt of your money making more money while you’re busy doing... well, anything else? Like binge-watching your favorite show, perfecting your sourdough starter, or perhaps, mastering the art of the perfectly timed nap? Well, buckle up, buttercup, because we’re diving into the wonderful world of deferred annuities and how the magic of interest accumulation happens! It’s like a tiny, money-making elf living inside your investment, diligently counting pennies and making them multiply.

The "Set It and Forget It" Snowball Effect

Imagine you have a little snowball. You give it a gentle push down a snowy hill. At first, it’s just a snowball. But as it rolls, it picks up more snow, getting bigger and bigger, right? That’s kind of how interest works in a deferred annuity. You put your money in (that’s your initial snowball), and then, thanks to the magic of compounding, it starts earning interest. But here’s the super-duper exciting part: the interest you earn also starts earning interest!

It’s like your money is having little money babies, and then those babies grow up and have their own money babies! Mind. Blown.

This incredible phenomenon is called compounding, and in a deferred annuity, it’s your best friend. Think of it as a turbocharged savings account, but way cooler because the growth can be significantly more impressive over time. The "deferred" part is key here. It means you’re not pulling the money out right away. You’re letting it sit there, cozy and undisturbed, while it works its little money-making heart out.

Different Flavors of Interest Growth

Now, not all deferred annuities are created equal. They come in a few different flavors, and each has its own way of making your money grow:

-

Fixed Annuities: The Steady Eddie. This one’s like your super reliable friend who always shows up on time and never forgets your birthday. With a fixed annuity, your interest rate is guaranteed for a certain period. So, you know exactly how much your money will grow. It’s predictable, safe, and a fantastic way to build a solid foundation for your future. No surprises, just sweet, sweet, guaranteed growth!

Understanding Deferred Immediate Annuity: A Complete Guide - Matador

Understanding Deferred Immediate Annuity: A Complete Guide - Matador -

Variable Annuities: The Thrill Seeker (with a safety net!). This is where things get a little more exciting! With a variable annuity, your money is invested in sub-accounts that are similar to mutual funds. This means your growth potential is higher because you’re tapping into the stock market (don't worry, it's managed!). However, the flip side is that your growth can fluctuate. But here’s the cool part: many variable annuities come with riders – these are like optional add-ons that can offer guarantees, like protecting your principal or guaranteeing a minimum income later on. It's like getting to ride a rollercoaster but knowing you have a super-strong harness.

-

Indexed Annuities: The Smarty Pants. These guys are pretty clever. A fixed indexed annuity links your growth to a market index, like the S&P 500. The genius part? When the index goes up, your annuity’s interest credited goes up too! But when the index goes down, your principal is usually protected. It’s like getting to enjoy the party when it’s happening but not having to worry about the messy cleanup if things get a little wild. You get a slice of the market’s success without taking all the bumps and bruises.

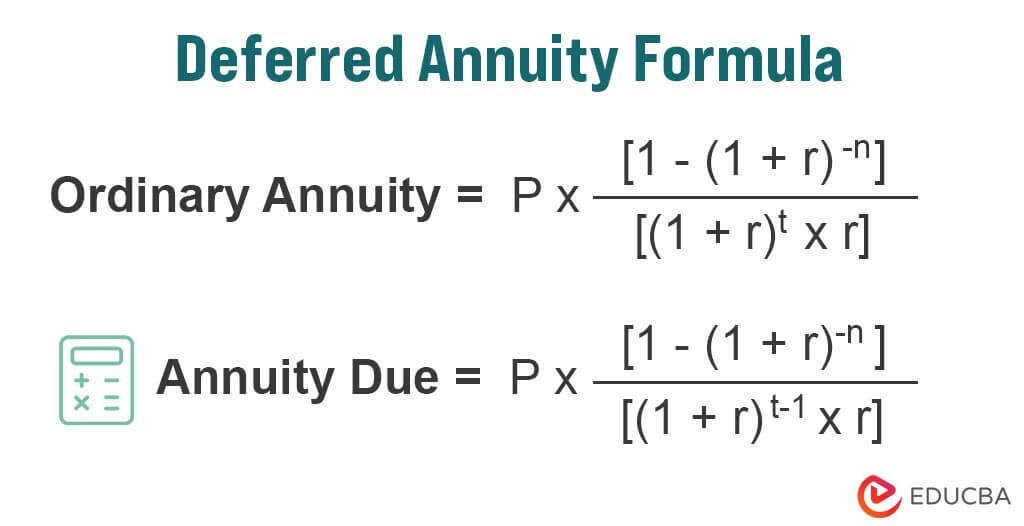

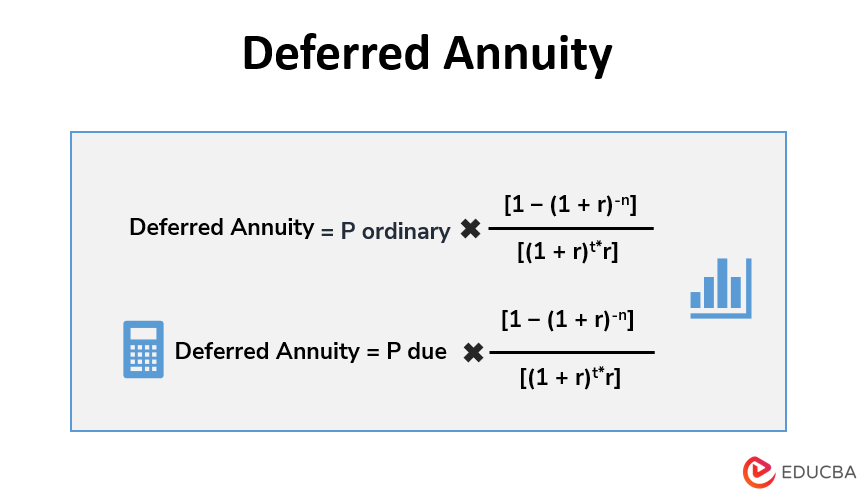

Deferred Annuity Formula

Deferred Annuity Formula

The "Deferred" Advantage: Why Waiting is Wonderful

The "deferred" in deferred annuity is your secret weapon for making this interest accumulation truly shine. You're essentially telling your money, "Hey, go have fun and grow! I'll be back to collect you and your awesome earnings later." This gives compounding a chance to work its magic over years, not just months. The longer your money is in the annuity, the more time it has to snowball, and the more impressive that final balance becomes.

It's like planting a tiny seed. You water it, give it sunlight, and then, BAM! After a while, you have a magnificent tree bearing delicious fruit. Your money in a deferred annuity is that seed, and the fruit is your future financial freedom.

So, there you have it! The fascinating, and dare we say, somewhat magical, way interest accumulates in a deferred annuity. It's all about giving your money the time and space to grow, powered by the incredible force of compounding. Whether you choose the steady reliability of a fixed annuity, the dynamic potential of a variable annuity, or the clever strategy of an indexed annuity, you’re setting yourself up for a future where your money is working for you. Now go forth and let your money do its thing – you’ve earned it!