How Do You Do Your Tax Return Online: Everything You Need To Know In 2026

Alright, fellow humans, gather 'round! It’s that magical time of year again – tax season! Don't groan, don't flee the room, because this year, we're tackling your tax return online like seasoned pros. Forget those dusty shoeboxes filled with crumpled receipts and that feeling of dread you get when you see a government envelope. In 2026, filing your taxes online is so easy, it’s practically a walk in the park… if the park had a friendly chatbot to guide you and a magical button that magically sends your money back to you (okay, maybe not that magical, but close!).

So, How Does This Online Tax Sorcery Work?

Imagine this: you're snuggled on your couch, wearing your comfiest PJs, a mug of your favorite beverage steaming beside you. Instead of a frantic scramble, you're casually navigating a website. This is your new tax battlefield, and the weapon of choice? Your trusty computer or even your smartphone. The government, in its infinite wisdom (and probably after realizing how much paper it was saving!), has made online tax filing the… well, the main way to do it. Think of it as the Netflix of tax preparation – convenient, accessible, and surprisingly less stressful than you might imagine.

First things first, you'll need to choose your weapon. You've got options, my friends! There are the official government platforms, which are like the sturdy, reliable sedan of tax software. They do the job, they’re usually free for simpler returns, and they’re a solid choice. Then you have the commercial tax software providers. These are more like the sleek sports cars of the tax world. They often come with more bells and whistles, helpful wizards that hold your hand through every step, and sometimes even offer live chat support with actual human beings who speak fluent “tax jargon” and can translate it into plain English. Think of names like TurboTax, H&R Block, or TaxAct. They're all vying to make your tax life easier, and honestly, they’re pretty darn good at it.

The beauty of these online platforms is their user-friendliness. They’re designed for folks like you and me, not for accountants who subsist on coffee and spreadsheets. They’ll ask you questions in plain English, like “Did you have any kids last year?” (Hopefully, you did, and it was a joyous occasion!). They’ll walk you through questions about your income – from your W-2s (those magical pieces of paper from your employer) to any freelance gigs you might have snagged. They’ll even ask about deductible expenses. This is where the fun begins! Did you work from home? Did you have to buy that ridiculously expensive ergonomic keyboard to save your wrists from impending doom? Did you donate to a worthy cause? These online systems are like a super-smart friend who remembers all the things you might have forgotten, helping you claim every penny you’re entitled to. It’s like a treasure hunt, but the treasure is your own money!

Gathering Your Digital Ammunition

Before you dive headfirst into this digital tax wonderland, you’ll need to gather your troops – I mean, your documents. Think of it like packing for a camping trip; you wouldn’t go without your marshmallows, right? For taxes, your essential gear includes:

- Your Social Security Number (obviously, this is your golden ticket).

- Proof of Income: This means your W-2 forms from employers, 1099 forms for freelance or contract work, and any other income statements.

- Deduction Documents: This is where your receipt-hoarding skills from the previous year might finally pay off! Think medical bills, student loan interest statements, donation receipts, business expenses if you’re self-employed.

- Bank Account Information: You’ll need your routing and account numbers for direct deposit if you’re getting a refund (woohoo!) or to pay if you owe (boo, but let’s get it done!).

Most of these documents will be readily available from your employer or financial institutions. If you’re missing something, many companies will allow you to access your tax documents online through their portals. It’s all about embracing the digital age, my friends!

The Actual Filing: Easier Than Ordering Pizza

Once you’ve got your digital ammunition ready and you’ve chosen your tax software, the actual filing process is surprisingly straightforward. You’ll log in, and the software will guide you through a series of screens. It’s like a guided tour of your financial life. You’ll input your personal information, then your income details, followed by your deductions and credits. The software will do the heavy lifting, calculating everything for you. It’s like having a super-intelligent calculator that also knows tax law.

The best part? Most of these platforms have error checks built-in. They’ll flag potential mistakes before you even submit, preventing those annoying letters from the IRS saying, "Uh, did you mean to do that?" It’s like having a personal tax detective working for you, sniffing out any slip-ups.

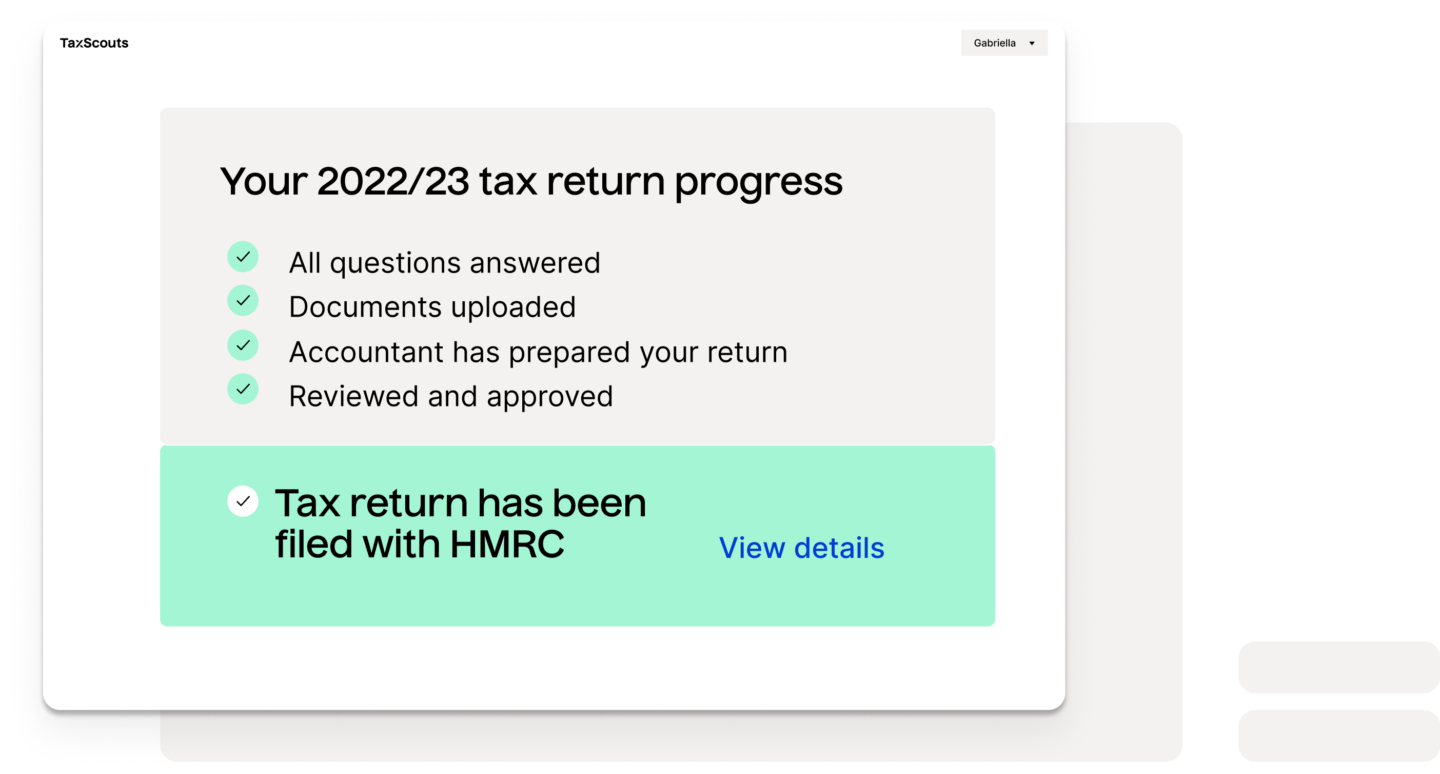

When you’re done, you’ll review everything, and then, with a click of a button, you’ll file! It’s remarkably anticlimactic, in the best possible way. No trips to the post office, no wondering if it got lost in the mail. It’s instant! And if you’re getting a refund? Prepare for a joyous notification that says something like, “Your refund has been approved and will be direct deposited into your account!” Best. Feeling. Ever.

Think of it this way: you’re trading in a stressful chore for a few hours of focused, couch-based productivity. And the reward? Peace of mind and potentially more money in your pocket. It’s a win-win!

So, there you have it! Filing your tax return online in 2026 is no longer a daunting task for the brave or the mathematically inclined. It’s accessible, it’s manageable, and with the right tools, it can even be… dare I say it… a little bit satisfying. So, embrace the digital revolution, put on those comfy PJs, and conquer your taxes. You’ve got this!